Regulatory Sentiment and Economic Performance†

Abstract

Regulatory sentiment refers to the market’s subjective evaluation of regulatory reform and is one of the most widely adopted indicators to those charged with implementing and diagnosing regulatory policies. The use of regulatory sentiment in advanced analysis has become universal, albeit it is often limited due to difficulties in articulating consistent and objective quantitative indicators that can meticulously reflect market sentiment overall. Thus, despite ample effort by scholars to read the economic impact of regulatory sentiment in the real economy, causal links are difficult to spot. To fill this gap in the literature, this study analyzes a regulatory sentiment index and economic performance indicators through a text analysis approach and by inspecting diverse tones in media articles. Using different stages of tests, the paper identifies a causal relationship between regulatory sentiment and actual economic activities as measured by private consumption, facility investment, construction investment, gross domestic investment, and employment. Additionally, as a result of analyzing one-unit impulse of regulatory perception, the initial impact on economic growth and private investment was found to be negligible; this was followed by a positive (+) response, after which it converged to zero. Construction investment showed a positive (+) response initially, which then rapidly changed to a negative (-) response and then converged to zero. Gross domestic investment as the initial effect was negligible after showing a positive (+) reaction. Unfortunately, the facility investment outcome was found to be insignificant in the impulse response test. Nevertheless, it can be concluded that it is necessary and important to increase the sensitivity to regulations to promote the economic effectiveness of regulatory reforms. Thus, instead of dealing with policies with the vague goal of merely improving regulatory sentiment, using regulatory sentiment as an indicator of major policies could be an effective approach.

Keywords

Regulatory Reform Policy, Social Sentiment, Topic Analysis

JEL Code

C32, E71, K23

I. Introduction

Kaynes (1936) explains that unpredictable economic bubbles, specifically the Great Depression, occurred as a result of animal spirits. Akerlof and Shiller (2009) also highlight the importance of animal spirits to accurately comprehend the cause of the 2008 financial crisis. Scholars argue that classic economic theory fails to explain why people could not presage the economic crisis until the complete collapse of a bank. Instead, animal spirits, which refer to the irrational behavior of economic agents affected by the mood of the market, help justify such a phenomenon. When people resort to animal spirits, their intuitive, emotional, and irrational moods for undue optimism about the economy induce bubbles and contribute to a financial crisis. Hence, policy advisers must take precautions against animal spirits and reflect irrational behaviors during the process of writing regulations.

To quantify the mood of the economy, several indices are adopted universally. The most widely used indicator is the Consumer Sentiment Index (CSI), or the Consumer Confidence Index (CCI), representing sentiment as it pertains to the general economic situation. CSI measures households’ economic perceptions based on their expectations as stated in financial situation survey responses and is known as a leading explanatory factor of economic growth. Additionally, the Korea Business Survey Index (BSI) seeks to determine companies’ perceptions of the present condition of their businesses, product stock, and investment agendas in terms of facilities and equipment. BSI monitors output growth and anticipates turning points in economic activity. Accordingly, recent macroeconomic studies have formed a consensus that sentiment indices are pertinent predictors of economic fluctuations (The Bank of Korea, 2019).

Public sentiment is also used in many political studies that analyze public opinion to evaluate policy performance outcomes (Mutz and Soss, 1997; Frost, 2010; Berinsky, 1999). Numerous policy successes are determined through public support. The Korean government has implemented various regulatory reform policies over the past 30 years to improve the economic environment and to improve performance outcomes. Regulatory reform policies are continuously implemented regardless of the period, and most policy goals ultimately seek to achieve economic growth. Therefore, measuring public sentiment involves speculation over regulatory reforms. In response, the Federation of Korean Industries (FKI) regularly announces the annual Regulatory Reform Perception Index (RRPI), which consists of surveys of enterprises with scores standardized at 100, where a score exceeding 100 indicates satisfaction while one below 100 indicates dissatisfaction. This index peaked at 116.5 in 2010, though it has continued to show a declining trend. The most recently announced value was 93.8 in 2020 (116 in 2010 and 93.8 in 2020). This downward trend indicates that there is growing negative sentiment toward regulatory policies, and studies point out that the negative sentiment over regulations and the modest performance of regulatory reforms are correlated (Kim, 2014; Lee-M, 2017; Lee and Park, 2017; Lee, 2006; Choi, 2008).

