Population Aging in Korea: Importance of Elderly Workers†

Abstract

Korea’s population is aging at a faster pace than any other major country, and the adverse impact of this trend on the economy is predicted to be significant. This paper focuses on the macroeconomic effects of population aging with particular attention paid to the pace of aging in Korea. According to our analysis, it is difficult to offset the decline in the labor supply driven by rapid population aging, even if the labor force participation rate of the working-age population rises to a significantly high level. We suggest a re-orientation of policy directions to correspond to the behavioral changes of economic agents. Policies must focus on promoting labor force participation among the elderly while pushing towards human capital advancement and higher productivity.

Keywords

Korean Economy, Population Aging, Economic Growth

JEL Code

J11, E66

I. Introduction

Population aging has become the dominant demographic trend on a global scale. Korea is not an exception; rather, its population aging is predicted to proceed at faster pace than those of any other OECD country. We note that population is a relatively sluggish factor compared to other determinants of economic growth, but corresponding impacts will be less uncertain and more significant. If population aging in Korea progresses at such a rapid pace, economic growth will slow down substantially (i.e., Bank of Korea, 2017; IMF, 2015).

Regarding the relationship between population aging and economic growth, a standard approach is to assume age-specific behavior with respect to labor, savings and investments and to assess the implications of any changes in the relative sizes of different age groups. Obviously, as a population ages, there are fewer workers in the active workforce. A widely accepted proposition is that a decrease in the working-age population share is associated with a decrease in the rate of economic growth. These results are robust across different methodologies and are broadly consistent with the literature on demographic effects on growth (see Bloom et al., 2007; Kelly and Schmidt, 1995; 2007). In this regard, Gordon (2016) points out demographic change as a type of “headwind” to the long-run economic growth of developed countries, as older workers will reduce productivity and show low labor force participation rates. Hence, demographic change requires policy actions to ensure economic stability and social cohesion. Our concern is that policy responses in an ordinary manner may not mitigate the impacts of the unprecedented demographic transition in Korea.

This study started from the following research question. The economic analysis of population aging is, in general, based on the life-cycle hypothesis. However, this method has a flaw in that it does not adequately reflect the endogenous responses of economic agents. In particular, the extension of life expectancy may bring changes in life-time decisions such as those related to the labor supply, saving/consumption, human capital, and others. Acemoglu and Restrepo (2017) present empirical evidence that population aging across countries is not associated with a decline in growth per capita, which is contrary to the conventional perception. We expect that the economic consequences of population aging can differ from popular dismal predictions depending on policy responses and institutional changes.

The paper proceeds as follows. Section II shows how rapidly Korea’s demographic change will proceed through a comparison with major countries, and from a macroeconomic perspective, we determine the impact population aging will have on Korea’s economic growth. Section III presents issues from a policy perspective. We conjecture that the impact of population aging will mainly be found in the scarcity of the labor force and that standard policy responses will be to provide some additional labor supply. We examine the effects of these policies on economic growth through a scenario analysis, demonstrating that increasing the labor supply within the working-age population is limited with regard to the ability of this strategy to offset the slowdown in growth. We propose to utilize the labor of the elderly and look into the status of the elderly worker’s labor market in Korea. Considering the generational change in the level of education, we find supportive evidence of a positive role of such a workforce. Section IV concludes the paper and suggests a re-orientation of the policy response to population aging in Korea.

II. Demographic Changes and the Macroeconomic Impact in Korea

A. The Pace of Population Aging

Korea has experienced relatively rapid population aging (see OECD, 2018). The old-age dependency ratio1 doubled only in two decades, rising from 11.2% in 2000 to 23.6% in 2020. Population aging is basically driven by mortality (or longevity), fertility, and the population structure. For Korea, all three factors have acted to accelerate the aging of the population. As Korea experienced high economic growth, socio-economic conditions rapidly improved and the country experienced a significant rise in life expectancy, i.e., from 75.9 in 2000 to 83.4 years in 2020. The fertility rate has also changed rapidly, recently dropping further to 0.84 in 2020, the lowest level among OECD countries (see Figure 1). The baby-boomer generation born in 1955~19632 resulted in age-specific imbalances in the population structure. As they reach retirement age, rapid aging is expected to continue. We pay attention here to the forward pace of aging in Korea.

FIGURE 1.

