Measuring the Effects of the Uniform Settlement Rate Requirement in the International Telephone Industry

Abstract

As a case study of an ex-post evaluation of regulations, in this paper I evaluate the ‘uniform settlement rate requirement’, a regulation that was introduced in 1986 and that was applied to the international telephone market in the U.S. for more than 20 years. In a bilateral market between the U.S. and a foreign country, each U.S. firm and its foreign partner jointly provide international telephone service in both directions, compensating each other for terminating incoming calls to their respective countries. The per-minute compensation amount for providing the termination service, referred to as the settlement rate, is determined by a bargaining process involving the two firms. In principle, each U.S. firm could have a different settlement rate for the same foreign country. In 1986, however, the Federal Communications Commission introduced the Uniform Settlement Rate Requirement (USRR), which required all U.S. firms to pay the same settlement rate to a given foreign country. The USRR significantly affected the relative bargaining positions of the U.S. and foreign firms, thereby changing negotiated settlement rates. This paper identifies two main routes through which the settlement rates are changed by the implementation of the USRR: the Competition-Induced-Incentive Effect and the Most-Favored-Nation Effect. I then empirically evaluate the USRR by estimating a bargaining model and conducting counterfactual experiments aimed at measuring the size of the two effects of the USRR. The experiments show remarkably large impacts due to the USRR. Requiring a uniform settlement rate, for instance, results in an average 32.2 percent increase in the negotiated settlement rates and an overall 13.7 percent ($3.43 billion) decrease in the total surplus in the U.S. These results provide very strong evidence against the implementation of the USRR in the 1990s and early 2000s.

Keywords

Ex-post Evaluation, Uniform Settlement Rate Requirement, Bargaining, Competition-Induced-Incentive Effect, Most-Favored-Nations Effect

JEL Code

C51, C78, K23, L13, L50, L96

I. Introduction

Regulations are everywhere. Our everyday lives are largely structured by regulations. Running a business is also greatly influenced by various types of regulation. Therefore, it is very important to maintain effective and efficient regulations in order to make our everyday lives better and to improve the competitiveness of our companies and even the level of national competitiveness.

However, finding unreasonable regulations around us is not at all difficult. For instance, regulations on opening hours for large marts, such as E-Mart, bring discomfort to consumers every weekend, with no positive impact on the revitalization of traditional markets, which was the initial purpose of the regulation. The differentiated broadcast advertising regulation is another example. From the standpoint of the viewer, although a terrestrial broadcasting channel and a pay broadcasting channel provide nearly identical services, differentiated advertising regulations continue between terrestrial broadcasting channels and pay broadcasting channels. For example, unlike pay broadcast channels, terrestrial broadcast channels are not allowed to include mid-program advertising.1 Not long ago as well there was a ridiculous case when a newly founded online car auction company called 'Hey Dealer’ was banned and was shut down, as online car auction companies were subjected to the same regulations as offline companies with regard to parking lots and auction facilities.

While it does not turn out to be obviously unreasonable, it is easy to find a controversial case regarding the legitimacy of a regulation. For example, currently in Korea, SK Telecom, the No. 1 mobile operator, is obliged to provide wholesale services for MVNOs2 with regulated wholesale prices. This regulation was introduced in 2010 to stimulate competition in the mobile telecommunications market and reduce the burden of the telecommunications costs for the public. The scope of the mandatory wholesale services and support for the MVNO continues to expand in the name of increasing the competitiveness of MVNOs. Recently, however, criticism has been raised, holding that the policy goal of activating competition in the mobile telecommunications market through MVNOs has already been largely achieved, and maintaining and expanding the regulation and support for MVNOs has undermined the incentives for MVNOs to secure their own competitiveness and eventually can hinder competition in the market.3

All of these examples illustrate the importance of ex-post evaluations of regulations. Initially, most regulations are introduced to achieve socially desirable outcomes, but over time, if the environment surrounding regulation changes, the legitimacy of the regulation can be undermined. Changes in the environment can lead to discrepancies between regulatory objectives and regulatory measures, and even when regulatory objectives have already been achieved, regulations may continue to have negative side-effects. Therefore, it is highly socially desirable regularly to check the rationality and legitimacy of regulations and to maintain the quality of regulations through ex-post evaluations.

As a case study of the ex-post evaluation of regulations, in this paper I evaluate the ‘uniform settlement rate requirement’, a regulation that was introduced in 1986 and that had been applied to the international telephone market in the United States for more than 20 years.

The international message telephone service (IMTS) is somewhat unique in that it is provided jointly by two firms or carriers. It is this was simply because a single firm cannot operate the service on an end-to-end basis. As an example of an international call from the U.S. to a foreign country, a call that originates from a U.S. IMTS firm is carried to an international midpoint and is then transferred to a foreign IMTS firm which carries the call to the destination and terminates it. Because users only pay the U.S. firm, a compensation mechanism must exist between the two firms.

There is such a compensation mechanism, called the ‘international accounting rate system.’ Under this mechanism, two IMTS firms bargain over 1) the per-minute total expense for carrying a call from the origin to the destination, and 2) each firm’s portion of the per-minute total expense. The negotiated per-minute total expense is called the ‘accounting rate’, and each firm’s portion of the accounting rate is called the ‘settlement rate.’4 Then, for an international call from the U.S., the U.S. IMTS firm pays the foreign firm a ‘settlement payment’ amounting to the foreign firm’s settlement rate times the number of minutes of the call. Because the U.S. has far more outgoing than incoming traffic for almost all foreign countries,5 U.S. carriers have paid foreign carriers large amounts in settlement payments. In 1996, for example, U.S. carriers paid $5.7 billion in net settlement payments for the termination of U.S. international calls, which amounts to 40% of all IMTS revenues.

Every U.S. IMTS firm has such an arrangement with regard to the accounting rate and settlement rate for each foreign country or international point. In principle, each U.S. carrier may have a different arrangement for the same foreign country. In 1986, however, the Federal Communications Commission (FCC) introduced the ‘International Settlement Policy (ISP)’ into the IMTS market. Among other things, it required U.S. IMTS firms to pay the same settlement rate to a foreign country for the termination of international traffic, referred to as the ‘uniform settlement rate requirement.’ Practically, the uniform settlement rate requirement has been implemented such that only one U.S. IMTS firm (mainly AT&T) entered into negotiations with foreign firms, and the resulting settlement rates were automatically applied to other U.S. firms. This requirement was applied to all foreign countries for nearly ten years, but since 1994 it has been lifted for many foreign countries, introducing significant competition into their IMTS markets. Nonetheless, in the mid-2000s, more than 100 countries operated under the requirement.

In fact, the uniform settlement rate requirement was implemented to remove entry barriers and to introduce competition into the IMTS market. After the imposition of this requirement, U.S. IMTS markets became increasingly competitive, and by 1992, three or more U.S. IMTS providers competed in the market for all main foreign countries. However, it also significantly changed the bargaining framework within which U.S. carriers negotiate with foreign carriers. Changes in the bargaining framework affect the relative bargaining positions of the IMTS carriers involved. There are two main routes through which the relative bargaining positions of the IMTS carriers are affected by the implementation of the requirement. First, the uniform settlement rate requirement may weaken U.S. carriers’ incentives to bargain aggressively over settlement rates, as they cannot gain any advantage during product market competition by lowering their own rates. This is referred to here as the ‘Competition-Induced-Incentive (CII) Effect.’ Second, it may also strengthen foreign carriers’ bargaining positions through what is termed the ‘Most-Favored-Nation (MFN) Effect,’ according to which whatever concession a foreign carrier gives to a specific U.S. carrier doubles. Because these two effects both have a negative impact on U.S. carriers’ bargaining positions, the uniform settlement rate requirement may have been detrimental to U.S. carriers during the negotiation of settlement rates. These ‘side-effects’ of the uniform settlement rate requirement will weaken or even eliminate the justification of the requirement, depending on their size. Hence, in terms of policy evaluations, it is very important to identify and measure these possible side-effects of the requirements of settlement rates, net settlement payments, and the total surplus in the U.S.

Given the potential for a negative impact from the uniform settlement rate requirement, this paper evaluates the uniform settlement rate requirement both theoretically and empirically, thereby providing a clear example which highlights the importance of conducting ex-post evaluations of regulations.6 First, in a theoretical model, I compare an actual regime in which the uniform settlement rate requirement is enforced with counterfactual regimes where various firm-specific settlement rates are allowed. I identify the presence of the Competition-Induced-Incentive Effect and the Most-Favored-Nation Effect in the actual regime and show that these two effects increase the settlement rate, thereby resulting in a higher settlement rate in the actual regime. It should be noted that U.S. carriers have an incentive to reduce settlement rates, as they have paid foreign carriers large net settlement payments. Second, I empirically measure the impact of the uniform settlement rate requirement, as found in the theoretical model, on the negotiated settlement rates, net settlement payments, and welfare in the U.S. My general strategy is to estimate a structural bargaining model of settlement rate negotiation and then conduct a counterfactual experiment using the estimated structural bargaining model.

