Measuring the Degree of Integration into the Global Production Network by the Decomposition of Gross Output and Imports: Korea 1970-2018†

Abstract

The import content of exports (ICE) is defined as the amount of foreign input embodied in one unit of export, and it has been used as a measure of the degree of integration into the global production network. In this paper, we suggest an alternative measure based on the decomposition of gross output and imports into the contributions of final demand terms. This measure considers the manner in which a country manages its domestic production base (gross output) and utilizes the foreign sector (imports) simultaneously and can thus be regarded as a more comprehensive measure than ICE. Korea’s input-output tables in 1970- 2018 are used in this paper. These tables were rearranged according to the same 26-industry classification so that these measures can be computed with time-series continuity and so that the results can be interpreted clearly. The results obtained in this paper are based on extended time-series data and are expected to be reliable and robust. The suggested indicators were applied to these tables, and, based on the results we conclude that the overall importance of the global economy in Korea’s economic strategy has risen and that the degree of Korea’s integration into the global production network increased over the entire period. This paper also shows that ICE incorrectly measures the movement of the degree of integration into the global production network in some periods.

Keywords

Integration into Global Economy, Input-output Analysis, Decomposition of Gross Output and Imports, Import Content of Exports, Korea

JEL Code

D57, F13, F14

I. Introduction

It is a widely known and extensively documented fact that export-driven economic growth has been an essential component of Korea’s growth strategy since the 1960s (Krugman et al., 2018, pp.321-323). In Korea’s Five-Year Economic Development Plans, which served as the backbone of Korea’s economic policy in the 1960s and 1970s, export promotion was one of the ‘core’ policies facilitating rapid economic growth (Han, 2014).

Exports, along with consumption and investment, form a component of an economy’s final demand. According to demand-side economics such as demanddriven input-output analysis, the supply side is assumed to be infinitely elastic. An increase in the final demand, therefore, receives an immediate reply from the supply side, which is followed by infinitely repeated rounds of inter-industry relationships represented by intermediate inputs and demands. This process results in the increases in gross output, imports of foreign intermediate inputs, value-added and employment, which can be computed by various methodologies, for example, a demand-driven input-output analysis using the Leontief inverse matrix.

In an early economic development period with low income levels when an economy does not have sufficient final demand, exports can be a good source for increasing final demand. If a developing country succeeds in finding products with a sufficient comparative advantage in the global market, therefore, it can embark on a path of an export-led growth. The four ‘Asian Tigers’ – Korea, Taiwan, Singapore and Hong Kong – are the most well-known examples of export-led growth in the twentieth century. Figure 1 presents the exports of Korea as a percent of GDP, from which we can confirm that Korea’s exports as a percent of GDP entered a consistent growth trend in 1970s.

FIGURE 1.

EXPORTS OF KOREA AND THE WORLD (% OF GDP, 1953-2019)

Source: Bank of Korea, Maddison (2001, p.363),1 World Bank.

In fact, the world economy has witnessed a consistent increase in international trade since the mid-twentieth century. According to Maddison (2001), world exports as a percent of GDP amounted to 9.0% in 1929 but declined to 5.5% in 1950 after two world wars, at which point it began recovering, eventually exceeding 10% in the early 1970s.

Many factors have been suggested as causes of this trend, such as improved transportation and information technology, containerization, declines in transportation costs, declines in protectionism, decreases in piracy, the development of a global production network (GPN), and international fragmentation, to name a few (Weil, 2013). Most of these factors are related to one another, and it can be said that they took place simultaneously and affected one another during the second half of the 20th century.

Out of these factors, the deepening of the GPN has become so strong over the past decades that taking advantage of and realizing integration into the GPN have become essential components in the growth strategies of many countries. The purpose of this paper is to measure the degree of integration into the GPN of Korea in 1970-2018 by means of a demand-side input-output (IO) analysis.

Specifically, we will decompose gross output and imports into the contributions of individual final demand terms, that is, consumption, investment and exports. Considering that gross output and imports constitute the total supply of an economy, following the tracks of the shares of gross output and imports induced by exports will help us better understand how Korea managed its domestic production base (DPB) and utilized the foreign sector as a part of its growth strategy. This approach will also enable the measurement of the degree of integration into the GPN over the past half century.

II. Motivation and Literature

The degree of integration into the GPN can be measured in various ways. The ratio of exports to GDP represents the degree of dependence on the foreign sector. While used in various contexts, this ratio can be regarded as a simple measure of integration into the GPN. Similarly, the ratio of total imports of products to GDP, if seldom used, can also be regarded as an alternative measure. These two ratios can be thought of as measures of dependence on the foreign sector on the demand and supply sides, respectively.

The ratio of the total trade volume, i.e., the sum of exports and imports, to GDP is frequently used as an indicator of the integration into the GPN, or the ‘openness of an economy.’ It has been used frequently as a determinant of the growth rate of the income level or total factor productivity.

