- P-ISSN 2586-2995

- E-ISSN 2586-4130

This paper reconsiders the empirical evidence of the relationship between tax treaties and FDI using U.S. outbound FDI to 78 countries over the period of 2007–2018. Unlike previous studies, we explicitly consider differences in the tax environments of recipient economies, including their tax-haven status, transfer pricing rules, CFC rules and anti-avoidance regulations, in our estimations. Our results confirm the importance of controlling for country-specific tax environments, especially the tax-haven status and transfer pricing rules. We find that tax treaties positively contribute to FDI inflows in developing countries, while they have no statistically significant impacts on OECD countries. Recently signed tax treaties still foster FDI but less than older ones do. Finally, our results indicate, all other things being equal, that the weaker the transfer pricing regulations, the greater the amount of U.S. direct investment into a non-OECD economy.

Tax Treaties, Foreign Direct Investment, Tax Havens, Transfer Pricing, Tax Regulations

O11, O47, C21, F4

Foreign direct investment (FDI hereafter) is generally regarded as an important driver of economic growth, a composite package of investment resources, technological know-how and managerial expertise (de Mello, 1997). Recognizing this, many countries compete to attract FDI by providing favorable incentives to foreign investors. In addition, countries enter into bilateral and/or multilateral economic agreements, such as tax treaties, investment treaties, and preferential trade agreements, to assure foreign investors that they adhere to global norms in trade and investment practices.

Among these agreements, tax treaties are aimed at ameliorating tax-related impediments to cross-border trade and investment. While the primary objective of tax treaties is to avoid the double taxation of income by more than one jurisdiction, they also cover other issues, including the prevention of tax evasion, excessive taxation, and tax discrimination. Since the League of Nations initially proposed the modern tax treaty model in 1928, such agreements have proliferated worldwide, and currently more than 3,000 bilateral tax treaties are in effect. The pace at which tax treaties are being established has even accelerated since the mid-1990s (Leduc and Michielse, 2021).

Despite the proliferation of tax treaties, there has been a growing sense of skepticism regarding their effectiveness, especially in recent years (Kysar, 2020; Brooks and Krever, 2015). The contemporary architecture of bilateral tax treaties largely preserves the principles and structure of the League of Nations model (Kobetsky, 2011). That model was developed when international transactions were usually carried out in a tangible form, but the world economy has changed considerably since then. In the face of accelerated globalization and digitalization, the roles of multinational companies have grown and international transactions increasingly take place in intangible forms.

At the present time, the digital transformation of cross–border transactions has contributed to the emergence of various techniques of tax avoidance or tax evasion across countries. Multinational enterprises can abuse tax treaties by ‘treaty shopping’ to avoid taxation, causing what are known as “double non-taxation” problems. Consequently, cross-border taxation issues are becoming more complex and the current tax treaty system has not sufficiently responded to these changes.

Tax treaties are designed to handle double taxation mainly by limiting a source country’s taxation on income not derived via a permanent establishment within the country (Brooks and Krever, 2015; Petkova et al., 2020).1 In other words, they shift the taxing rights from the source country to the investor’s country of residence at the expense of tax revenue to the former. Hence, if capital inflows are greater than capital outflows for an economy, as is true for most developing countries, the cost of lost tax revenue may outweigh the potential benefits of forgoing taxing rights, unless tax treaties induce a sufficient level of FDI inflow and other externalities that create jobs and sustained economic growth.2

Several researchers have empirically investigated the tax treaty–FDI nexus but a consensus on whether tax treaties increase FDI flows remains elusive. Such mixed findings have contributed to the controversy over the validity of tax treaties. Against this backdrop, this paper aims to reconsider the empirical evidence of the impact of tax treaties on FDI. While the tax environments of recipient countries, such as their local tax systems and regulations, are inarguably a decisive factor in investment decisions, previous studies of the tax treaty–FDI nexus failed to consider country-specific tax environments as a determinant of FDI, leading to omitted variable bias in their estimations.3

To explain this, it is helpful to consider tax treaties with tax-haven countries. Tax havens do not tax foreign-sourced income; thus, tax treaties do not in fact affect their tax systems. This implies that a country that enters into a tax treaty with a tax haven could potentially give up a significant amount of tax revenue. Consequently, countries may be reluctant to sign tax treaties with tax havens. Even tax havens may hesitate to conclude tax treaties due to the built-in obligation to provide tax information. For similar reasons, the likelihood of a tax agreement can vary depending on the tax regulations of partner countries. In this context, our analysis explicitly controls for the specific tax environments of recipient countries, including their tax-haven status, the quality of their tax avoidance regulations, controlled foreign corporation rules (CFC rules hereafter) and transfer price rules. We find that the mixed evidence from previous studies may stem to some extent from omitted variable bias in the estimations.