Regulatory sentiment serves as both a driver and an outcome indicator of regulatory reforms, and several major arguments are based upon this claim. This claim, however, must be carefully reviewed. The limitations of assessing regulatory sentiment stem from the heavy reliance on qualitative measures. Regulatory reform affects a wide range of social activities, and gathering reliable sentiment indicators that achieve representativeness and replicability is often viewed as troublesome. The issue of representativeness is related to the question of whether the derived index contains bias in its representation of social sentiment. In most cases, surveys that collect information on social sentiment are conducted through sampling, and it is difficult to guarantee that what is gained in this way represents people from all walks of life, engaging in relevant economic activities. There is also the issue of non-replicable questions, referring to whether the survey can yield the same results if repeated in the same manner.

In this study, we focus on whether social regulatory sentiment is an actually decisive factor in economic performance. Given that the Korean government is continuously implementing various regulatory reform policies, we consider regulatory reform policies collectively as an endogenous variable of regulatory sentiment, which means that all regulatory reform policy information is assumed to contain regulatory sentiment during the analysis period. Therefore, as we do not analyze separating regulatory reform policies from regulatory sentiment, regulatory sentiment can be used to evaluate regulatory reform policies.

By quantifying regulatory sentiment and identifying the positive and negative tones from articles related to regulatory reforms, the study utilizes several notable indices to analyze the impact on macroeconomic variables. If a regulatory reform policy acts as intended to improve economic environment, economic growth, investments and employment increases will occur through regulatory reforms. The study concludes by finding that macroeconomic indicators and regulatory sentiment are closely linked, suggesting that regulatory sentiment should be acknowledged more actively when implementing regulatory policies.

The rest of this paper is structured as follows: Chapter II summarizes the existing research on regulatory sentiment. Chapter III introduces the regulatory psychology index and other relevant variables, followed by the model used for this study’s analysis; Chapter IV presents the results of the analysis, and Chapter V summarizes the nature of regulatory sentiment and discusses measures for improvement.

II. Literature Review

Over time, an extensive collection of literature has developed, focusing on the economic outcomes of regulatory reform policies. However, only a handful of studies verify the exact factors that had significant impacts on regulatory reform policies, and whether pessimistic regulatory policy sentiment reduces policy outcomes is questionable. To assess the effects of regulatory sentiments, scholars have relied on survey results that measure the sentiment over a specific regulatory policy (Regulatory Reform Committee, 2020; FKI, 2020; Korea Federation of Small and Medium Businesses, 2014; Choi, Koo, and Kim 2007; Kim, 2014; Kang, 2004: Park and Son, 2015; Lee-J, 2017). Choi, Koo and Kim (2007) assessed the sentiment associated with participatory governmental regulatory reform policies through a survey of business groups, academia, experts, and public officials. Interestingly, their work found different responses from each survey group. Compared to public officials who implement regulatory reform policies, the index related to the regulatory compliance sentiment of business groups, academia, and experts appeared to be relatively more pessimistic. Their study confirms that regulatory sentiment differs among groups, emphasizing the need to promote policy reforms that satisfy all non-public official groups.

Park and Son (2015) attempted to analyze major issues related to improving the regulatory positive sentiment when adjusting regulatory reform policies. Using a structural equation model based on the results of a survey of entrepreneurs, they find that regulatory authorities greatly affect the entrepreneurial sentiment. Lee (2017) analyzed regulatory types that directly affect business activities in regional areas using the Regional Business Environment Map of the Korea Chamber of Commerce and Industry (KCCI), survey data on the regulatory sentiment of regional entrepreneurs. Their results show that regulations related to industrial sites are the major factors driving the strong negative sentiment of entrepreneurs. This result feeds into the existing literature that holds that the initiation of new regulations has a significant impact on entrepreneurial sentiment. However, results are also somewhat limited in their use of questionnaire-derived data, the continuity problem of time series in the study, and the frequent alteration of the questionnaire.

Regulatory uncertainty is reflected in regulatory sentiment, and work by Finkelstein and Hambrick (1996) describes regulatory uncertainty as the basis for cognitive judgments by decision makers. The major works on regulatory uncertainty can be narrowed down to two channels in the literature. On one hand, entrepreneurs perceive regulatory uncertainty as a factor of future risks. Higher perceived risk leads to postponements of investment decisions to avoid any possible crisis. On the other hand, decision makers take on risky but rewarding investments as a survival tactic during times of uncertainty (Park, 2020; Fabrizio, 2012; Henisz and Delios, 2001; Hoffmann et al., 2009; Aragón-Correa and Sharma, 2003; Marcus, Aragon-Correa, and Pinkse, 2011).