LIFE EXPECTANCY AND TOTAL FERTILITY (2020)

Source: World Development Indicators, “Life expectancy at birth & the total fertility rate.”

Looking ahead, the pace of Korea’s population aging will be accelerating in the near future. Remarkably, the UN projects that in 2050 Japan will have the highest share of the population aged 65 and over, at 80.7%, among OECD countries, but the change in the ratio from 2020 to 2050 will be largest in Korea. Figure 2 shows projections of future changes in the old-age dependency ratio in OECD countries, arranged according to per capita income. Korea is located at the highest changes in the 65+ share with the middle level of per capita income among OECD countries.3

FIGURE 2.

CHANGES IN THE 65+ SHARE, 2020-2050, VERSUS THE INCOME LEVEL

Source: Author’s calculations based on data from United Nations 2020.

Accordingly, the next three decades will be the most important period regarding the population aging phenomenon and how it affects the Korean economy. The pace of population aging will be unprecedented. The response to offset the adverse effects of aging is, therefore, the most critical and urgent issue at present.

B. Macroeconomic Impacts

There is a large body of literature on the economic effects of population aging (e.g., Clark et al., 2013; Lee, 2016). Here, we focus on the main impacts on macroeconomic variables related to economic growth.

Regarding the production side, population aging has significant impacts on economic growth through the labor supply channel. As fertility declines and a growing number of elderly enter into retirement, the size of the labor force is projected to shrink in the near future. Accordingly, economic growth will also decelerate if other factors are fixed. In the Korean case, the working-age population began to decrease in 2017, and this trend is expected to continue. According to data from Statistics Korea displayed in Figure 3, the working-age population in 2050 will have decreased by a third from its 2017 peak.

FIGURE 3.

POPULATION PROJECTIONS FOR KOREA

Source: Statistics Korea, “Population Projections for Korea 2020~2070”, 2021.

Meanwhile, the impact of the labor shortage on economic growth is relatively direct, but it can be, in part, offset by the responses of economic agents in several dimensions (Bloom et al., 2000). For instance, workers are expected to work longer due to longer longevity with better labor fundamentals, such as those related to health and education. Labor force participation may increase because more women can enter the labor market as fertility declines. Human capital can also increase through the mechanism of the quantity vs. quality trade-off. Firms may invest more in capital-intensive technologies to respond to the scarcity of labor. All of these responses mitigate the negative effects of the labor shortage on economic growth. Overall, the aggregate labor supply will vary depending on the rate of participation in the labor force by gender and age. It is questionable, however, as to whether this factor will be able to make up for the absolute decline in the working-age population. We look into this in the next section by means of a simulation.

On the consumption/savings side, demographic changes affect aggregate savings mainly by altering the relative sizes of age cohorts. According to the life-cycle theory, population aging tends to decrease savings because an increasing number of elderly dependents start to de-cumulate their assets. However, households may tend to increase their income and savings when longevity is expected to increase, a phenomenon entangled with the savings behavior outcomes. We examine the relevant data in order to observe households’ responses in Korea.

Figure 4 shows the age profiles of labor income and consumption in Korea. For a comparison over time, they are standardized by dividing by the average labor income across age range of 30-49 for each year. The upper panel in Figure 4 shows the per capita age patterns of consumption and labor income in 2010 and 2019. The shapes in both years are broadly similar; consumption exceeds labor income at younger ages and older ages, and the ages in between have substantial surpluses. We note that there are some differences between 2010 and 2019. First, the labor income profile in 2019 shifts to the right, which means that labor income peaks later and is slightly higher. This indicates that the elderly tend to work longer and that their labor income remains substantial, even into their 60s. We think that the shift of the labor income curve is likely due to the aging population because both curves depict the size relative to the prime worker group in the age range of 30-49. In particular, this phenomenon may reflect an improvement in labor productivity, which is expected to occur as life expectancy is extended with better health (see Burtless, 2013). However, there is a possibility that it may appear as a result of the unique seniority-based wage practice in Korea. Distinguishing them is an interesting topic but requires separate research. Second, the consumption curve has remained almost flat since this cohort was in their 20s, differing from the rising pattern of consumption in the elderly observed in developed countries (see Lee, 2016). This rising consumption for older citizens may reflect increases in expenditures for health and life care, and in 2019 consumption increases slightly for the elderly above the age of 78, meaning that increasing consumption by the elderly may be in progress. Third, there is upsurge in consumption for children of school ages, reflecting intensive expenditures on early education. A noticeable difference is that the consumption of school-aged children rose significantly in 2019. There may be many reasons for recent increase in education expenditures. Among them, the theoretical prediction that fertility and human capital investment have an inverse relationship is suitable as an explanation, reflecting an important behavioral change in the aging society.

