Assessing the Contributions of Non-bank Financial Institutions (NBFI) and ELS Issuance to Systemic Risk in Korea†

Abstract

Since the Global Financial Crisis of 2008-2009, the importance of non-bank financial institutions in macroprudential management has increased significantly. Consequently, major countries and international financial institutions have been actively discussing and implementing macroprudential supervision and regulation for non-bank financial institutions (NBFI). In this context, this paper analyzes the systemic risk of both banks and non-bank sectors (securities firms and insurance companies) in South Korea over different time periods. Using the widely recognized ΔCoVaR methodology for measuring systemic risk, the analysis reveals that systemic risk increased substantially across all three sectors (banks, securities firms, and insurance companies) during the Global Financial Crisis, the European Sovereign Debt Crisis, and the COVID-19 pandemic. Although the banking sector exhibited relatively high systemic risk compared to the securities and insurance sectors, the relative differences in systemic risk varied across the different crisis periods. Notably, during the margin call crisis in March of 2020, the gap in systemic risk between the banking and securities sectors decreased significantly compared to that during both the Global Financial Crisis and the European Sovereign Debt Crisis, indicating that securities firms had a more substantial impact on risk in the overall financial system during this period. Furthermore, I analyze the impact of the issuance of equity-linked securities (ELS) by financial institutions on systemic risk, as measured by ΔCoVaR, finding that an increase in the outstanding balance of ELS issuance by financial institutions had an impact on increasing ΔCoVaR during the three crisis periods. These findings underscore the growing importance of non-bank financial institutions in relation to South Korea’s macroprudential management and supervision. To address this evolving landscape, enhanced monitoring and regulatory measures focusing on non-bank systemic risk are essential components of maintaining financial stability in the country.

Keywords

NBFI, Systemic Risk, Macroprudential Policies, Financial Stability, Equity-linked Seurities

JEL Code

G01, G23, G28, G32

I. Introduction

Since the Global Financial Crisis, both the role and the share of non-bank financial institutions in the global financial market have significantly increased. As of the end of 2021, non-bank financial institutions accounted for 49.2% of the global financial market, marking an increase of 6.4 percentage points from 42.8% in 2011 (FSB, 2022). Furthermore, due to factors such as strengthened regulations that affect banks (including Basel III), prolonged periods of low-interest-rate monetary policies, and the growth of insurance and pension funds, non-bank financial institutions have been providing various forms of credit to both corporations and households. In response to this trend, major countries and international organizations such as governments, the BIS, and the IMF have actively engaged in discussions regarding the macroprudential supervision and regulation of non-bank financial intermediation. They have also worked on improving and introducing relevant regulatory frameworks. A notable example is the establishment of the Financial Stability Board (FSB) by G20 leaders in April of 2009, which tasked the FSB with developing regulatory measures for shadow banking, later renamed non-bank financial intermediation in November of 2011.

In South Korea, the importance of non-bank financial institutions has also increased since the Global Financial Crisis. The proportion of total assets held by non-bank financial institutions has consistently risen compared to that in the banking sector since the Global Financial Crisis. As of the end of 2020, non-bank financial institutions held approximately 90.4% of all assets compared to the banking sector. This marked an increase of approximately 28.4 percentage points from the end of 2010, when the proportion stood at 72.0% (Bank of Korea, 2022).

Furthermore, the scale of non-bank financial institutions has expanded significantly. By the end of 2021, the size of all non-bank intermediaries had increased by approximately two to four times compared to 2008. Specifically, the total assets of the securities industry grew from $80 billion in 2008 to around $350 billion by 2021, representing a substantial increase of approximately 4.4 times.

As a result, South Korea has introduced various measures to strengthen the macroprudential supervision of non-bank financial institutions such as securities firms and insurance companies. However, discussions focusing on the extent and means of enhancing macroprudential supervision for these non-bank financial institutions are ongoing. One key discussion point is whether the systemically important financial institution (SIFI) designation and the enhanced management framework, which were introduced for banks and bank holding companies, should also be applied to large securities firms and insurance companies. Additionally, while banks have experienced enhanced regulatory requirements, such as additional capital requirements and liquidity management through the implementation of Basel III, discussions on the topic of introducing similar levels of prudential regulation for securities firms and insurance companies are still ongoing.

Meanwhile, the COVID-19 Crisis has once again highlighted the importance of strengthening macroprudential regulations as they pertain to non-bank financial institutions. As the COVID-19 pandemic began in February of 2020 and various countries implemented lockdown measures, there was an increased demand for safe-haven assets among global investors. Particularly, as the crisis deepened in March of 2020, there was a surge in demand for cash-like assets, leading to the “Dash for Cash” phenomenon. This, in turn, resulted in selling pressure on safe-haven assets, including U.S. Treasuries. Consequently, yields on government bonds in major countries experienced rapid increases over a short period. For example, with regard to U.S. Treasuries, the yield on the ten-year maturity bond increased by 50 basis points in just 12 days from March 11th to the 23rd.

In South Korea, there were financial market disruptions during the early stages of the COVID-19 Crisis. Like several other countries, South Korea experienced financial market turmoil, but due to different mechanisms. In March of 2020, securities firms faced margin calls triggered by the price drop of foreign assets underlying previously issued derivative-linked securities. They were required to provide additional collateral. As a result, these securities firms needed foreign currency funds, leading to a rapid surge in exchange rates and commercial paper (CP) rates over a short period.

In response to these challenges, the South Korean government and the Bank of Korea provided foreign currency liquidity to non-bank financial institutions through repurchase agreements (RPs). Additionally, the government established the Foreign Exchange Soundness Council, improved the monitoring system for foreign currency liquidity at non-bank financial institutions, enhanced the foreign currency liquidity supply system, and encouraged diversification of investments in the hedging assets of securities firms issuing derivative-linked securities. These measures aimed to strengthen the macroprudential regulation and management for non-bank financial institutions in South Korea during the COVID-19 Crisis.

