- P-ISSN 2586-2995

- E-ISSN 2586-4130

The primary goal of this paper is to explore the microeconomic foundation of Korean firms’ adoption of foreign technologies. The paper also reviews the overall trend of international technology transfers to Korea. The period covered in this paper is Korea’s high growth era, from the 1960s to the 1990s. The works of this paper center on the two questions of what characterizes foreign technologies which had been imported through licensing contracts, and which driving forces expedite technology adoption by firms. The Korean experience provides the context of success in the catch-up growth. The co-movement of technology imports with capital goods imports manifests Korea’s effort to improve the technical efficiency toward the world frontier. Underlying this trend are firms’ decisions to adopt new technologies. The paper shows that firms respond proactively to wage increases by adopting newer technologies and thus, in turn, increasing employment, which implies the existence of a virtuous interactive mechanism among these factors.

Korean manufacturing firms, catch-up growth, international technology transfer, technology adoption, microeconomic analysis of economic development

O12, O14, O33

The effective utilization of foreign technologies is of critical importance for economic growth because, as stated by Keller (2004), for many countries, “Foreign sources of technology account for 90 percent or more of domestic productivity growth.” The existence of foreign technologies offers opportunities for catch-up growth, but the effectiveness critically depends upon recipients’ efforts with regard to the learning and assimilation of imported technologies. The interplay between imported foreign technologies and intensive domestic efforts is common among successful late industrializing economies. The use of foreign technologies is as important for advanced economies as it is for developing countries, as tapping into the world technology pool offers a better chance of success than solely relying on domestic sources.

The experience of Korea is a good case for the role that foreign technologies can play in promoting economic growth in developing economies. As Lall (2003) shows, compared with other high-growth Asian developing economies, Korea’s development path is distinctive in her strategy to raise indigenous enterprises by assimilating foreign technologies. Korea’s path to build indigenous technological capabilities by promoting domestic firms had been more costly than the path of, for instance, Singapore, which had relied heavily on foreign direct investment and multinational enterprises. However, Korea’s path was as effective as the FDI path in the long-run, as the country has realized a superb national innovation system. Presumably, the success of the Korean path crucially depends on the efficiency of the adoption process and the effectiveness of the assimilation of foreign technologies.

The primary goal of this paper is to explore the microeconomic foundation of Korean firms’ adoption of foreign technologies. In order to set the context of exploration, the paper also reviews the overall trend of international technology transfers to Korea. As the interplay between foreign technologies and domestic efforts comprises a major part of the evolutionary process of Korea’s innovation system, research focusing on technology adoption will unveil clues about the sources of sustained economic growth. In order to organize the study, the works of this paper will center on the two questions of what characterizes foreign technologies which had been imported through licensing contracts, and which driving forces expedite technology adoption by firms.

As the World Bank observed in a recent paper (Correa, Fernandes, and Uregian 2010), microeconomic evidence of the determinants of technology adoption in developing countries is scarce mainly due to data limitations.1 This paper also faces a similar data problem. The data in this paper are compiled from official reports from the government and from certain surveys done by public organizations. Because it was originally produced for the purpose of, among other purposes, monitoring the process of international technology transfer, the data lacks a considerable amount of important information which is essential for an empirical analysis. In addition, modeling strategies in empirical research are constrained by data limitations. As the adoption and diffusion of technology is a time-intensive and dynamic process, theoretical models need reflect such aspects explicitly. However, because data used in a regression analysis is collected from cross-section survey results, it has many shortcomings. A heuristic approach in which the entire sample is divided into groups with different temporal aspects was used as a compromise. This method is discussed further in section III.

The paper is composed as follows. Section II will make a brief survey of the literature on technology adoption and diffusion across national borders. Of the numerous studies in this area, the literature survey will summarize the key results of economic studies. Section III will review the general trends in the area of international technology transfer to Korea from the early 1960s to the late 1990s. The covered period is a high-growth era during which Korea successfully pursued state-led industrialization. The main research objective here is to determine the roles of imported technologies and how effectively the imported technologies were used. Section IV investigates the microeconomic foundations of technology adoption by firms. Despite the data limitations and the use of a static model as an analytical framework, this study is expected to shed light on the factors and/or mechanisms that influence adoption decisions by firms. Because theories of technology adoption and diffusion are believed to be well established, a standard summary of the literature is appended after the main text. Section V concludes the paper.