In fact, the traditional way to analyze an economy’s dependence on, and utilization of, the global market was to use various indices using trade statistics. Trade statistics are type of first-hand statistics collected and published by the tariff authorities of most countries and by international organizations. Trade statistics by direction (export of import), by various product classifications (e.g., Standard International Trade Classification, Harmonized Commodity Description and Coding System), by partner countries or regions, are the major statistics long used by various institutions.

The wide availability of trade statistics has led to the development of numerous indices based on these data. A few examples are market shares in partner countries, in various regions, and in the world market; the compositions of exports and imports by product and by partner countries; export similarity indexes that measure the degree of competition between two countries in a specific market; a revealed comparative advantage index that measures the strength of a comparative advantage of a country, as developed by Balassa, to name a few. Woo et al. (2003) evaluated Korea’s trade performance based on various trade statistics for the period of 1992-2000.

The consistent increase in international trade in goods and services has led to the development and utilization of new indicators, many of which are derived from the IO analysis. Since Wassily Leontief published the first IO tables of US in the 1940s, many countries have compiled their own IO tables and used them in various situations, mostly in forecasting the impact of final demand shocks on supply-side variables such as gross output, intermediate input, value-added, employment, and so forth. Hence, the IO analysis has been applied to export data, a component of final demand, to compute the trade performance and the degree of integration into the global economy.

Export-led growth requires additional resources. An increase in exports requires an increase in production, which, in turn, implies an increase in the service of the primary production factors, labor and capital, and in intermediate input, both domestic and imported.

An increase in the demand for labor can be met by an increase in the labor supply mostly by domestic households. Increased demand for capital, on the other hand, can be satisfied by more domestic savings. However, this is usually difficult for developing countries and is supplemented by foreign capital inflows, which can be measured by the net savings rate, or, alternatively, by net exports as a percent of GDP. See Figure 2, where the net exports graph was computed as the ratio of net exports to GDP while the net savings graph was computed as the total savings rate less the total domestic investment rate. These two ratios are connected by the national income identity S - I = EX - M , where S , I , EX and M denote savings, investments, exports and imports, respectively.

Thirdly, an increase in the demand for imported intermediate input is met by importing these products. Lastly, an increase in the demand for domestic intermediate input must be met by producing them domestically, in other words, by an increase in gross output, which initiates the second and the subsequent rounds of the production process involving almost all industries in the economy. This production process results in increases in gross output, value-added, imports and employment, all of which can be computed for individual industries and for the entire economy by means of an IO analysis. Miller et al. (2009) is the most widely used reference.

The consistently increasing trend of international trade in the 1990s and 2000s attracted the attention of a number of countries, in particular those with major shares in the world market, such as Germany, Japan, Hong Kong, Singapore, and Korea, among others. Kim (2004) observed that while Korea’s exports recorded unprecedented high growth rates, domestic demand such as consumption and investment levels were showing extremely low or even negative growth rates. Increases in exports usually have a positive chain effect on value-added and then on domestic demand with some time lag. Here, the huge gap between foreign and domestic demand levels implied a structural change.

Kim (2004) showed that the share of imported intermediate input in total intermediate input continued to decrease until the 1980s but later entered a rapidly increasing trend in early 1990s. He also showed, using an IO analysis, that the share of GDP generated by exports began to decrease in the early 1990s. He conjectured that this phenomenon may have been caused by (i) Korea’s large-scale market opening in the 1990s, (ii) the deteriorating competitiveness of Korea’s parts and components industries, (iii) the concentration of Korea’s exports on a few products that heavily depend on imported intermediate inputs, and/or (iv) by the increasing trend of ‘global sourcing.’

Loschky and Ritter (2006) were motivated by a similar observation. They observed that Germany achieved record-breaking exports of products in the mid-2000s, but, at the same time, the share of imported intermediate input in German products was also quickly increasing. They computed the share of imported input in German exports, which they called the ‘import content of exports (ICE),’ and showed that ICE increased from 31% in 1995 to 42% in 2005.2

Breda et al. (2009) interpreted ICE as a measure of ‘internationalization’ and computed the ICE of individual products and the aggregate ICE of seven European countries in 1995 and 2000. They showed that the ICE of most products in most countries increased during the period while also analyzing the various internationalization patterns of the seven countries.

As seen earlier, increases in exports lead to increases in various terms on the supply side. Out of the increases in these variables, the increases in value-added and imports add up to the increase in exports given that value-added and import equal the total final demand in a national economy. One unit of export, therefore, can be decomposed into the shares of domestic and imported intermediate inputs, or, equivalently, the shares of domestic and imported value-added. The former set represents the measures used by Kim (2004), while the latter, ICE, is used by Loschky and Ritter (2006) and Breda et al. (2009). Years earlier, Hummels et al. (2001) referred to the trend of the increasing integration of a GPN as ‘vertical specialization’ and used ICE as the measure of vertical specialization.

Since the 2010s, ICE has been frequently used in studies of the global value chain. Also, the OECD has published the ICE statistics of its member countries along with some non-member countries since the 2010s in addition to the OECD Input-Output Database.3 We will propose an additional measure of integration into the global economy in the next section.