The remainder of the paper is organized as follows. In Section 2, I discuss the ISP, and in particular, the uniform settlement rate requirement more extensively. In Section 3, I provide a theoretical model in which the competition-induced-incentive effect and the most-favored-nation effect are identified. In the next section, I suggest an empirical strategy and develop an econometric framework to measure the impact of the requirement on the settlement rates, settlement payments, and welfare. The data are described in Section 5. In Section 6, I present the estimation result for the bargaining model and conduct the counterfactual experiment. Finally, Section 7 concludes the analysis by summarizing the results of the experiment and suggesting several policy measures for strengthening the ex-post evaluations of regulations in Korea.

II. The Uniform Settlement Rate Requirement: Can it be Justified?

The greatest concern of the FCC regarding the IMTS market has been excessively high calling prices. The Commission determined that inflated consumer calling prices were attributable to both above-cost international settlement rates and the lack of competition in the IMTS markets. As a response to those problems, in 1986 the FCC implemented the International Settlement Policy (ISP), which provides a regulatory framework within which U.S. IMTS carriers negotiate with foreign carriers to provide bilateral international services. Under the ISP, (1) all U.S. carriers entering into agreements with foreign carriers must be offered the same effective accounting rate and same effective date for the rate (‘nondiscrimination’); (2) U.S. carriers are entitled to a proportionate share of return traffic based upon their proportion of U.S. outgoing traffic (‘proportionate return’); and (3) the accounting rate is divided evenly between the U.S. and foreign carriers for U.S. incoming and outgoing traffic (‘symmetrical settlement rates’). The first and third requirements imply that all U.S. carriers must be offered the same settlement rate (‘uniform settlement rate’).

The second and third requirements can be thought of as a means of reducing above-cost settlement rates.7 In contrast, the uniform settlement rate requirement is a response to the lack of competition in the IMTS markets rather than to the above-cost settlement rates. In the IMTS industry, the greatest entry barrier for potential competitors was that they needed an arrangement with each foreign carrier about the accounting and settlement rates for the provision of service. Furthermore, monopolistic foreign carriers tended to be more favorable to the incumbent U.S. carrier, AT&T, rather than to new entrants.8 Thus, the FCC forced all U.S. carriers to have the same arrangement (the uniform settlement rate requirement) as an effective way to remove this type of entry barrier. As mentioned in the introduction, in reality the uniform settlement rate requirement has been implemented such that only one U.S. carrier (mainly AT&T) enters negotiations with foreign carriers and the negotiated settlement rate is automatically applied to other U.S. carriers.

Since 1986, the IMTS markets have become increasingly competitive. In 1986, AT&T was the only service provider for 63 of the 100 countries for which U.S. outgoing traffic was largest. Since then, that number has decreased rapidly, falling to 36 in 1988 and eleven in 1990, and finally, by 1992, the IMTS markets for all main foreign countries became competitive, with three or more U.S. IMTS providers.

The trend towards more competitive markets suggests that the uniform settlement rate requirement did in fact play a role in developing competition by removing a major entry barrier. Even if this were true, however, it is problematic as to whether the uniform settlement rate requirement continues to be beneficial to the U.S. The unification of the bargaining position may actually weaken U.S. carriers’ bargaining positions in their negotiations with foreign carriers. The following effects, which are unique in the uniform settlement rate requirement, are important.

(1) Competition-Induced-Incentive Effect (from the viewpoint of U.S. carriers): Because the settlement rate is a major component of the marginal cost for U.S. carriers, if there is no requirement, each U.S. carrier will attempt to gain a competitive advantage in the product market competition by lowering its own settlement rate. However, under the uniform settlement rate requirement, any reduction in the settlement rate obtained by a specific U.S. carrier will be automatically applied to other U.S. carriers, thereby leaving no competitive advantage from a reduction in the settlement rate. Therefore, the uniform settlement rate requirement weakens U.S. IMTS carriers’ incentives aggressively to bargain over settlement rates.

(2) Most-Favored-Nation Effect (from the viewpoint of foreign carriers): Whatever concessions a foreign carrier gives to a specific U.S. carrier are at least doubled because the same concessions should be automatically given to other U.S. carriers. This fact will harden the bargaining positions of foreign carriers.

These two effects weaken the U.S. carriers’ bargaining positions, leading to higher settlement rates than those that would be seen if the uniform settlement rate requirement were not enforced. These higher settlement rates are likely to give rise to higher prices and greater net settlement payments to foreign carriers. Higher prices will also result in a welfare loss in the U.S.

Therefore, regarding whether the uniform settlement rate requirement can be justified from the viewpoint of the U.S. involves a comparison between the benefit (introducing competition into the markets) and the cost (raising settlement rates). Conducting this comprehensive comparison is beyond the scope of this paper. Instead, this paper focuses solely on the cost side and measures the impact of the uniform settlement rate requirement on the negotiated settlement rates, net settlement payments, and finally welfare in the U.S. However, with the cost-side analysis alone, we can still gain a clear answer concerning the implementation of the uniform settlement rate requirement after 1992, as the benefit of the requirement was fully exhausted after its first stage of implementation. By 1992, MCI and Sprint had already entered all major markets and, in particular, MCI had gained a significant market share.9 Nonetheless, the uniform settlement rate requirement was maintained for almost all foreign countries until 1998 and was enforced for more than 100 countries even into the mid-2000s. Therefore, an empirical finding of a major negative impact of the requirement in terms of the settlement rates, net settlement payments, and welfare, will provide strong evidence against continuing with the requirement after 1992.

III. Theoretical Evaluation of the Uniform Settlement Rate Requirement

In this section, using a simple model, I compare individual settlement rates with a uniform settlement rate and identify the Competition-Induced-Incentive (CII) Effect and Most-Favored-Nation (MFN) Effect.

From the U.S. viewpoint, for each foreign country, the IMTS industry consists of two domestic firms, carrier 1 (AT&T) and carrier 2 (MCI), and one foreign firm. The events in this industry take place in two stages. In the first stage, if the uniform settlement rate requirement is not enforced, each domestic carrier bargains with its foreign correspondent over the settlement rate. If the uniform settlement rate requirement is enforced, carrier 1, as the representative firm, bargains over the uniform settlement rate. In the second stage, the settlement rate agreements are known, and the domestic firms compete in the product market. During product market interaction, domestic firms decide on the prices they will charge.10 For computational simplicity, the quantity produced by the foreign firm is assumed to be given at a fixed ratio m of the total quantity produced by the domestic firms. That is, qf = m(q1 + q2).11 I assume that 0 < m < 1.12

Furthermore, the price charged by the foreign firm is assumed to be fixed at pf.13

A. Product Market Competition

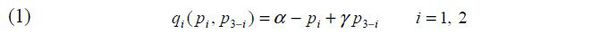

The demand for product i is

where 1>γ>0.

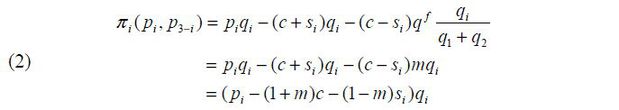

Given the settlement rates si, the profit function of the domestic firm i is

where c is the per-minute handling cost. I assume that this cost is identical for both outgoing and incoming calls. The third term in the first line in equation (2) represents the costs incurred from terminating incoming calls. The foreign carrier must return traffic to the US carriers in proportion to the number of minutes sent to that carrier’s country by each US carrier (the proportionate return requirement).

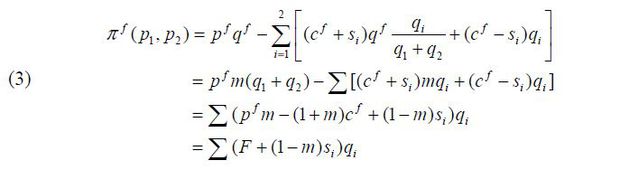

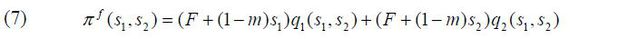

The profit function of the foreign firm is

where F = pfm−(1+m)cf.

As seen in equations (2) and (3), the domestic firms have an incentive to reduce settlement rates while the foreign firm has the opposite incentive. This stems from the fact that m <1.

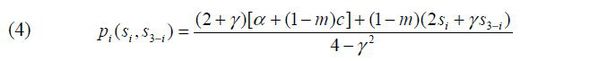

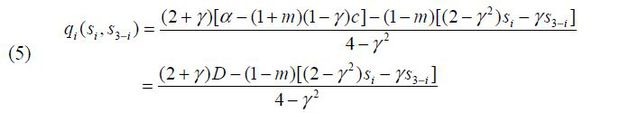

In the second stage, two domestic firms compete over prices in the product market. The equilibrium concept for this interaction is the Nash equilibrium. Given the profit functions, it is straightforward to calculate the equilibrium price and output:

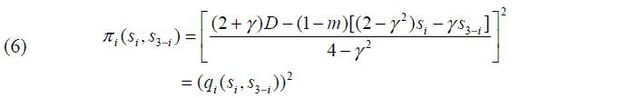

where D=α−(1+m)(1−γ)c, i=1, 2. The equilibrium profit of the domestic carrier i is

The profit of the foreign carrier can also be expressed by the given settlement rates such that

In the following analysis I assume that D and F have proper values so that positive bargaining solutions result.