Due to the increased importance of macroprudential regulation for non-bank financial institutions and the changing domestic and international regulatory landscape, this paper aims to analyze the changes in systemic risk over time and by industry sector in South Korea. It also examines the impact of the issuance of derivative-linked securities (ELS) on systemic risk. The goal is to derive policy implications pertaining to systemic risk as it affects non-bank financial institutions and macroprudential regulations of these institutions.

Specifically, I analyze the systemic risk of banks and non-bank financial institutions (securities firms and insurance companies) in South Korea by time and industry sector. Among various methods that can be used to measure systemic risk, I utilize the well-known ΔCoVaR metric. The analysis reveals that the level of systemic risk in all sectors, in this case banking, securities, and insurance, significantly increased during the Global Financial Crisis, the European Sovereign Debt Crisis, and the COVID-19 Crisis.

The estimated systemic risk based on ΔCoVaR for the banking sector was relatively high compared to that in the securities and insurance sectors. However, the inter-sectoral differences in systemic risk exhibited varying patterns depending on the crisis. Notably, during the margin call crisis in March of 2020, the difference in systemic risk between the banking and securities sectors decreased significantly compared to that during the Global Financial Crisis and the European Sovereign Debt Crisis. This suggests that the impact of the securities sector on the overall financial system risk during the margin call crisis was more substantial than during previous crises.

Furthermore, to understand the effects of the initial margin call crisis in securities firms’ ELS and the development of the derivative-linked securities market on systemic risk, this study analyzed the effect of financial companies’ ELS issuance on systemic risk using ΔCoVaR and MES. Initially, the ΔCoVaR and MES outcomes of financial companies were estimated, and a panel fixed-effects regression analysis was conducted to analyze the impact of ELS issuance on systemic risk. Through this analysis, it was found that the impact of the increase in the outstanding balance of financial companies’ ELS issuance during three crisis periods and the Hong Kong Hang Seng Index’s period of sharp decline led to an increase in systemic risk.

The structure of this paper is as follows. In Chapter II. I review existing research related to systemic risk measurements and macroprudential regulations as aspects of non-bank financial intermediation. Chapter III. provides an overview of the current status and policy trends in non-bank financial institutions. In Chapter IV, I briefly explain the systemic risk analysis method, ΔCoVaR, and its estimation techniques as used in this report. Chapter V presents the main empirical analysis results of this study, and finally, in Chapter VI, I conclude the report.

II. Literature Review

Since the Global Financial Crisis, various studies have attempted to measure systemic risk using different methodologies. Among the most actively utilized approaches for measuring systemic risk are those by Adrian and Brunnermeier (2016), who developed ΔCoVaR, and Acharya et al. (2017), who developed MES (marginal expected shortfall). These two methodologies are highly relevant due to their utilization of market data, but they have the drawback of limited insight into the transmission mechanisms within financial institutions or financial markets.

Contrary to market-based systemic risk measures such as ΔCoVaR and MES, balance-sheet-based systemic risk measures utilize data on financial institutions’ assets, liabilities, and transactions. This approach has the advantage of being able to quantify the contagion mechanisms between financial institutions directly, though due to privacy concerns mandated by current laws and regulations, such data are confidential and available exclusively to regulatory bodies. Owing to these constraints, this study uses market-based systemic risk measures. Balance-sheet-based systemic risk measures are also generally associated with lower data frequency rates than market-based systemic risk measurement methods. In this paper, I estimate ΔCoVaR and MES using daily and weekly data. A survey study focusing on various systemic risk measurement methods was conducted by Suh (2018).

In research that utilizes ΔCoVaR, several noteworthy studies can be highlighted. Firstly, Kim and Kim (2010) conducted research on inter-industry contagion among commercial banks, mutual savings banks, and securities firms using the ΔCoVaR estimation technique. They particularly found that mutual savings banks exhibit greater exposure to systemic risk compared to other sectors.

Using ΔCoVaR, Kim and Lee (2017) analyzed the impact of changes in the proportion of non-deposit liabilities for large financial holding companies in South Korea and the United States before and after the Global Financial Crisis. Their findings indicated that an increase in the proportion of non-deposit liabilities had a negative effect on systemic risk for large financial holding companies in the U.S. In contrast, for South Korea, it was observed that immediately after an increase in the proportion of non-deposit liabilities, there was a negative impact on systemic risk, but over time, the effect was positive. Consequently, they concluded that it is difficult to discuss the impact of non-deposit liabilities on systemic risk uniformly across different countries.

Jin and Lee (2021) estimated the impact of the credit cycle on systemic risk in the financial industry using ΔCoVaR and panel regression models. Their results confirmed that the credit cycle increases systemic risk, particularly highlighting the significant influence of non-financial corporate credit and household credit on the deterioration of systemic risk.

The discussion over whether securities firms and insurance companies are systemic financial institutions as important as banks is ongoing (Lee, 2020 and Kim, 2019). Lee (2020) argued that the systemic risk associated with securities firms has been steadily increasing but is not immediately worrisome. Kim (2019) contended that the nature of the insurance industry is changing, with exposure to systemic risk arising as the industry undertakes non-traditional insurance tasks, thereby increasing the magnitude of the risk as well. Regarding the measurement of systemic risk, Lee (2020) utilized indicators applied to banks, finding that the systemic risk for banks, securities, and insurance sectors was high in that order according to the mean of CoVaR as opposed to the outcome when using ΔCoVaR as introduced by Adrian and Brunnermeier (2016), though details about the estimation methods (i.e., VAR, quantile regression) were not provided.

Kim (2019), on the other hand, analyzed the systemic importance of securities and insurance companies by means of a concentration analysis, a principal component analysis, and with the Granger causality analysis method. In contrast, this paper used ΔCoVaR to compare and analyze systemic risk across different financial sectors, showing that the systemic risk of securities firms and insurance companies varies over time and that the gap with banks decreases during financial crises.