III. Methodology and Data

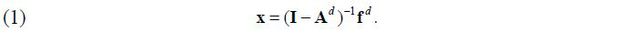

Let x be the n ×1 gross output vector and Ad be the n×n domestic input coefficient matrix where n is the number of products/industries. We can then express the domestic intermediate demand 4 vector as ud = Adx . The market clearing conditions for n domestic products can be expressed as x = Adx + fd , where fd is the n ×1 final demand vector. Solving this for x leads to

Equation (1) explains how gross outputs are determined by the final demand for domestic products. Here, (I − Ad )-1 is called the Leontief inverse matrix.

Equation (1) can be obtained in an alternative way. To meet the domestic final demand fd , firms produce goods and services by the same amount as fd ; that is, the initial gross output equals fd . This requires domestic inputs, imported input and value-added, of which the domestic inputs amount to Ad fd . Domestic inputs need to be produced by domestic firms, meaning that the same amounts become the gross output in the second round. This process is repeated infinitely, and the final gross output equals the sum of gross outputs in all rounds; hence x = fd + Ad fd + (Ad )2 fd + (Ad )3 fd +⋯= (I − Ad )-1fd .

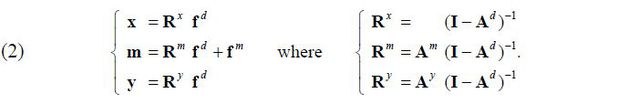

We can also show that um = Amx , where um is the n ×1 imported intermediate demand vector and Am is the n×n imported input coefficient matrix. Applying (1), we obtain um = Am (I − Ad )-1fd . The total demand for imported products consists of the intermediate and final demands for imported products; thus, the market clearing condition for imported products becomes m = um + fm = Am (I − Ad )-1fd + fm , where m is the n ×1 import vector and fm is the n ×1 imported final demand vector.

Thirdly, we can show that y = Ayx , where y is the n ×1 value-added vector and Ay is the n×n diagonal value-added ratio matrix.5 By applying (1), we obtain y = Ay (I − Ad )-1fd . In summary,

Equation (2) explains how the gross outputs, imports and value-added of individual products/ industries are determined by domestic and imported final demands.

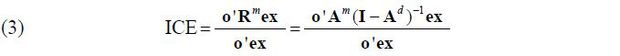

Exports form a part of domestic final demand fd , therefore, the second equation in (2) indicates that the amount of imports generated by exports is Rmex , where ex is the n ×1 vector of exports. ICE is defined as the total imports generated by total exports divided by total exports;

where o is the sum vector, i.e., the n ×1 vector of 1s. ICE is the amount of imported input embodied in the total exports and is the indicator of the integration into the GPN or of the vertical specialization used in Hummels et al. (2001), Loschky and Ritter (2006), Breda et al. (2009) and in the OECD database.

ICE can be computed also for individual products. Note from (2) that the (i, j) th elements of Rx , Rm and Ry denote the increases in the gross output, import and value-added of the i th product/industry when the final demand for the j th product only increases by one unit, respectively. In that case, fd is an n ×1 vector of 0s except for the j th element being equal to 1, and (3) becomes the sum of the elements in the j th column of Rm = Am (I − Ad )-1 . In consequence, o'Rm = o'Am (I − Ad )-1 is the 1× n vector of the ICEs of individual products.

It should be noted that o'Rm = o'Am (I − Ad )-1 is the vector of the import content of individual products not only for exports but also for consumption and investment, as the elements of o'Rm are computed under the assumption that the demand for only one product changes and because, in such a case, there is no difference among the impacts of the individual final demand terms. They do make a difference when the final demand levels for two or more products change at the same time because different products have different import contents and different final demand terms have different compositions of products. In other words, the ‘composition effect’ causes a difference in the import contents among consumption, investment and export.6

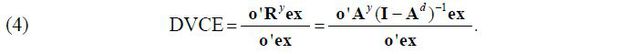

Following a similar line of reasoning, it can be seen from the third equation in (2) that the amounts of value-added generated by exports are Ryex , and the index used in Kim (2004) is the total value-added generated by total exports divided by total exports, which we will call the ‘domestic value-added content of export (DVCE).’

ICE is the amount of imported input embodied in aggregate exports, but it can also be interpreted as the amount of foreign value-added embodied in aggregate exports, as the imported input is the export for the exporting country, and export is a part of final demand. Hence, DVCE and ICE represent the amounts of domestic and foreign value-added embodied in one unit of export, respectively. Furthermore, it can easily be proved that DVCE + ICE = 1.7 We can say, in conclusion, that DVCE and ICE contain the same amount of information.

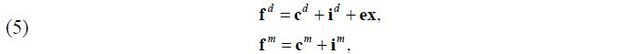

The domestic final demand consists of the consumption, investment and export of domestic products, and the imported final demand consists of the consumption and investment of imported products;

where cd and id are the n ×1 vectors of the consumption and investment of domestic products and cm and im denote the n ×1 vectors of the consumption and investment of imported products, respectively.