Park (2020) analyzed the impact of regulatory uncertainty during the startup of new businesses, focusing on venture startups that make aggressive investments to overcome their limited capital. The study results deliver surveys of two groups which were divided according to the presence of regulatory experience to identify regulatory uncertainty. Park (2020) further analyzed the survey results based on different levels of difficulty with regulatory compliance. Accordingly, for venture startups, the intention to enter a new industry was high when there was no regulatory experience. The findings suggest that the higher the uncertainty about regulation, the higher the intention to start a business. However, among companies that have prior experience with regulations, the group that experienced severe regulatory compliance difficulties expressed a negative attitude toward new investments. This highlights the tendency of firms to rely heavily on their previous experiences, confirming that the factors promoting corporate investment are not the content of the regulatory policies but the hardships companies face considering their past experiences with regulatory compliance.

Hoffmann et al. (2009) analyzed the impact of regulatory uncertainty in the European Union Emissions Trading System (EU ETS). After analyzing German companies, their study found that the influence of regulatory uncertainty on corporate decision-making was insignificant. In contrast, Lee (2004) examined the effect of regulatory uncertainty on what was termed the Total Contribution Limit System between business groups. The Total Contribution Limit System prevents the spilling of one affiliate’s crisis to other business groups. Due to a lack of social consensus, the system was amended several times before finally being abolished in 2009. The author focused on regulatory uncertainty and analyzed how business investment strategies change depending on the perception of regulatory uncertainty. They found that affiliates accumulate cash without investing in the event of regulatory uncertainty, even when they increase their cash flow. This result indicates the possibility that regulatory sentiment has an impact on the entrepreneurial economic behavior and the economic activity of a society.

III. Data and Analysis

A. Regulatory sentiment

Regulatory sentiment is often employed to assess governmental regulatory reform policies (Kang, 2004; Choi, Koo, and Kim, 2007; Lee-J, 2017). As the working principles of each regulation policy are vastly complex, it is challenging to evaluate regulatory reform policies. Here, regulatory sentiment is utilized to evaluate regulatory reform policies according to various social groups with distinctive compliance experiences. Earlier studies derive regulatory sentiment through diverse methods. The majority rely on surveys to construct regulatory sentiment variables. The present study extracts information from media articles and constructs an index representing the social mood from regulation reforms. We are confident that the sentiment index used in this study is more comprehensive and representative than those adopted in existing studies.

The oldest and most well-known indicator of regulatory sentiment in Korea is the Regulatory Reform Satisfaction index, presented by the Regulatory Reform Commission. The index has been published annually since 2005, and it is derived from a survey of satisfaction with regulatory reform policies as recorded each year. The survey groups consist of the public, experts, and public officials. As this survey is conducted by the Regulatory Reform Committee, which promotes and manages regulatory reform policies, the questionnaires are often changed according to regulatory policy issues that are deemed timely. Therefore, the use of a time series analysis accompanies the crucial problem of the consistency of the questionnaires.

The next most widely used indicator of regulation sentiment is the Regulatory Reform Perception index, prepared by the Federation of Korean Industries (FKI). Although this indicator uses the same method of surveying satisfaction used to compile the Regulatory Reform Satisfaction index, it limits the subjects of the survey to companies and focuses on the impact on corporate management. Therefore, while this indicator can be viewed as a representation of corporate regulatory reform consciousness, it cannot be broadly interpreted as representing society’s sentiment toward regulatory reform policies. This data also undergoes frequent changes of the questionnaires, with an expansion of the sample as well from large enterprises to small and medium-sized enterprises (SMEs).

A survey on corporate perceptions published by the Korea Chamber of Commerce and Industry is also a universally used index. This indicator was published annually for four years from 2014 to 2017, and what sets it apart from other indicators is that it provides regulatory awareness at a regional level. However, Lee-J (2017) pointed out that the subjects of this survey were limited to well-established companies with sufficient regulatory experience. Lee-J (2017) argues that the perceptions of local residents are not taken into account, reducing the indicator’s representativeness of the region.