Previous research analyzing the impact of ELS issuance on financial stability or markets includes work by Yoon and Jung (2018) and by Lee (2017). Yoon and Jung (2018) used the Bank of Korea’s Financial Stability Index (FSI), a weighted average of 20 indicators (such as bank delinquency rates, stock price, and foreign exchange volatility), to demonstrate that ELS issuance negatively affects financial stability. One limitation of their approach is that the FSI does not account for the contagion effect in systemic risk estimations. Lee (2017) estimated the impact of increased ELS on stock returns, government and corporate bond yields, and repurchase agreement (RP) sales balances, arguing that the financial risks associated with increased ELS are not alarming but have increased slightly. Lee (2017)’s study also did not use systemic risk indicators that reflect market contagion effects.

A range of earlier work has examined different aspects of systemic risk, but the present study is unique in the following ways. First, this study estimates the systemic risk of both banks and non-banks (securities firms and insurance companies) using the dynamic conditional correlation (DCC) model, with data available on a daily basis. Notably, the analysis period includes the margin call crisis of March of 2020. During the securities firms’ margin call crisis in March of that year, collateral requirements for securities firms increased significantly on a daily basis, causing turmoil in the South Korean financial markets. Therefore, this study examines daily changes in systemic risk, taking this period into account.

The second distinctive feature of this study is that it compares and analyzes the systemic risk of both banks and non-bank financial institutions. This allows for a discussion of the need to enhance systemic risk management and macroprudential policies, particularly for South Korea’s non-banking sector. Based on the results of this study, discussions could include the introduction of Basel-style regulations for securities firms and considerations when applying the systemically important financial institution (SIFI) designation.

Lastly, this study includes a time-specific analysis using ΔCoVaR and MES to examine the impact of securities firms’ ELS issuances on systemic risk, discovering that the magnitude of this impact increased during crises in the past, with variations observed during different crisis periods. Given the unique characteristics of South Korea’s ELS market and its market size, this research utilized two representative systemic risk measurement methods, ΔCoVaR and MES, to analyze the effect of ELS issuances on the stability of South Korea’s financial markets.

III. NBFI in Korea

A. Overview of NBFI in Korea

First, as with major countries worldwide, Korea has also seen an increase in the proportion of the non-bank financial intermediation (NBFI) sector within its financial markets since the Global Financial Crisis. This shift is evident when examining the size and proportion of NBFI’s assets relative to banking assets. As of the end of 2020, the non-bank financial intermediation (NBFI) sector held approximately 90.4% of all assets, a notable increase of approximately 28.4 percentage points compared to the end of 2010, when this proportion stood at 72.0%.

FIGURE 1.

BANK AND NON-BANK’S TOTAL ASSET AND NON-BANK/BANK TOTAL ASSET RATIO

Note: Total assets for the Non-Bank category here refers to the sum of the total assets of insurance, credit unions, securities firms, specialized credit finance firms, and savings banks.

Source: Banking Statistics System of Financial Supervisory Service and Financial Stability Report of Bank of Korea.

As of the end of 2021, South Korea’s non-bank financial intermediation (NBFI) sector reached $1.1 trillion in size. When categorized according to their economic function (EF) by the Financial Stability Board (FSB), the components of the narrow measure of NBFI, listed in descending order of their proportions, are shown in Table 1.

EF3, which includes securities firms engaged in credit intermediation within the direct finance market, accounts for 31.8% of the total. EF1, representing collective investment schemes with the potential for mass redemptions, makes up 31.1%. EF5, focusing on liquidity facilities involved in credit intermediation through securitization, constitutes 19.4%. EF2, encompassing lending institutions reliant on short-term funding, contributes 14.4%. EF4, comprising specialized bond guaranty insurers and similar entities involved in credit enhancement functions, represents 3.1% of the total.

When examining the scale and proportions by function over the years in Figure 2, it is evident that the rankings remain relatively stable. EF1 (collective investment schemes) and EF3 (securities firms) consistently account for approximately 20-30% each, collectively making up around 60-70%. Following these, EF2 (credit specialized finance companies), EF5 (liquidity facilities), and EF4 (guarantee institutions) take their positions in descending order.

FIGURE 2.

MAIN MONITORING AGGREGATES OF THE FSB’S GLOBAL MONITORING REPORT ON NBFI

Note: The definitions of Economic Functions are given in Table 1.

Source: FSB.

The rankings based on size by year correspond to the rankings based on proportion. By the end of 2021, the size of all non-bank intermediaries had increased by approximately two to four times compared to 2008. Particularly, the assets of EF3 (securities firms) grew from $80 billion in 2008 to around $350 billion by 2021, an increase of approximately 4.4 times. This is mainly attributable to the introduction of the Comprehensive Financial Investment Business Entities system in 2013 and the Large-Scale IB system in 2016, which led to the expansion of asset sizes for securities firms.

Figure 3 shows the asset composition of banks, securities firms, and insurance companies. Banks have a large proportion of loans among their assets, while securities and insurance companies hold a substantial portion of securities. Such asset composition differences can lead to varying levels of systemic risk across these sectors. For instance, as evidenced by the margin call crisis in March of 2020, securities firms’ self-hedging through the ownership of foreign index futures and credit card companies’ bonds can affect systemic risk.

FIGURE 3.

ASSET COMPOSITION OF BANKS, SECURITIES FIRMS AND INSURANCE COMPANIES

Notes: Other Assets of Security Firms include derivatives, CMA operating assets, lease assets, and other assets; Other Assets of Insurance Firms include non-operating assets and special account assets.

Source: Financial Supervisory Service Information.

B. March 2020 market turmoil and equity –linked securities (ELS)

The COVID-19 Crisis marked the first event with the potential to threaten global financial stability since the 2008-09 Global Financial Crisis. Specifically, it exposed vulnerabilities in the non-bank financial intermediaries (NBFI) sector within the short-term financial markets, prompting unprecedented interventions by central banks and governments.