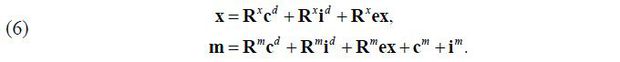

Using (2) and (5) together, we can decompose the aggregate gross output and imports into the contributions of individual final demand terms. We will use these decompositions when analyzing the pattern in which a country manages DPB (gross output) and utilizes the foreign sector (imports). By substituting (5) into the first two equations in (2), we obtain the decompositions of the gross outputs and imports into the contributions of the final demand terms;

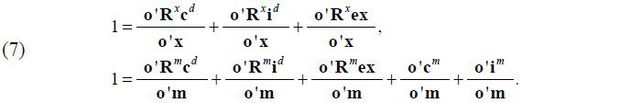

Finally, we pre-multiply the transpose of the sum vector to (6) and divide both sides by the left-hand sides, obtaining the decompositions of the aggregate gross output and imports into the contributions of the individual final demand terms in shares;

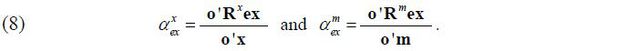

We then define the third terms on the right-hand sides in (7) as  and

and  ;

;

Note that  is the share of the contribution of exports in gross output, or, equivalently, the

share of gross output generated by exports out of the total gross output. It can be

interpreted as the degree to which an economy utilizes its DPB for international trade.

Similarly,

is the share of the contribution of exports in gross output, or, equivalently, the

share of gross output generated by exports out of the total gross output. It can be

interpreted as the degree to which an economy utilizes its DPB for international trade.

Similarly,  is the share of imports generated by exports out of total imports, and it can be

interpreted as the degree to which an economy utilizes the GPN for international trade.

is the share of imports generated by exports out of total imports, and it can be

interpreted as the degree to which an economy utilizes the GPN for international trade.

This paper claims that the two shares ( ,

,  ) provide a more comprehensive and accurate degree of integration into the GPN than

ICE. Suppose

) provide a more comprehensive and accurate degree of integration into the GPN than

ICE. Suppose  increases by 10%p from 20% to 30%. This implies an increase in the share of imports

generated by export, and it can be said that the country’s integration into the GPN

has been strengthened. This is not valid, however, if

increases by 10%p from 20% to 30%. This implies an increase in the share of imports

generated by export, and it can be said that the country’s integration into the GPN

has been strengthened. This is not valid, however, if  increases by 20%p from 20% to 40% at the same time because the country operated the

DPB more than it utilized the GPN in order to meet the increase in exports. In conclusion,

therefore, we can say that the country’s integration into the GPN was weakened.

increases by 20%p from 20% to 40% at the same time because the country operated the

DPB more than it utilized the GPN in order to meet the increase in exports. In conclusion,

therefore, we can say that the country’s integration into the GPN was weakened.

On the other hand, the value of ICE increases in this example, and we would conclude

that the integration into the GPN is strengthened if ICE is the only measure used.

This reversal transpires because ICE only considers the utilization of the GPN while

the two shares ( ,

,  ) consider the utilization of both the DPB and GPN. This can also be confirmed from

the observation that

) consider the utilization of both the DPB and GPN. This can also be confirmed from

the observation that  equals ICE when o 'm = o 'ex , i.e., when a country is in an equilibrium current account.

equals ICE when o 'm = o 'ex , i.e., when a country is in an equilibrium current account.

The two shares ( ,

,  ) have one more advantage over ICE. As mentioned earlier, ICEs at the product level

are meaningless given that the import contents at the product level do not depend

on the type of the final demand, i.e., whether the type of the final demand is exports,

consumption, or investments. In other words, the terminology itself, ‘import content

of exports,’ is misleading.

) have one more advantage over ICE. As mentioned earlier, ICEs at the product level

are meaningless given that the import contents at the product level do not depend

on the type of the final demand, i.e., whether the type of the final demand is exports,

consumption, or investments. In other words, the terminology itself, ‘import content

of exports,’ is misleading.

On the other hand, the two shares ( ,

,  ) are well defined at the product level. In fact, these two shares are well defined

at the aggregate level and at the product level, for countries and for years, and

are perfectly comparable. For example, comparisons of the degrees of integration into

the GPN among countries, among products and among years are all clearly defined using

these two shares.

) are well defined at the product level. In fact, these two shares are well defined

at the aggregate level and at the product level, for countries and for years, and

are perfectly comparable. For example, comparisons of the degrees of integration into

the GPN among countries, among products and among years are all clearly defined using

these two shares.

This is possible because the two shares  and

and  are defined on an identical scale [0, 1]. Specifically, these two shares measure

the degrees to which a country utilizes the DPB and the GPN on an identical scale

and are comparable to each other. Numerous indicators have been developed to measure

the extent to which a country is open to the foreign sector and utilizes the DPB and

the GPN, but we cannot directly compare the degrees with which a country utilizes

the DPB and the GPN using any of these indices.

are defined on an identical scale [0, 1]. Specifically, these two shares measure

the degrees to which a country utilizes the DPB and the GPN on an identical scale

and are comparable to each other. Numerous indicators have been developed to measure

the extent to which a country is open to the foreign sector and utilizes the DPB and

the GPN, but we cannot directly compare the degrees with which a country utilizes

the DPB and the GPN using any of these indices.

