Effects of Intellectual Property Rights Protection on Services Export Diversification in Developing Countries†

Abstract

The effects of the betterment of enforced intellectual property rights (IPRs) provisions on services export diversification are investigated. The analysis used an unbalanced panel dataset of 76 developing countries over the period of 1970-2014. The empirical analysis is based on the feasible generalized least squares estimator. It suggests that the implementation of weaker IPR protection fosters services export diversification in less developed countries (i.e., those whose real per capita incomes are less than US$ 1458.60), including those with a low level of export product upgrading. Conversely, in relatively advanced developing countries (countries whose real per capita income exceeds US$ 3356.80), including those with high levels of export product upgrading, the implementation of stronger IPR laws induces greater services export diversification. Finally, the analysis revealed the existence of a non-linear relationship between IPR protection and services export diversification. The implementation of stronger intellectual property laws spurs services export diversification in countries with high degree of IPR protection, especially when IPR protection exceeds a certain level, recorded here as having a score of 1.197. In contrast, in countries with weaker IPR protection, in particular those with IPR protection levels that score less than 0.915, it is rather the implementation of weaker intellectual property laws that promotes services export diversification.

Keywords

Intellectual Property Rights, Services Export Diversification, Export Product Upgrading, Developing Countries

JEL Code

E31, F13, O34

I. Introduction

Does the strengthening of intellectual property rights (IPRs) systems contribute to enhancing services export diversification? The present study aims to address this question, which, to the best of our knowledge, has received little attention in the literature.

The importance of services exports for economic growth and development has now been well established in the literature (e.g., Hoekman, 2017; Hoekman and Shepherd, 2017; Kong et al., 2021; Lanz and Maurer, 2015). Interestingly, a recent study has provided empirical evidence that exporting a wide range of services items across different services sectors (including both traditional and modern services1), as well as exporting sophisticated services items, are strongly beneficial for economic growth. This provides policymakers with new avenues for promoting economic growth and development (e.g., Anand et al., 2012; Gnangnon, 2021a; Mishra et al., 2011; Stojkoski et al., 2016).

In the meantime, the process of global diffusion and the strengthening of intellectual property rights (IPRs) systems that followed the entering into force of the Trade-Related Aspects on Intellectual Property Rights (TRIPS) Agreement2 on January 1st, 1995, has led to a rich body of literature3 on the economic effects of changes in IPRs. The global transformation of IPR standards is underpinned by the theoretical hypothesis that the strengthening of IPRs systems will provide incentives to innovate and, in this way, to promote economic growth and development. In reality, the effectiveness of IPRs in achieving higher economic growth and development has been the subject of a much debate in both policy and academic circles (e.g., Chang, 2001; Dinopoulos and Segerstrom, 2010; Eicher and García-Peñalosa, 2008; Gould and Gruben, 1996; Hudson and Minea, 2013; Kim et al., 2012; Lorenczik and Newiak, 2012).

Specifically, the effects of IPRs on international trade are ambiguous (e.g., Grossman and Helpman, 1990; Grossman and Lai, 2004; Helpman, 1993; Maskus and Penubarti, 1995). In one study by Maskus and Penubarti (1995), for example, IPR systems were found to have ambiguous effects on international trade. The strengthening of IPRs can increase firms’ market power and encourage them to engage in monopolistic behavior, thereby increasing prices and reducing sales. On the other hand, stronger IPRs can provide incentives to export patentable goods to countries with stronger intellectual property protection, as the risk of imitation in such countries is low. Building on models of dynamic general equilibrium with two regions (‘north’ and ‘south’), where the north innovates and the south imitates technologies invented in the north, Helpman (1993) posited four channels through which IPRs can influence trade between countries: terms of trade, inter-regional allocations of manufacturing, product availability, and research and development (R&D) investment patterns. In addition to the empirical literature on the effects of IPRs on international trade, including on export and import flows4 , other works have investigated the effect of IPRs on certain aspects of export product upgrading, including export product diversification and export product quality improvement (e.g., Campi and Dueñas, 2016; Dong et al., 2022; Glass and Wu, 2007; Gnangnon and Moser, 2014; Liu et al., 2021; Ndubuisi and Foster-McGregor, 2018; Song et al., 2021). However, we are not aware of a study that has investigated the relationship between changes in IPRs and services export diversification.

The General Agreement on Trade in Services5 (GATS) has provided no specific definition of “a service” but has defined four different modes of services trade (see Article I:2 of the GATS) in light of the intangible nature of many services products. These are the cross-border supply of services (mode 1), consumption abroad (mode 2), the commercial presence (mode 3), and the presence of natural persons (mode 4).

The link between IPRs and innovation in the goods sector has been the subject of important research (e.g., Chen and Puttitanun, 2005; Naghavi and Strozzi, 2015; Sweet and Maggio, 2015). Innovation is important and prevalent in both the goods and services sectors (e.g., Peters, 2009; Zahler et al., 2014). Therefore, one could question the relevance of protecting innovation in the services sector, as has been the case in the goods sector. In this regard, research such as that by Maskus (2008) has emphasized the need for IPR protection in sectors such as information technology, the internet, digital entertainment, and financial services, as these sectors have engaged in significant innovation. However, to the best of our knowledge, researchers have not investigated whether IPR protection stimulates the diversification of services export items.

The present paper aims to fill this void in the literature by building on recent works6 on the macroeconomic determinants of services export diversification in an effort to examine the effects of strengthening IPR protection on services export diversification. We argue that stronger IPRs would affect services export diversification through the corresponding effects on innovation.

The empirical exercise here uses the two-step system generalized method of moments (GMM) estimator, with empirical support for the hypothesis that the betterment of enforced IPRs contributes significantly to enhancing services export diversification, in particular when enforced IPR protection reaches relatively high levels. Additionally, the strengthening of IPR protection induces greater services export diversification, and this effect is greater in advanced countries than in relatively less advanced economies.

In the remaining part of the analysis, Section II provides a theoretical explanation underpinning the effect of IPRs on services export diversification. Section III presents the empirical strategy, and section IV interprets empirical outcomes. Section V concludes the paper.

II. Theoretical considerations

This paper postulates that the implementation of stronger intellectual property laws would affect services export diversification through a positive innovation effect. The initial discussion focuses on the issue of innovation in the services sector (Section II. A), after which the paper explores how IPR protection could affect services export diversification through the innovation channel (Section II. B).

A. On the importance of innovation in the services sector

While the prevalence of innovation in the goods (including manufacturing) sector and the link between IPRs and innovation in the goods sector are well documented in the literature,7 innovation in the services sector (and the effect of IPRs on innovation in this sector) has received less attention (e.g., Love and Mansury, 2007; Pires et al., 2008; Zahler et al., 2014).

Love and Mansury (2007) documented how new services introduced via innovation occur through external linkages, particularly with customers, suppliers, and strategic alliances, as well as through both the presence of a highly qualified workforce and an unqualified workforce. Pires et al. (2008) used firm-level data to compare innovative activities in the various manufacturing and services sectors in Portugal, showing statistically that service firms do not underperform manufacturing firms in terms of innovation. Additionally, the highest performing service sectors (e.g., financial services) are as innovative as the highest performing manufacturing sectors (high-technology manufacturing). Zahler et al. (2014) used firm-level data on the manufacturing and services sector for Chile to compare manufacturing and tradable services from a joint trade and innovation perspective. Their analysis has revealed interesting findings, showing that manufacturing firms tend to have a much higher propensity to export than services firms but that services firms that do export are not necessarily much larger than non-exporters. While exporters tend to be more skill-intensive than non-exporters, the export skills premium in the services sector is greater than that in the manufacturing sector. While services firms are as innovative as manufacturing firms in terms of both the inputs and outputs of innovative activities (this is in line with the findings by Pires et al., 2008), services firms tend to rely relatively more on non-technological forms of innovation than manufacturing firms. Non-technological forms of innovation include innovations in product design and organizational management in production, the work environment, or the management structure of the firm, while ‘technological’ innovation refers to the introduction of new products or processes in the market, and expenditures related to R&D, physical equipment acquisitions and training related to these factors (see Zahler et al., 2014, p.954). On another note, in both the manufacturing and services sectors, exporters exhibit higher innovation performance than non-exporters, and within each group of exporters and non-exporters, services firms have a higher propensity to innovate than manufacturing firms.