FIGURE 4.

CONSUMPTION AND LABOR INCOME BY AGE

Note: For comparability, each age profile is divided by the average level of labor income for the age range of 30-49. Labor income is an average across males and females based on pretax wages and salaries plus employer-provided benefits; it includes two-thirds of self-employment income. Consumption refers to household consumption expenditures on health and education allocated to recipients of these. It includes public in-kind transfers such as public education, health care, and long-term care.

Source: Statistics Korea, “Population Projections for Korea 2020~2070”, 2021.

On the whole, the labor income curve shifted to the right, whereas the consumption curve has scarcely changed since this cohort was middle-aged, indicating that the timing of dis-savings by the elderly has been delayed and that the sizes of individual deficits have decreased. Looking at the aggregate data, however, it appears that the total deficit for the elderly increased significantly in 2019. The lower panel in Figure 4 shows that the beginning of dis-saving is postponed from age of 56 to 60 and that the size of the deficit by the elderly increases from 20.4% to 25.2% of the aggregate income level of those in the age range of 30-49. 4 Even given an increase in individual savings in preparation for the aging population, total savings may decrease as a whole in the economy, suggesting a likely reduction of both the source of capital accumulation and future growth.

n sum, according to the life-cycle hypothesis, economic incentives and behaviors differ depending on the stage of life, and the older generation's economic characteristics gradually dominate the overall economy as population aging progresses. The characteristics of this cohort are that they work less and spend the assets they saved in their previous life stages. Thus, as the proportion of this older generation increases, the labor and capital factors of production as a whole will gradually be reduced, causing a decline in economic growth (see Figure 5). In particular, many studies indicate the burdens of pension and health insurance due to the increased number of elderly citizens. Among these studies, the IMF (2015) predicts that the Korean economy will need approximately 10% of GDP for population aging for financial burdens such as medical expenses and public pensions. If other conditions remain the same, most of the impact channels of population aging, such as the decline in labor supply, the slowdown in capital accumulation, and the increased financial burden, will negatively affect economic growth in the long run.

III. Policy Issues

From a policy perspective, the aging of the population presents many challenges. The nature of this unprecedented problem means that policymakers have no earlier references for guidance on how the upcoming disturbances work and how they can manage them. In this section, the expected effect of policies that affect the labor supply will be assessed.

A. Alternative Labor Supply

1. Scenario Analysis

The impending issue with population aging in Korea is whether the standard policies to increase the labor supply are sufficient to alleviate the adverse impact as the working-age population shrinks. We simulate scenarios in which the labor force participation (LFP) rate of Korea's economy rises to a certain level and calculate this effect on GDP growth using a model of growth accounting (see Appendix: Simulation for Economic Growth).

As noted earlier, Korea’s working-age population (15-64) began to decline in 2017. If labor force participation (LFP) rates were to remain at their current levels for each age/gender group, the size of the labor force would peak in 2022 and then fall by nearly 20% by 2050. The baseline scenario is the case in which the LFP rate for each age group in the next 30 years is fixed at the initial level of 2017. Baseline in the second column in Table 1 shows the results. The average GDP growth rate for the 2021–2030 period is expected to be 2.0%, and it will continue to fall. The average growth rate for 2041–50 will drop to 1.0%.

Scenario 1 assumes that Korea’s LFP rate for each gender/age group changes to the average for G7 countries. As shown in the third column of Table 1, Korea’s growth prospects do not improve. Contrary to expectations, the average GDP growth rates for all forecast periods are lower than those in the Baseline Scenario. One of the reasons for the slower growth in this case is that the G7 average LFP rates (henceforth LFPs) for males aged 35 to 64 are not higher than that of Korea.6