The purpose of this paper is to examine the degree of integration of Korea into the

GPN during the period of 1970-2018 using the two shares ( ,

,  ) based on Korea’s input-output tables. Korea’s input-output tables have been produced

34 times since 1960, but the tables since 1970 are used in this paper due to reliability

and time-series continuity.

) based on Korea’s input-output tables. Korea’s input-output tables have been produced

34 times since 1960, but the tables since 1970 are used in this paper due to reliability

and time-series continuity.

In Korea, product/industry classifications of input-output tables have been revised in the years which end with 0 or 5 and in 2003. All tables used in this paper were rearranged into tables with a common 26-industry classification. See the Appendix for the 26-industry classification table. Tables of the years for which this rearrangement is not possible were not used in this paper. Finally, the tables of 21 years were included in the analysis of this paper, while the results for only the years ending with 0 or 5 and 2018 are reported. The 2018 table is Korea’s most recent one.

IV. Results8

Three simple measures of openness are given in Figure 3. Exports and total trade as a percent of GDP recorded a remarkable increase in the past half century. Exports accounted for only 13.8% of GDP in 1970, but they peaked at 50.8% in 2010 and then slightly declined afterwards. Total trade shows a similar pattern; it was 39.1% of GDP in 1970 but increased rapidly and approached 100.0% in 2010, after which it declined in the 2010s. We observe that both exports and imports of Korea show an M-shaped trend over the past five decades, with the first peak at around 1980 and the second at around 2010.

There was a dramatic change in the composition of Korea’s exports and imports, as shown correspondingly in Figures 4 and 5. Korea’s exports began with agricultural and light manufactured products such as foods and beverages, textiles and leather products, and wood and paper products, for instance. The shares of these products were consistently replaced by the products of heavy industries, such as petroleum and chemical products, metal products, machinery, electrical and electronic equipment and components, and transportation equipment. The former accounted for 76.4% in 1970 but was reduced to 10.0% in 2018, while the latter constituted only 12.7% in 1970 but soared to 79.9% in 2018. This trend was almost linear until the mid-2000s, and it stabilized afterwards. The overall share of other products, mostly services and a few manufactured products, remained at about 10% during the period.

Korea’s imports also recorded a major change in composition, if less dramatic than that of exports. The overall share of four products, agricultural products, chemical products, machinery, and non-automobile transportation equipment, was 53.5% in 1970, but it decreased to 19.5% in 2018. On the other hand, the overall share of another four products, mining products, petroleum products, electrical and electronic equipment and components, and financial and business services, was 14.5% in 1970 but rose to 44.4% in 2018. When attempting to understand the composition of Korea’s imports, it is necessary to note that Korea is a small open economy and is therefore vulnerable to international environmental shocks. In addition, Korea has depended on imported energy almost entirely since the 1970s when its coal endowment began to approach depletion. For example, the share of mining products, consisting mostly of crude oil and materials for power generation, was 7.1% in 1970 but rose to 21.3% in 2018.

It is necessary to compute the import content of individual products before we compute ICE. Figure 6 gives the import contents of individual products of Korea in 1970 and 2018 as a scatter diagram, from which we can find the following characteristics of Korea’s experience. First, there are large variations in the import contents among various products. In 2018, the import content of coal and petroleum products (6th product) was highest at 0.6577, while that of public administration (24th) was lowest at 0.0759. Manufactured products (3rd~16th), as denoted by the black circles, tend to have higher import contents than other products mainly due to the higher share of imported input in the total production cost. Two exceptions are the electricity, gas and water supply (17th) and transportation services (21st) due to the high share of imported or refined energy.

Second, there have been considerable changes in the import contents of many products over the past half century.9 The import content of electricity, gas and water supply (17th) increased by 0.4562 from 0.0841 to 0.5403 and that of coal and petroleum products (6th) increased by 0.2843 from 0.3733 to 0.6577.10 In addition, that of wood and paper products (5th) decreased by 0.2096 from 0.5203 to 0.3107.

The import and domestic value-added contents of the aggregate final demand terms can be computed using those of the individual products and the composition vector of the final demand terms by product, as depicted in Figure 7 and Figure 8, respectively. Again, these two measures add up to 1 and carry the same amount of information.11

The curve labeled ‘Export (ICE)’ in Figure 7 is the ICE suggested by Hummels et al. (2001), Loschky and Ritter (2006), Breda et al. (2009), among others, while that labeled ‘Export (DVCE)’ in Figure 8 is the index used in Kim (2004). Hummels et al. (2001) computed the ICEs of several developed countries, showing that, with some exceptions, the ICEs are in the range of 0.2~0.3 and that they increased in the 1980s in many developed countries. They also computed the ICEs of Korea for certain years in the period of 1963-1995, for which their values in the 1990s are similar to those reported here. Also, their estimates for Germany are similar to the corresponding results in Loschky and Ritter (2006).