B. Bargaining over Settlement Rates

I model the outcomes of settlement rate bargaining using the formula of a Nash bargaining solution. In fact, real-world bargaining between a U.S. firm and a foreign firm can be described better by a noncooperative dynamic bargaining game of the type presented by Rubinstein (1982) rather than the static Nash bargaining model.14 Binmore et al. (1986), however, show that the Nash solution approximates the perfect equilibrium outcome of the noncooperative dynamic bargaining game when the length of a single bargaining period is sufficiently short. Therefore, although I build up logic on the static Nash bargaining model in this paper, it will be useful to think of the Nash bargaining model as a reduced form of an appropriate dynamic bargaining model and to interpret the Nash solution in the context of the noncooperative dynamic bargaining game observed in the real world.

1. Individual Settlement Rates Regime

When the uniform settlement rate policy is not enforced, applying a Nash solution is not straightforward. In such a case, each of the domestic carriers takes part in the bargaining with the foreign correspondent and determines its own settlement rate. Therefore, it is necessary to account for interdependence between the two different bargaining problems. Here, I analyze these symmetric and simultaneous outcomes, in which the foreign carrier negotiates with two domestic firms symmetrically and simultaneously.

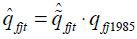

The solution is a pair of settlement rate agreements  and

and  such that

such that  is the Nash solution to the bargaining problem between the foreign carrier and the

domestic carrier i , given that both anticipate correctly that the other rate will be

is the Nash solution to the bargaining problem between the foreign carrier and the

domestic carrier i , given that both anticipate correctly that the other rate will be  . Therefore, given

. Therefore, given  , I describe the bargaining problem between the foreign carrier and the domestic carrier

i using the following set of payoff pairs,

, I describe the bargaining problem between the foreign carrier and the domestic carrier

i using the following set of payoff pairs,

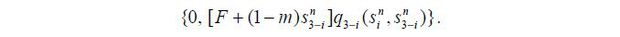

and a choice over the disagreement point.15

Although a proper specification of the disagreement point is not straightforward, we can consider two plausible scenarios by which disagreement points can be characterized.

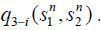

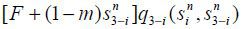

Case 1. If firm i and the foreign firm cannot reach an agreement, firm i earns zero and firm (3−i) operates at the anticipated equilibrium level  The disagreement point will then be

The disagreement point will then be

If we interpret the Nash bargaining solution while examining the underlying dynamic

game of the Rubinstein type (1982), the disagreement point should correspond to the streams of income that accrue to

the two parties during the course of the dispute. Furthermore, the two negotiations

take place simultaneously rather than sequentially. In this case, it may be reasonable

to assume that firm (3−i) operates at the anticipated equilibrium level and that the foreign firm earns positive

profit amounting to  from the business with firm (3−i) during the dispute with firm i . The Nash bargaining solution with respect to the above disagreement point is

from the business with firm (3−i) during the dispute with firm i . The Nash bargaining solution with respect to the above disagreement point is

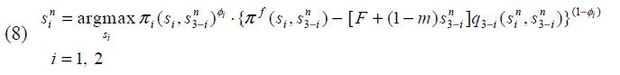

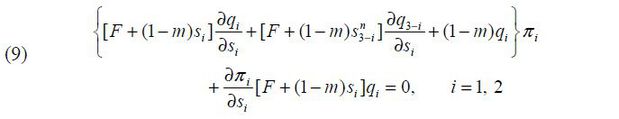

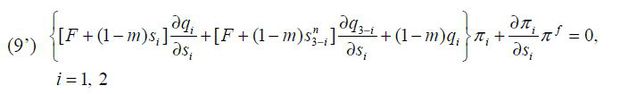

where ϕi is firm i ’s bargaining power and may capture other possible asymmetries between firm i and the foreign firm which are not reflected in the profit functions and disagreement point. In the following empirical sections, I recover the actual value of ϕi from the data. Here, however, I simply assume that ϕ1 = ϕ2 = 0.5; i.e., all asymmetries are reflected in the profit functions and disagreement point. The first order conditions for (8) are then expressed as shown below.

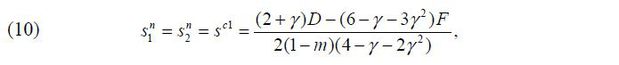

Substituting equations (5), (6), and (7) into equation (9) and solving yields

where sc1 refers to a counterfactual settlement rate in Case 1.

Case 2. In contrast to Case 1, we can assume that a regulation exists requiring both domestic carriers to break off relations with a specific foreign carrier if any of the domestic carriers cannot reach an agreement with that foreign carrier.16 In this case, the disagreement point will be zero for all bargaining participants and the Nash solution is

with the assumption of ϕ1 = ϕ2 = 0.5, the first-order conditions for (8’) are

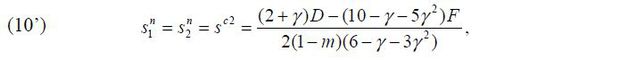

substituting equations (5), (6), and (7) into equation (9’) and solving yields

where sc2 refers to a counterfactual settlement rate in Case 2.

2. Uniform Settlement Rate Regime

If the uniform settlement rate requirement is enforced, there should be only one settlement rate applied to both domestic firms. As an example, carrier 1 bargains with the foreign carrier over the settlement rate. This negotiated settlement rate is then applied to carrier 2. The solution here is the settlement rate agreement s1 = s2 = su . The bargaining problem between the foreign carrier and domestic carrier 1 can be described by the following set of payoff pairs,

and the choice over the disagreement point.

I make the following assumption pertaining to the disagreement point: if firm 1 and the foreign firm cannot agree, the interdependent relationships between the domestic firms and the foreign firm break down completely. As such, all firms in the industry earn zero profit. 17 With respect to this disagreement point, the Nash bargaining solution is

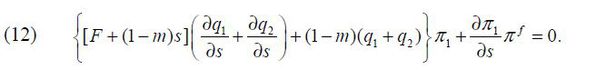

Once again, I assume that ϕ1 = 0.5. The first-order condition for (11) is

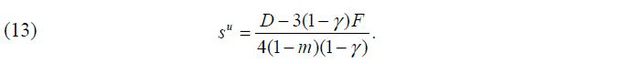

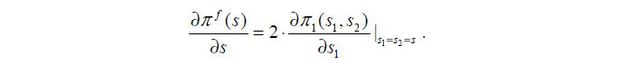

Substituting equations (5), (6), and (7) into equation (12) and solving yields

3. Comparison: Individual Settlement Rates vs. Uniform Settlement Rate

When comparing the first case of the individual settlement rates regime with the uniform

settlement rate regime, three differences are apparent from the two first-order conditions

(9) and (12). First, we observe the Competition-Induced-Incentive (CII) Effect. That

is, the uniform settlement rate requirement reduces incentives for the domestic carrier

to negotiate low settlement rates, as it removes any possible differential in rates

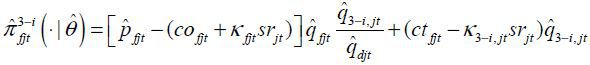

paid by competing carriers for the termination of outgoing traffic (FCC, 1999). This effect is captured by  in equation (12).

in equation (12).

The second difference comes from the Most-Favored-Nation (MFN) Effect. Because any

settlement rates negotiated by firm 1 and the foreign firm are automatically applied

to firm 2, whatever concession (reduction in the rate) the foreign firm gives to firm

1 doubles under the uniform settlement rate requirement, thereby hardening the foreign

firm’s bargaining position. The differentiation  expressed by the large [·] in equation (12) describes this effect:

expressed by the large [·] in equation (12) describes this effect:

The third difference arises from asymmetry in the foreign carrier’s disagreement point. When choosing disagreement points, I punish the foreign carrier more severely in the uniform settlement rate regime if it fails to reach an agreement. With more severe punishment, the foreign carrier’s bargaining position becomes weaker.