Using data from German manufacturing and service firms, Peters (2009) indicated the presence of path-dependence in innovation, both in the manufacturing and services sector, as past innovation experience positively drives current innovation in both manufacturing and service sector firms. Nevertheless, persistence is less prevalent and state-dependent effects are less pronounced in the services sector than in the manufacturing sector. The author has concluded that the implications of the presence of state dependence in innovation behavior are that innovation-stimulating policy programs open up potential long-lasting effects.

A relatively nascent strand of the literature has emphasized the link between IPRs and services innovation. For example, Miles et al. (2000) underlined the fact that many service firms do not patent, as the patent system often deals with more tangible innovations. Noting that the intangible nature of many service innovations creates challenges for IPRs systems, they discussed the management of knowledge, innovation, and intellectual property in knowledge-intensive business services. Maskus (2008) explored the different interrelationships between innovation in service industries and the need for IPR protection, concluding that IPRs are of increasing importance in sectors such as information technology, the internet, digital entertainment, and financial services, as these sectors have brought forth significant innovations. He also noted that IPR protection would be relevant in other services sectors that have not made much use of IPRs but where innovations were emerging. Bader (2008) stressed the importance of IPR protection for service innovations in the financial services industry sector (the case of the reinsurance company Swiss was studied). Battisti et al. (2014) used the Eurostat Fourth Community Innovation Survey (CIS4) dataset on 17 service sectors across 18 countries, finding that radical innovations are concentrated in the knowledge-intensive research and development sectors. Interestingly, across all sectors, IPRs tend to be used by leading innovators to protect their ideas and by service innovators to engage in international sales. Using Japanese firm-level data, Morikawa (2014) found that while service firms have shown fewer product innovations than manufacturing firms, the productivity of innovative service firms is very high. At the same time, services firms tend not to hold many patents (see also Miles et al., 2000), although their holding of trade secrets is similar to that by manufacturing firms. In addition, patents and trade secrets influence in the same way product innovations in both the manufacturing and the service sectors, while trade secrets affect process innovations only for manufacturing firms.

The relatively brief literature review provided in this section shows that stronger intellectual property laws for services products can promote innovation and the development of services exports while also enhancing services export diversification. However, in the absence of data on indicators of services innovation at the aggregate (macroeconomic) level, we postulate that regardless of the possible effect of strengthening IPRs on services export diversification through the services innovation channel, improved IPRs can affect services export diversification through export product upgrades, such as export product diversification, export product quality improvements and greater economic complexity8 (i.e., the export of sophisticated products).

B. How could IPRs affect services export diversification through the export product upgrading avenue?

In this section, we describe how IPR strengthening could affect services export diversification through the channel of export product upgrading. First, this involves an examination of the theoretical literature exploring how IPR strengthening affects export product upgrading. Second, we discuss how export product upgrading affects services export diversification.

Some works have considered how IPRs affect export product upgrading (e.g., Campi and Dueñas, 2016; Dong et al., 2022; Glass and Wu, 2007; Gnangnon and Moser, 2014; Liu et al., 2021; Ndubuisi and Foster-McGregor, 2018; Song et al., 2021). Glass and Wu (2007) developed a model where northern firms innovate to improve the quality of existing products and may, later, shift production to the south by engaging in foreign direct investment, with southern firms then possibly imitating the products of multinationals. They showed empirically that stronger intellectual property laws can reduce imitation and shift innovation away from improvements in existing products toward the development of new products. Gnangnon and Moser (2014) documented empirically that legal protections for minor and adaptive inventions encourage the diversification of export products in both developed and developing countries. Campi and Dueñas (2016) found (for the agricultural sector) that the strengthening of IPRs has, inter alia, exerted a negative effect on the intensive margin of agricultural trade and a positive impact on the extensive margin of agricultural trade. Ndubuisi and Foster-McGregor (2018) established empirically that stronger intellectual property laws promote exports at extensive margins. Dong et al. (2022) used firm-product level data from Chinese exporters and city-level data on IPR protection to test empirically the effect of IPRs on export product quality. This effect was expected to materialize through strengthened R&D inputs, new product development, and mitigated financial constraints. The authors showed that the betterment of de facto IPRs contributes to enhancing the upgrade of export product quality, although this effect varies across geographic regions (it is not statistically significant for certain regions). Song et al. (2021) investigated the effect of domestic and foreign intellectual property rights (IPR) protection on quality upgrading using firm-level data from China. They postulated that the effect of IPR protection on firms’ export quality depends on whether the innovation-induced effect - which promotes export product quality upgrading - dominates the threshold induced effects, which inhibit quality upgrading. Their empirical analysis revealed that the innovation channel dominates the threshold effects channel, as both domestic and foreign IPR protection positively influence export quality upgrading. Liu et al. (2021) found that the effects of patent protection on export quality upgrading depend on the technological stage of the country in question. Specifically, patent protection helps to improve export product quality if an economy’s product quality is sufficiently close to the world frontier level. On another note, in a recent study Sweet and Maggio (2015) documented why a country’s level of economic complexity is a better proxy of its level of innovation than traditional indicators such as the number of patents granted or disbursements on research and development (R&D) - used to measure the level of innovation in a country. Sweet and Maggio (2015) demonstrated empirically that strengthening IPR systems generates a greater level of economic complexity, which genuinely reflects a country’s level of innovative inputs.

This short literature review conveys the message that strengthening IPR protection is likely to induce greater export product diversification and/or greater improvements of export product quality, as well as a higher degree of economic complexity.

On the other hand, the strengthening of IPR protection is associated with greater export product upgrading. First, as services are strongly embedded in manufactured exports (e.g., Ceglowski, 2006; Jiang and Zhang, 2021; Kimura and Lee, 2006; Lodefalk, 2014; Su et al., 2021), we can expect that the export of manufacturing products, including those that are more sophisticated,9 would reflect higher services production by, for instance, through the introduction of new services during the manufacturing production process. This expansion of services production can be associated with the diversification of services exports at intensive margins (i.e., an increase in the number of existing service items exported) or with the diversification of services exports at extensive margins (i.e., the introduction of new service export products).

Second, in a recent paper, Gnangnon (2022) provided empirical evidence that greater economic complexity (as a measure of innovation input) is positively associated with services export diversification. The paper builds on the theoretical argument that countries that export increasingly complex products would likely experience higher penetration in international markets for goods and develop a network in such a market that could, in turn, be used to export a wide range of services items. This argument is drawn from the “network effect” hypothesis developed by Eichengreen and Gupta (2013b), which holds that a country with a high penetration rate in goods markets would likely use the networks established in these markets to export and eventually diversify its services export items. Eichengreen and Gupta (2013b) and Sahoo and Dash (2014) provided empirical support for this hypothesis. Building on the same arguments, Gnangnon and Priyadarshi (2016) reported that greater export product diversification is associated with a rise in commercial services exports by least developed countries. Gnangnon (2020a) and others have reported that the diversification of export products fosters the diversification of services exports, and Gnangnon (2021b) demonstrated empirically that a higher manufactured export share in total exports induces greater services export diversification. Taking a cue from the findings of work by Gnangnon (2021a), it can be expected that innovation would enhance services export diversification through its positive impact on export product diversification, especially considering that Chen (2013) established that innovation (as measured by patent counts) fosters export product diversification both at extensive margins (i.e., by increasing the number of products exported from a country) and at intensive margins (i.e., by increasing the export value of each product from a country). As export product diversification exerts a positive effect on services export diversification (e.g., Gnangnon, 2020a), one can expect that innovation would promote services export diversification through its positive impact on export product diversification.