Before going into the main arguments, a qualification of the term ‘technology imports’, abbreviated as TI, as used in this paper is in order. TI in section III is an English translation of Gi-Sul-Do-Ip, a Korean word which means “international technology transfer from abroad in the form of a business contract.” Technology adoption also roughly corresponds to an English translation of Gi-Sul-Do-Ip. Given that it better highlights firms’ decisions to choose new technologies, technology adoption is used in section IV.2

Technology adoption and diffusion3 is a significant research area covering a broad range of disciplines. According to Rogers (1995),4 the early application of a diffusion research approach can be found in anthropology in the 1920s and communications research in the 1940s. Rapidly expanding to various disciplines during the 1950s and 1960s, Rogers (1995) states, diffusion research achieved the status of Kuhn’s research paradigm in the 1990s. Although some fields of research matured, the rapid advance of new technologies generates new themes and thereby makes diffusion research ever more active and expanding. Searching with keywords such as diffusion, adoption, innovation and transfer, Sriwannawit and Sandstrom (2015) identified 6,811 publications in the area of diffusion research over the period of 2002-2011. Today’s diffusion research covers a broad range of disciplines, from biology and ethnology and to economics, with many overlapping research subfields.

In economics, diffusion research has been used as a means of understanding sources of technological change and productivity growth. Diffusion research in economics can be broadly classified into two groups: firm- or industry-level studies and cross-country studies. Early efforts in economic research primarily sought to understand firms’ technology adoption decisions. Since the 1990s, a variety of research has emerged in which the issues addressed are considerably broader (Keller 2008). Early micro-studies ascertained s-shaped diffusion curves and factors affecting the speed of diffusion, and the research framework extended to macro-studies of international technology diffusion. The increasing difficulty facing micro-studies in collecting appropriate data is a partial reason for the prominence of macro-studies in recent years (Comin and Mestieri 2014).

Table 1 summarizes the key findings from prior economic studies of technology diffusion. The literature cited in Table 1 is highly selective, only including review papers or seminal works on the subjects. Early studies conceived the analytical framework as the decisions made by firms, based on cost and expected benefits, regarding whether to adopt an innovation. Mansfield (1982) emphasized the significance of resource costs in international technology transfers. More than a physical investment project, the decision to adopt a type of innovation is accompanied by an uncertain stream of future benefits. In general, firms expecting greater benefits from technology will adopt more rapidly (Jensen 1982), and large firms that are positioned to cope better with future uncertainties as well as riskloving firms are more likely to adopt earlier (Davies 1979; Reinganum 1983). Research findings also show that firms with greater human capital and more experience tend to adopt earlier while firms with a multinational scope also hasten their adoption of new technologies (Benhabib and Spiegel 2005; Geroski 2000).

Source: Comin and Mestieri (2014), Galang (2014), and Keller (2004).

In cross-country studies, research has usually been concerned with the barriers and facilitators of international technology diffusion. Among the key research issues are through what channels and to what extent knowledge and technologies are internationally transferred. Trade openness and lower barriers to international trade are in general known to facilitate international technology diffusion (Keller 2004), as firms exposed to foreign competition tend to adopt newer technologies. But technology transfers across borders are generally imperfect with any means of transfer; codified knowledge can relatively easily cross borders, but the tacit dimensions of knowledge are not simple to transfer internationally. Consequently, the effective transfer of, in particular, tacit knowledge, depends on the intensity of the recipient’s learning efforts (Caselli and Coleman 2001; Benhabid and Spiegel 2005). Moreover, history matters in international technology diffusion (Comin and Mestieri 2014). One related issue is the implication of localized knowledge spillover in technology diffusion; studies show that geographical proximity to innovation sources promotes technology adoption (Keller 2002). Recent studies also show that the grip of geography is weakened, as advances in ICT substantially lower the transaction costs between regions (Keller and Yeaple 2013).