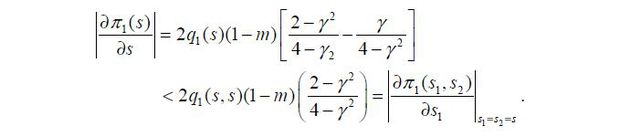

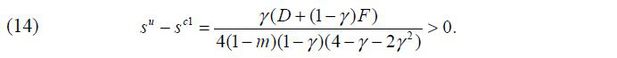

While the Competition-Induced-Incentive and the MFN effects increase the settlement rate, the difference in the disagreement points suggests a lower settlement rate in the uniform settlement rate regime. A direct comparison of sc1 and su , however, gives the following result:

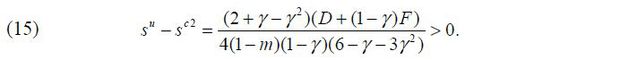

In Case 2, the comparison of the individual settlement rates regime and the uniform settlement rate regime results in a clearer answer. By forcing both domestic carriers to break off their relationships with a specific foreign carrier if either of the domestic carriers cannot reach an agreement with that foreign carrier, we have the same disagreement point of the foreign carrier in both regimes. Then, with the remaining two differences, the CII and MFN effects, we unambiguously expect a higher settlement rate in the uniform settlement rate regime. The comparison of sc2 and su confirms this expectation:

IV. Estimation Strategy and Empirical Model

At this stage, I introduce an estimation strategy and develop an econometric framework to measure the negative impacts of the uniform settlement rate requirement on the U.S. side, as found in the previous section. If there were two datasets between which the only structural change was whether the uniform rate requirement was enforced or not, it would be straightforward to measure the effects of the requirement. Unfortunately, this is not possible. Therefore, I measure the impacts of the requirement in the following two stages. First, I estimate a bargaining model of settlement rate negotiation, after which, using the estimated bargaining model, I conduct a counterfactual experiment in which the negative impacts of the uniform settlement rate requirement are measured from a direct comparison between the actual regime and a counterfactual regime. Essentially, the same bargaining model used in the previous section will be estimated. Moreover, when conducting the counterfactual experiment, I consider the two counterfactual scenarios specified in the previous section (Case 1 and Case 2).18

A. Estimation of the Bargaining Model

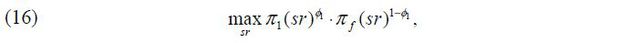

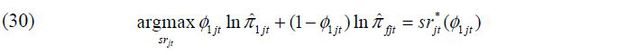

In the actual regime, AT&T (as a representative U.S. carrier) and a foreign carrier bargain over a common settlement rate sr . Given the assumptions on the bargaining model described in the previous section (in particular subsection 3.B.2), their objective function is

where π1 and πf are the profit functions of AT&T and foreign carrier, respectively, and ϕ1 is AT&T’s bargaining power function.

As stated in the introduction, I estimate the bargaining model (16) in two steps. First, I estimate the profit functions for the U.S. carriers and foreign carriers and express each one as a function of the settlement rate. In the second step, I plug the estimates of the profit functions into the bargaining model (16) and estimate the remaining bargaining power function ϕ1 using the observed uniform settlement rates.

1. Estimation of Profit Functions

Profit functions can be estimated directly or indirectly. The indirect estimation method involves two steps. First, demand and markup equations are estimated, with profit functions then constructed using the estimates. Because the counterfactual experiment requires estimates of the demand and markup equations as well as the profit functions, I utilize the indirect means of estimating the profit functions.

For each observation, there are two U.S. carriers, AT&T and MCI, which I index by i =1, 2, respectively, and there is one foreign carrier (f).19 When referring to all carriers, I use the subscript h . Firm-specific variables have three subscripts, for example, qijt or pfjt . The first subscript (i or f) refers to a specific U.S. carrier or foreign carrier. The second subscript (j) designates the foreign country considered and the third one (t) is for the year. Superscripts O and I correspondingly stand for “outgoing” and “incoming” traffic from the U.S. perspective.

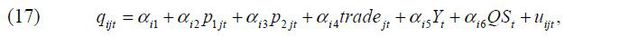

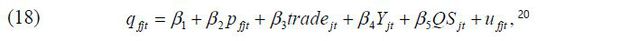

Demand. The demand for U.S. carrier i ’s IMTS to foreign country j at time t is

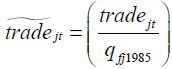

where qijt is U.S. carrier i ’s outgoing traffic to country j , pijt is U.S. carrier i ’s per-minute collection rate for outgoing calls to country j , tradejt denotes the real exports and imports between the U.S. and country j , Yt is the U.S. real GDP per capita, and QSt measures the U.S. network quality of service as a percentage of mainlines connected to digital switches. Finally, uijt is a mean-zero stochastic term representing either the measurement error or a demand shock and is assumed to be serially uncorrelated.

The demand for the foreign carrier’s IMTS by the U.S. at time t is

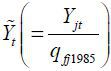

where qfjt denotes the total minutes of incoming traffic from country j to the U.S., Yjt is country j ’s real GDP per capita, QSjt measures the foreign network quality of service as a percentage of mainlines connected to digital switches, and ufj is a mean-zero stochastic term that is serially uncorrelated.

When estimating these demand equations, a possible endogeneity problem arises: the correlation between prices and country-specific demand shocks. I deal with this challenge using an identification strategy similar to Nevo (2001). The identifying assumption for the U.S. demand equations (17) is that country-specific demand shocks uijt are independent across destination countries. Given this assumption, a demand shock for a specific country will be independent of the prices for other countries. Due to the similar marginal costs, prices for different countries within a region will be correlated and can therefore be used as valid instrumental variables.21 For the foreign demand equation (18), I also make a similar identifying assumption: country-specific demand shocks ufjt are independent across origination countries. With this assumption, for the price in a specific country, prices in different countries within the same region can be used as a valid instrumental variable.

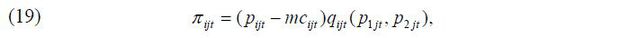

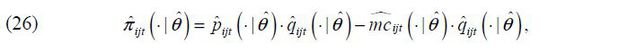

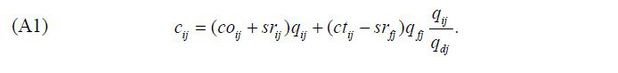

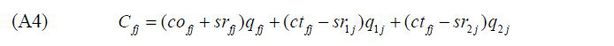

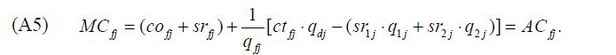

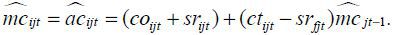

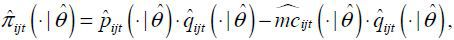

Markup. U.S. carrier i ’s profit from a bilateral market between the U.S. and foreign country j is

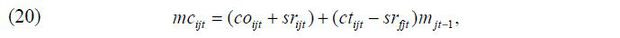

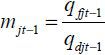

where mcijt is the marginal cost of a call. Reflecting the proportionate return traffic requirement, the marginal cost is specified as follows:22

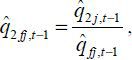

where srhjt is the firm-specific per-minute settlement rate between the U.S. and country j , coijt is the per-minute cost of originating a U.S. call, ctijt is the perminute cost of terminating a foreign call, and  is the ratio of incoming traffic to the total outgoing traffic between the U.S. and

foreign country j in the previous year. In theory, sr1j = sr2j = srfj = srj . That is, settlement rates are identical for all U.S. competing carriers and foreign

carriers under the ISP. In reality, however, negotiated settlement rates usually vary

according to the time of the day, i.e., peak and off-peak rates, and U.S. consumers

have different usage patterns over peak and off-peak times from foreign consumers.

Furthermore, significant differences may exist in the usage patterns among U.S. carriers’

subscribers. Therefore, when I compute the average settlement rate of each carrier

by dividing its settlement payments by its quantity, it is natural to observe some

variation in these average settlement rates even under the uniform settlement rate

requirement, as shown in the data.

is the ratio of incoming traffic to the total outgoing traffic between the U.S. and

foreign country j in the previous year. In theory, sr1j = sr2j = srfj = srj . That is, settlement rates are identical for all U.S. competing carriers and foreign

carriers under the ISP. In reality, however, negotiated settlement rates usually vary

according to the time of the day, i.e., peak and off-peak rates, and U.S. consumers

have different usage patterns over peak and off-peak times from foreign consumers.

Furthermore, significant differences may exist in the usage patterns among U.S. carriers’

subscribers. Therefore, when I compute the average settlement rate of each carrier

by dividing its settlement payments by its quantity, it is natural to observe some

variation in these average settlement rates even under the uniform settlement rate

requirement, as shown in the data.

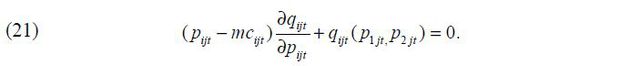

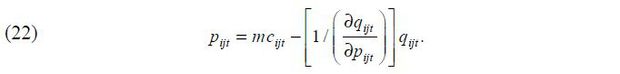

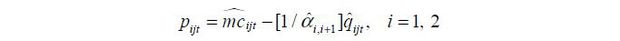

To specify the markup equations of U.S. carriers, I assume that they compete in the product market a la a Bertrand-Nash game. Assuming the existence of a pure-strategy equilibrium and assuming as well that the equilibrium prices are strictly positive, the price pijt must satisfy the first-order condition of

This implies the following markup equation of U.S. carrier i :

By virtue of assuming a Bertrand-Nash game, we can estimate the markup equations of U.S. carriers using estimates of the demand parameters without observing the actual handling costs, co and ct .