In addition, while most of the existing literature analyzes the effectiveness of tax treaties during the 1980s and 1990s, this study deliberately targets a more recent period, 2007–2018. One of the striking findings in the existing literature is that tax treaties signed more recently tend to have a more negative impact on FDI flows than older treaties. Blonigen and Davis (2004) and Egger et al. (2006) interpret this as evidence that new tax treaties or the revision of old ones may reduce FDI flows, as they contain more sophisticated incentive schemes to limit FDI for tax avoidance purposes. If this claim is correct, our estimates for the more recent period should show an even stronger negative impact of tax treaties on FDI. It is also plausible that the accelerated pace of globalization and digitalization may further undermine the effectiveness of tax treaties.

The paper is organized as follows. Section II provides a brief literature review on the relationship between tax treaties and FDI. Section III discusses our estimation strategy and describes the data used in this study. In section IV, we present the estimation results based on our model. Some concluding remarks are provided in section V.

As mentioned above, the empirical evidence on the effectiveness of tax treaties is largely mixed. Blonigen and Davis (2004) analyze the effects of tax treaties on both U.S. inward and outward FDI for the period of 1980–1999, separating tax treaties signed before the sample period from those signed during the sample period. They find little evidence of an impact of tax treaties on FDI. In addition, their analysis indicates that new tax treaties may even have a negative impact on U.S. direct investment activities abroad. Blonigen and Davis (2005) find similar results for OECD countries over the period of 1982–1992, suggesting that tax treaties serve as a mechanism for reducing tax evasion rather than boosting foreign investment. Egger et al. (2006) employ the propensity score matching (PSM) method to analyze the impact of bilateral direct investments on OECD countries during the period of 1982–1992. They also show that tax treaties have a negative effect on direct investment abroad. Likewise, Davis (2003) examines 20 cases of U.S. tax treaty revisions during the period of 1966–2000 and reports that treaty renegotiations do not increase FDI.

On the other hand, Stein and Daude (2007) report that with regard to OECD direct investment abroad over the period of 1997–1999, tax treaties affected which recipient countries were chosen. Neumayer (2007) analyzes a sample of developing countries and finds that FDI stocks were on average approximately 20 percent higher if a treaty was concluded during the sample period. However, these effects were confined to medium-income countries. Neumayer’s results also suggest that countries that have more tax treaties with major developed countries have greater FDI inflows. Recently, Lejour (2014) applied a propensity score matching estimation to a sample of 34 OECD countries over the period of 1985–2011. In the estimation, tax treaties are instrumentalized using exogenous geographic variables to control for endogeneity issues. Contrary to Blonigen and Davis (2005) and Egger et al. (2006), Lejour (2014) shows that tax treaties significantly contribute to FDI, and new treaties have an especially large effect. Employing a quantile treatment model with U.S. FDI data over the period of 1988–1999, Kumas and Millimet (2018) suggest that the impacts of tax treaties on FDI differ depending on the extent of FDI activity at the time of treaty conclusion. Specifically, tax treaties increase FDI at lower quantiles of the FDI distribution but decrease FDI at upper quantiles.

Potential reasons for the mixed findings on the effectiveness of tax treaties are as follows. First, tax treaties aim to prevent both double taxation and tax evasion. Consequently, tax treaties have conflicting effects in that they promote direct investment by preventing double taxation but reduce FDI through their anti–tax-avoidance provisions.4 Hence, empirical studies may observe negative impacts of tax treaties if they reduce the inflow of new direct investments for tax avoidance purposes more than they promote investment through the prevention of double taxation (Blonigen and Davis, 2004; Egger et al., 2006).

Second, as Baker (2014) argues, developed countries are equipped with organized legal frameworks and policies to prevent double taxation and tax avoidance. This mitigates the major benefits of signing tax treaties with partner countries, meaning that the effect of tax treaties on developed countries could be minimal. However, this finding does not explain why the effect of tax treaties could be negative.

Third, it cannot be ruled out that the ambiguous evidence stems from estimation problems that are inherent to the existing studies. This paper pays special attention to potential omitted variable bias in previous studies. As described above, the exclusion of variables related to countries’ specific tax environments from the regression analyses may mean that tax treaties are correlated with the error terms, resulting in biased and inconsistent estimates.

Fourth, most of the aforementioned empirical studies treat tax treaties as a binary variable – regardless of whether a tax treaty exists or not – without considering differential attributes among these treaties. It is highly plausible that the effectiveness of individual tax treaties may not be the same, especially considering the possibility of treaty shopping.

In this context, there has been recently a growing strand of research that employs network analysis techniques and/or micro-level data to identify the specific conduits through which tax treaties contribute to FDI (van’t Riet and Lejour, 2018; Hong, 2018; Petkova et al., 2020). For instance, Petkova et al. (2020) find that tax treaties that offer investors a financial advantage both over domestic law and the entire treaty network would increase FDI, while others do not. Similarly, Hong (2018) demonstrates the existence of tax-minimizing direct routes that contribute to FDI. Such a differential impact of tax treaties may not be well captured in the existing literature, which relies on a binary treatment of tax treaties.