We look for some specific LFPs to be benchmarked among developed countries. Korea has relatively large gaps between genders in terms of wages and LFPs. Among the potential sources of labor force in Korea, women's participation in economic activities has much room to increase and can be expected to make up for the labor shortage caused by the aging population. In this regard, Sweden has the smallest gap between men and women in terms of economic activity, and both men and women have higher participation rates than in Korea in all working-age groups. Thus, we examine the effect of the increase in LFP relative to the Swedish case in Scenario 2. Second, the LFP for the elderly in Korea was relatively high, but it is expected gradually to decrease as the pension system becomes fully developed in the future. We look at the case in which the economic activity of the elderly follows a country with relatively high LFP for the elderly among developed countries. In Scenario 3, Japan is chosen as another benchmark case because those aged 65+ participate in economic activity more compared to any other developed country. The fourth and fifth columns in Table 1 show the simulation results for additional scenarios. Scenarios 2 and 3 have slightly higher growth projections during all forecast periods than Scenario 1, but the overall growth trend is still lower than that in the Baseline Scenario.

Why does the economic growth trend not improve even if the labor force participation rate rises to the levels found in developed countries? We note that there are several differences in the characteristics of the LFP in benchmarked countries. First, the participation rate is generally high in the 15–64 age group. Second, the LFP difference between men and women is small. Finally, the LFP for those aged 65+ is far lower than that of the 15-64 age group. We found that these characteristics play a critical role in our simulation.

In the prediction of the Korean economy, the absolute size of the working population will continue to decline and the elderly population aged 65+ will grow at a steady pace up to 2050. Therefore, as long as the LFP of the population aged 65+ remains lower than it is at present, such as in Scenarios 1, 2 and even 3, the overall labor supply will not increase enough to realize higher economic growth, even if the LFP of the working-age population rises to a higher level. These findings from the simulation mean that even if the LFP of Korea approaches the level of any developed country, it will not be able to offset the labor supply shortage due to population aging.7

A standard policy measure for population aging is to encourage participation in economic activity by all working-age groups, especially women and young people. The results of the simulation here,8 however, imply that in Korea, the pace of population aging is so fast that an alternative labor supply from the working-age population may be insufficient to compensate for the adverse effects on economic growth.

2. Other Measures for the Labor Supply

There is no doubt that the super-low fertility rate in Korea is one of the most serious socio-economic problems, but we must also note that raising the fertility rate is not a direct solution to the current population aging issue. Considering the variety of birth determinants and individual preferences, it is difficult to find effective instruments for raising the fertility rate. Even with successful policies for birth, two or three decades will be required for newborn children to reach their prime working age to thus provide sufficient human resources. Therefore, an increase in fertility is neither an easy nor a timely measure to deal with the aging population.

Migration from relatively young developing countries could slow the shift to the aged population and ease the burden on the economy theoretically. In Korea, immigration, including temporary foreign workers, would take require a large increase from the current level and would need to last for at least 30 years in order to achieve a sufficient replacement rate. Immigration, however, can bring with it social burdens and unrest if it goes beyond a certain point, and Korean society is already struggling to find a balance between the need for labor and social cohesion. We think that replacement immigration as a policy for population aging may not be feasible in practice.

B. The labor market for older workers

1. The Quality of Employment

A labor policy that increases the LFP of the working-age population seems reasonable, but due to the severe imbalance in the population structure, it is not sufficient to recover the growth trend, as discussed in the previous section. Thus, an effective alternative in terms of the labor supply is that older generations must participate longer in production activities. The problem is that the current participation rate of the elderly in Korea is relatively high, meaning that it is unclear as to whether there is enough room for a further increase.

Table 2 shows some of the characteristics of older workers by industry and occupation, reflecting the dismal aspects of the labor market for older workers in Korea. The employment rate of the elderly aged 65+, 43.9%, is higher than that of any other developed country. These workers are mainly engaged in low-value-added industries, such as agriculture, fisheries, and traditional service sectors such as wholesale, retail and lodging. Looking at job types, the share for ‘simple worker’ is highest (34.4%), and that of ‘manager’ is relatively low at 5.3%. In sum, the labor market for older workers in Korea shows seemingly good performance in terms of quantity, but it is in an impoverished condition in terms of quality.

TABLE 2

ECONOMIC ACTIVITY STATUS OF THE ELDERLY IN KOREA

Note: The category of distribution is selected by the author and is not exhaustive.

Source: Statistics Korea, “Economically Active Population Survey,” May 2022.