Korea’s ICE was as low as 0.2460 in 1970 and recorded two periods of ‘ups and downs.’ The highest level was in 2010, at 0.4194. Rigorous identification of the determinants of ICE goes beyond the scope of this paper, but it is conjectured that (i) the gradual integration into the GPN affected the long-term increasing trend of ICE, (ii) the two oil shocks in 1973 and 1979 played an important role in the first rise of ICE in the 1970s, and (iii) the market opening in the 1990s was an important factor in the second rise of ICE in the 1990s and 2000s. Additionally, regression analyses show that foreign exchange rates have considerable explanatory power on the movement of ICE. Further research on the topic is desired.

Note from Figure 7 that the import content of exports is considerably higher than those of domestic consumption and investment. Equivalently, the domestic value-added content (DVC) of exports, which we refer to as ‘DVCE,’ is considerably lower. Again, this is due to the composition effect. The DVCs of individual products in 2018 and their rankings are given in Table 1 along with the compositions of the final demand terms by product. Also, the top five products in terms of shares are shaded. Note from Table 1 that the top five products in the composition of domestic consumption, the share of which overall amounts to 73.5%, are the products with high DVCs. On the other hand, Korea’s exports are concentrated on those products with very low DVCs, while domestic investment is positioned in the middle. This explains the gaps between the import and domestic value-added contents of consumption and exports in Figures 7 and 8.

One striking fact that can be drawn from Figure 7 and Figure 8 is that the gap has consistently widened. That is, the DVC of exports compared to the DVC of domestic demand13 has been deteriorating consistently. This could be reflecting the increasing degree of Korea’s integration into the global economy, but it is widely believed that it has been caused by the deteriorating competitiveness of Korea’s parts and components industries. This could be another reason why ICE cannot be solely regarded as the measure of global vertical specialization.

This can be indirectly confirmed by a small counterfactual experiment. Using the composition of imports by product applied to the DVCs of individual products given in Table 1, we can compute the DVC of imports, which is given in Figure 9 along with the DVC of exports. The DVC of imports can be interpreted as the amount of the hypothetical GDP if the imported products were procured domestically.

Figure 9 implies that the compositions of exports and imports were similar in 1970 in terms of the impact on the GDP, but the DVC of exports became lower than that of imports and the gap widened afterwards; in other words, exports are more concentrated on products with a lower impact on the GDP than imports, as DVC is the increase in the GDP when the final demand increases by one unit. This result does not imply that Korea’s overall international competitiveness has deteriorated but means simply that the composition of Korea’s exports has changed such that the average impact of exports on value-added decreased.

Before we compute the measure suggested in this paper, ( ,

,  ), it is worthwhile to review the allocation structures of domestically produced

products (gross output) and imported products (total imports) separately. In other

words, we will review the compositions of the total demand for domestic and imported

products, as given in Figures 10 and 11, respectively.

), it is worthwhile to review the allocation structures of domestically produced

products (gross output) and imported products (total imports) separately. In other

words, we will review the compositions of the total demand for domestic and imported

products, as given in Figures 10 and 11, respectively.

From Figures 10 and 11, we find that gross output and imports have entirely different allocation structures, even setting aside the considerable difference in the magnitudes.15 The greatest difference lies in the shares of intermediate demand. In the domestic product markets, the share of intermediate demand has been stable at around 45% since 1980. On the other hand, it has been almost 80% on average in the imported product markets with some fluctuations. In other words, procuring intermediate inputs has been the major purpose of imports.16 Furthermore, the share of intermediate and investment demand, that is, non-consumption demand, exceeded 90% during the period of Korea’s rapid economic growth. The Korean government’s policy to restrain the consumption of imported products by high tariff rates on consumer goods in the 1970s and 1980s may have been a cause of the low share of imported consumption demand in the early decades. It was in the late 1990s when the share first exceeded 10%.

The second difference is on the shares of investment demands. The share of capital goods out of total imports was as high as nearly 20% in the 1970s but has decreased to less than 10% in recent years. On the other hand, the share of capital goods in the domestic product markets has long remained highly stable at around 12%. Lastly, we observe that exports as percent of the total domestic demand have increased steadily from 7.5% in 1970 to almost 20% in recent years, but this cannot be considered as a difference between the domestic and imported product markets.

The decompositions of the gross output and imports into the contributions of the final

demand terms as computed by equation (7) are depicted in Figures 12 and 13, respectively, where the two shares ( ,

,  ) can be found at the bottom of the corresponding charts.

) can be found at the bottom of the corresponding charts.

Gross output can be interpreted as the magnitude of the operation of DPB to serve

the three categories of the final demand: consumption, investments and exports. According

to Figure 12, the share of the operation of DPB to serve the foreign demand, i.e., exports, ( ), increased steadily, from 12.6% in 1970 to 33.4% in 2010, while it has decreased

slowly since 2010.

), increased steadily, from 12.6% in 1970 to 33.4% in 2010, while it has decreased

slowly since 2010.

A similar trend is observed in Figure 13. Imports can be interpreted as the magnitude of the utilization of the GPN to serve

the same three categories of final demand. According to Figure 13, the share of total imports to serve the export demand ( ) increased steadily, from 13.4% in 1970 to 43.3% in 2010, but has decreased slowly

since 2010. In summary, the Korean economy operated the DPB and utilized the GPN to

more serve export demand.