In particular, the surge in demand for cash in March of 2020, commonly referred to as the “Dash for Cash,” resulted in turmoil across various financial markets, including stocks, bonds, and the foreign exchange market (see FSB, 2020). As the COVID-19 Crisis deepened in March of that year, there was a sharp increase in the demand for cash, a short-term highly liquid asset, which translated into selling pressure on major financial assets. On March 16th, 2020, the S&P 500 experienced a 12% decline, marking the largest single-day drop since 1987. Additionally, yields on government bonds of major economies experienced rapid increases. For instance, for U.S. Treasury bonds, the ten-year maturity yield surged by 50 basis points over 12 days (from March 11th to March 23rd).

For South Korea, the initial turmoil in global financial markets during the early stages of the COVID-19 Crisis had a direct impact on the derivatives and structured securities markets, indirectly leading to disruptions in South Korea’s foreign exchange and short-term financial markets. In March of 2020, securities firms faced margin calls due to the price declines of underlying assets in derivatives and structured securities issued abroad. The total net outflows from securities firms amounted to 1.3 trillion KRW from March 2nd to March 6th, with daily outflows subsequently ranging from 0.1 trillion KRW to 3 trillion KRW. As a result, a total of 10.1 trillion KRW was transferred to overseas exchanges to meet margin calls during March (see Figure 4).

FIGURE 4.

TREND OF SECURITIES FIRMS’ NET TRANSFER DURING MACH 2020

Source: MoneyToday, “The day one year ago when securities firms shook, the system teetered,” April 3, 2021.

In South Korea, the persistent low-interest-rate environment following the Global Financial Crisis led to continuous growth in the structured securities market, offering investors higher yields than traditional deposit accounts while maintaining a relatively low risk of principal loss. The market expanded from 26.9 trillion KRW at the end of 2008 to 111.7 trillion KRW at the end of 2018 but then decreased to 89.0 trillion KRW by the end of 2020.

Among the prominent types of structured securities in South Korea are equity-linked securities (ELS). The ELS type typically provides investors with a structure that guarantees a fixed return, often around 5.4% per year, as long as the underlying assets (such as the Hong Kong Hang Seng Index or Euro Stock) do not fall below a certain predefined level, set at around 85%, every six months.

This structure has been attractive to investors seeking relatively stable returns while minimizing the risk of significant capital loss, and it played a role in the growth and popularity of structured securities in South Korea during the low-interest-rate era.

Securities firms that issue equity-linked securities (ELS) use the funds received from investors to purchase or sell underlying assets and bonds, ultimately delivering returns to investors based on pre-established agreements. Through this process, the issuer engages in hedging to manage their exposure arising from the positions established within the products they have sold. The magnitude and direction of hedging transactions depend on the price and volatility of the underlying assets, which are determined based on sensitivity measures stemming from no-arbitrage-based derivative product pricing models (Bakshi and Kapadia, 2003).

The mechanism through which the issuance of ELS by securities firms can trigger market turmoil lies in the behavior of hedging against the potential loss risks associated with ELS issuance. When securities firms issuing ELS opt for self-hedging by investing in stock index futures, they may need domestic or foreign currency funds to meet any margin calls that may arise. Consequently, the financial institution may attempt to sell assets such as bonds or borrow on the short-term money market to meet these additional margin calls.

For instance, for financial institutions that issue ELS, as depicted in Figure 5, there is a high likelihood that they will adopt long positions in the underlying asset futures to guarantee a certain annual interest rate (total return increases over time) to investors until maturity. Consequently, if the price of the underlying asset drops significantly over a short period, financial companies that have chosen self-hedging as a strategy may incur losses from their futures long positions. This situation can lead to an increase in liquidity risk as the firms must meet margin calls (arrange for additional collateral).

FIGURE 5.

EXAMPLE OF STEP-DOWN AND AUTO-CALLABLE TYPE ELS PROFIT AND LOSS STRUCTURES

Source: Prepared by the author.

Furthermore, the sale of assets and borrowing in the short-term money market to secure funds can lead to the purchase of foreign currencies, potentially causing exchange rate fluctuations. These mechanisms, characterized by asset fire sales, short-term borrowing, and foreign exchange purchases, can contribute to sharp increases in interest rates and exchange rates, thereby inducing turmoil in financial markets, including disruptions of short-term financial instruments such as commercial paper (CP) and repurchase agreements (RP).

Moreover, securities firms engaged in ELS sales have the option to invest a portion of their ELS sales proceeds in bonds issued by specialized credit finance companies, as illustrated in Figure 7. When examining the capital-raising activities and bond holdings of specialized credit finance companies as of 2018, it is evident that these entities sourced approximately 76.2% (equivalent to KRW 147.1 trillion) of their funds through the issuance of bonds. Notably, among these bonds, 37.4% were held by securities firms, as depicted in Figure 7.

FIGURE 7.

FUNDING STRUCTURE OF SPECIALIZED CREDIT FINANCING COMPANIES AND THE POSSESSION OF THOSE BONDS

Source: The Financial Services Commission (2018).

The increasing interconnectedness between securities firms and specialized credit finance companies through such bonds can lead to an elevated rollover risk for specialized credit finance companies. This risk could potentially impact not only securities firms but also specialized credit companies in the event of a sudden decline in the assets underpinning the ELS.

As shown above, considering the characteristics of the structured securities market in South Korea, such as the ELS revenue structures, the rapid growth of this market, and the hedging practices of securities firms (utilizing bonds and index futures for self-hedging), it is possible that the issuance of structured securities has had varying effects on financial stability and systemic risk in the Korean economy. Therefore, I analyze the impact of derivative-linked securities issuance on systemic risk later in this paper.

IV. Data and Methodology

A. Systemic risk measure

There exist various approaches by which to measure systemic risk, and many prior studies have relied on the two prominent indicators of ΔCoVaR (Adrian and Brunnermeier, 2016) and MES (Acharya et al., 2017). The combination of these indicators is appealing due to their complementary perspectives. ΔCoVaR considers banks as “risk inducers” and estimates the additional value at risk (VaR) that a financial institution contributes to the overall systemic risk level when it encounters distress. In contrast, MES treats banks as “risk recipients” and calculates their conditional equity losses when distress strikes the financial system.