One of factors for this low level of quality is related to a peculiar practice in the Korean labor market. The majority of workers in Korea tend to retain their jobs only up to their early 50s. When retiring early, many become self-employed or take low-paying jobs in low-value-added industries, at which point they maintain a second career for a decade or two to support their livelihoods. This tends to continue before they stop working in their early 70s. These retirement dynamics are mainly driven by a certain pay scheme, known as the seniority-based wage system. Under this wage system, as the gap between older workers’ wages and productivity rises, many face dismissals from their main job with limited opportunities for re-employment.

2. A condition for improving older workers’ employment

We examine the characteristics of the labor market for older workers in Korea, focusing on their relevance to education. Figure 6 shows the employment rates of older workers by education level. They are divided into two cohorts at the age of 60, the usual retirement age in Korea, because we focus on the nature of the labor market for this cohort as a secondary market.

FIGURE 6.

EMPLOYMENT RATE BY EDUCATIONAL LEVEL

Source: Author’s calculations based on the Economically Active Population Survey of Statistics Korea.

For workers aged 51-60, as shown in Panel A of Figure 6, we find that the employment rate rises with educational attainment, tending to rise over time, except for the ‘Below elementary school’ group. The gains are relatively large for workers with a ‘high-school’ education, rising from 65.8% in 2000-02 to 73.0% in 2015-17. In contrast, a relationship between education level and the employment rate is not observed in the group aged 61-70 (Panel B). This phenomenon may be related to the fact that, as mentioned above, most of the job opportunities offered to older workers mainly involved simple types of work and/or were in the low-value-added sector where the level of education is not a deterministic factor when hiring.

Here we must examine the flip side of this phenomenon. In Korea, there is a relatively large generation gap in the educational attainment of the elderly. In particular, the education level of the baby boomers is significantly different from those of the previous generations. Because they were on the verge of their retirement age in 2015, we compare them at that point in Figure 7. Among those in their 60s, 38.9% had an elementary school or lower level of education, 22.9% had a middle-school education, 27.3% had a high school diploma, and only 10.9% attended college or had higher education. Considering that Korea's economic and social environments were precarious in the early 1950s due to the Korean War, it is inevitable that the fundamentals of the labor force, i.e., education and health, for those aged 60+ were very poor. On the other hand, for those who were in their 50s in 2015 — mostly baby boomers — the proportion who record ‘below elementary school’ drops to 13.7%, while the proportion of those with a college degree rises significantly to 21.9%. In the past, most of the potential suppliers in the elderly labor market were mainly under-educated, and this weakness of the supply side was one of the reasons for the poor condition of the labor market of the elderly. In the near future, potential entrants into the elderly labor market have significantly enhanced educational attainment levels compared to those of previous generations, causing the fundamentals of the labor market for the elderly to improve.

3. Education and Employability

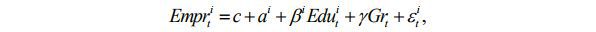

We implement a quantitative analysis in order to determine whether educational attainment is significantly related to employment and whether the link differs with age.9 In the equation,

is the employment rate of cohort i = 1, 2, ⋯, M (5-year age group from 20~24 to 70~74) at time t = 1, 2, ⋯, T (1988~2017) and

is the employment rate of cohort i = 1, 2, ⋯, M (5-year age group from 20~24 to 70~74) at time t = 1, 2, ⋯, T (1988~2017) and  is the variable for their educational attainment. We use the proportion of people

who have education higher than a college degree as a proxy. Grt is the GDP growth rate to control for common macroeconomic shocks to the labor market.10 The disturbance

is the variable for their educational attainment. We use the proportion of people

who have education higher than a college degree as a proxy. Grt is the GDP growth rate to control for common macroeconomic shocks to the labor market.10 The disturbance  in the equation above has an (MT*MT) covariance matrix in a stacked model. We conjecture

some features of the error structure.

in the equation above has an (MT*MT) covariance matrix in a stacked model. We conjecture

some features of the error structure.

First, the errors may be heteroskedastic across the equations because the labor market for different cohort has its own characteristics. Second, the errors in each equation may be correlated because employment conditions are affected by common economic shocks. In this case, Zellner’s SUR (seemingly unrelated regression) estimator is appropriate given that the errors are contemporaneously correlated and the regressors, the educational attainment and GDP growth rate, can be assumed to be exogenous.