This paper examines the impact of tax treaties on U.S. outbound FDI destined to 78 countries over the period of 2007–2018. In our empirical analysis, we consider the gravity model as a benchmark and augment it with other key predictors. Our conceptual framework can be summarized by the following equation:

where fdiit represents the volume of U.S. FDI destined to a country i in year t, GRAVit is the vector of gravity variables, such as GDP (GDPit) and the physical distance between the U.S. and country i ( disti ). KNOWit represents the extent of knowledge capital of recipient country i , T_COSTit is the bilateral trade cost between the U.S. and country i. Tax_treatyit is a dummy variable indicating whether a bilateral tax treaty is in effect between i and the U.S. in year t , and Zit is the vector of other bilateral and multilateral economic agreements in effect at time t . TAXit represents the vector of tax environment variables for recipient country i .

Among the gravity variables, GDP is expected to be a robust determinant of FDI, as horizontal FDI is often destined to countries that boast large markets and great purchasing power. 5 While physical distance is inarguably a crucial factor that determines trade flows as it is indicative of trade costs, its impact on FDI flows is ambiguous. On one hand, physical distance could be an indicator of costs related to FDI activities, such as transport, communication, market search, among others, implying that distance could affect FDI flows. On the other hand, firms often locate production in direct proximity to a foreign market to avoid distance-related costs. Therefore, all other factors being equal, it is plausible that the greater the distance, the greater the horizontal FDI incentives for firms.

As shown in Equation (1), we consider the degree of knowledge capital of a recipient country as a determinant of FDI flows. Markusen (2007) presents a theoretical model showing that FDI provides knowledge-intensive services to recipient countries for whom developing their own knowledge-intensive inputs would be cost prohibitive. At the same time, the absorptive capacity of recipient countries matters when multinationals decide on a location for FDI. In this paper, we use the relative level of human capital ( HCit ) and total factor productivity (TFPit) for country i compared to the U.S. as a proxy for its absorptive capacity.

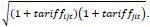

Our trade cost variable, T_COSTit , is the geometric average of bilateral tariff rates between the U.S. and country i . High tariff rates induce foreign firms to avoid tariff barriers by locating their production within the destination market. This implies that, other things being equal, we can expect a positive relationship between tariff rates and FDI. However, the likelihood of such tariff-jumping FDI is influenced by other factors, including differential production costs, relocation costs and local demand conditions. Furthermore, high tariff rates may also be related to the inclination to protect domestic producers. Therefore, the estimated coefficient of this trade cost variable could be ambiguous.

The vector of Zit includes dummy variables for tax information exchange agreements (TIEA hereafter), free trade agreements (FTA hereafter) and WTO membership (WTO hereafter). TIEA allows for the exchange of tax information to address harmful tax practices. It can complement tax treaties or can be used by countries for whom taxes on income or profits are low or even zero, making tax treaties inappropriate.6 FTAs often contain investment provisions to foster FDI flows between member countries. More importantly, FTAs and WTO membership can assure foreign investors that recipient countries adhere to global norms in trade and investment practices.

Finally, TAXit consists of several variables to capture country-specific tax environments. These include tax haven status ( tax_ hvni ), transfer pricing rules ( trn_ prcit ), controlled foreign corporation ( cfcit ) rules, anti-avoidance regulations ( anti_ avdit ) and corporate income tax rates ( tax_cpit ). Tax havens tend to attract a large amount of FDI relative to their market size, especially by enabling multinationals to attain tax rates that are effectively close to zero. These impacts are not confined to tax havens but indeed apply to all countries with which an investing country has a tax treaty. Therefore, tax haven status should definitely be included in the estimation of a tax treaty–FDI nexus. Transfer pricing rules require firms to establish prices based on similar transactions between unrelated parties, and CFC rules prevent the artificial diversion of profits to a related company to minimize tax liabilities. Anti-avoidance regulations are designed to discourage or prevent tax avoidance in advance rather than addressing it after the fact.

Taking the abovementioned discussions into account, our estimation specification is as follows:

where Tt represents the vector of year dummies; ψ, ξ and ω are the vectors of the coefficients; and εit is the error term. While we employ several different estimators, including ordinary least squares (OLS hereafter), a fixed effects estimator, and a random effects estimator, we consider the potential impact of time-invariant unobserved heterogeneity across countries using a fixed effects estimator. In addition, as a robustness check, we also employ Arellano and Bond (1991)’s GMM estimation method to control for potential endogeneity bias.