In the context of our study, which analyzes the impact of equity-linked securities (ELS) issuance on systemic risk, it is more appropriate to consider individual financial institutions as risk inducers. Consequently, I use ΔCoVaR in the primary analysis, with MES employed to assess the robustness of this approach.

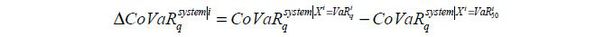

Firstly, following Adrian and Brunnermeier (2016), ΔCoVaR is defined as follows:

Here, Xi represents the stock returns of financial institution i, and q signifies the q-th percentile, i.e., the value at risk (VaR). C(Xi) is the conditional event for financial institution i, and C(Xi) is defined conditionally for the financial system (S). I estimate ΔCoVaR using the dynamic conditional correlation (DCC) model (Brownlees and Engle, 2012).

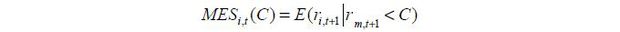

As a robustness check, I also use MES (marginal expected shortfall) as a systemic risk measure, as mentioned above. MES is defined as follows:

In short, MES is defined as the expected value of a financial institution’s returns when the financial system’s returns fall below C, where C is set to -2%, following the methodology proposed by Brownlees and Engle (2012).

B. Summary statistics

I use daily returns of KOSPI indices for the banking, securities, insurance, and overall financial sectors from January of 2006 to December of 2020 to estimate ΔCoVaR at different time points. Table 2 provides basic statistical measures for the returns of each sector’s index.

To analyze the impact of equity-linked securities (ELS) issuance on systemic risk (ΔCoVaR and MES), I devised a fixed-effects panel regression model. Within the fixed-effects model, I controlled for various macroeconomic variables, including the Korean policy interest rate, U.S. policy interest rate, Korean Consumer Price Index, and GDP. Table 3 provides descriptive statistics for these variables.

Furthermore, I employed the daily stock returns of a total of 15 financial institutions, consisting of five banks, five securities firms, and five insurance companies, to estimate ΔCoVaR for each of these financial institutions.

V. Empirical Results

A. Systemic risk contribution by sector

In an analysis estimating ΔCoVaR across banking, securities, and insurance sectors over different time periods, I observed significant increases in ΔCoVaR during global financial crises, specifically the Global Financial Crisis, the European Sovereign Debt Crisis, and the COVID-19 Crisis (Figure 8). These findings are consistent with the concept of systemic risk, which aims to measure the heightened risk across the entire financial system during crises. Additionally, during these three crisis periods, the increase in ΔCoVaR across all sectors corroborates studies that focused on financial distress, where financial distress is defined according to ΔCoVaR criteria. Specifically, this implies situations in which the weekly returns of individual sector indices decline to the bottom 5% from the median value.

The increase in ΔCoVaR across all sectors signifies a heightened impact on the overall financial system’s risk profile. This phenomenon manifests as an increase in the correlation between the financial sector indices and individual financial institution returns, as well as an increase in the bankruptcy risk of individual financial institutions.

Upon examining specific estimates, the findings are as follows (Table 4). Over the entire analysis period from January of 2006 to December of 2020, the average ΔCoVaR estimates for the banking, securities, and insurance sectors are 2.03%, 1.75%, and 1.64%, respectively. In other words, when the daily returns of individual sector indices fall to the bottom 5% from the median value, the daily 5% value at risk (absolute value of the lower fifth percentile) for the financial sector index increases on average by 2.03, 1.75, and 1.65 percentage points, respectively. This implies that distress in individual sectors has an impact on the overall increase in downside risk for the financial system (corresponding averages of 2.03%, 1.75%, and 1.65%). Considering that the average 5% value at risk for the financial sector index over the entire analysis period (January 2006 to December 2020) is 2.30%, the ΔCoVaR estimates indicate that the impact of each sector on the overall financial system is non-negligible (averages of 2.03%, 1.75%, and 1.65%)

TABLE 4

ΔCOVaR, ASSET VaR, AND MARKET VaR OF BANKS SECURITIES FIRMS AND INSURANCE FIRMS BY DIFFERENT TIME PERIODS

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

The average estimated ΔCoVaR values for different sectors during the Global Financial Crisis period (October 2008 to June 2009) are 5.24%, 4.73%, and 4.30% respectively. These figures are markedly elevated in comparison to the average ΔCoVaR estimates for the entire analysis period of January of 2006 to December of 2020, which are 2.03%, 1.75%, and 1.65%, respectively. Specifically, the averages during the crisis period exceed the long-term averages correspondingly by 3.21, 2.98, and 2.65 percentage points. Additionally, this difference is notably greater than the standard deviations of ΔCoVaR, 1.12%, 1.07%, and 0.96%, for the sectors over the entire analysis period. The ratios between the differences and these standard deviations are 2.86, 2.79, and 2.76, respectively.

These findings imply a statistically significant increase in systemic risk within these sectors during the period of the Global Financial Crisis.

During the period of the Global Financial Crisis (October 2008 to June 2009), the average 5% VaR for the financial sector index was 5.66%. This represents an increase of 3.66 percentage points compared to the average 5% VaR of 2.30% for the entire analysis period (2008.10 to 2009.6). These data imply increased overall risk within the financial sector during the crisis, consistent with the concept of rising systemic risk during periods of financial instability.

Similarly, during the European Sovereign Debt Crisis (January 2010 to June 2012), the maximum ΔCoVaR values for the banking, securities, and insurance sectors were 4.87%, 4.27%, and 4.17%, respectively. These figures are significantly higher than the average ΔCoVaR estimates for the entire analysis period from January of 2006 to December of 2020, which are 2.03%, 1.75%, and 1.65%. The specific increases in these values are correspondingly 2.84, 2.52, and 2.52 percentage points. Moreover, these increases are 3.75, 3.2, and 3.21 times greater than the standard deviations of ΔCoVaR for the sectors over the entire analysis period, which are 1.12%, 1.07%, and 0.96%.