The SUR estimation results are in the second column of Table 3. The coefficients of interest are significant, but the Durbin-Watson test strongly suggests serial correlations in the error terms, which means that the estimates may be biased. To handle this with serially correlated errors, we add an auto-regressive (AR) term in the errors, and these results are in the third column, SUR with AR error. Furthermore, we checked the stationarity of the dependent variables, and the test could not reject the null of the unit root for most age groups. Also, some of the education variables could not reject the unit root. If these two variables have a unit root, the estimation is likely to be a spurious regression. Thus, we estimate the SUR system with first-differenced variables.

TABLE 3

ESTIMATES FOR  BY AGE GROUP

BY AGE GROUP

Note: 1) *, **, and *** indicate significance at p < 0.10, p < 0.05 and p < 0.01, respectively; 2) Standard errors are in parentheses.

Depending on the estimation method, the estimates of the coefficient change considerably.

For the SUR estimation, all coefficients appear significant, but if the autocorrelation

is taken into account, the magnitude of the coefficient estimates generally decreases

and the level of significance deteriorates. We pay attention to the relative variations

across age groups. In Table 3, we compare the estimated coefficients,  to find age-specific relationships between education and employment.11

to find age-specific relationships between education and employment.11

The magnitude of the estimate is generally small or insignificant for those in their 20s and 30s, after which it becomes positive and significant for those past their 40s. Interestingly, these values are significant after the late 40s, and the magnitude continues to rise, remaining until this cohort reaches their 60s in all three estimations. In other words, although the estimation results are quite different according to the estimation method, it is common that the influence of education on employment increases in the elderly labor market, which means that workers who tend to work longer have better educational credentials.

Considering the employability gain for greater educational achievements for young adults, workers with potentially higher abilities tend to invest more in human capital and to remain out of the labor force. In their 30s most workers — the prime working-age group — tend to maintain their employment status. The employability gain gradually increases over the age profile after the middle age levels, which is consistent with the fact that retirement in Korea begins at the age of 50. Thus, the higher the educational background, the higher the possibility of remaining in the labor market or being re-employed after retirement. This result implies that employment benefits by educational attainment increase in the labor market for older workers.

In the past, working by the elderly seemed mostly poverty driven and related to their livelihoods, and it was common for this cohort to work in unstable and low-value-added sectors. It is not desirable for the increasing number of the elderly to engage in economic activities under such unfavorable conditions. We note that in the past, the low educational attainment of those aged 60+ underlay the low quality of the elderly labor market in Korea. However, the baby boomers in Korea, who have recently approached their retirement age, have higher education levels than previous generations, as well as experience in economic development. The supply of this workforce with enhanced human capital can be a fundamental basis to improve the elderly labor market in the near future.

C. Policy Recommendations

It is more likely that those with higher skills and education will be engaged in professional jobs with longer tenures. Hence, the level of education or human capital has a significant causal effect on the economic participation of older people. Therefore, policy measures should focus on improving human capital for older citizens. There are some prerequisites for this action.

Most of all, the perception of the elderly above a certain age as dependent should be jettisoned, and accordingly the social practices and institutions based on the presumption that those aged 65+ are “old” should be changed.12 We must utilize the positive factors during the on-going population aging trend, such as improving health and increasing longevity. The older generations should have the opportunity to enter a new, productive stage in their life cycles so that they may continue to contribute to society. Social reforms must be promoted for this purpose.

Mandatory retirement, which forces workers to leave the labor market at a certain age, should become an obsolete system. We must reform the retirement rule and have a more flexible system so that people can decide whether or not to retire based on their abilities and willingness to work. In this regard, it is crucial to ensure that aging does not reduce overall productivity. More resources should be invested in the improvement of human capital, especially to improve the human capacity for older workers. The current education system, which utilizes both time and resources for higher education for those in their early years of adulthood, is unlikely to be a reasonable approach given the pace of future technological change and social development. The education system must adjust to life expectancy reaching the 80s, in particular, in order to be of practical help to middle-aged individuals who attempt to build another career.

Finally, labor market conditions must be improved to become more age-friendly. Age discrimination should be prohibited in all workplaces. Accordingly, reforming the seniority-based wage system entrenched in most sectors in Korea will be the first step towards flexibility, enabling longer retention that could benefit both workers and employers. In the longer run, Korea’s entire human resources sector will need to move towards more performance-based jobs and away from the focus on stability.