In a nutshell, while greater IPRs10 protection encourages export product upgrading, greater export product upgrading enhances services export diversification. We therefore expect that improving IPRs would contribute to fostering services export diversification through its effect of greater export product upgrading, i.e., greater export product diversification, export product quality improvements and greater economic complexity. Furthermore, given that the strengthening of IPR protection increases with the development level (e.g., Auriol et al., 2023; Chu et al., 2014; Hudson and Minea, 2013; Kim et al., 2012; Parello, 2008), one can expect that the positive effect of IPR protection on services export diversification would be greater in countries with higher development levels.

Against this backdrop, we postulate the following three hypotheses:

Hypothesis 2: The positive effect of the betterment of IPRs on services export diversification will be greater in countries with higher development levels.

Hypothesis 3: The positive effect of the betterment of IPRs on services export diversification will be greater with a higher degree of export product upgrading, including a greater level of export product diversification, a better quality of export products, and a greater level of economic complexity.

The next section will test these hypotheses empirically.

III. Empirical strategy

This section initially presents the baseline model specification used to test the effect of IPR protection on services export diversification empirically (Section III. A). Next, we conduct a data analysis of key variables of interest, in particular the indicators of enforced IPR protection and services export diversification (Section III. B). Third, we present the econometric approach used in the analysis (Section III. C).

A. Model specifications

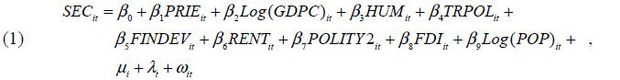

To examine the effect of IPR protection on services export diversification, we build on the recent works on the macroeconomic determinants of services export diversification or the services export structure (e.g., Anand et al., 2012; Eichengreen and Gupta, 2013a; Gnangnon, 2020a; 2020b; Gnangnon, 2021b; 2021c; 2021d; 2021e; 2021f; Gnangnon, 2022; Sahoo and Dash, 2017). Specifically, the baseline specification includes the variable of interest “PRIE” along with its squared term, as well as a set of control variables derived essentially from the previous works cited above. These control variables are the real per capita income, denoted as “GDPC” (representing a proxy for the development level of a country); inward foreign direct investment denoted as “FDI;” financial development (“FINDEV”); the level of human capital accumulated (“HUM”); the degree of trade openness (“OPEN”); a proxy for the institutional quality, measured according to the degree of democratization in a country (“POLITY2”); and the population size (“POP”).

For the sake of brevity, we do not present here a discussion on the theoretical effects of control variables to be used in the baseline model on services export diversification. We refer readers to work by Gnangnon (2020a; 2020b), Gnangnon (2021b; 2021c; 2021d; 2021e; 2021f) and Gnangnon (2022) for a detailed and theoretical discussion of the effects of each these variables on services export diversification.

We consider the following baseline model:

where the subscript i represents the country and t stands for the time-period. On the basis of available data, we construct an unbalanced

panel dataset of 76 developing countries over the period from 1970 to 2014. The dependent

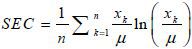

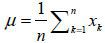

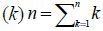

variable “SED” is the Theil index of services export diversification. It is obtained

by taking the opposite value of the indicator of the services export concentration

(denoted “SEC”) calculated using the following formula (see for example, Agosin et al., 2012; Cadot et al., 2011):  , where

, where  , n represents the total number of the (services) export lines

, n represents the total number of the (services) export lines  ; and xk denotes the amount of services exports associated with the services line “k”. Values

of the index “SEC” range from 0 to 100, with higher values of this index reflecting

greater services export concentration and lower values indicating greater services

export diversification. Thus, our indicator of services export diversification is

computed as follows: SEDit = 100 - SECit, where the subscripts i and t stand respectively for the given country and given sub-period. Its values also range

from 0 to 100, with higher values of the index indicating greater services export

diversification and lower values reflecting a tendency for a greater services export

concentration. Data pertaining to the indicator “SED” cover the sub-periods of 1976-1980,

1981-1985, 1986-1990, 1991-1995, 1996-2000, 2001-2005, 2006-2010, and 2011-2014. The

computation of the services export diversification index was conducted by collecting

data from a database developed by the International Monetary Fund (IMF) (see Loungani et al., 2017) on eleven major sectors of services (categories of services). Disaggregated data

on services exports at the two-digit level are used, as this is the maximum digit

level of disaggregated data available on services export items. In particular, we

relied on eleven major sectors of services (categories of services) - at the one-digit

level - and used the disaggregated data on services exports for sub-sectors at the

two-digit level (see Table A1 for further details on the computation of these indices).

; and xk denotes the amount of services exports associated with the services line “k”. Values

of the index “SEC” range from 0 to 100, with higher values of this index reflecting

greater services export concentration and lower values indicating greater services

export diversification. Thus, our indicator of services export diversification is

computed as follows: SEDit = 100 - SECit, where the subscripts i and t stand respectively for the given country and given sub-period. Its values also range

from 0 to 100, with higher values of the index indicating greater services export

diversification and lower values reflecting a tendency for a greater services export

concentration. Data pertaining to the indicator “SED” cover the sub-periods of 1976-1980,

1981-1985, 1986-1990, 1991-1995, 1996-2000, 2001-2005, 2006-2010, and 2011-2014. The

computation of the services export diversification index was conducted by collecting

data from a database developed by the International Monetary Fund (IMF) (see Loungani et al., 2017) on eleven major sectors of services (categories of services). Disaggregated data

on services exports at the two-digit level are used, as this is the maximum digit

level of disaggregated data available on services export items. In particular, we

relied on eleven major sectors of services (categories of services) - at the one-digit

level - and used the disaggregated data on services exports for sub-sectors at the

two-digit level (see Table A1 for further details on the computation of these indices).

The main variable of interest in the analysis, which is “PRIE,” is a measure of the effective patent protection, computed as the Index of Patent Protection (PRI) (see Park, 2008) multiplied by the Index of Legal Enforcement Effectiveness, as extracted from the Fraser Institute database. The Index of Patent Protection is based on patentee rights and comprises five components. These include the duration of patent protection relative to international standards, subject matter that is patentable (or not unpatentable), participation in international intellectual property rights agreements, the enforcement mechanisms available, and how limited (or less restricted) patenting exceptions are (such as any requirement to practice the invention or license the patents to third parties). Thus, the computed index “PRIE” accounts for the enforcement of the legal patent provisions in practice and captures the scope of effective IPR protection (see Hu and Png, 2012; Liu et al., 2021; Maskus and Yang, 2018). The values of this indicator vary from 0 to 5, with higher numbers reflecting strong patent rights. As data on the indicator “PRI” is available only every five years, data on the indicator “PRIE” is also available every five years. In the present analysis, data on “PRIE” cover the sub-periods of 1975, 1980, 1985, 1990, 1995, 2000, 2005, and 2010.

The variable “HUM,” the index of human capital, represents the average years of total schooling for the population aged between 15 and 64. It is extracted from the Barro and Lee Dataset, updated in 2021 (Barro and Lee, 2013). Data on this variable is available every five years (like the indicator “PRIE”) and covers the sub-periods of 1975, 1980, 1985, 1990, 1995, 2000, 2005, and 2010 in the present analysis.