Our country panel data come from various data sources, including the U.S. Bureau of Economic Analysis (BEA hereafter), the Tax Treaty database, Penn World Tables, the ESCAP-WB trade cost database and CEPII, as presented in Table 1. The set of tax haven countries is created based on Garcia-Bernardo et al. (2017), and the tax environment variables come from Schanz et al. (2017). Our dependent variable is the U.S. outbound stock for each recipient country obtained from the U.S. BEA.7 We use the CEPII dataset as the source of the gravity variables. TFPit is measured as the PPP-adjusted TFP level relative to that of the U.S. This measure, along with the human capital index ( HCit ), comes from Penn World Tables 10.0. Moreover, the trade cost variable, proxied by the geometric average of bilateral tariff rates between the U.S. and country i , comes from the ESCAP-WB trade cost database.8

For tax-related regulation variables such as anti-avoidance regulations, transfer pricing rules and CFC rules, the higher the value of these variables, the weaker the regulations of recipient country i . For example, if transfer pricing rules are not well established or are not applied appropriately for country i , then the related dummy variable has a value of 1, implying that the likelihood of tax evasion or avoidance increases. Therefore, if the estimated coefficients for these variables are positive for country i , it means that the weaker the relevant regulations are to prevent tax evasion, the greater the amount of U.S. direct investment is into the country. In addition, as countries with low tax rates are more likely to attract FDI, we also include the corporate tax rate ( tax_cpit ) of recipient country i in the estimation. Schanz et al. (2017) construct this variable in the following way: first, they note the maximum observed tax rate among all the countries in their sample data, after which they subtract each country’s tax rate from this value and divide that by the maximum rate. Thus, the corporate tax rate is normalized to a range between zero and one, with a higher value indicating a more attractive statutory tax rate. We use this variable in our regression and expect its estimated coefficient to be negative.

Defining which countries are tax havens is a complicated challenge. Traditional methods for identifying tax havens are based on differences in the tax and legal structures for base erosion and profit-shifting (BEPS) practices.9 Using this method, the EU includes 12 countries in its 2021 tax haven blacklist, mostly Caribbean and Channel Islands economies.10 Likewise, the OECD defined a total of 35 locations as tax havens in 2000, but by 2017, only Trinidad & Tobago was still listed as a tax haven. Recently, Garcia-Bernardo et al. (2017) identified a larger set of tax havens using an analysis of big data on the ownership networks of 98 million global companies across countries. They identify a total of 55 tax haven countries, including some advanced countries that function as offshore financial centers (OFCs hereafter), such as the Netherlands, the U.K., Switzerland, Ireland and Singapore.11 We adopt the approach of Garcia-Bernardo et al. (2017) to define tax havens.

As our panel data are collected from multiple sources produced by various institutions, there is underlying variation in the data coverage across data sources. As a result, our final panel data contain a total of 78 countries over the period of 2007–2018. The country list is presented in Table 2.12

As of 2018, the U.S. had a total of 60 tax treaties and 32 TIEA in effect. As shown in Table 2, our dataset comprises the majority of the countries that have a tax treaty with the U.S. Meanwhile, many TIEA treaty signatories are excluded from our sample due to the unavailability of information on taxation-related regulations and rules. Another observation is that the lion’s share of these countries consists of tax havens that have neither a tax treaty nor a TIEA with the U.S.

Note: * indicates a tax haven country as identified by Garcia-Bernardo et al. (2017).

Tables 3 and 4 contain summary statistics and present the correlations among the variables, respectively. Tax treaties are positively correlated with FDI flows, as are TIEA but with a much lower correlation coefficient. The correlations of FDI flows with tax environment variables except for tax haven status are negative, meaning that the better and stronger the tax systems and rules, the larger the amount of FDI inflows. However, because these are simple correlation coefficients, if the regression analysis controls for other determinants of FDI, the relationship between these variables could change. Tax haven status is positively correlated with FDI, while physical distance appears to have less of an impact on investment than it does on international trade. Tax treaties are negatively correlated with TIEA and FTA.

In this section, we report our estimation results from several different estimators. Table 5 contains the empirical results of the OLS, fixed effects, and random effects models. As presented in Column (1), a negative coefficient for tax treaties emerges when we run the OLS regression only using the gravity and absorptive capacity variables, which is often the case in existing studies (Blonigen and Davis, 2004; 2005). The size of the estimated coefficient becomes smaller if additional economic agreements are included in the estimation, but the negative sign remains, with high statistical significance (Column 2). In this regression, TIEA seemingly increases U.S. FDI into the partner countries. The effect of distance also becomes statistically insignificant. As we expect, the absorptive capacity variables all increase FDI.

Note: 1) All regressions include year dummies. 2) Figures in parentheses are heteroscedasticity-robust standard errors. 3) *, ** and *** indicate significance at the 10%, 5% and 1% levels, respectively.