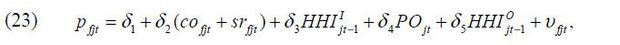

When specifying a markup equation for foreign carriers, there should be concern over the assumption of a specific type of conduct: most foreign carriers had been state-owned or at least strictly regulated in terms of their respective pricing until the mid-1990s. Reflecting this, rather than assuming the conduct, I specify a markup equation for foreign carriers using a general functional form similar to that in Madden and Savage (2000):

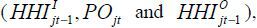

where cofjt is the per-minute cost of originating a call to the U.S.,  is the extent of the market concentration for incoming traffic from foreign country

j to the U.S. in the previous year, POjt is the extent of the privatization of the dominant foreign carrier,

is the extent of the market concentration for incoming traffic from foreign country

j to the U.S. in the previous year, POjt is the extent of the privatization of the dominant foreign carrier,  is the extent of the market concentration for outgoing traffic from the U.S. to foreign

country j in the previous year, and υfjt are mean zero-error terms, which represent the randomness of the carriers. In contrast

to the markup equations of U.S. carriers, the estimation of equation (23) requires

additional information about the foreign carriers’ handling costs, cof . I impute cof for each foreign carrier using cost information from the FCC (1997a). Finally, the inclusion of the lagged endogenous variables

is the extent of the market concentration for outgoing traffic from the U.S. to foreign

country j in the previous year, and υfjt are mean zero-error terms, which represent the randomness of the carriers. In contrast

to the markup equations of U.S. carriers, the estimation of equation (23) requires

additional information about the foreign carriers’ handling costs, cof . I impute cof for each foreign carrier using cost information from the FCC (1997a). Finally, the inclusion of the lagged endogenous variables  and

and  in equation (23) may bring about another endogeneity problem: a correlation between

these lagged endogenous variables and the error term, υfjt . However, I already assumed that the demand shocks, uijt and ufjt , are serially uncorrelated. Given this assumption, the presence of lagged endogenous

variables in the markup equation does not lead to any endogeneity problem.23

in equation (23) may bring about another endogeneity problem: a correlation between

these lagged endogenous variables and the error term, υfjt . However, I already assumed that the demand shocks, uijt and ufjt , are serially uncorrelated. Given this assumption, the presence of lagged endogenous

variables in the markup equation does not lead to any endogeneity problem.23

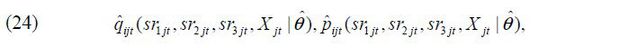

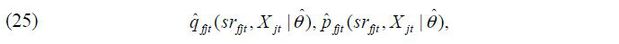

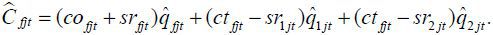

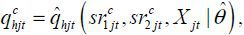

Profit Functions. Thus far, I have specified the demand and markup equations for the two U.S. carriers and one foreign carrier. Estimating these equations will give us the following equilibrium quantity and price estimates for the U.S. carrier i :

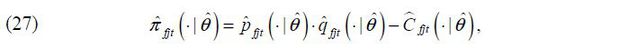

and for the foreign carrier j

where Xj terms are exogenous variables, except srhj in the bilateral relationship between the two countries, and  refers to the estimated parameters.

refers to the estimated parameters.

Using equations (24) and (25), I construct estimates of the profit functions. The estimate of the U.S. carrier i ’s profit function is

where

Similarly, the estimate of foreign carrier j ’s profit function is

where

2. Estimation of the Bargaining Power Function

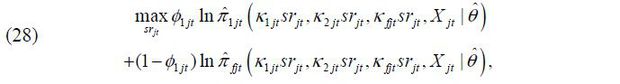

To estimate AT&T’s bargaining power function, first I plug the estimated profit functions (26) and (27) into the bargaining model (16). If we consider a bargaining problem between AT&T and foreign carrier j at time t , their objective function is then expressed as follows:24

where κhj = srhj / srj reflects firm-specific usage patterns over various times of the day.

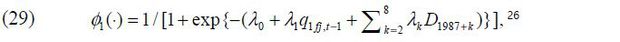

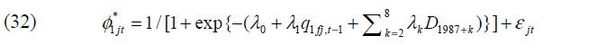

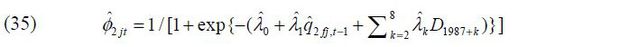

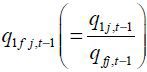

Specification of Bargaining Power Function ϕ1 (⋅) . I specify the bargaining power function as follows:25

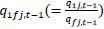

where  is the ratio of the outgoing traffic of AT&T to the incoming traffic from country

j in the previous year, and the D1987+k terms are year dummies.

is the ratio of the outgoing traffic of AT&T to the incoming traffic from country

j in the previous year, and the D1987+k terms are year dummies.

Historically AT&T’s bargaining power has varied depending on the foreign country. The variable q1fj,t−1 captures this historical cross-sectional variation. If AT&T had a relatively large stake involved during the bargaining with a foreign carrier in the past, its historical bargaining power would be lower because it would lose more in the event of a disagreement. The inclusion of year dummies reflects the fact that since the late 1980s, the FCC has appealed settlement rates that were far in excess of the true termination costs, eliciting a worldwide response. With this international trend, we can expect that the bargaining power of AT&T, whose aim is to decrease settlement rates, has been increasing over time. The year dummies will capture this time trend and are expected to have positive signs.

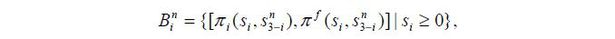

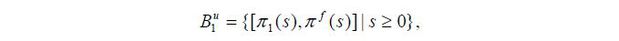

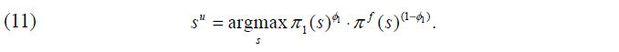

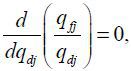

Estimation of Bargaining Power Function ϕ1 (⋅) . Given an observation, for each possible value of ϕ1jt , we can find an optimal settlement rate  which maximizes the objective function (28).

which maximizes the objective function (28).

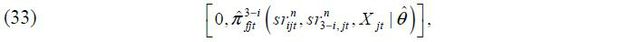

If the estimated profit functions capture precisely what the carriers have in mind

when bargaining,27 and if any agreement is reached following the Nash bargaining model, then the observed

settlement rate  should be located between

should be located between  and

and  . Here,

. Here,  is the solution to the maximization problem (30) for the case in which AT&T has full

bargaining power, and

is the solution to the maximization problem (30) for the case in which AT&T has full

bargaining power, and  is the solution when the foreign carrier has full bargaining power. The function

is the solution when the foreign carrier has full bargaining power. The function

is also continuous and monotonically decreasing in the domain of [0,1] . The Intermediate

Value Theorem then says that there exists a unique value of ϕ1jt which satisfies the following equation:

is also continuous and monotonically decreasing in the domain of [0,1] . The Intermediate

Value Theorem then says that there exists a unique value of ϕ1jt which satisfies the following equation:

For each foreign country j and each year t , we can find  .

.

Once I find  , I estimate the bargaining power function (29) by nonlinear least squares and complete

the estimation of bargaining model (16):

, I estimate the bargaining power function (29) by nonlinear least squares and complete

the estimation of bargaining model (16):

B. Counterfactual Experiment

Given the estimated structural bargaining model, we can conduct a counterfactual experiment. In the experiment, I consider two counterfactual regimes in which each U.S. carrier bargains over its own settlement rate with a foreign carrier. Therefore, each counterfactual regime involves two interdependent bargaining problems. As in Section 3, I assume that the foreign carrier negotiates with the two U.S. carriers symmetrically and simultaneously. I also assume Nash equilibrium for the equilibrium concept for those interdependent bargaining problems.

In the first counterfactual regime (Case 1) where, if a U.S. carrier and the foreign carrier cannot reach an agreement and that U.S. carrier earns zero profit and the other U.S. carrier operates at the anticipated equilibrium level of the settlement rates, the disagreement point for U.S. carrier i and foreign carrier j is

where  represents foreign carrier j ’s profit when it has business only with U.S. carrier (3−i) . In contrast, in the second regime (Case 2) assuming that if any U.S. carrier does

not agree with the foreign carrier, the interdependent relationships between the U.S.

carriers and foreign carrier totally break down and the disagreement point is simply

[0,0] for both bargaining problems.

represents foreign carrier j ’s profit when it has business only with U.S. carrier (3−i) . In contrast, in the second regime (Case 2) assuming that if any U.S. carrier does

not agree with the foreign carrier, the interdependent relationships between the U.S.

carriers and foreign carrier totally break down and the disagreement point is simply

[0,0] for both bargaining problems.

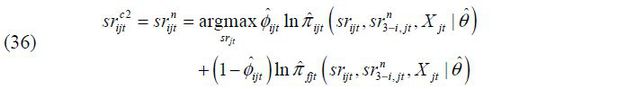

1. Counterfactual Settlement Rates

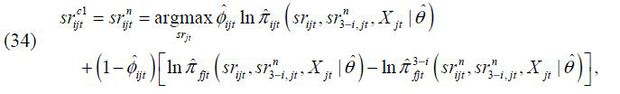

In Case 1, counterfactual individual settlement rates  are the Nash equilibrium of the following two Nash bargaining problems:

are the Nash equilibrium of the following two Nash bargaining problems:

where represents the estimated bargaining power of U.S. carrier i .28

represents the estimated bargaining power of U.S. carrier i .28

AT&T’s bargaining power  is simply

is simply  , which satisfies equation (31), and MCI’s bargaining power

, which satisfies equation (31), and MCI’s bargaining power  is imputed by replacing

is imputed by replacing  with

with  in the estimated bargaining power function, as follows:

in the estimated bargaining power function, as follows:

Here,  and

and  ,

,  and

and  are estimated parameters.

are estimated parameters.