Data on all other regressors used in the analysis cover the sub-periods of 1971-1975, 1976-1980, 1981-1985, 1986-1990, 1991-1995, 1996-2000, 2001-2005, and 2006-2010. The variable “GDPC” is the real per capita income (constant 2015 US$). The variable “TRPOL” is an indicator of trade policy, measured here according to the index of freedom to trade internationally. Higher values of this index indicate greater freedom to trade internationally. The variable “FINDEV” is a proxy for financial development and is measured according to the share (in percentage) of domestic credit to the private sector by banks in GDP. The variable “POLITY2” is an indicator of the level of democracy based on the competitiveness of political participation, the openness and competitiveness of executive recruitment, and constraints on the chief executive. Its values are between -10 and +10, with lower values reflecting more autocratic regimes and greater values indicating more democratic regimes. The variables “RENT,” “FDI,” and “POP” are respectively the share (in percentage) of total natural resources rents in GDP (a proxy for a country’s dependence on natural resources), the share (in percentage) of net FDI inflows in GDP, and the total population size.

The sources of all variables used in the analysis are provided in Table A1. Table A2 reports the list of the 76 countries used in the analysis. Table A3 reports descriptive statistics, including the standard statistics (mean, standard deviation, maximum and minimum) as well as the within-country and between-country variations of the variables used in the analysis. Table A4 lists countries on the basis the ascending values of the variable “PRIE” over the last sub-period, i.e., 2010 for this indicator (we explain later why we proceed in that way). This Appendix is also used in the subsequent analysis.

β0 to β9 are parameters to be estimated. μi refers to a country’s unobservable time invariant characteristics that could affect services export diversification, and the λt variables are time dummies for global shocks that hit simultaneously all countries’ services export diversification paths. ωit is a well-behaving error term.

The structure of the panel dataset allows us to consider the variables “GDPC,” “HUM,” “TRPOL,” “FINDEV,” “RENT,” “POLITY2,” and “FDI” as exogenous, or at least weakly exogenous. For example, model (1) allows us to examine the effect of IPR protection and that of human capital, i.e., in year 1975, on the sub-period 1976-1980. Likewise, model (1) allows an estimation of the effects of the variables “GDPC,” “TRPOL,” “FINDEV,” “RENT,” “POLITY2,” and “FDI” during, for instance, the sub-period of 1971-1975, on services export diversification in the sub-period 1976-1980. The same reasoning applies to all other sub-periods of the panel data. It is important to note that the indicator of the population size is treated as ‘de facto’ exogenous.

B. Data analysis

We provide in Figure 1 the development of the indicators of enforced IPR protection (“PRIE”) and services export diversification (“SED”) over the full sample. Figure 2 shows the correlation pattern between these two indicators over the full sample. Figure 3 presents the correlation pattern between real per capita income and the indicator of services export diversification. This figure helps provide initial insight into the correlation between services export diversification and a country’s development level, as proxied by real per capita income.

We note from Figure 1 that the indicators “PRIE” and “SED” tend to move in opposite directions. The index of IPR protection increased from 0.72 in 1975 to 1.33 in 2010, and the index “SED” decreased from 77.7 in 1976-1980 to 29.5 in 2011-2015. This suggests that while on average countries tended to strengthen their enforced IPR protection, they also tended to diversify their services export items less. Figure 2 shows a negative correlation between the two indicators. However, this does not imply negative causality, as the latter would be determined by an appropriate estimation of a model specification that links IPR protection to services export diversification. Figure 3 shows a negative correlation pattern between real per capita income and the indicator of services export diversification.

FIGURE 1.

DEVELOPMENT OF THE INDICATORS OF INTELLECTUAL PROPERTY RIGHTS AND SERVICES EXPORT DIVERSIFICATION OVER THE FULL SAMPLE

Source: Author.

C. Econometric approach

We note from Table A2 that for all variables, except for the dependent variable “SED,” the between-country variation of variables dominates the corresponding within-country variation. For the variable “SED,” the between-country variation is lower than the within-country variation. In this context, the use of the within fixed-effects estimator to estimate model (1) would result in a loss of the efficiency of the estimates, as this estimator disregards between-country variations of variables. The feasible generalized least squares (FGLS) approach helps to address this concern, as it allows one to obtain more efficient estimates than those generated by the within fixed-effects estimator, especially in the presence of heteroskedasticity as well as serial and cross-sectional correlations in the residuals (e.g., Bai et al., 2021; Zellner, 1962). The FGLS estimator is particularly useful when the variance-covariance matrix of errors is unknown, as in such a case, the unknown matrix is estimated from the sample (Verbeek, 2012). The coefficients obtained from the estimation of model (1) or its variants by the FGLS approach represent the average effects, that is, the long-run average effect of each regressor on services export diversification (see Phillips and Moon, 1999). Many recent studies have used the FGLS approach in their analyses in conjunction with a panel dataset similar to ours (e.g., Can and Gozgor, 2018; Gnangnon, 2020c; 2023a; Meinhard and Portrafke, 2012; Nguyen and Su, 2021).

Overall, we estimate model (1) using primarily the FGLS estimator. However, for the sake of a proper comparison of estimates, we also present, only once, the results stemming from the estimation of model (1) using the within fixed-effects estimator (denoted “FE 11”).

The outcomes of the estimation of model (1) by means of the FE and FGLS estimators are presented respectively in columns [1] and [2] of Table 1. These outcomes help test hypothesis 1. Column [3] of the same Table allows for the testing of hypothesis 2. It contains outcomes arising from the estimation of a variant of model (1) that contains the interaction between real per capita income and the indicator “PRIE.”

TABLE 1

EFFECT OF INTELLECTUAL PROPERTY RIGHTS ON SERVICES EXPORT DIVERSIFICATION (ESTIMATORS: FEDK AND FGLS ( WITH PANEL- SPECIFIC FIRST- ORDER AUTOCORRELATION))

Note: 1) *p-value<0.1, **p-value<0.05, ***p-value<0.01, Robust standard errors are in parenthesis; 2) Pseudo R2 is calculated as the correlation coefficient between the dependent variable and corresponding predicted values; 3) Time dummies are included in the FGLS-based regressions.

The results in Table 2 allow for the testing of hypothesis 3. These outcomes were obtained by estimating three different variants of model (1). Each of these variants of model (1) includes an indicator of export product upgrading along with the corresponding interaction with the indicator “PRIE.” The three export product upgrading indicators are the overall export product diversification (denoted as “EPD”), export product quality (denoted as “QUAL”) and economic complexity (denoted as “ECOMP”). The indicator of overall export product diversification is obtained by taking the opposite value of the indicator of the overall export product concentration developed by the International Monetary Fund (IMF); it is computed using the Theil index and following the definitions and methods used in Cadot et al. (2011). The indicator “EPD” is the sum of the intensive and extensive components of export product concentration. It encompasses both the extensive and intensive margins of concentration. Extensive export diversification reflects an increase in the number of new export products or trading partners, while intensive export diversification considers the shares of export volumes across active products or trading partners. If we denote as “EPC” the IMF’s indicator of overall export product concentration, its transformation to obtain the indicator “EPD” is then as follows: EPDit = -EPCit, where the subscripts i and t stand respectively for the given country and given sub-period. Higher values of the index “EPD” indicate greater overall export product diversification, and lower values reflect a tendency for a greater (overall) export product concentration.

TABLE 2

EFFECT OF INTELLECTUAL PROPERTY RIGHTS ON SERVICES EXPORT DIVERSIFICATION (ESTIMATOR : FGLS (WITH PANEL- SPECIFIC FIRST- ORDER AUTOCORRELATION))

Note: 1) *p-value<0.1, **p-value<0.05, ***p-value<0.01, Robust standard errors are in parenthesis; 2) Pseudo R2 is calculated as the correlation coefficient between the dependent variable and the corresponding predicted values; 3) Time dummies are included in the FGLS-based regressions.

The index of export product quality “QUAL” reflects the quality of existing exported products. It has been calculated using bilateral trade values and quantities at the SITC 4-digit level (see Henn et al., 2013; 2015). The calculation relies on an estimation methodology which derives quality from unit values, whereby export quality is measured according to the average quality (unit value) demanded in an exporter’s present destination markets for any product. The trade dataset contains information about trade prices, values and quantities as well as information pertaining to preferential trade agreements and other gravity variables. Higher values of this indicator indicate higher export product quality levels.