Such findings strongly suggest that systemic risk escalated during the European Sovereign Debt Crisis, aligning with the notion that the overall risk within the financial sector intensifies during crisis periods.

During the COVID-19 Crisis period (January 2020 to June 2020), the average ΔCoVaR values for the banking, securities, and insurance sectors were 3.31%, 3.12%, and 2.88%, respectively. These figures are considerably higher than the average ΔCoVaR estimates for the Global Financial Crisis period (October 2008 to June 2009), which were 2.03%, 1.75%, and 1.65%. Specifically, the COVID-19 Crisis period averages exceed the Global Financial Crisis period averages by 2.19, 2.05, and 1.92 percentage points, respectively. These increases are also 2.95, 2.91, and 3 times greater than the standard deviations of ΔCoVaR for the sectors during the Global Financial Crisis period (1.12%, 1.07%, and 0.96%).

Moreover, during the period of securities firms’ margin call events (March 1 to March 31, 2020), as referred to above, a significant surge in ΔCoVaR was observed. The peak ΔCoVaR values during this period for the banking, securities, and insurance sectors were 7.94%, 7.81%, and 7.16%, respectively. These values are 7.1, 7.3, and 7.46 times greater than the standard deviations of ΔCoVaR during the Global Financial Crisis period (1.12%, 1.07%, and 0.96%). They are approximately 0.81 to 0.87 times the peak ΔCoVaR values observed during the Global Financial Crisis (9.82%, 8.94%, and 8.40%) and about 1.63 to 1.82 times the peak ΔCoVaR values during the European Sovereign Debt Crisis (4.87%, 4.27%, and 4.17%).

TABLE 5

∆COVaR, ASSET VaR, AND MARKET VaR OF BANKS SECURITIES FIRMS AND INSURANCE FIRMS DURING COVID-19 AND 2020 MARGIN CALL CRISIS

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

In summary, these findings imply that systemic risk increased during the COVID-19 Crisis, albeit at a magnitude smaller than that of the Global Financial Crisis but greater than that of the European Sovereign Debt Crisis. Particularly during the securities firms’ margin call events in the initial phase of the COVID-19 Crisis, these results suggest that the overall risk within the Korean financial market was markedly elevated.

B. Systemic risk contributions by individual financial institutions

When comparing the difference in ΔCoVaR among industry sectors over the entire analysis period, ΔCoVaR for the securities and insurance sectors was lower than that of the banking sector. Furthermore, individual banks (including bank holding companies), securities firms, and insurance companies exhibited similar trends in their ΔCoVaR values compared to the industry-specific ΔCoVaR indices (see Figure 9 and Table 6).

FIGURE 9.

JAN. 2006 ~ DEC. 2020 ΔCOVaR (DCC) - ASSET VaR SCATTERPLOT

Note: Five banks (Shinhan, KB, Hana, Woori, IBK), five securities firms(Mirae Asset, Meritz, Korea-Investment, Samsung), and five insurance firms (Mirae Asset Life, Samsung Life, Hanhwa Life, DB, Lotte) constitute the sample for the CoVaR and Asset VaR calculations.

Source: Author’s calculations.

TABLE 6

∆COVaR AND ASSET VaR BY EACH INDUSTRY AND FIRM FROM 2006 TO 2020

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

To delve into specifics, as of the end of 2020, the ΔCoVaR for the top five banks and bank holding companies ranged from 1.61 to 1.80, notably more significant than the values of 1.20 to 1.56 observed for the five securities firms and the range of 0.58 to 1.13 observed for the five insurance companies. This analysis highlights a tendency to find larger ΔCoVaR values among the major banks and bank holding companies compared to those of securities and insurance firms.

This outcome aligns with banks’ status and role in the Korean financial market and system compared to securities and insurance companies. While it is true that the proportion of non-banking sector assets relative to banks has increased over the past decade, the overall estimation results of ΔCoVaR throughout the analysis period underscore the relative significance of banks compared to securities and insurance firms within the Korean financial market.

This analysis highlights the prevailing importance of banks in the Korean financial landscape, in contrast to securities and insurance companies, despite the observed growth in the non-banking sector’s asset share over the past ten years.

Furthermore, during the Global Financial Crisis, the average ΔCoVaR for individual banks, securities firms, and insurance companies ranged from 4.26% to 4.78%, 3.59% to 4.17%, and 2.81% to 3.40%, respectively. Compared to banks, the average ΔCoVaR values for securities firms and insurance companies were smaller, ranging from 0.09% to 1.19% and from 0.86% to 1.97%, respectively.

In contrast, during the European Sovereign Debt Crisis period, the average ΔCoVaR for banks, securities firms, and insurance companies ranged from 1.65% to 1.87%, 1.26% to 1.60%, and 0.84% to 1.19%, respectively. Notably, compared to banks, the average ΔCoVaR for securities firms and insurance companies was relatively small, ranging from 0.05% to 0.61% and 0.68% to 1.03%, respectively. Therefore, during the Global Financial Crisis, the ΔCoVaR for banks relative to securities firms and insurance companies was higher than it was during the European Sovereign Debt crisis period.

This implies that during the Global Financial Crisis, the impact of financial distress experienced by banks on the overall financial market was more significant than in the European Sovereign Debt crisis period. This difference could be attributed to the higher relative share of assets held by banks in the overall financial market during the Global Financial Crisis and the heightened importance of core banking activities such as lending and deposit-taking within the broader financial system.