In broader terms, the Burden of Government Regulation issued by the World Economic Forum (WEF) is an indicator of regulatory sentiment that compares international regulatory levels. This indicator is derived from a survey of companies that responded to questionnaires regarding their administrative burden as they conducted business in their respective country.1 Respondents can select a score on a scale of one (very burdensome) to seven (not burdensome at all) regarding on how burdensome the regulations are to their businesses, allowing for an international comparison. However, because this index is a relative indicator that measures the intensity of regulations, it is not suitable for identifying changes over time. Consequently, as a majority of the regulatory sentiment surveys published to date rely on questionnaires, the problem of using time series analysis data arises due to the changes and instability of the questionnaire sample and items. Additionally, the fact that most questionnaires are scored on a Likert-type scale makes interpreting the results more complex due to the frequently mentioned problem of the error of central tendency (Douven, 2018).

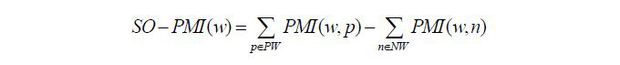

This study utilizes the research results in Kim et al. (2020) on regulatory sentiment. Kim et al. (2020) analyzed and derived the tone of media articles using a text analysis, as the media represent the most representative and appropriate medium in which to express public opinion and grasp social sentiment. In deriving regulatory sentiment, Kim et al. (2020) collected regulation-related internet articles from January of 1998 to June of 2020 by means of web crawling to build a database and then conducted a sentiment analysis to determine social trends. For the sentiment analysis, the SO-PMI (Semantic Orientation from Pointwise Mutual Information) tool by Turney (2002) was used. SO-PMI is a technique that relies on the fact that a basic word can be a seed of positive/negative words and that words used along with that basic word have characteristics similar to the seed. In selecting seeds, the KOSAC sentiment lexicon was used, where 28 words were selected and used after removing some words with low credibility.

TABLE 1

SEED SELECTION USING THE KOSAC SENTIMENT LEXICON

Source: Kim et al. (2020). Figure 4-3, p.49.

The SO-PMI of a specific word was calculated by deriving the co-occurrence frequency ( P(w1, w2) ) and the co-occurrence probability ( PMI(w1, w2) ) of each word based on the seed. SO-PMI indicates the difference between the used positive word seed set and the negative word seed set.

Using this, 9,013 words with an appearance frequency of 0.1% or more with the selected seed were selected, and as a result of evaluating the positive/negative characteristics of each word, 4,002 positive ( SO - PMI (w) > 0 ) and 5,011 negative ( SO - PMI (w) < 0 ) words were drawn out.

The top 20 positive/negative words are shown in Table 2.

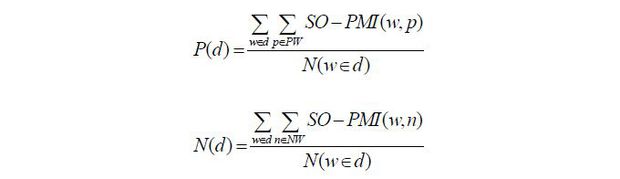

By using the positive and negative SO - PMI (w, p) outcomes of the published article ( d ), positive P(d ) and negative N (d ) values of the 9,013 derived words could be identified.

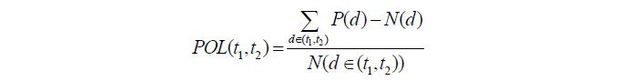

Using the derived P(d ) and N (d ) outcomes, the regulatory trend POL(t1,t2) of the analysis period (t1,t2) was calculated.

Figure 1 shows the sensitivity to regulation (rs) outcome as derived in Kim et al. (2020). However, it is helpful to suppose that t in Kim et al. (2020) is derived by month. In such a case, because all macro-variables used in this analysis are quarterly data, recalculation as a quarterly value is done for consistency of the analysis. The basic statistics for the media regulatory sentiment variables used in the analysis are shown in Table 3. A derived (+) value indicates a socially positive attitude towards a regulatory policy, and a negative (-) values can be interpreted as a negative trend emerging in the market.

FIGURE 1.

MEDIA REGULATORY SENTIMENT INDEX

Note: Just before the first quarter of 2020, a sharp negative feeling of regulation was derived, likely stemming from regulations such as social distancing due to COVID-19.