Finally, the indicator “ECOMP” measures the economic complexity index, reflecting the diversity and sophistication of a country’s export structure. Hence, it indicates the diversity and ubiquity of a country’s export structure. It is estimated using data connecting countries to the products they export, applying the methodology in described in Hidalgo and Hausmann (2009). Higher values of this index reflect greater economic complexity.

IV. Interpretation of empirical results

The results in columns [1] and [2] of Table 1 show (with different magnitudes of the coefficients) that at the 1% level, the strengthening of IPR12 protection promotes services export diversification. These outcomes confirm hypothesis 1, suggesting that the betterment of IPRs encourages services export diversification over the full sample. With regard to the control variables, we note that the estimates in columns [1] and [2] of the table are slightly different, both in terms of magnitude and statistical significance. Focusing on outcomes obtained using our preferred estimator, i.e., the FGLS estimator (see column [2]), we find that export product diversification is positively driven by improvements in human capital, higher FDI inflows, and a fall in the population size. Incidentally, countries tend to reduce their degree of services export diversification as they enjoy higher per capita incomes (the coefficient of the real per capita income is negative13 and significant at the 1% level). Trade policy liberalization, financial development, and the improvement of institutions (proxied by greater democratization) are associated with greater services export concentration. These findings indicate, for example, that as countries liberalize their trade regime or as access to credit provided by the banking sector improves, firms tend to concentrate their services-related activities on a relatively limited number of services export items. Finally, natural resource dependence exerts, on average, no significant effect on services export diversification.

Turning to the outcomes reported in column [3] of Table 1, we find that the coefficient of the variable “PRIE” is negative and significant at the 1% level, while the interaction term related to the interaction variable “PRIE*Log(GDPC)” is positive and significant at the 1% level. These outcomes suggest that on average over the full sample, improved IPR protection induces greater services export diversification in countries whose real per capita income exceeds US$ 2140 [= exponential(70.29/9.166)]. Countries whose real per capita incomes are lower than US$ 2140, experience greater services export concentration. In other words, these findings indicate that for less developed countries, including least developed countries (LDCs) (i.e., countries whose real per capita incomes are lower than US$ 2140), it is rather weaker IPR protection that promotes services export diversification, while for relatively advanced developing countries, strengthening IPR protection promotes services export diversification. These outcomes appear to be consistent with the literature that supports weak IPR protection in less developed countries with a view to promoting imitation, and innovation at a later development stage. To get a clearer picture of the impact of IPR protection on services export diversification across countries in the full sample, we present in Figure 4, at the 95 percent confidence intervals, the marginal impact of IPR on services export diversification for varying levels of real per capita income. It appears from this figure that the marginal impact of IPR protection on services export diversification is negative for countries whose real per capita incomes are lower than US$ 1458.6 but positive for countries whose real per capita incomes are higher than US$ 3356.8. Countries whose real per capita incomes range from US$ 1458.6 to US$ 3356.8 experience no significant effect of IPR protection on services export diversification. In a nutshell, less developed countries, including LDCs, enjoy greater services export diversification when they adopt weakly enforced IPR protection, while relatively advanced developed countries promote their services export diversification when they strengthen their IPR protection. The lower countries’ real per capita incomes are, the greater is the positive effect of weak IPR protection on services export diversification. On the other hand, with greater magnitudes of the positive effect of IPR protection on services export diversification increases, greater levels of IPR protection exist.

FIGURE 4.

MARGINAL IMPACT OF “PRIE” ON “SED” FOR VARYING LEVELS OF REAL INCOME PER CAPITA

Source: Author.

The outcomes in column [1] of Table 2 suggest that the coefficient of “PRIE” and the interaction term related to the interaction variable “PRIE*EPD” are both positive and significant at the 1% level, thereby suggesting that at the 1% level, export product diversification consistently induces greater services export diversification as counties improve their export product diversification level; on average over the full sample, the greater the degree of export product diversification, the higher the level of services export diversification. At the same time, the coefficient of the variable “EPD” is negative and significant at the 1% level. We display in Figure 5 the marginal impact14 of IPR protection on services export diversification for varying degrees of export product diversification. According to this figure, it appears that this marginal impact increases as countries improve their degree of export product diversification. However, this factor is negative for countries with low degrees of export product diversification and positive for countries with relatively high levels of export product diversification. Putting it differently, developing countries such as LDCs that have high degrees of export product concentration tend also to experience higher levels of services export concentration, while developing countries with relatively high degrees of export product diversification also tend to enjoy greater levels of services export diversification. These findings align, to some extent, with those in column [3] of Table 1, which suggest that less developed countries (likely to have high degrees of export product concentration) tend to have high levels of services export concentration, while relatively advanced developing countries (which tend to experience relatively higher degrees of export product diversification) have greater services export diversification.

The results in column [2] of Table 2 show that the coefficient of “PRIE” is negative and significant at the 1% level, while the interaction term of the variable “PRIE*QUAL” is positive and significant at the 1% level. These outcomes suggest that improved export product quality15 levels promote services export diversification in countries whose level of export product quality exceeds 0.77 (= 51.10/66.4). This means that on average over the full sample, countries that have greater export product quality levels (i.e., values higher than 0.77) experience a positive effect of IPR strengthening on greater services export diversification, and the greater the level of export product quality, the higher the positive effect of improving IPR on services export diversification. Other countries (whose levels of export product quality are lower than 0.77) experience a negative effect of improving IPR protection on their services export concentration. In other words, these countries enjoy a positive effect of weak IPR protection on services export diversification. Figure 6 shows, at the 5% level, the marginal impact of IPR protection on services export diversification for varying levels of export product quality. It appears that while this marginal impact increases as the level of export product quality improves, only countries with a level of export product quality higher than 0.83 experience a positive and significant effect of IPR protection strengthening on services export diversification. For countries whose levels of export product quality are lower than 0.72, weak IPR protection fosters services export product diversification, and lower levels of export product quality are linked to a greater positive effect of weak IPR protection on services export diversification. Finally, in countries whose levels of export product quality are between 0.72 and 0.83, there is no significant effect of IPR protection on services export diversification.

The estimates in column [3] of Table 2 reveal that the coefficient of “PRIE” remains positive, but not significant at the 10% level, whereas the interaction term related to the variable “PRIE*ECOMP” is positive and significant at the 1% level. On the basis of these outcomes, we will be tempted to deduce that on average over the full sample, and regardless of the degree of economic complexity, the betterment of IPR protection consistently enhances services export diversification, and the greater the level of economic complexity, the larger is the magnitude of the positive effect of IPR protection strengthening on services export diversification. Incidentally, the coefficient of the variable “ECOMP” is negative and significant at the 5% level. Figure 7 displays at the 5% level, the marginal impact of IPR protection on services export diversification for varying degrees of economic complexity. It shows that this marginal impact increases as the degree of economic complexity rises, but it can take both positive and negative values and is not always statistically significant. Countries whose degree of economic complexity exceeds 0.153 enjoy a positive and significant effect of fostering IPR protection on services export diversification. For these countries, the higher the degree of economic complexity is, the larger is the positive effect of economic complexity on services export diversification. In contrast, countries with lower levels of economic complexity (especially those whose degrees of economic complexity are lower than -0.8) experience a negative (positive) effect of greater (weaker) IPR protection on services export diversification. For these countries, the lower the degree of economic complexity is, the higher the positive effect of weaker IPR protection on services export diversification also is. Finally, countries whose degree of economic complexity ranges is -0.8 and 0.153 experience no significant effect of IPR protection on services export diversification.

Overall, the findings from Table 2 suggest that weak IPR protection tends to promote services export diversification in countries with low degrees of export product upgrading, while strengthening IPR protection tends to foster services export diversification in countries with relatively high degrees of export product upgrading, regardless of whether the latter is export product diversification, improved export product quality, or an improved level of economic complexity.