Meanwhile, during the COVID-19 Crisis period, especially during the margin call event, the difference in ΔCoVaR between the securities industry and the banking sector decreased significantly compared to the periods of the Global Financial Crisis and the European Sovereign Debt Crisis. As indicated in Table 9, during the COVID-19 Crisis, the average ΔCoVaR of many securities firms relative to banks was higher than that of specific banks. This suggests that during the COVID-19 Crisis and the margin call period, the securities industry had a relatively more significant impact on the overall risk of the financial system compared to the periods of the Global Financial Crisis and the European Sovereign Debt Crisis.

TABLE 7

∆COVaR AND ASSET VaR BY EACH INDUSTRY AND FIRM DURING THE GLOBAL FINANCIAL CRISIS (OCT. 2008 ~ JUN . 2009)

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

TABLE 8

∆COVaR AND ASSET VaR BY EACH INDUSTRY AND FIRM DURING EUROPEAN SOVEREIGNDEBT CRISIS (APR. 2010 ~ JUN. 2012)

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

TABLE 9

∆COVaR AND ASSET VaR BY EACH INDUSTRY AND FIRM DURING THE COVID-19 CIRISIS (JAN. 2020 ~ JUN. 2020)

Note: Figures in the table represent the average value, and ( ) represents the standard deviation.

This implication arises from the fact that during the Global Financial Crisis and the European Sovereign Debt Crisis, the average ΔCoVaR of securities firms relative to banks was lower, suggesting that during the COVID-19 Crisis and the margin call period, the securities industry had a more pronounced influence on the financial system, potentially due to factors such as margin calls on overseas assets underlying ELS products and securities firms’ foreign currency liquidity shortages, which contributed to increased rollover risks and short-term interest rate spikes during the initial phase of the COVID-19 Crisis.

C. Analysis of the impact of ELS (equity-linked securities) on systemic risk

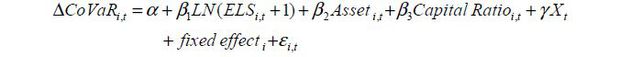

In the following section, we analyze the impact of ELS (equity-linked securities) issuance on CoVaR (conditional value-at-risk) by means of fixed-effects regression, as represented by the equation below. The specific regression model is as follows:

The control variables included in the model are macroeconomic factors, specifically the Korean base interest rate, the U.S. base interest rate, the Korean Consumer Price Index (CPI), and gross domestic product (GDP).

In this section, we estimate the change in conditional value-at-risk (ΔCoVaR) based on weekly stock returns. The outstanding balance of ELS (equity-linked securities) issuance is also examined on a weekly basis, while asset, capital ratio and macroeconomic control variables are considered on a quarterly basis. To align the periods of the dependent variable (ΔCoVaR) and the independent variable (outstanding balance of ELS issuance), ΔCoVaR was estimated using weekly stock returns in the fixed-effects regression model.

The analysis spans multiple periods, including three crisis intervals and two non-crisis intervals. Specifically, the crisis periods are the (1) Global Financial Crisis, (2) European Sovereign Debt Crisis, and (3) COVID-19 Crisis. The non-crisis intervals are the (4) Post-Global Financial Crisis to the Pre-European Sovereign Debt Crisis and the (5) Post-European Sovereign Debt Crisis to the Pre-COVID-19 Crisis.

Tables 11 and 12 present the descriptive statistics for ΔCoVaR and the outstanding balance of ELS issuance across these analysis periods. As observed in earlier estimations of ΔCoVaR using daily data, the magnitude of ΔCoVaR was highest during the Global Financial Crisis, followed by the COVID-19 Crisis and the European Sovereign Debt Crisis, in descending order.

Table 13 presents the results of the fixed-effects regression analysis across different time periods. The analysis reveals that the increase in ELS issuance had a significant impact on the increase in ΔCoVaR during each of the three crisis periods. Additionally, during the periods prior to the European Sovereign Debt crisis and before the COVID-19 Crisis, i.e., the Post-Global Financial Crisis, I did not find a significant influence of ELS issuance on ΔCoVaR through the regression analysis. Similar results were obtained when varying the number of control variables in the model (see Tables A1-A3). Furthermore, to conduct a robustness check, I estimated systemic risk based on MES and performed a fixed-effects regression analysis as well (see Tables 14 and A4- A6).

TABLE 13

EFFECT OF ELS OUTSTANDING ON ∆COVaR

Note: *, **, and *** represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

TABLE 14

EFFECT OF ELS OUTSTANDING ON MES

Note: *, **, and *** represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

The impact of the outstanding balance of equity-linked securities (ELS) on ΔCoVaR was greatest during the Global Financial Crisis, followed by the COVID-19 Crisis and the European Sovereign Debt Crisis in decreasing order. Specifically, during the Global Financial Crisis, a 1% increase in the outstanding balance of ELS issuance led to an approximate increase of 0.018 percentage points in ΔCoVaR, with this estimate being statistically significant. Considering that the average ΔCoVaR for the securities firms analyzed during the Global Financial Crisis was 1.37% and that the average ELS outstanding amount was 1.24 trillion won with a standard deviation of 1.23 trillion won, the volatility of ELS issuance was high, and its impact on systemic risk was significant. For instance, if the outstanding balance of ELS issued by securities firms increased by 10% during the Global Financial Crisis, ΔCoVaR would rise by 0.18 percentage points, which is approximately 13% of the average ΔCoVaR at that time. Meanwhile, during the European Sovereign Debt Crisis and the COVID-19 Crisis periods, a 1% increase in the ELS outstanding balance resulted in increments of 0.003 and 0.012 percentage points in ΔCoVaR, respectively, and these estimates are also statistically significant.

Furthermore, as part of a robustness check, I estimated systemic risk based on MES and conducted the same fixed-effects regression analysis (see Table 14). The analysis results indicated that during crisis periods, the impact of ELS issuance on MES was notably significant.

VI. Conclusion

I use the widely recognized system risk analysis method, ΔCoVaR, to investigate the systemic risk within the banking and non-banking sectors (specifically, securities firms and insurance companies) in South Korea. Additionally, I examine the impact of financial institutions’ issuance of equity-linked securities (ELS) on systemic risk as measured by ΔCoVaR.