) increased steadily, from 13.4% in 1970 to 43.3% in 2010, but has decreased slowly

since 2010. In summary, the Korean economy operated the DPB and utilized the GPN to

more serve export demand.

Note from Figures 12 and 13 that  increased more rapidly than

increased more rapidly than  . Both shares were similar at approximately 13% in 1970 and 24~25% in 1975, but

. Both shares were similar at approximately 13% in 1970 and 24~25% in 1975, but  began to rise more rapidly after 1980. The gap reached 6.9% in 2005, remaining at

4.9% in recent years. This implies that in order to meet the increased foreign demand,

Korea utilized the GPN more than it operated the DPB, indicating that the degree to

which Korea became integrated into the GPN increased during the period.

began to rise more rapidly after 1980. The gap reached 6.9% in 2005, remaining at

4.9% in recent years. This implies that in order to meet the increased foreign demand,

Korea utilized the GPN more than it operated the DPB, indicating that the degree to

which Korea became integrated into the GPN increased during the period.

We can investigate the trend of the degree of integration into the GPN more easily

using a scatter diagram of ( ,

,  ). It can be said that (i) the importance of international trade increases if point

(

). It can be said that (i) the importance of international trade increases if point

( ,

,  ) moves farther from the origin, and (ii) the degree of integration into the GPN

increases if the line segment connecting point (

) moves farther from the origin, and (ii) the degree of integration into the GPN

increases if the line segment connecting point ( ,

,  ) and the origin rotates counterclockwise.

) and the origin rotates counterclockwise.

The chart on the left in Figure 14 is a scatter diagram of ( ,

,  ) during the period of 1970-2018. Note that point (

) during the period of 1970-2018. Note that point ( ,

,  ) moved farther from the origin and rotated counterclockwise even though it moved

closer to the origin or rotated clockwise in some periods. We conclude that the importance

of international trade and the degree of integration into the GPN both increased during

the period even if there were some fluctuations.

) moved farther from the origin and rotated counterclockwise even though it moved

closer to the origin or rotated clockwise in some periods. We conclude that the importance

of international trade and the degree of integration into the GPN both increased during

the period even if there were some fluctuations.

The chart on the right in Figure 14 is a plot of the fitted values of ( ,

,  ) from the regression of (

) from the regression of ( ,

,  ) using the quadratic function of time, from which the above-mentioned trends can

be more clearly observed.

) using the quadratic function of time, from which the above-mentioned trends can

be more clearly observed.

The values of the two shares ( ,

,  ) and ICE are given in Table 2, from which we can confirm the values of the two shares (

) and ICE are given in Table 2, from which we can confirm the values of the two shares ( ,

,  ) and ICE are given in Table 2, from which we can confirm the advantage of the measures suggested in this paper.

Note that during 1980-1985, for example, both

) and ICE are given in Table 2, from which we can confirm the advantage of the measures suggested in this paper.

Note that during 1980-1985, for example, both  and

and  increased, and the increment of

increased, and the increment of  (5.90%p) exceeded that of

(5.90%p) exceeded that of  (2.13%p), meaning that the difference

(2.13%p), meaning that the difference  −

−  increased by 3.76%p. In other words, the importance of the foreign sector for the

Korean economy expanded, and the degree of integration into the GPN increased. During

the same period, however, ICE decreased by 0.85%p, and we would incorrectly conclude

that the degree of integration of Korea into the GPN decreased if we depend only on

ICE. In Table 2, the shaded cells signify the periods in which the measures suggested in this paper

and ICE imply a reverse direction of the degree of integration into the GPN.

increased by 3.76%p. In other words, the importance of the foreign sector for the

Korean economy expanded, and the degree of integration into the GPN increased. During

the same period, however, ICE decreased by 0.85%p, and we would incorrectly conclude

that the degree of integration of Korea into the GPN decreased if we depend only on

ICE. In Table 2, the shaded cells signify the periods in which the measures suggested in this paper

and ICE imply a reverse direction of the degree of integration into the GPN.

As mentioned in the previous section, the two shares ( ,

,  ) are well defined at the product level. Figure 15 depicts the shares (

) are well defined at the product level. Figure 15 depicts the shares ( ,

,  ) of the two important products with regard to the development of the Korean economy,

textile and leather products (T&L), and electrical and electronic equipment and components

(E&E). The former was a key product in the Korean economy until the 1980s, while the

latter has taken on tremendous importance in recent decades.

) of the two important products with regard to the development of the Korean economy,

textile and leather products (T&L), and electrical and electronic equipment and components

(E&E). The former was a key product in the Korean economy until the 1980s, while the

latter has taken on tremendous importance in recent decades.