The results of the control variables in Table 2 align broadly with those in column [2] of Table 1.

V. Further analysis

We dig deeper into the previous analysis by investigating the existence of a non-linear effect of IPR protection on services export production. The motivation for doing so comes from the observation in Figure 8 that there exists a non-linear correlation pattern, in the form of a U-shaped curve, between intellectual property rights and services export diversification over the full sample. To test this observation empirically, we estimate by means of the FGLS estimator a variant of model (1), which is nothing more than model (1) with the squared term of the variable “PRIE” included. The outcomes of this estimation are reported in Table 3.

FIGURE 8.

NON-LINEAR CORRELATION PATTERN BETWEEN INTELLECTUAL PROPERTY RIGHTS AND SERVICES EXPORT DIVERSIFICATION OVER THE FULL SAMPLE

Source: Author.

TABLE 3

NON-LINEAR EFFECT OF INTELLECTUAL PROPERTY RIGHTS ON SERVICES EXPORT DIVERSIFICATION (ESTIMATOR : FGLS ( WITH PANEL- SPECIFIC FIRST-ORDER AUTOCORRELATION))

Note: 1) *p-value<0.1, **p-value<0.05, ***p-value<0.01, Robust standard errors are in parenthesis; 2) Pseudo R2 is calculated as the correlation coefficient between the dependent variable and the corresponding predicted values; 3) Time dummies are included in the FGLS-based regressions.

The results in Table 3 show (with different magnitudes of the coefficients) that the coefficients of the variable “PRIE” and the corresponding squared terms are respectively positive and negative, and significant at the 1% level. These outcomes suggest that there is a non-linear effect of IPR protection on services export diversification that takes the form of a U-shaped curve. This finding confirms the non-linear correlation pattern observed in Figure 2. Based on these results, we can conclude that there is a level of “PRIE” above which the effect of IPRs on services export diversification changes sign; i.e., it becomes positive (as below this level, the effect is negative). Specifically, on average over the full sample, the strengthening of IPR protection promotes services export diversification in countries whose levels of PRIE exceed 1.013 [= 19.91/(2*9.824)]. To recall, values of “PRIE” range from 0 to 3.52 (see Table A3). We, therefore, deduce that on average, countries for which the IPR protection level exceeds 1.013 experience a positive effect of enforced IPR protection on services export diversification. For these countries, the greater the level of IPR protection is, the higher is the positive effect of IPR protection on services export diversification. Conversely, for countries whose level of IPRs is lower than 1.013, strengthening IPR protection leads to a greater services export concentration, with the magnitude of this effect increasing as the level of IPR protection decreases. In other words, for these countries, weak IPR protection fosters services export diversification, and weaker IPR protection levels are linked to greater levels of services export diversification.

Figure 9 presents, at the 95 percent confidence interval, the marginal impact of IPR protection on services export diversification for different levels of IPR protection. We note from this graph that the marginal impact of IPR protection on services export diversification increases as countries further strengthen their IPR protection. This outcome can take positive or negative values but is not always statistically significant at the 5% level. This marginal impact is not statistically significant for levels of IPR protection ranging from 0.915 to 1.197. As a result, countries whose levels of IPR protection range from 0.915 to 1.197 experience no significant effect of IPR protection on services export diversification. At the same time, for countries whose degrees of IPR protection are lower than 0.915 (i.e., falling between 0 and 0.915), the marginal impact is negative and significant at the 5% level. This suggests that the implementation of weaker (stronger) IPR protection exerts a positive (negative) and significant effect on services export diversification, with lower degrees of IPR protection meaning a higher positive effect of IPR protection on services export diversification. Conversely, countries whose level of IPR protection exceeds 1.197 experience a positive and significant effect of IPR protection on services export diversification (as the marginal impact is positive and significant at the 5% level). For these countries, with greater strengthening of IPR protection, the magnitude of the positive impact of IPR protection on services export diversification also increases. Overall, strengthening IPR protection contributes to enhancing services export diversification in countries with a high degree of IPR protection, especially when the IPR protection level exceeds a certain level, which is 1.197. Conversely, in countries with weaker IPR protection levels, including those with IPR protection levels lower than 0.915, it is rather the implementation of weaker IPR protection levels that promotes services export diversification.

As indicated earlier, Table A4 presents a list of countries in the full sample on the basis ascending values of the variable “PRIE” over the last sub-period of the analysis, i.e., in the year 2010 for the indicator “PRIE.” It appears that many of those countries that have weakly enforced IPR protection are LDCs16 . This is not surprising, as LDCs have been exempted from implementing the majority of the provisions contained in the TRIPS Agreement (see for example Article 66 of the TRIPS Agreement17). It is apparent in Table A3 that 18 countries18 (ranging from Mozambique to Pakistan) had IPR values lower than 0.915 (many of them being LDCs) in 2010. Concurrently, 42 countries had levels of enforced IPR protection higher than (or equal to) the level of 1.197. These countries range, in ascending order in terms of the strength of IPR protection, from Costa Rica (with a value of PRIE in 2010 equal to 1.204) to Singapore (with a value of PRIE in 2010 equal to 3.370).

It should be noted that outcomes relating to the control variables in Table 3 are consistent with those in column [2] of Table 1.

VI. Conclusion

The present analysis investigates the effect of improving IPR protection of services export diversification using a panel dataset containing data from 76 countries (both developed and developing countries) over annual periods from 1970-2014. The results have shown that the implementation of weak IPR protection by less advanced developing countries (i.e., countries whose real per capita incomes are lower than US$ 2140) is associated with greater services export diversification, while in advanced developing countries, it is rather the implementation of stronger intellectual property laws that promotes services export diversification. The analysis has also explored the extent to which export product upgrading (that is, export product diversification, improved export product quality levels or improved economic complexity levels) matters with regard to the effect of IPR protection on services export diversification. The findings have revealed that weak IPR protection tends to promote services export diversification in countries with low degrees of export product upgrading, while stronger intellectual property laws tend to foster services export diversification in countries with relatively high degrees of export product upgrading. Finally, the analysis has revealed that IPR protection strengthening induces greater services export diversification in developing countries whose IPR protection levels exceed the value of 1.197. On the other hand, in countries with low levels of IPR protection, it is rather the implementation of weaker IPR protection that stimulates services export diversification.

While the present analysis has not used an indicator of IPR protection that reflects specifically the protection of patent rights in the services sector, it has provided evidence of the effect of IPR protection on services export diversification through the avenue of export product upgrading. Any policy implication from the empirical analysis would involve a discussion on how IPR protection affects services export diversification through the export product upgrading channel.

The literature has provided that the strengthening of IPR protection can exert ambiguous effects on innovation; that is, it can enhance the market power of innovating firms and result in higher prices in the domestic markets. It can also reduce the risk of imitation and encourage the export of patentable products. The present study has shown that the implementation of weaker IPR protection promotes services export diversification in less developed countries, including those with a low level of export product upgrading. These countries, of which many LDCs, are exempted from the implementation of the TRIPS Agreement (from 1995), which allows them to adopt weaker IPR protection levels (see Gnangnon, 2023b), although membership in regional trade agreements could constrain them in their efforts to adopt and implement stronger intellectual property laws (e.g., Campi and Dueñas, 2019; Syam and Syed, 2023). On the other hand, IPR protection promotes services export diversification in relatively advanced developing countries, including those that foster export product diversification. Thus, strengthening IPR protection and ensuring that the legal provisions of IPRs are enforced in practice contributes to enhancing services export diversification, notably in countries that upgrade their export products.