Kim et al. (2020) analyzed and derived the tone of media articles by means of a text analysis, as the media sources are the most representative and appropriate type by which express public opinion and grasp social sentiment. Thus, the authors identified the positive and negative tone of voices from the words used in articles over time and identified the tones to quantify trends in social regulation sentiment overall. The index value derived by this method offers an excellent advantage in that it is more objective, complementing the aforementioned shortcoming of using survey data. In addition, the continuity of the data makes it the most suitable index for the purpose of this study. Figure 2 shows the discontinuities and restrictions associated with the use of regulatory and other sentiment indices. The time series analysis, which serves as this study’s analysis method, can be used with our index to identify the effects of regulation sentiment on economic activities.

FIGURE 2.

COMPARISON OF REGULATORY SENTIMENT INDEXES

Source: FKI (2015; 2016), Regulatory Reform Commission (2005; 2013; 2016; 2019), Kim et al.(2020).

Note that FKI’s 2014 and 2015 evaluations were performed qualitatively. RRC’s 2017 data only evaluated companies, and the score range is 0 to 5. Because regulatory sentiment in Kim et al. (2020) is derived by month, it is recalculated to determine a yearly value for comparison with the other indexes.

B. Analysis Model

The Vector Auto Regression (VAR) model of Sims (1980) is used widely in empirical analyses. In general, VAR models fully utilize the information contained in time series of economic data without setting an explicit economic hypothesis (Stock and Watson, 2001; Moon, 1997; Lee and Kim, 2014; Park and Lee, 2014; Kim, 2011). Using the VAR model in an empirical analysis allows researchers to grasp the dynamic ripple effect by including the lagged variable from the VAR analysis as an explanatory variable.

In this study, a VAR analysis was conducted to confirm the effects of regulatory sentiment on the macro economy in terms of investment, employment, and economic growth.

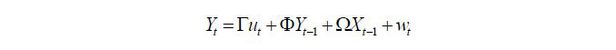

Here, Yt is composed of the seven variables of the economic growth rate (gr), regulatory sentiment (rs_q), investment (private investment (cs), facility investment (is), construction investment (i_cs), gross domestic investment (tgt)), and employment (employment rate (en)). Seven vector functions were derived in unison, one for each of the variables, where the regressors in all equations are lagged values of all of the variables. Thus, Xt-1 indicate all time variables except for Yt, ut includes terms that simultaneously fit the constant and trend, and wt is the error term.

With the VAR model, it is difficult to identify the relationship between two variables, as different parameters are included in all cases. Therefore, based on the VAR results, a transitory volatility triggering relationship between the variables was confirmed through the Granger causality test. Granger causality tests the null hypothesis that all coefficients of variable X are zero. If the Granger causality test rejects the null hypothesis, we can say that the variable X has a Granger causal relationship with Y.

Finally, the dynamic responses of economic variables from a change in regulatory sentiment can be estimated. If the VAR model is stable, expressing it as a vector moving average (VMA) becomes possible (Box and Jenkins, 1976; Hamilton, 1994). Thus, the impulse response function can be estimated to reveal the dynamics caused by the change in regulatory sentiment on economic growth, investment and employment.

In this study, the relationship between economic growth, investment, and employment was analyzed as a macro-variable to validate the argument for an improvement of the existing regulatory sentiment. The economic growth rate (gr), the most representative indicator, measures the degree of economic growth in Korea, and for this quarterly data published by the Bank of Korea was used.

As indicators related to investment, the indicators of private consumption (cs), facility investment (is), and construction investment (i_cs) of national income expended provided by the Bank of Korea were used to show the sideways trend of each business entity. Private consumption (cs) is an index that identifies changes in household consumption, from national income expended to final consumption expenditure, in a household. Equipment investment (is) and construction investment (i_cs) are subsections of the gross fixed capital formation of national income expended, where facility investment refers to a company’s consumption expenditure for transportation equipment and all machinery used as production facilities. In contrast, construction investment refers to expenditures on buildings and civil engineering construction (The Bank of Korea, 2019). In particular, facility investment (is) is an important variable because it acts as a factor in employment and income increases along with increases in the productivity of companies (Park, Byeon, and Jeong, 2011; Young, 1995). It was also included in the analysis of the gross domestic investment ratio (tgt) as an indicator related to investment. The gross domestic investment ratio (tgt) is an indicator of total domestic capital formation divided by gross national disposable income, which refers to the ratio of total investment among the total amount of national disposable income, the most comprehensive concept of income; it is an index that can confirm an increase in assets accumulated for future consumption.

The employment rate (em) data of the Economically Active Population Survey, provided by the National Statistical Office, was used as an employment-related indicator. The unemployment rate may be biased, as those who are preparing for a job and those who are giving up searching for a job are classified as economically inactive and are excluded when counting those who are unemployed. Therefore, the employment rate, rather than the unemployment rate, was used to avoiding this source of bias.