Note from the chart on the left in Figure 15 that (i) the share of the contribution of exports out of the total gross output ( ) of T&L peaked at 72% in the late 1980s and declined afterwards, (ii) the share

in the imports (

) of T&L peaked at 72% in the late 1980s and declined afterwards, (ii) the share

in the imports ( ) also peaked at 67% in mid 1980s and then rapidly decreased, (iii)

) also peaked at 67% in mid 1980s and then rapidly decreased, (iii)  was lower than

was lower than  during the entire period, and finally (iv) the gap widened steadily. In conclusion,

the importance of T&L exports increased until 1980s and then decreased afterwards;

looking at this another way, Korea has depended more on the DPB than on the GPN to

meet T&L export demand, and the degree of integration into the GPN weakened steadily

during the period.

during the entire period, and finally (iv) the gap widened steadily. In conclusion,

the importance of T&L exports increased until 1980s and then decreased afterwards;

looking at this another way, Korea has depended more on the DPB than on the GPN to

meet T&L export demand, and the degree of integration into the GPN weakened steadily

during the period.

Applying the same line of reasoning, we can deduce from the chart on the right in Figure 15 that the importance of E&E exports has increased consistently, that Korea has depended more on the DPB than on the GPN to meet E&E export demand, and that the degree of integration into the GPN has been stable during the period. Finally, note from Figure 15 that the gap between the two shares of T&L was smaller than that of E&E in 1970 but larger in 2018. This implies that the degree of integration into the GPN of the T&L industry was greater than that of the E&E industry, but the relative degrees of integration into the GPN reversed in the mid-1990s.

V. Conclusion

The import content of exports (ICE) was proposed as a measure of internationalization or integration into the GPN and has been used frequently in recent studies. While it is a useful indicator and carries much information, it is not a comprehensive measure and is an incorrect measure in certain situations given that ICE reflects only the information embodied in import data.

The purpose of this paper is to suggest an alternative indicator, which is the decompositions of gross output and imports into the contributions of the final demand terms. This can be regarded as a more comprehensive indicator in the sense that it considers the manner in which a country manages its domestic production base (gross output) and utilizes the foreign sector (import) simultaneously. In addition, it provides more comprehensive and richer information regarding the degree of integration into the GPN as it is well defined at the aggregate level, at the product level, for countries and for years, and is perfectly comparable.

The proposed indicator was applied to the input-output tables of Korea for the period of 1970-2018. Based on the results of this paper, we conclude that the overall importance of the global economy in Korea’s economic strategy has risen and that the degree of Korea’s integration into the global production network has increased consistently.

Notes

I would like to express my gratitude to team head Kyuchae Jung and senior economist Sangdon Bu at the Bank of Korea for their kind and generous help regarding Korea’s input-output tables. I am grateful to Hanna Jang for her outstanding assistance in rearranging Korea’s input-output tables according to a common industry classification. I am deeply grateful to the KDI School of Public Policy and Management for providing financial support for this research. I thank two anonymous reviewers for their useful suggestions.

World exports as a percent of GDP in 1950, 5.5%, is from Maddison (2001), and those during 1970-2019 are from the World Bank; the shares between 1950 and 1970 were computed by linear interpolation.

Simultaneous increases in international trade and the share of imported raw materials in the exports of most countries, and many related phenomena, have been given various names, such as global outsourcing, international fragmentation of production, offshoring, vertical specialization, integration of global production network, global market integration, and a bazaar economy, among others.

In this paper, ‘domestic intermediate demand’ refers to the intermediate demand for domestically produced products. Similar naming conventions will be applied to other demand terms, for example, domestic investment demand. Also, this will be applied to the demands for imported products.

The value-added vector enters the input-output table as a row vector. We define it as a column vector for the sake of notational convenience. The value-added ratio is defined as value-added/gross output.

The national income identity underlies this equality. Let Y and C denote aggregate GDP and consumption, respectively. The national income identity, Y = C + I + EX - M , can then be rewritten as Y + M = C + I + EX . The last expression implies that the sum of GDP and import equals the total final demand, leading to ΔY + ΔM = ΔEX . That is, when exports increase, the sum of the increases in GDP and imports equals the increase in exports.

Figures in this section were constructed based on the author’s computations using input-output tables and national accounts data from the Bank of Korea.

The surge in international oil prices and the rapid economic growth of Korea appear to be the most important causes.

Rotating Figure 8 by 180 degrees and adjusting the axis allows one to obtain the import contents of the final demand terms given that these two numbers add up to 1.

The DVC of domestic demand is the weighted average of the DVCs of domestic consumption and investment.

References

Bank of Korea. Bank of Korea, Foreign Exchange Rate Statistics, http://ecos.bok.or.kr/, accessed in October 13, 2020.

Bank of Korea. Bank of Korea, Input-Output Tables, http://ecos.bok.or.kr/, accessed on October 13, 2020.

Bank of Korea. Bank of Korea, National Account Statistics, http://ecos.bok.or.kr/, accessed on October 13, 2020.

, , & . (2001). The Nature and Growth of Vertical Specialization in World Trade. Journal of International Economics, 54, 75-96, https://doi.org/10.1016/S0022-1996(00)00093-3.

OECD. OECD, Import Content of Export, https://doi.org/10.1787/5834f58a-en, accessed on October 13, 2020.

World Bank. World Bank, World Development Indicators, https://databank.worldbank.org/databases, accessed on October 13, 2020.