On the other hand, as shown in Column (3), once we control for country-specific tax environments, the negative impact of tax treaties on FDI disappears. This implies that the omission of these variables in the estimation could lead to biased estimated coefficients and create some spurious inference regarding the impact of tax treaties on FDI. Despite the fact that the tax environments of recipient countries, such as their local tax systems and regulations, are inarguably decisive factors in investment decisions, previous studies have failed to consider country-specific tax environments as a determinant of FDI, leading to omitted variable bias in their estimations. Among the tax environment variables, tax haven status appears to be the most decisive factor affecting FDI flows. Other factors being equal, tax havens’ FDI stock from the U.S. tends to be approximately 2.3% higher than that of non–tax havens. The regression results also indicate that the weaker a country’s CFC rules, the higher their FDI inflow from the U.S. One puzzling finding in this regression is the negative coefficient of the corporate tax rate. As mentioned above, a higher value of this variable indicates a more attractive statutory tax rate. Therefore, we can expect a positive coefficient for this variable if a lower tax burden increases FDI inflows from the U.S. However, our estimate finds the exact opposite, with strong statistical significance. We suspect that the OLS regression does not sufficiently control for cross-country characteristics to produce a sensible marginal effect of the independent variables.

One way to control for country-specific heterogeneity in the estimation is to use a fixed effects or random effects estimator. Our panel data allow for the use of these estimators in order to control for time-invariant unobserved characteristics across countries. We report the estimation results using these estimators in Columns (4) and (5). As depicted in Table 5, the impact of tax treaties is statistically significant, with a positive sign for both the fixed effects and random effects estimations. Both models suggest that tax treaties increase FDI stock into a recipient country by about 0.6%. The estimated coefficients of the absorptive capacity variables are now insignificant. Similarly, the effect of FTA is statistically insignificant. Transfer pricing rules, instead of CFC rules, emerge as one of the key variables that determine the magnitude of FDI stock.

While our Hausman test suggests that the fixed effects model is the more appropriate model, the sizes of the estimated coefficients for tax treaties are similar across the two models. A pitfall of the fixed effects estimator, however, is that one cannot examine time-invariant causes of the dependent variables separately, as time-invariant predictors, such as tax haven status and physical distance, are perfectly collinear with the individual fixed effects.

As discussed above, Blonigen and Davis (2004) and Egger et al. (2006) found that recently signed tax treaties tend to decrease FDI flows. They claim that new tax treaties or the revision of old ones may reduce the incentive for FDI, as they contain a more sophisticated incentive scheme for limiting FDI for tax avoidance purposes. Given that our sample contains tax agreements concluded in more recent years, we may find even more negative impacts if this claim is correct.

In Table 6, we report the correlation coefficients between tax treaties and other explanatory variables after classifying tax treaties into three groups based on the time of entry into force of the agreement. As shown in the table, for tax agreements that took effect before the 1990s, the target countries are mainly countries with a large GDP and high levels of productivity and human capital during our sample period. The strong negative correlation with tax environment variables suggests that countries with well-organized domestic regulations to prevent tax avoidance are more likely to have signed tax agreements with the United States.

Note: 1) † The period classification is based on the year when the first tax agreement came into force, 2) * indicates the significance at the 1% level after Bonferroni adjustment.

On the other hand, tax treaties that came into force in the 1990s have a slightly lower correlation coefficient with GDP compared to the previous period, and the correlation with productivity and human capital level is not statistically significant. In addition, the correlation with tax haven status appears to have a negative relationship, indicating that there had been a strong tendency to enter into agreements with countries other than tax havens. For tax treaties that took effect after the 2000s, we find a negative correlation with GDP but a positive correlation with human capital. In addition, these treaties have no statistically significant relationships with tax haven status, CFC or transfer pricing rules. Hence, it appears likely that the United States had signed tax treaties with countries with large economies, high productivity and human capital levels, and well-organized tax regulations until the 1980s but that the target countries of tax treaties became more diversified after that decade.

Table 6 also includes correlation coefficients among these variables when the sample is divided into OECD countries and non-OECD countries. The results suggest that the size of GDP shows a positive correlation only in cases of tax treaties with the non-OECD countries. The negative correlation between tax treaties and TIEA in the non-OECD sample implies that the TIEA is used complementarily in countries that do not enter into tax treaties. We also find that the quality of domestic regulations to prevent tax avoidance matters for non-OECD countries. Countries with well-organized tax regulations are more likely to have signed tax treaties with the United States.

Table 7 contains the analysis results estimated by comparing the impacts of recently signed tax treaties with those of older ones. In Columns (1) and (2), we compare the effects of tax treaties that took effect before the 1980s and those that took effect thereafter. In the fixed effects model, for the tax agreements that took effect before the 1980s, the coefficient cannot be estimated because the agreements are perfectly collinear with the fixed effects. On the other hand, according to the random effects estimation results, both new and old tax treaties appear to have a positive effect on FDI in our sample. However, the size of the effect is smaller for the new treaties compared to older ones. Columns (3) and (4) show the results of a re-estimation when the tax agreements are divided into those that went into effect before the 1990s and those that went into effect afterward. These results are qualitatively similar to those shown in columns (1) and (2). Therefore, our results suggest that tax treaties have a positive effect on direct investment regardless of the time they went into effect, but the investment promotion effect is somewhat reduced in the case of newer agreements.