Counterfactual settlement rates  in Case 2 are the Nash equilibrium of the following two Nash bargaining problems:

in Case 2 are the Nash equilibrium of the following two Nash bargaining problems:

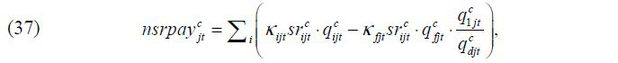

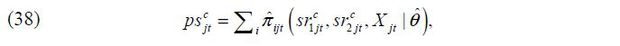

2. Counterfactual Net Settlement Payments, Consumers’ and Producers’ Surpluses

Once we find the counterfactual settlement rates  it is straightforward to compute the counterfactual net settlement payment

it is straightforward to compute the counterfactual net settlement payment  consumer surplus

consumer surplus  and producer surplus

and producer surplus  for each counterfactual regime. The computation of the counterfactual net settlement

payments is as follows,

for each counterfactual regime. The computation of the counterfactual net settlement

payments is as follows,

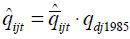

where  as computed using equations (24) and (25), denotes the counterfactual outgoing and

incoming traffic levels. The counterfactual consumer surplus obtained by consuming

as computed using equations (24) and (25), denotes the counterfactual outgoing and

incoming traffic levels. The counterfactual consumer surplus obtained by consuming

and

and  is computed using the estimates of the demand and markup equations. The counterfactual

producer surplus is the sum of the profits of the two U.S. carriers at the counterfactual

settlement rates,

is computed using the estimates of the demand and markup equations. The counterfactual

producer surplus is the sum of the profits of the two U.S. carriers at the counterfactual

settlement rates,

where  as given in equation (26).

as given in equation (26).

Actual settlement rates and net settlement payments in the actual regime are observed. The actual consumer surplus and producer surplus values can be computed identically to how the counterfactual values were determined. Finally, a direct comparison of the counterfactual settlement rates, net settlement payments, consumer surplus, and producer surplus values with the actual values provides the magnitude of the effects of the uniform settlement rate requirement on the negotiated settlement rates, net settlement payments, and welfare in the U.S.

V. Data Description

To measure the effects of the uniform settlement rate requirement, I obtained annual data for forty bilateral markets from 1988 to 1995 (281 observations).29 From these data, I dropped fifty two observations in which a foreign carrier’s collection rate is not available or MCI does not provide the IMTS. As a result, there are 229 total observations.30 The bilateral markets represent approximately 72% of the total outgoing traffic and 82% of incoming traffic in 1995. Definitions, sample means and standard deviations for all variables are provided in Table A1 in the appendix. Some variables need to be explained in more detail.

A. Price

I construct the U.S. carrier i ’s average per-minute price for calls to country j by dividing the revenue by the quantity, pij = revij / qij . I cannot follow the same procedure to find the average foreign price for international calls to the U.S. simply because foreign carriers’ revenue information is not available. Instead, for each foreign country, I have the basic peak rate and discount off-peak rate of international calls to the U.S. I create the following steps to calculate country j ’s average price. First, I derive the usage pattern of U.S. consumers based on p1j , AT&T’s basic peak rate, and the discount off-peak rate. Second, I calculate foreign carrier j ’s average rate by applying the U.S. usage pattern to foreign carrier j ’s basic peak rate and discount off-peak rate. In doing so, I also consider the difference in the digitalization of the main lines between the U.S. and country j . This captures possible differences in the effectiveness of discount off-peak rates between the U.S. and country j .

B. Cost

International telephone carriers’ marginal costs consist of two components. One is the handling cost of carrying a call from the origin to the international midpoint (originating a call, co ) or from the international midpoint to the destination (terminating a call, ct ). The other is the settlement payment to the foreign carrier (originating a call) or settlement receipt from the foreign carrier (terminating a call). Once again, the handling cost consists of three components: international transmission, international switching, and national extension. I assume that each foreign carrier has an identical handling cost when both originating and terminating a call ( cof = ctf ). In contrast, in the U.S., the handling cost of originating a call differs from that of terminating a call because U.S. local telephone companies impose different access charges for originating and terminating a call ( coi ≠ cti ).

This handling cost information is not publicly available. In 1995, however, the FCC estimated each component of the handling cost of making a call to the U.S. for major foreign countries (FCC, 1997b). By extrapolating these estimates into the past, I construct the handling cost for each foreign country for the period of 1988-1994. When I construct the first component of the handling cost (international transmission), I consider the distance between the U.S. and the foreign country, the percentage of digitalization of the main lines in the U.S. and the foreign country, and AT&T’s and the foreign carrier’s discount off-peak rates. I also consider technology development reflecting the fact that the construction costs of trans-Atlantic and trans-Pacific cable have dropped significantly.

In order to estimate the second component (international switching), the FCC employed the method developed in ITU (1995), and here I follow the same method to recover the international switching costs for 1988-1994. When I construct the last component (national extension) for each foreign country, I consider the size, investment per main line, location of the foreign country, and the foreign carrier’s basic peak rate to the U.S. For the U.S., I construct the national extension cost by adding $0.01 (an approximation of the domestic transmission cost) to the access charge.

C. Settlement Rates

There are usually two different settlement rates for each international point. One is for the peak time and the other is for the off-peak time. I could not calculate an average settlement rate with these official settlement rates here because reliable information about usage patterns over peak and off-peak times is not available. Instead, following the same approach used to construct the average prices, I obtained U.S. carrier i ’s average settlement rate for foreign country j by dividing its settlement payments by its quantity, srij = srpayij / qij . These variables should reflect existing peak and off-peak settlement rates and the usage pattern of consumers. In the same manner, foreign carrier j ’s average settlement rate srfj is srpayfj / qfj .

VI. Estimation Results and Counterfactual Experiment

A. Nash Bargaining Model

1. Profit Functions

When estimating demand equations (17) and (18), the greatest concern is that prices may be correlated with country-specific demand shocks. As stated in the previous section, I address this problem using an instrumental variable with the assumption that country-specific demand shocks uijt and ufjt are independent across countries.

Another challenge in the estimation of demand functions is that there are large differences

among foreign countries in terms of the market size. For instance, with similar prices,

the amounts of outgoing traffic to Finland and the U.K. in 1995 were 22.3 billion

and 905.6 billion minutes, respectively. The numbers for incoming traffic also show

similar patterns. If demand equations are estimated without controlling for these

differences, price variables would explain in excess the variation of the quantities

for small-market countries while explaining very little in the case of large-market

countries. The inclusion of other country-specific aggregate variables, such as GDP

and the amount of trade, may mitigate this problem but would not remove it. One means

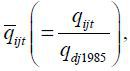

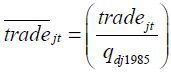

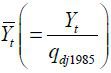

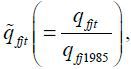

by which to avoid this difficulty is to divide each aggregate variable by market size.31 I use the amounts of outgoing and incoming traffic in 1985 ( qdj1985, qfj1985 ) as a proxy for market size. Therefore, when estimating the domestic demand equations,

I use the normalized variables

and

and  instead of qijt, tradejt, and Yt . For the foreign demand equation,

instead of qijt, tradejt, and Yt . For the foreign demand equation,

and

and  are used. I also include country dummies in each demand equation.

are used. I also include country dummies in each demand equation.

When estimating markup equation (23), I add regional dummies to each equation to capture unobserved cost differentials over various locations.

All demand and markup equations are estimated by GLS. These results are reported in Tables A2 and A3 in the appendix. Table A2 summarizes the estimation results of the domestic and foreign demand functions.32 Because I had controlled for cross-sectional variation over foreign countries with the inclusion of country dummies and the normalization of the aggregate variables, the price coefficients are nailed generically by time-dimensional variations. As expected, own-price effects are all negative and statistically significant in the domestic demand functions. I also obtain positive signs of rival prices despite the fact that one of them is not statistically significant. With regard to trade, however, I fail to obtain expected positive signs. In particular, the negative sign is even significant for the AT&T demand function. This result may be explained by the fact that the U.S. has very different relative sizes of trade to call traffic ( = trade/qd ) relative to those of foreign countries.33 In this case, estimating a common relationship between trade and outgoing traffic in an equation is doomed to be restrictive.34 I also find that improving the call quality ( QSus ), as measured by the percentage of digitalization of the main lines, has a negative impact on the demand for MCI.35

In the foreign demand equation, all variables have the expected signs. It should be noted, however, that the estimate of the price coefficient is much smaller than those in the domestic demand equations. Outgoing traffic from the U.S. and incoming traffic from foreign countries increase at similar rates. Therefore, if foreign prices decreased much more than U.S. prices during the period of analysis, that point would be explained. In fact, that is the case. Nominal prices dropped dramatically from 1988-1995 in the foreign countries. Furthermore, compared with the U.S., inflation rates were higher in foreign countries. When converting from nominal to real prices, this factor will induce even greater changes in foreign prices.