IV. Conclusion

Population aging is taking place in nearly every country with considerable variations. A distinctive feature of the Korean case is that its magnitude and speed are enormous such that the dependency ratio will quadruple only in the next three decades, even without sufficient per capita income, as shown in Figure 2. This study showed, through an analysis of growth accounting, that policies that seek substitutes for retired labor will not easily realize any recover from the decline in economic growth caused by population aging.

An effective measure to prevent the decline in the labor supply due to population aging is to utilize labor from the older generations. Participation in the labor market by older generations would be effective because it can boost economic growth and reduce the fiscal burden. To this end, it is necessary to improve the conditions of the labor market for elderly workers. In particular, we pay attention to the fact that Korea’s baby boomers, who just recently reached retirement age, have much higher levels of education than those of the previous generations, which will act as the driving force from the supply side of the elderly labor market.

Population aging affects most economic decisions and consequently transforms many parts of the economy. The rapid aging process in Korea gives policymakers a very narrow window of opportunity to prepare for the changes. We note that economic agents will most likely respond to these changes rationally. Policymakers must pay more attention to the behavioral responses of economic agents and build more flexible institutions for the aged society.

Appendices

APPENDIX

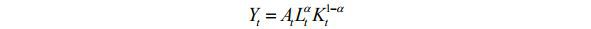

A. Simulation for Economic Growth

To examine the magnitude of the consequences of population aging, we project the long-run GDP growth rate based on population projections, assuming that the LFPs of ages remain in the same shape. Our long-term growth projections are based on a growth accounting frame. Some features are described below. We assume the production process in a simple form because the gains of a parsimonious model would be greater than those of a complicated model. Doing this reduces the sources of uncertainty. We use the standard Cobb-Douglas production function,

where Y denotes GDP, A : total factor productivity, L denotes the number of workers, K is capital stock and, α is the labor share. The measurement of the labor supply is the number of employees and the labor force participation rates are projected from an estimated model (see Kwon, 2014). The population is based on the estimated future population from Statistics Korea. The data for capital stock are based on the BOK’s Korean National Balance Sheet. For future investments, we estimate the savings rates on the dependency ratios and then convert these values to investments under the assumption of long-run equilibrium between them. There is considerable uncertainty in forecasting future productivity in the aging economy. Hence, total factor productivity (TFP), including the quality of labor, is presumed to grow at a steady rate (i.e., 1.2%) based on qualitative judgements of technologies and institutions (see Shin et al., 2013). The forecast horizon is set to 30 years because population aging is predicted to accelerate by 2050 and then stabilize gradually (see Lee, 2019).

Notes

This paper is based on the presentation prepared for the KDI-EWC Conference 2020. The author thanks all the participants for their comments at that event. The views expressed in this paper are those of the author and not necessarily those of the KDI.

The measure of aging, admittedly well stylized, is the old-age dependency ratio, which is the elderly (65+) population / the working-age (15-64) population.

The old-age dependency ratio in Korea is predicted to rise to 78.8% in 2050, and the magnitude of the change will be 55.2%p.

Some characteristics of the labor force’s age structure in Korea are as follows: 1) The LFP rate between ages 15 and 35, which is broadly defined as youth, is lower than the OECD average. 2) The LFP of men aged 35–55, i.e., the prime working-age group, is slightly higher, but women's LFP for the same age range is lower than the OECD average. 3) The LFP rate at 55+ is much higher than the OECD average. For the LFPs of other countries, see the table in the Appendix.

In order to make up for the slowdown of growth, Korea needs to maintain the high LFP rates for the elderly (65+) at the current level and must follow Japan’s LFP for men and Sweden’s LFP for women. See Lee (2019).

There are caveats: when interpreting the simulation results, the impact of the reduced labor supply is based on a static analysis under the assumption that there are no changes in other variables.

This data analysis is not for the determinants of the employment rate but is rather to determine whether the relationship between employment and educational attainment differs by age, which may present partial evidence to support policy implications for the elderly labor market.

References

, & . (2017). Secular Stagnation? The Effect of Aging on Economic Growth in the Age of Automation. American Economic Review, 107(5), 174-179, https://doi.org/10.1257/aer.p20171101.

, , & . (2013). Low Fertility, Human Capital, and Economic Growth: The Importance of Financial Education and Job Retraining. Demographic Research, 29, 865-884, https://doi.org/10.4054/DemRes.2013.29.32.

, & (1995). Aggregate population and economic growth correlations: The role of the components of demographic change. Demography, 32(4), 543-555, https://doi.org/10.2307/2061674.