Note: 1) All regressions include year dummies. 2) Figures in parentheses are heteroscedasticity-robust standard errors. 3) *, ** and *** indicate significance at the 10%, 5% and 1% levels, respectively.

Table 8 includes the estimates of the effects of tax treaties when the sample is divided into OECD countries and non-OECD countries. Columns (1) and (2) include the results estimated for the entire sample after creating interaction terms between the tax treaty dummy and the OECD country dummy. In this case, the estimated coefficient represents the effect of tax agreements in other groups compared to non-OECD countries without tax treaties.13 According to the random effect analysis, the group of non-OECD countries with tax treaties has, on average, 0.96% more FDI stock invested from the U.S. than the group of non-OECD countries that do not have tax treaties with the U.S. While OECD countries have positive estimated coefficients regardless of whether they have a tax treaty, it should be noted that the size of the estimated coefficient for the OECD group with tax treaties is smaller than that of the OECD group without tax treaties. This implies that among OECD countries, tax agreements may not have a positive effect on FDI inflows from the U.S.

To verify this, after dividing the entire sample into OECD countries and non-OECD countries, we separately estimate each subsample.14 These results are presented in Columns (3) through (6). As shown in Table 8, we find that tax treaties appear to increase FDI among non-OECD countries. The estimated coefficient of tax treaties for the non-OECD sample is statistically significant, and tax treaties appear to increase the FDI stock invested from the U.S. by about 1%. On the other hand, there is no statistically significant effect of tax treaties on FDI in the OECD sample. Our results can be interpreted as evidence, as Baker (2014) suggests, that developed countries have various institutional mechanisms to prevent double taxation other than tax treaties, implying that the net effect of tax agreements may not appear. Brooks and Krever (2015) also argue that tax treaties could be redundant in developed countries, taking into account that most advanced economies have domestic tax laws stipulating either an exemption for tax income derived from other countries or a tax credit for taxes paid in the source country.

Note: 1) All regressions include year dummies. 2) Figures in parentheses are heteroscedasticity-robust standard errors. 3) *, ** and *** indicate significance at the 10%, 5% and 1% levels, respectively, 4) F-test statistic based on the correlated random effects approach.

We perform robustness tests of the regression results in the following way.15 First, it is possible that our analytic results may be affected by endogeneity problems, especially reverse causality bias. While our testing hypothesis is the causal impact of tax treaties on FDI, it may also be likely that tax treaties tend to be signed with countries with large FDI flows. To mitigate this potential bias, we employ Arellano and Bond (1991)’s GMM estimation method. In the meantime, we should recall that our tax treaty variable is a dummy variable and thus the first-differencing of this variable implies that the tax treaty effect can be estimated only for the exact year following the year the tax treaty entered into force. Following Barthel et al. (2010), we overcome this problem by applying an alternative tax treaty variable that measures the total number of years that pass after a tax treaty enters into effect. In this case, the first-differenced variable has a value of one for all years after a tax treaty becomes effective and zero otherwise, which is exactly what we want to test for.

Our GMM results are presented in Table A1 in the Appendix. We confirm that the estimated effect of tax treaties on FDI remains statistically significant and positive, although its statistical significance becomes weaker than in the fixed effect estimation. The Hansen statistics for over-identifying restrictions indicate that the validity of our instruments is not rejected.

Second, we use the approach of Garcia-Bernardo et al. (2017) to define tax havens, which includes several OECD countries. Given that some OECD countries, notably the U.K. and the Netherlands, have more FDI stock invested from the U.S. than others, it is possible that they are outliers in the analysis, affecting the estimation results. Thus, we re-run the regression excluding the Netherlands, the U.K., Switzerland, Ireland and Singapore from the list of tax havens. We confirm that such a change does not greatly affect our results quantitatively or qualitatively.

Third, considering the possibility that the tax prevention regulations have been strengthened in recently revised tax treaties, we conduct a regression analysis based on the time of entry into force of the most recently revised tax treaties. We find that despite these changes, the robustness of our analytic results is preserved. This result is consistent with findings by Davies (2003) showing that treaty renegotiations have no robust impact on FDI.

Fourth, we add more tax-related variables, such as country-specific tax withholding rates for dividends, interest, and royalties, as explanatory variables in the estimation. The estimated coefficients of these variables are largely insignificant. At the same time, our results suggest that a lower tax withholding rate levied on dividends attracts more FDI among the non-OECD sample, while a lower tax withholding rate levied on royalties increases FDI in the OECD sample.