Finally, for regulatory sentiment (rs), findings by Kim et al. (2020) were used. A derived (+) value indicates a socially positive attitude towards regulatory policy, and a negative (-) value can be interpreted as a negative mood in society.

The basic statistics for the variables used in the analysis, including regulatory sentiment (rs), are shown in Table 4.

IV. Results

Prior to the analysis, a unit root test was conducted to confirm the stationarity of the time series variables used in the analysis. This was done because if the time series variable is nonstationary, the problem of spurious regression may arise. For verification, the augmented Dickey-Fuller test, which corrects the autocorrelation of the error term of Dickey-Fuller (DF), by Fuller (1976) was utilized. As a result, it was confirmed that all variables were stable (see Table 5).

After confirming that the variables are stable, verification was performed to select the optimal lag for the analysis. Lag selection is important because if too many lags are included in the analysis, the standard error of the coefficient estimate may be overestimated and the prediction error may increase. On the other hand, if the time difference to be included in the model is omitted, a biased estimation result value may be derived. An ideal verification method has been the subject of various discussions, with inconsistencies found when selecting the time difference. Thus, it is mostly selected based on the analysis result. As a result of verification using the variables for the analysis, it was derived as shown in Table 6. In FPE, AIC, and HQIC, except for SBIC, the optimal lag was determined to be 4, as in the verification, and a VAR analysis with a lag of 4 was conducted.

TABLE 6

SELECTION OF THE LAG ORDER

Note: * LL (Log-Likelihood function), LR(Likelihood ratio), FPE (Akaike’s final prediction error), AIC (Akaike information criterion), HQIC(Hannan and Quinn information criterion), SBIC(Schwarz’s Bayesian information criterion)

Based on the analysis results of VAR, Granger causality verification was utilized and the impulse response functions were derived.

First, as a result of the Granger causality test (Table 7), both investment and employment were found to have a causal effect on the economic growth rate (gr), as in economic theory. Private investment (cs) derived from economic growth (gr) and mutual Granger causality, and facility investment (is) derived from employment (en) and mutual Granger causality. Mutual Granger causality was confirmed for construction investment (i_cs) with gross domestic investment (tgt) and economic growth (gr), and for employment (en) with economic growth (gr).

Cases of single Granger causality were as follows: construction investment (tgt) to private investment (cs), private investment (cs) to construction investment (i_cs), and facility investment (is) to gross domestic investment (tgt). Private investment (cs) and gross domestic investment (tgt) were single Granger causality factors related to employment (en).

Regarding regulatory sentiment (rs), which is the main subject of interest in this study, Granger causality was statistically significant with all macro indicators, specifically investment (cs), facility investment (is), construction investment (i_cs), gross domestic investment (tgt), employment rate (en), and economic growth rate (gr). In other words, it was confirmed that regulatory sentiment affects the decision-making of actual economic agents. This means that changes in regulatory sentiment have an effect on both investment and employment and ultimately affect economic growth. In addition, it is notable that the causality factor of other macro-variables, in this case economic growth, employment, and investment, as well as economic growth, was not significant with regulation (rs). This indicates that regulatory sentiment, which is regulatory trend, is not a relative concept that is affected by the real economy but a social trend that is independent of real economic indicators.

Finally, when a unit impulse was applied to regulatory sentiment (rs) through the impulse response function, a dynamic pattern of macro-variables was identified (Figure 3). As a result of analyzing one unit impulse of regulatory sentiment (rs), the initial impact on economic growth (gr) and private investment (cs) was found to be negligible; this was followed by a positive (+) response, with the impact then converging to zero. In other words, these two indicators are positively affected by a regulatory sentiment (rs) shock. On the other hand, construction investment (i_cs) showed a positive (+) response at the beginning which rapidly changes to a negative (-) response and then converges to zero. This shows that the impulse of regulatory sentiment may be temporarily positive but smoothens out over time. Even in the case of gross domestic investment (tgt), the initial effect was negligible. After showing a positive (+) reaction, it converged to zero after a few sideways movements. Among economic agents, for facility investment (is), which represents corporate behavior, the impact of such a shock showed a positive (+) and negative (-) sideways pattern for a considerable period of time compared to the other variables. However, facility investment (is) remained at zero in all confidence intervals, meaning that caution is required when interpreting this outcome. Comprehensively considering the results of the previous Granger causality test, regulatory sentiment shows a Granger causal relationship in facility investment, but the unit stochastic impact is not significant enough to track in future periods.