The present study has also established that export product upgrading is an important channel through which the level of IPR protection could affect services export diversification. The WTO has established minimum standards of the protection and enforcement of intellectual property by each of its members. Many works have considered how IPR protection influences export product upgrading (e.g., Campi and Dueñas, 2016; Dong et al., 2022; Glass and Wu, 2007; Gnangnon and Moser, 2014; Liu et al., 2021; Ndubuisi and Foster-McGregor, 2018; Song et al., 2021). As noted above, they tend to show that while weak IPR protection can promote export product upgrading in less developed countries (including LDCs), stronger IPR protection enhances export product upgrading in relatively advanced countries among developing countries. On the other hand, export product upgrading tends to foster services export diversification (e.g., Gnangnon, 2020a; 2022). The findings of the present study do not contradict the existing literature to the extent that they show how weak IPR protection tends to foster services export diversification through greater export product upgrading in less developed countries, while stronger IPR protection matters for services export diversification through export product upgrading in relatively advanced countries. Insofar as less advanced countries, especially LDCs19 tend to adopt weaker IPR protection levels (e.g., Auriol et al., 2023; Chu et al., 2014), and relatively advanced developing countries tend to strengthen their IPR protection levels, the issue is therefore what types of measures could accompany developing countries’ IPR policies so as to enhance export product upgrading with a view ultimately to spurring the diversification of services exports. Policies to promote export product diversification, including those in developing countries, have been discussed in depth in the literature (e.g., Atolia et al., 2020; Hidalgo, 2022; Mosley, 2018; Salinas, 2021; Sweet and Maggio, 2015; Vogel, 2022).

While the present study does not focus on a specific country to provide policy recommendations tailored to that country, future analyses on this topic could explore, if relevant data are made available, how IPR protection strengthening affects services exports, including by services sector and item. This would help those who make policy recommendations specific to a country, or a group of countries, and hence inform decision-making at the national level.

APPENDIX

Notes

This paper represents the personal opinions of individual staff members of the World Bank and is not meant to represent the position or opinions of the World Bank Group, nor the official position of any staff members. The author expresses his sincere thanks to the two anonymous Reviewers for their very useful comments on the previous version of the paper. These comments contribute significantly to improving the quality of the paper. Any errors or omissions are the fault of the author.

There is no clear distinction between traditional and modern services in the literature. For example, Eichengreen and Gupta (2013a) consider that “traditional services” include trade and transport, tourism, financial services and insurance, while “modern services” encompass communications, computer, information, and other related services. According to Sahoo and Dash (2017), traditional services include transport and travel services, while modern services encompass transportability and tradability, financial services, insurance, business processing and software services.

The TRIPS Agreement is one of the founding agreements of the World Trade Organization (WTO). It sets out the minimum standards of intellectual protection to be provided by WTO members in the following fields: copyright and related rights; trademarks, including service marks; geographical indications; industrial designs; patents, including the protection of new varieties of plants; the layout-designs of integrated circuits; and undisclosed information, including trade secrets and test data. Further information on the TRIPS Agreement can be found online at: https://www.wto.org/english/tratop_e/trips_e/trips_e.htm and https://www.wto.org/english/tratop_e/trips_e/ta_docs_e/modules1_e.pdf

See for example Dinopoulos and Segerstrom (2010), Eicher and García-Peñalosa (2008), Hudson and Minea (2013), Kim et al. (2012), or Panda et al. (2020). See also the literature reviews provided by Hassan et al. (2010), Mrad (2017), and Park and Lippoldt (2008).

See for example Branstetter et al. (2011), Delgado et al. (2013), Falvey et al. (2009), Ivus and Park (2019), Panda et al. (2020), and Yang and Maskus (2009).

These studies include Anand et al. (2012), Eichengreen and Gupta (2013a), Gnangnon (2020a; 2020b; 2021b; 2021c; 2021d; 2021e; 2021f), and Sahoo and Dash (2017).

See for example, Akiyama and Furukawa (2009), Brüggemann et al. (2016), Chen and Puttitanun (2005), Naghavi and Strozzi (2015), Papageorgiadis and Sharma (2016), and Sweet and Maggio (2015).

The concept of “economic complexity” provides an indication of the information about the amount of “productive knowledge” (i.e., the technical know-how/the set of capabilities) embedded in the productive structure (and hence export structure of a country) (e.g., Hidalgo and Hausmann, 2009; Hausmann et al., 2013; Mishra et al., 2020).

Exports of sophisticated manufacturing products can be associated with greater economic complexity.

As indicated later in the analysis, patent protection is based on patentee rights, which covers the duration of patent protection relative to the international standard, subject matter that is patentable (or not unpatentable), participation in international intellectual property rights agreements, the enforcement mechanisms available, and how limited (or less restricted) the patenting exceptions are (such as any requirement to practice the invention or license the patents to third parties) (see Park, 2008).

When using this estimator, we correct the standard errors using the approach proposed by Driscoll and Kraay (1998) that helps deal with heteroscedasticity, serial correlations, and contemporaneous cross-sectional dependence in the residuals.

Henceforth, we refer to “IPRs” as “enforced IPRs” given the way the indicator “PRIE” has been computed.

The negative effect of real per capita income on services export diversification is consistent with the negative correlation pattern observed in Figure 3 between real per capita income and the indicator of services export diversification. Previous studies covered different samples and reported mixed evidence on the effect of real per capita income on services export diversification, depending on the topic under analysis. For example, Gnangnon (2021b; 2021c; 2022) found a positive effect of real per capita income on services export diversification when examining respectively the effect of manufactured exports, aid for trade, and economic complexity on services export diversification. However, Gnangnon (2020b) noted a positive effect of real per capita income on services export diversification when studying the effect of poverty on services export diversification. Ultimately, the effect of a country’s development level on services export diversification needs to be examined deeply in another study. In the present study, the negative effect of the real per capita income on services export diversification may reflect differentiated effects of the strengthening of IRP on services export diversification across countries in the full sample. This is what we test later in the analysis.

The statistically significant marginal impacts at the 95 percent confidence intervals are those including only the upper and lower bounds of the confidence interval that are either above or below the zero line.

The category of least developed countries includes those poorest and most vulnerable (to external and environmental shocks) in the world. Information on this category of countries is provided online at https://www.un.org/ohrlls/content/least-developed-countries.

These countries are Mozambique, Myanmar, Bangladesh, Congo Democratic Republic, Papua New Guinea, Benin, Burundi, Cote d’Ivoire, Mali, Guyana, Panama, Niger, Indonesia, Gabon, Congo Republic, Honduras, Togo, and Pakistan.

LDCs enjoy specific flexibilities in WTO agreements that have allowed them to reduce their IPR protection levels (e.g., Gnangnon, 2023b).

References

, , & (2012). Determinants of Export Diversification around the World: 1962-2000. The World Economy, 35(3), 295-315, https://doi.org/10.1111/j.1467-9701.2011.01395.x.

, & (2009). Intellectual property rights and appropriability of innovation. Economics Letters, 103(3), 138-141, https://doi.org/10.1016/j.econlet.2009.03.006.

, , , & (2020). Rethinking development policy: What remains of structural transformation? World Development, 128, 104834, https://doi.org/10.1016/j.worlddev.2019.104834.

, , & (2023). Intellectual property rights protection and trade: An empirical analysis. World Development, 162, 106072, https://doi.org/10.1016/j.worlddev.2022.106072.

(2008). Managing intellectual property in the financial services industry sector: Learning from Swiss Re. Technovation, 28(4), 196-207, https://doi.org/10.1016/j.technovation.2007.05.007.

, , & (2021). Feasible generalized least squares for panel data with cross-sectional and serial correlations. Empirical Economics, 60, 309-326, https://doi.org/10.1007/s00181-020-01977-2.

, & (2013). A New Data Set of Educational Attainment in the World, 1950-2010. Journal of Development Economics, 104, 184-198, https://doi.org/10.1016/j.jdeveco.2012.10.001.

, , , & (2011). Does intellectual property rights reform spur industrial development? Journal of International Economics, 83(1), 27-36, https://doi.org/10.1016/j.jinteco.2010.09.001.