Finally, Blonigen and Davies (2004) employ a slightly different specification compared to ours. In particular, basing on the empirical specification of Carr, Markusen and Maskus (2001), they include the following GDP-related variables in their estimations to distinguish between horizontal and vertical motivations for FDI: the sum of the two countries’ GDPs and the squared difference between the GDPs. Again we confirm that our results remain robust when these variables are taken into account.

This paper empirically examines the relationship between tax treaties and foreign direct investment using U.S. outbound FDI to 78 countries over the period of 2007–2018. Our results suggest the importance of controlling for country-specific tax environments in the estimation. Once these, along with other unobserved country-specific characteristics, are controlled, we find a positive impact of tax treaties among the non-OECD sample but no statistically significant impact of tax treaties among the OECD sample. Our results indicate that recently signed tax treaties increase FDI but with a smaller impact than the older treaties.

As discussed above, the mixed empirical evidence pertaining to the effect of tax treaties on FDI has contributed to controversy over the validity of such treaties. For instance, Kysar (2020) suggests that the United States should cancel or scale down its tax treaties, given the lack of evidence of their overall positive effect. Brooks and Krever (2015) claim that tax treaties could be a ‘poisoned chalice’ for developing countries, encouraging such countries to give up their tax rights without receiving sufficient benefits, such as increased FDI. Thuronyi (1999) even propose the establishment of a World Tax Organization to create a fairer global tax system. Taking into consideration the accelerated pace of globalization and digitalization, reform of the existing architecture of bilateral tax treaties may inevitably be needed. However, prior to any institutional reform, more extensive research on bilateral tax treaties is needed.

Based on the empirical results in this paper, we suggest the following agenda for future research. First, although this paper confirms the benign effect of tax treaties on FDI flows, it does not guarantee that the benefits are sufficiently large to outweigh the costs incurred from forfeiting taxation rights. Hence, a more detailed cost-benefit analysis is imperative. Second, estimations using either a wider set of data or more micro-level data would definitely be helpful. Third, taking into consideration that many countries are parties to multiple tax treaties, further analysis of the tax treaty network across countries is needed. Finally, it is desirable explicitly to consider differential attributes of tax treaties in the estimation as opposed to using a simple binary treatment. This is particularly the case because we observe that there is not much year-to-year variation in tax treaty status as a binary treatment. While there exists a growing number of studies dealing with treaty attributes, most of them focus only on dividend withholding tax rates. A more comprehensive analysis of treaty attributes and their linkage to FDI would provide a better understanding of the tax treaty-FDI linkage.

The source country refers to the country that hosts the inward investment, while the residence country is the investor’s country of residence.

Given the heightened suspicion of the unfavorable revenue impacts of tax treaties, a number of countries have recently canceled or restructured their existing tax treaties, especially those with tax-haven countries. For instance, Mongolia canceled its tax treaties with Luxembourg, the Netherlands and the UAE in 2012. In 2014, Uganda also suspended new treaty negotiations. Cyprus, Malta and Luxembourg recently agreed to amend the terms of their tax treaties with Russia. The key change is an increase in the withholding tax rates for dividends and interest.

Please see Feld and Heckemeyer (2011) for an excellent meta-study of the relationship between taxation and FDI.

An increase in cross-border FDI flows is also expected when prevention of excessive taxation and tax discrimination are stipulated in tax treaties.

Horizontal FDI represents the overseas production of products and services similar to those a firm produces in its home market. It occurs when a firm directly serves a foreign market to avoid distance-related costs associated with exports.

Kysar (2020) and Brooks and Krever (2015) claim that TIEA could be a good substitute for tax treaties that avoid changing the taxing jurisdiction. On the other hand, Sheppard (2009) casts doubt on the effectiveness of the current TIEA architecture.

Missing data of FDI stocks for recipient countries account for less than 3% of the total observations in our sample, and these are left out mostly to protect the confidentiality of individual companies.

Specifically, the bilateral tariff cost is measured by  The ESCAP-WB trade cost database contains another bilateral trade cost index proposed

by Anderson and van Wincoop (2003). This index captures not only tariff-related costs but also other indirect and direct

costs associated with bilateral trade. We do not adopt this index in our study for

the following reasons. First, the magnitude of the trade costs for this measure is

sensitive to underlying assumptions on the elasticity of substitution (Novy, 2013). More importantly, by construction, this index is highly correlated with other explanatory

variables in Equation (1), including GDP, physical distance and FTA, which may change

the statistical property of our estimations. For this reason, we use the bilateral

tariff cost as a proxy for the exogenous trade cost.

The ESCAP-WB trade cost database contains another bilateral trade cost index proposed

by Anderson and van Wincoop (2003). This index captures not only tariff-related costs but also other indirect and direct

costs associated with bilateral trade. We do not adopt this index in our study for

the following reasons. First, the magnitude of the trade costs for this measure is

sensitive to underlying assumptions on the elasticity of substitution (Novy, 2013). More importantly, by construction, this index is highly correlated with other explanatory

variables in Equation (1), including GDP, physical distance and FTA, which may change

the statistical property of our estimations. For this reason, we use the bilateral

tariff cost as a proxy for the exogenous trade cost.