The markup equations of U.S. carriers are estimated by plugging the demand estimates into equation (22) and solving with respect to the prices:

The estimation result for the markup equation of foreign carriers is summarized in

Table A3. It shows that a change in the marginal cost has a strong effect on pricing. For

the variables representing market competitiveness  I obtain the expected signs.

I obtain the expected signs.

Using the estimation results for the demand and markup equations, I construct estimates

for the profit function  with h =1, 2, and f . When I do this, I use

with h =1, 2, and f . When I do this, I use  and

and  to recover the differences in the market size.

to recover the differences in the market size.

2. Bargaining Power Function

Table A4 in the appendix reports the estimates of  and

and  for each observation. As expected,

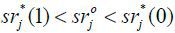

for each observation. As expected,  in 223 out of the total of 229 observations. This preliminary test may convince us

that the demand and markup equations are correctly specified in the first stage of

the estimation. When I estimated

in 223 out of the total of 229 observations. This preliminary test may convince us

that the demand and markup equations are correctly specified in the first stage of

the estimation. When I estimated  and

and  , I assumed that AT&T cannot ask for a settlement rate below its termination cost,

ct1jt . That is, ct1jt is the lower bound for the settlement rate when bargaining.

, I assumed that AT&T cannot ask for a settlement rate below its termination cost,

ct1jt . That is, ct1jt is the lower bound for the settlement rate when bargaining.

The last column ( bp1 ) in Table A4 reports the unique value of ϕ1jt for each observation which equates the solution of the maximization problem (31),

, with the observed settlement rate

, with the observed settlement rate  .36 The average bargaining power of AT&T over all observations is 0.635.

.36 The average bargaining power of AT&T over all observations is 0.635.

Finally, Table A5 summarizes the estimation results of the bargaining power function (32). As discussed earlier, AT&T’s bargaining power is expected to be low with high values of q1fj,t−1 , the relative business size of AT&T in the previous year. The estimation result confirms the expectation by showing that the coefficient of q1fj,t−1 is negative and statistically significant. All year dummies except 1991 have statistically significant, positive coefficients. Furthermore, they increase over time, meaning that AT&T’s bargaining power has likely increased continuously since 1988.

B. Counterfactual Experiment: Uniform Settlement Rate Regime vs. Individual Settlement Rates Regimes

Given the estimates of the structural bargaining model, I conducted two counterfactual experiments. Table A6 in the appendix summarizes all of the results of the counterfactual experiments. In this table, regimes A, C1, and C2 refer to the actual regime and two counterfactual regimes (Case 1 and Case 2), respectively. For the first six variables, comparisons are made for each observation and the results are averaged out over all observations. For the remaining variables, in contrast, comparisons are made with the sum of each variable over all observations.

1. Uniform Settlement Rate Regime vs. Case 1

As mentioned in Section 3, there are three differences between the actual regime and Case 1 of the counterfactual regimes: the Competition-Induced-Incentive Effect, Most-Favored-Nation Effect, and difference in the disagreement points. In the theoretical example presented in Section 3, the overall effect of the first two differences dominates that of the third difference, resulting in a higher settlement rate in the actual regime.

The experiment shows that counterfactual settlement rates are lower than the observed actual settlement rate in most observations. 37 On average, allowing individual settlement rates reduces negotiated settlement rates by 13.2% ($0.10). These settlement rate changes flow through to IMTS prices. Compared to the actual regime, the production-weighted average prices of U.S. carriers decrease by 2.6% and foreign carriers’ prices drop by 9.5% in the counterfactual regime. With these price changes, outgoing traffic from the U.S. and incoming traffic to the U.S. increase by 9% and 8%, respectively, resulting in a 15.6% increase in the amount of the traffic imbalance. While the reduction in the settlement rate and the increase in the outgoing traffic have countervailing effects on settlement payments to each other, the experiment shows that the settlement rate changes dominate the outgoing traffic changes. The settlement payments of the U.S. carriers decrease by 7.7% overall in the counterfactual regime. However, settlement receipts from foreign carriers also drop by 12%, causing little change in the net settlement payments. The net settlement payments decrease by only 1% ($74 mil.) compared to the observed net settlement payments in the actual regime. Regarding the welfare analysis, we can easily expect that consumer surplus in the U.S. would increase with the reductions of IMTS prices in the counterfactual regime. In fact, the experiment reports a 9.5% increase in consumer surplus in the U.S. Producer surplus in the U.S. also increases by 9.5% with the help of a major increase in demand.38 These changes in the consumer and producer surplus outcomes result in a 9.5% ($2.05 bil.) increase in the total surplus in the U.S.

In foreign countries, consumer surplus increases by 4% in the counterfactual regime. Producer surplus, however, drops by 14% overall. These two reciprocal changes in consumer and producer surpluses offset each other, resulting in little change in the total surplus (0.25% decrease). Interestingly, allowing individual settlement rates only has a minor effect on the foreign countries’ total surplus while providing the U.S. a very large increase in the total surplus.

2. Uniform Settlement Rate Regime vs. Case 2

In addition to allowing individual negotiation over the settlement rate, the Case 2 counterfactual regime also imposes a regulation such that all U.S. carriers are required to break off their relationships with a specific foreign carrier if any U.S. carrier cannot reach an agreement with that foreign carrier. With this regulation, the difference in the disagreement points which existed between the actual regime and the Case 1 counterfactual regime is removed; therefore, only the first two differences, the CII and MFN effects, remain as differences between the two regimes. In this sense, the second counterfactual experiment corresponds exactly to the purpose of the paper of measuring the effects of the uniform settlement rate requirement.

We can easily predict that the counterfactual individual settlement rates are lower than the actual uniform settlement rates given that the two remaining differences, the CII and MFN effects, commonly increase actual settlement rates. Furthermore, compared to the first experiment, the changes in the settlement rates would be even greater because the regulation discussed above already removed the countervailing effect from the difference in the disagreement points.39

As expected, the experimental result shows that negotiated settlement rates in the Case 2 counterfactual regime are much lower than the actual settlement rates in most observations; they are also lower than those in the Case 1 counterfactual regime in all observations. On average, allowing individual settlement rates under the above regulation reduces the negotiated settlement rates by 22% ($0.16) compared to the actual regime, which is significantly larger than the amount of the reduction in the first experiment (13.2%). As in the first experiment, these settlement rate changes decrease the IMTS prices and increase the outgoing and incoming traffic amounts, but on a much larger scale. The second experiment also reports a reduction of 6.45% ($0.45 bil.) in the net settlement payments in the counterfactual regime. The patterns of changes in consumer surplus and producer surplus in the U.S. and in the foreign countries are very similar to those in the first experiment. However, the magnitudes of the changes in the second experiment are much larger than those in the first. The total surplus in the U.S. increases by 16% ($3.43 bil.) overall in the counterfactual regime. The total surplus in the foreign countries decreases by 0.84%.

Thus far, I have estimated the Nash bargaining model, and, using estimates of the structural bargaining model, I conducted two counterfactual experiments. The second experiment shows that the costs of the uniform settlement rate requirement or the impacts of the CII and MFN effects amount to a 32.2% ($0.16) increase in the negotiated settlement rates and a 13.7% ($3.43 bil.) decrease in the total surplus in the U.S. It also imposes on U.S. carriers a 6.9% ($0.45 bil.) increase in the net settlement payments.

VII. Conclusion

In 1986, the FCC introduced the International Settlement Policy (ISP) into the IMTS market. Among other things, it required U.S. IMTS firms to pay the same settlement rate to a foreign country for the termination of international traffic [uniform settlement rate requirement]. Major motivations behind this regulation were to remove entry barriers and introduce competition into the market. However, it also significantly changed the bargaining framework for the settlement rate. Changes in the bargaining framework affect the relative bargaining positions of all IMTS carriers involved and accordingly change the negotiated settlement rate. This “side-effect” of the uniform settlement rate requirement may strengthen, weaken or even obliterate the rightfulness of the regulation, depending on its direction and size.

The counterfactual experiment reports remarkably large impacts of the uniform settlement rate requirement. Enforcing the uniform settlement rate results in an average 32.2% increase in the negotiated settlement rates and an overall 13.7% ($3.43 billion) decrease in the total surplus in the U.S. It also presents U.S. carriers with a 6.9% ($0.45 billion) increase in their net settlement payments. These results do not provide evidence against the initial implementation of the uniform settlement rate requirement. As explained in Section 2, the uniform settlement rate requirement was implemented to remove entry barriers and introduce competition into the IMTS markets. In fact, the U.S. IMTS markets became increasingly competitive after the imposition of the requirement. In order to evaluate the requirement fairly, the analysis should include not only its costs but also the benefits it generates. However, the benefit side of the requirement was not analyzed in the paper, as the paper focused solely on the cost side.40 Therefore, the large negative impacts of the requirements shown in the counterfactual experiments can lead us to biased and unbalanced implications against the implementation of the requirements in the late 1980s and early 1990s, when the intended competition effect arose largely through the requirements. However, the findings in the counterfactual experiments serve as strong evidence against the continuation of the requirement during the 1990s and early 2000s, as by 1992, entry barriers were removed from the market for all main foreign countries and three or more U.S. companies competed in the market, which can be interpreted as evidence that the benefit of the requirement was fully exhausted after that time.