, , , & (2016). Intellectual property rights hinder sequential innovation. Experimental evidence. Research Policy, 45(10), 2054-2068, https://doi.org/10.1016/j.respol.2016.07.008.

, , & (2011). Export Diversification: What’s Behind the Hump? Review of Economics and Statistic, 93, 590-605, https://doi.org/10.1162/REST_a_00078.

, & (2016). Intellectual Property Rights and International Trade of Agricultural Products. World Development, 80, 1-18, https://doi.org/10.1016/j.worlddev.2015.11.014.

, & (2019). Intellectual property rights, trade agreements, and international trade. Research Policy, 48(3), 531-545, https://doi.org/10.1016/j.respol.2018.09.011.

, & (2018). Effects of export product diversification on quality upgrading: an empirical study. Journal of International Trade & Economic Development, 27(3), 293-313, https://doi.org/10.1080/09638199.2017.1370006.

(2006). Does gravity matter in a service economy? The Review of World Economics, 142(2), 307-328, https://doi.org/10.1007/s10290-006-0069-5.

(2001). Intellectual Property Rights and Economic Development: Historical lessons and emerging issues. Journal of Human Development, 2(2), 287-309, https://doi.org/10.1080/14649880120067293.

(2013). The Extensive and Intensive Margins of Exports: The Role of Innovation. The World Economy, 36(5), 607-635, https://doi.org/10.1111/twec.12032.

, & (2005). Intellectual property rights and innovation in developing countries. Journal of Development Economics, 78(2), 474-493, https://doi.org/10.1016/j.jdeveco.2004.11.005.

, , & (2014). Stage-dependent intellectual property rights. Journal of Development Economics, 106, 239-249, https://doi.org/10.1016/j.jdeveco.2013.10.005.

, , & (2013). Intellectual property protection and the geography of trade. The Journal of Industrial Economics, 61(3), 733-762, https://doi.org/10.1111/joie.12027.

, & (2010). Intellectual property rights, multinational firms and economic growth. Journal of Development Economics, 92(1), 13-27, https://doi.org/10.1016/j.jdeveco.2009.01.007.

, , & (2022). Intellectual property rights protection and export product quality: Evidence from China. International Review of Economics & Finance, 77, 143-158, https://doi.org/10.1016/j.iref.2021.09.006.

, & (1998). Consistent Covariance Matrix Estimation with Spatially Dependent Panel Data. Review of Economics and Statistics, 80(4), 549-560, https://doi.org/10.1162/003465398557825.

, & (2013b). Exports of services: Indian experience in perspective. Indian Growth and Development Review, 6(1), 35-60, https://doi.org/10.1108/17538251311329540.

, & (2008). Endogenous strength of intellectual property rights: Implications for economic development and growth. European Economic Review, 52(2), 237-258, https://doi.org/10.1016/j.euroecorev.2007.10.003.

, , & (2009). Trade, imitative ability, and intellectual property rights. Review of World Economics, 145(3), 373-404, https://doi.org/10.1007/s10290-009-0028-z.

, & (2007). Intellectual property rights and quality improvement. Journal of Development Economics, 82(2), 393-415, https://doi.org/10.1016/j.jdeveco.2005.08.002.

, & (2016). Export Product Diversification, Services Production and Exports in Least Developed Countries. Journal of International Commerce, Economics and Policy, 7(3), 1650013, https://doi.org/10.1142/S1793993316500137.

(2020a). Effect of the Internet on Services Export Diversification. Journal of Economic Integration, 35(3), 519-558, https://doi.org/10.11130/jei.2020.35.3.519.

(2020b). Effect of Poverty on Services Export Concentration in Developing Countries. Journal of International Commerce, Economics and Policy, https://doi.org/10.1142/S1793993324500017.

(2020c). Export product diversification and tax performance quality in developing countries. International Economics and Economic Policy, 17, 849-876, https://doi.org/10.1007/s10368-020-00462-6.

(2021b). Manufacturing Exports and Services Export Diversification. The International Trade Journal, 35(3), 221-242, https://doi.org/10.1080/08853908.2020.1779877.

(2021c). Aid for Trade and Services Export Diversification in Recipient-Countries. Australian Economic Papers, The Fraser Institute, Vancouver, Canada, 60(2), 189-225, https://www.fraserinstitute.org/economic-freedom/dataset?geozone=world&page=dataset&min-year=2&max-year=0&filter=0, https://doi.org/10.1111/1467-8454.12200.

(2021d). Effect of Multilateral Trade Liberalization on Services Export Diversification. Journal of Economic Studies, 49(6), 1117-1136, https://doi.org/10.1108/JES-01-2021-0057.

(2021e). Development aid and services export diversification. International Journal of Economic Policy Studies, 15(1), 125-156, https://doi.org/10.1007/s42495-020-00053-y.

(2021f). Services export diversification and services export revenue stability: does trade openness matter? International Trade, Politics and Development, 5(2), 90-113, https://doi.org/10.1108/ITPD-04-2020-0012.

(2022). Effect of economic complexity on services export diversification: do foreign direct investment inflows matter? International Journal of Development Issues, 21(3), 413-437, https://doi.org/10.1108/IJDI-01-2022-0023.

(2023a). Export Product Concentration and Poverty Volatility in Developing Countries. The International Trade Journal, https://doi.org/10.1080/08853908.2023.2192016.

(2023b). The least developed countries’ transitional exemption in the TRIPS agreement and the strength of intellectual property protection. Information Economics and Policy, 101065, https://doi.org/10.1016/j.infoecopol.2023.101065.

, & (1996). The role of intellectual property rights in economic growth. Journal of Development Economics, 48(2), 323-350, https://doi.org/10.1016/0304-3878(95)00039-9.

, & . (2004). International protection of intellectual property. American Economic Review, 94(5), 1635-1653, https://doi.org/10.1257/0002828043052312.

, , , , , & Economic Freedom of the World 2022 Annual Report, The Fraser Institute, Vancouver, Canada, 2022, Data can be retrieved online at: , https://www.fraserinstitute.org/economic-freedom/dataset?geozone=world&page=dataset&min-year=2&max-year=0&filter=0.

, & (2009). The building blocks of economic complexity. Proceedings of the National Academy of Sciences, 106(26), 10570-10575, https://doi.org/10.1073/pnas.0900943106.

(1993). Innovation, imitation, and intellectual property rights. Econometrica, 61(6), 1247-1280, https://doi.org/10.2307/2951642.

The Policy Implications of Economic Complexity, 2022, arXiv:2205.02164, https://doi.org/10.48550/arXiv.2205.02164.

, & (2017). Services Productivity, Trade Policy, and Manufacturing Exports. World Economy, 40(3), 499-516, https://doi.org/10.1111/twec.12333.

, & (2013). Innovation, intellectual property rights and economic development: A unified empirical investigation. World Development, 46, 66-78, https://doi.org/10.1016/j.worlddev.2013.01.023.

, & (2019). Patent reforms and exporter behaviour: Firm-level evidence from developing countries. Journal of the Japanese and International Economies, 51, 129-147, https://doi.org/10.1016/j.jjie.2019.02.002.

, & (2021). Visualizing the services embodied in global manufacturing exports. Physica A: Statistical Mechanics and its Applications, 571, 125365, https://doi.org/10.1016/j.physa.2020.125365.

, , , & (2012). Appropriate intellectual property protection and economic growth in countries at different levels of development. Research Policy, 41(2), 358-375, https://doi.org/10.1016/j.respol.2011.09.003.

, & (2006). The gravity equation in international trade in services. Review of World Economics, 142(1), 92-121, https://doi.org/10.1007/s10290-006-0058-8.

, , , , & (2021). How demand scale affect services exports? Evidence from financial development perspective. Research in International Business and Finance, 58, 101428, https://doi.org/10.1016/j.ribaf.2021.101428.