BEPS refers to the tax strategies used by multinationals to shift profits from higher-tax countries to lower-tax countries.

They are American Samoa, Anguilla, Dominica, Fiji, Guam, Palau, Panama, Samoa, the Seychelles, Trinidad and Tobago, the US Virgin Islands and Vanuatu.

According to Garcia-Bernardo et al. (2017), these five advanced countries channel about 47% of offshore investments from tax havens.

The tax treaty database (https://eoi-tax.com) contains information on only the most recent revisions of tax treaties. The original tax treaties for many countries, especially OECD countries, date from the 1930s to the 1970s. We revise the data on the dates that tax treaties went into effect based on Blonigen and Davies (2004).

All OECD countries except Chile, Columbia, Costa Rica and Croatia have tax treaties in effect with the United States. In addition, these countries entered into tax treaties before the mid-2000s, when our analysis begins. Consequently, in the fixed effects model, the effects of tax treaties on these countries are included in the fixed effects; thus, separate coefficients cannot be estimated.

When we run the regressions for the OECD and non-OECD subsamples separately, we find that the standard Hausman test cannot be used, as its asymptotic assumptions are not met. An alternative is to adopt the correlated random effects approach proposed by Mundlak (1978). We report the F-test statistics based on this approach in Table 7 and confirm that the fixed effects estimator is more appropriate.

, & (2003). Gravity with gravitas: A solution to the border puzzle. the American Economic Review, 93(1), 170-192, https://doi.org/10.1257/000282803321455214.

, & (1991). Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations. Review of Economic Studies, 58(2), 277-297, https://doi.org/10.2307/2297968.

(2014). An analysis of double taxation treaties and their effect on foreign direct investment. International Journal of the Economics of Business, 21(3), 341-377, https://doi.org/10.1080/13571516.2014.968454.

, et al. (2010). The impact of double taxation treaties on foreign direct investment: evidence from large dyadic panel data. Contemporary Economic Policy, 28(3), 366-377, https://doi.org/10.1111/j.1465-7287.2009.00185.x.

, & (2004). The effects of bilateral tax treaties on U.S. FDI activity. International Tax and Public Finance, 11(5), 601-622, https://doi.org/10.1023/B:ITAX.0000036693.32618.00.

, , & (2001). Estimating the knowledge-capital model of the multinational enterprise. American Economic Review, 91, 693-708, https://doi.org/10.1257/aer.91.3.693.

(2003). Tax treaties, renegotiations, and foreign direct investment. Economic Analysis and Policy, 33, 251-273, https://doi.org/10.1016/S0313-5926(03)50020-0.

, , , & (2006). The impact of endogenous tax treaties on foreign direct investment: Theory and evidence. Canadian Journal of Economics, 39(3), 901-931, https://doi.org/10.1111/j.1540-5982.2006.00375.x.

, & (2011). FDI and taxation: a meta-study. Journal of Economic Surveys, 25(2), 233-272, https://doi.org/10.1111/j.1467-6419.2010.00674.x.

, et al. (2017). Uncovering offshore financial centers: conduits and sinks in the global corporate ownership network. Scientific Reports, 7(6246), 1-10, https://doi.org/10.1038/s41598-016-0028-x.

(2018). Tax treaties and foreign direct investment: A network approach. International Tax and Public Finance, 25(5), 1277-1320, https://doi.org/10.1007/s10797-018-9489-0.

, & (2018). Reassessing the effects of bilateral tax treaties on US FDI activity. Journal of Economics and Finance, 42(3), 451-470, https://doi.org/10.1007/s12197-017-9400-3.

(1978). On the pooling of time series and cross section data. Econometrica, 46, 69-85, https://doi.org/10.2307/1913646.

(2007). Do double taxation treaties increase foreign direct investment to developing countries? Journal of Development Studies, 43(8), 1501-1519, https://doi.org/10.1080/00220380701611535.

(2013). Gravity redux: measuring international trade costs with panel data. Economic Inquiry, 51(1), 101-121, https://doi.org/10.1111/j.1465-7295.2011.00439.x.

, et al. (2020). On the relevance of double tax treaties. International Tax and Public Finance, 27(3), 575-605, https://doi.org/10.1007/s10797-019-09570-9.

, & (2007). Longitude matters: time zones and the location of foreign direct investment. Journal of International Economics, 71, 96-112, https://doi.org/10.1016/j.jinteco.2006.01.003.

, & (2018). Optimal tax routing: network analysis of FDI diversion. International Tax and Public Finance, 25(5), 1321-1371, https://doi.org/10.1007/s10797-018-9491-6.