The findings of this paper reveal that systemic risk in both the banking and non-banking sectors increased substantially during global financial crises, specifically the Global Financial Crisis, the European Sovereign Debt Crisis, and the COVID-19 pandemic. Although the banking sector exhibited a higher level of systemic risk compared to the securities and insurance sectors, the inter-sector systemic risk differentials varied across these crises. Notably, during the March 2020 margin call crisis, the disparity in systemic risk between the banking and securities sectors decreased significantly when compared to that during previous crises, indicating the heightened impact of the securities sector on the overall financial system’s risk.

Furthermore, the findings demonstrate that an increase in the outstanding balance of ELS issuance by financial institutions is associated with an increase in ΔCoVaR, particularly during the three crisis periods and during a significant drop in the Hang Seng Index. These findings emphasize the growing importance of monitoring and enhancing supervisory measures concerning systemic risk in the non-banking sector in South Korea.

In light of these results, it is evident that South Korea’s macroprudential management and regulatory framework should adapt to the increasing significance of non-banking institutions. Vigilant monitoring and regulatory measures aimed at controlling systemic risk within the non-banking sector are essential components of the framework to maintain financial stability.

A potential avenue for future research related to this study could involve exploring the utilization of market-based systemic risk measures such as ΔCoVaR in the macroprudential management and supervision of non-banking institutions. Specifically, one could consider research on incorporating market-based systemic risk measures into an assessment of the systemic importance of financial institutions.

Currently, the selection of systematically important financial institutions (SIFIs), including banks and bank holding companies, relies on indicator-based criteria. These criteria are used to select institutions for mandatory additional capital requirements. Indicator-based criteria involve assessing the systemic importance of financial institutions by selecting relevant indicators and assigning fixed weights to calculate scores for each bank or bank holding company.

However, this approach may have limitations when used to capture changing market dynamics and information. Using market-based systemic risk measures such as ΔCoVaR could complement indicator-based criteria and enhance the monitoring of the systemic importance of both banking and non-banking financial institutions. By incorporating market-based systemic risk measures, policymakers could better assess the impact of these institutions on the overall downside risk of the financial system, potentially leading to more effective regulatory and supervisory policies.

Furthermore, future research could explore appropriate liquidity metrics and liquidity ratios for monitoring foreign exchange (FX) liquidity in securities firms, considering both ELS issuance and their hedging activities. Since the margin call crisis, authorities have introduced measures to enhance FX liquidity management in non-bank financial institutions, including strengthening FX liquidity ratios and conducting FX stress tests. Research in this area could aim to identify the most suitable liquidity indicators and ratios that take into account ELS issuance and hedging, potentially leading to more efficient policy measures.

Additionally, considering the various interconnections between banking and non-banking sectors, there could be research on systemic risk analyses and macroprudential monitoring methods that account for the associated linkages. Presently, the government and the central bank in South Korea utilize stress testing models based on financial institutions’ interbank networks when conducting a financial stability analysis. Securities firms that issue ELS and engage in hedging activities may establish links with other capital market participants through overall holdings and short-term borrowing in financial markets. Reflecting the characteristics of non-bank financial institutions, research could explore the development of systemic risk analysis and stress testing models based on financial institutions’ debt networks to consider these interconnections more comprehensively.

Lastly, it would be worthwhile to consider research into the impact of non-bank financial institutions, such as money market funds (MMFs) and collective investment schemes, and their behavior on the financial markets. Recently in the UK, there was a threat to financial stability due to a surge in government bond yields stemming from liability-driven investment (LDI) activities. To address this, the Bank of England intervened by purchasing government bonds to stabilize yields and restore financial stability.

Research in this area could investigate how the behavior and activities of non-bank financial institutions, including MMFs and investment schemes, influence financial stability. Understanding the dynamics between these institutions and the broader financial markets, particularly during periods of market stress or unexpected events, can provide insights into potential vulnerabilities and systemic risks. This research can be valuable for policymakers and regulators to develop more effective measures to safeguard financial stability in the face of evolving market dynamics and behaviors.

APPENDIX

As an additional robustness check, I utilized a hierarchical fixed-effects panel regression model, as described in this section.

TABLE A1

HIERARCHICAL REGRESSION ANALYSIS ON ∆CoVaR DURING THE GLOBAL FINANCIAL CRISIS PERIODS (OCT. 2008 ~ JUN 2009)

Note: *, **, and *** correspondingly represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

TABLE A2

HIERARCHICAL REGRESSION ANALYSIS ON ∆COVaR DURING THE EUROPEAN SOVEREIGN DEBT CRISIS (APR. 2010 ~ MAR. 2012)

Note: *, **, and *** correspondingly represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

TABLE A3

HIERARCHICAL REGRESSION ANALYSIS ON ∆COVaR DURING COVID-19 CRISIS (FEB. 2020 ~ APR. 2020)

Note: *, **, and ***correspondingly represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

TABLE A4

HIERARCHICAL REGRESSION ANALYSIS ON MES DURING THE GLOBAL FINANCIAL CRISIS PERIODS (OCT. 2008 ~ JUN 2009)

Note: *, **, and *** correspondingly represent significance at the 10%, 5%, and 1% levels, and ( ) is the standard error.

Notes

This paper is an extension of Hong (2021, forthcoming). I thank two anonymous referees and Editor for their valuable suggestions. All remaining errors are mine.

References

, , , & . (2017). Measuring Systemic Risk. The Review of Financial Studies, 30(1), 2-47, https://doi.org/10.1093/rfs/hhw088.

, & (2016). CoVaR. American Economic Review, 106(7), 1705-1741, https://doi.org/10.1257/aer.20120555.

, & . (2018). The Effect of Equity Linked Securities on Financial Stability in Korea. Journal of Derivatives and Quantitative Studies, 26(1), 85-114, in Korean, https://doi.org/10.1108/JDQS-01-2018-B0004.