V. Conclusion

Based on work by Kim et al. (2020), who determined regulatory sentiment by analyzing the tone of media articles as positive and negative, the relationship with economic indicators is analyzed in this study to determine the impact of regulatory sentiment on actual economic activities. In this study, an empirical analysis was conducted to identify the factors that have a significant impact. The study found a Granger causal relationship between regulatory sentiment and certain actual economic activities, specifically private consumption, facility investment, construction investment, gross domestic investment, and employment. In other words, if regulatory sentiment is improved, a positive effect on economic activity can be guaranteed. Additionally, it can be concluded that among diverse economic entities, corporations, in particular, are most sensitive to the impact of regulatory sentiment and are affected for the longest period.

As previously acknowledged, the research results provide evidence that efforts to increase regulatory sentiment are necessary to derive the effects of regulatory reform policies. It is necessary to increase the participation of the private sector in planning and implementing policies while actively discovering their demand. Thus, instead of dealing with policies with the vague goal of merely improving regulatory sentiment, using regulatory sentiment as derived from Kim et al. (2020) as an indicator of major policies could be an effective approach.

A causal relationship between this indicator and major economic indicators has been revealed in this study and the credibility of the indicator has been guaranteed. Accordingly, the indicator can serve as a means of official regulatory policy management. In addition, as mentioned in the work of Kim et al. (2020), in contrast to determining regulatory sentiment through a survey, the use of the text analysis approach has the advantage of being able to draw more objective and quicker values, meaning that it is more convenient and efficient.

Notes

References

, & (2003). A Contingent Resource-Based View of Proactive Corporate Environmental Strategy. Academy of Management Review, 28(1), 71-88, https://doi.org/10.2307/30040690.

(1999). The Two Faces of Public Opinion. American Journal of Political Science, 43(4), 1209-1230, https://doi.org/10.2307/2991824.

(2018). A Bayesian perspective on Likert scales and central tendency. Psychonomic Bulletin & Review, 25, 1203-1211, https://doi.org/10.3758/s13423-017-1344-2.

(2012). The effect of regulatory un-certainty on investment: evidence from renewable energy generation. The Journal of Law, Economics, & Organization, 29(4), 765-798, https://doi.org/10.1093/jleo/ews007.

(2010). Beyond Public Opinion Polls: Punitive Public Sentiment & Criminal Justice Policy. Sociology Compass, 4, 156-168, https://doi.org/10.1111/j.1751-9020.2009.00269.x.

, & (2001). Uncertainty, imitation, and plant location: Japanese multinational corporations, 1990-1996. Administrative Science Quarterly, 46(3), 443-475, https://doi.org/10.2307/3094871.

, , & (2009). Regulatory Uncertainty: A Reason to Postpone Investments? Not Necessarily. Journal of Management Studies, 46(7), 1227-1253, https://doi.org/10.1111/j.1467-6486.2009.00866.x.

. (2017). A Critical Review on Regulatory Reform of Korea: Focusing on Regulatory Governance and Public-Private Cooperation. Korean Governance Review, 24(1), 271-298, in Korean, https://doi.org/10.17089/kgr.2017.24.1.010.

, , & (2011). Firms, Regulatory Uncertainty, and the Natural Environment. California Management Review, 54(1), 5-16, https://doi.org/10.1525/cmr.2011.54.1.5.

, & Reading Public Opinion: The Influence of News Coverage on Perceptions of Public Sentiment, 1997, 61, 3, http://www.jstor.org/stable/2749580, https://doi.org/10.1086/297807.

(1980). Macroeconomics and Reality. Econometrica, 48(1), 1-48, https://doi.org/10.2307/1912017.

, & (2001). Vector Autoregressions. The Journal of Economic Perspectives, 15(4), 101-115, http://www.jstor.org/stable/2696519, https://doi.org/10.1257/jep.15.4.101.

Thumbs up or thumbs down? Semantic orientation applied to unsupervised classification of reviews, 2002, https://arxiv.org/abs/cs/0212032.

. (1995). The Tyranny of Numbers: Confronting the Statistics Realities of the East Asian Growth Experience. Quarterly Journal of Economics, 110, 641-680, https://doi.org/10.2307/2946695.