The analysis in this paper exemplifies how important ex-post evaluations of regulations are. In Korea, however, ex-post evaluations of regulations are generally poor. In the context of Korea, some policy measures would be important to strengthen ex-post evaluations of regulations. First, when preparing a Regulatory Impact Statement for a newly created or reinforced regulation, it should be required that the ex-post evaluation plan for the regulation be as specific as possible. A plan for who and when to conduct an ex-post evaluation and under which criteria should be specified, and it is of the utmost importance to specify the data necessary for the evaluation and how to compile the data.41 Requiring a detailed ex-post evaluation plan not only allows ex-post evaluations to be carried out effectively but also increases the likelihood that a regulatory impact statement will be properly drawn up in advance. The second way to strengthen ex-post evaluations of regulations is to substantiate the operation of the sunset system currently in effect.42 In Korea, every year thousands of regulations reach the sunset stage, but human and material resources for the government are clearly inadequate to conduct in-depth ex-post evaluations of all of these regulations. Therefore, it will be much more efficient and effective to select 3-5% of the regulations which reach the sunset stage as ‘major regulations’ through consultations between the Office for Government Policy Coordination in charge of regulation management and each ministry, and to carry out in-depth ex-post evaluations on only those major regulations while carrying out simple ex-post evaluations of the remaining regulations.

Appendices

APPENDIX

A. Tables

TABLE A1

VARIABLE DESCRIPTIONS AND SAMPLE STATISTICS 1988-1995

Note: USD is real. Base year is 1995.

Source: FCC (1985-1995; 1997a; 1997b; 1998; 2001); IMF (1996-1997); ITU (1995); OECD (1990-1997); TeleGeography (1995); World Bank (2003).

TABLE A2

ESTIMATIONS OF DOMESTIC AND FOREIGN DEMAND FUNCTIONS

Note: 1) Table (A) and Table (B) summarize the estimation results of demand functions with and without instrumental variables, respectively, 2) When estimating domestic demand functions, q1, q2, trade, and Yus are normalized by qd1985 , 3) When estimating domestic demand functions, qf , trade, and Yf are normalized by qf1985, 4) Coefficient estimates for country dummies are omitted from the report.

TABLE A4

ATT’S BARGAINING POWER

Note: 1) 𝑠𝑟∗(1) is the optimal settlement rate when AT&T has full bargaining power, 2) 𝑠𝑟∗(0) is the optimal settlement rate when the foreign carrier has full bargaining power, 3) 𝑠𝑟o is the observed settlement rate, 4) bp1 is AT&T’s bargaining power, satisfying the equation, 𝑠𝑟∗(⋅) = 𝑠𝑟o. Portugal (1988), Sweden (1989; 1990; 1992), and Australia (1990; 1994) are dropped from this table as they do not satisfy the constraint of 𝑠𝑟∗(1) < 𝑠𝑟o < 𝑠𝑟∗(0).

TABLE A5

ESTIMATIONS OF BARGAINING POWER FUNCTIONS

Note: Coefficient estimates for country dummies are omitted from the report.

TABLE A6

ESTIMATIONS OF BARGAINING POWER FUNCTIONS

Note: 1) The average of sri and the average of pi are the production-weighted averages of U.S. carriers 1 and 2, respectively, 2) srrec denotes the settlement receipts from foreign carriers, 3) Fifteen observations which generate negative demand for MCI are excluded from the counterfactual experiment.

B. Derivation of Marginal Cost Functions

For U.S. carrier i , the total cost of sending qij minutes to country j and terminating  minutes from country j is

minutes from country j is

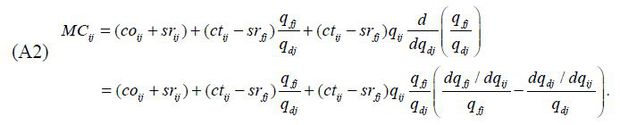

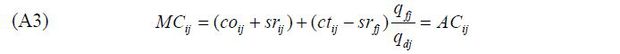

Then, the marginal cost is

By adding some assumptions with regard to  and

and  such that

such that  that is,

that is,  is constant, the marginal cost is

is constant, the marginal cost is

For foreign carrier j , the total cost of sending qfj minutes to the U.S. and terminating qdj minutes from the U.S. is

For simplicity, I assume that the elasticity of qij w.r.t. qfj is equal to 1; that is,  The foreign carrier j ’s marginal cost is then

The foreign carrier j ’s marginal cost is then

Notes

Some analysts justify regulatory discrimination between terrestrial and paid channels based on the high viewership of terrestrial broadcast channels. However, in 2017, the viewership of J-TBC, a paid broadcast channel, surpassed that of MBC, a terrestrial broadcasting channel.

A MVNO (Mobile Virtual Network Operator) does not have a communications network and provides mobile communications services by borrowing the communications networks of MNOs (Mobile Network Operators).

Most countries that enforced regulations on MVNOs abolished regulations five to six years after the introduction of regulations intended to activate competition in the mobile market. Except for the UK and the Netherlands, these countries have MVNO market shares of around 10% as of October of 2016, lower than Korea's MVNO market share as of May of 2017 (European Commission, 2017a). Spain abolished its wholesale obligations for MVNOs in 2016, at which time their total market share was 10.7% (European Commission, 2017b).

Because negotiated accounting rates have been equally divided between two firms involved in almost all cases, we may define the settlement rate as one half of the negotiated accounting rate.

From the U.S. viewpoint, an international call from the U.S. to a foreign country is ‘outgoing’ traffic and a call to the U.S. is ‘incoming’ traffic.

Although the main contribution of the paper is that it provides a good case study of ex-post evaluations of regulations, a couple of contributions can also be found in the methodology of estimating a bargain model. For example, my bargaining model is unique in the sense that product market competition is explicitly embedded in the bargaining model. Additionally, when estimating the bargaining model, I take a two-step approach, initially estimating the profit functions and then, by plugging the profit function estimates into the bargaining model, estimating the remaining bargaining power function, which allows for great flexibility in the functional form when specifying the bargaining power function. These points will be apparent in the main part of the paper.

Because U.S. outgoing traffic outnumbers U.S. incoming traffic for almost all foreign countries, historically foreign carriers with monopoly power have engaged in ‘whipsawing’ behavior; that is, they have ‘manipulated traffic flows’ and ‘retained a greater percentage of the accounting rate’ in order to obtain a higher settlement rate (FCC, 2001). Thus, the second and third requirements of the ISP are natural responses to the above-cost settlement rates.

The U.S. carriers’ partners in international facilities are largely monopolistic, and these monopolists are most comfortable with traditional practices which tend to favor incumbent carriers, including AT&T (FCC, 1996).

In 1992, MCI’s and Sprint’s market shares based on net revenue were 19.8% and 7.5%, respectively (FCC, 1998).

Pricing competition appears to be more appropriate than quantity competition when characterizing the IMTS market. Qualitative results of the model do not change when we characterize product market competition as a quantity game.

Although the main reason for assuming this is computational ease, this assumption

may not be unrealistic. The existence of “reciprocity” in international telephone

traffic, that is,  has been commonly surmised among researchers. Appelbe et al. (1988) show the existence of reciprocal calls using traffic data between the U.S. and Canada.

has been commonly surmised among researchers. Appelbe et al. (1988) show the existence of reciprocal calls using traffic data between the U.S. and Canada.

The U.S. has more outgoing traffic than incoming traffic at almost all international points. Factors such as the large U.S. population, the high per capita income of U.S. consumers, low U.S. calling prices, and numerous immigrant populations contribute to greater U.S. outgoing traffic flows (FCC, 2002).

pf is likely to be affected by the settlement rate. The main reason for assuming a fixed pf is to make the model analytically tractable. Considering that nearly all foreign firms have been state-owned firms, however, this assumption may not be very restrictive as state-owned firms may have objectives other than profit maximization. For example, they may try to boost the consumption of IMTS by maintaining a low price. In such a case, the price may not reflect any change in the settlement rate.

In the model considered by Rubinstein, the bargaining takes place over time according to a predetermined procedure of alternating offers and responses of both parties.

The disagreement point is also referred to as the status quo or the threat point depending on the context considered.

The FCC may impose this regulation to improve U.S. carriers’ bargaining positions. In the context of an underlying dynamic game, this regulation is interpreted as requiring both domestic firms to suspend their business with a specific foreign firm until both domestic firms reach an agreement with that foreign firm.

In the context of underlying dynamic game, this assumption is interpreted as the interdependent relationships between the domestic firms and the foreign firm being suspended until firm 1 and the foreign firm reach an agreement.