Unlike research results pertaining to other drivers of international technology diffusion, research on the role of foreign direct investment in international technology diffusion shows mixed results. Blomstrom and Kokko (1998) surveyed the research on technology spillover effects of the activities of multinational firms and concluded that there is no comprehensive evidence of the exact nature or magnitudes of these effects. Lipsey and Sjoholm (2005) report more positive results of foreign direct investment on technology spillovers. This paper pays special attention to the role of foreign direct investment with regard to international technology diffusion, as the issue is closely related to a country’s technologystrategy for industrialization.

Based on the combination of domestic capability building and the attraction of multinational enterprises’ production chains, Lall (2003) classified four technology strategies in industrialization among East Asian countries. The autonomous strategy pursued by Korea and Taiwan was based on the development of the capabilities of domestic firms, selectively restricting foreign direct investment (FDI) and actively encouraging technology imports in other forms. The autonomous strategy is clearly different from the FDI-dependent strategies pursued by Singapore and Malaysia in that FDI had been actively promoted as an important policy priority. China and India could leverage large domestic markets to upgrade their import-substituting industries (ISI) along with their global supplier networks. These countries used as the main policy tools trade liberalization and strong export incentives, but they lacked such a coordinated industrial policy as pursued as part of the autonomous strategies of Korea and Taiwan.

Figure 1 shows the differences among these countries in terms of foreign direct investment as a percentage of GDP and technical tertiary enrolment as a share of the population. The latter is used as a proxy indicator of domestic technology capabilities. Korea and Taiwan, which pursued an autonomous strategy, showed very low levels of FDI and high levels of technical tertiary enrolment. Singapore, which that pursued an active FDI-dependent strategy, shows the opposite pattern to Korea and Taiwan, while other countries lie between these two groups of countries.

Note: Technical tertiary enrollments are as of 1995; foreign direct investments are annual average of 1994-1997.

Source: Lall (2003).

The advantage of the FDI-dependence strategy is that it allows, as Lall (2003) noted, the bypassing of “the slow and arduous process of building domestic capabilities.” Trade and investment in those countries with high FDI are closely related to the activities of multinational enterprises (MNEs). MNEs in general are technologically advanced, with spillover from MNEs being an important source of technological learning for host countries. It is crucial to create a favorable environment for MNEs to undertake more advanced, state-of-the-art activities. Collaboration between MNEs and domestic institutions, including business enterprises, is strongly encouraged, but the outcome of this strategy is mixed, as noted in the previous section. The positive spillover effects from MNEs and FDI frequently fall short of expectations.

Korea did not tread this path. Instead, domestic companies are the main actors for building indigenous technological capabilities. However, it is very costly and time-consuming for developing countries to climb the technological ladder. According to the product life cycle theory, the manufacturing process of various products generally moved overseas only after exporting opportunities of products became limited and the core product technologies reached a mature stage in their development and application (Simon 1991). As shown below, the majority of technologies transferred to Korea were already matured, which implies that product markets are also matured and very competitive. Hence, the key to successful industrialization for Korea lies in the country’s ability to take advantage of product life cycle characteristics by relying on mature technologies to manufacture products that are sufficiently cost-effective to compete in both domestic and overseas markets.

Selectively restricting foreign direct investment, Korea had encouraged technology imports in other forms. The importation of capital goods embodies the technology and know-how of machine producers. Arm’s-length licensing contracts between business enterprises are also popular as a means to trade technologies. Joint ventures, research contracts, reverse engineering, and copying are all possible ways to learn and transfer technologies. Korea has utilized all of these channels.

Out of various channels of technology transfer, this section focuses on what is known as technology imports (TI) in Korea. This is done for two reasons. First, TI highlights the role played by the Korean government in promoting industrial and technological upgrades. Until the late 1980s, the importation of foreign technologies was tightly controlled by the government. A shortage of foreign exchanges to pay for TI was the main reason behind this government control. However, the intervention into TI transactions enabled the government to steer industrial development in a way which fit the national development plan.5 Second, because the goal of Korea’s industrial policy was to build a ‘self-sufficient industrial base’, which meant to raise domestic companies rather than relying on foreign, multinational companies, effective learning through the importation and assimilation of foreign technologies was a key to accomplish this goal. An analysis of the TI record can unveil the process of the interaction between foreign technologies and indigenous learning efforts.

From 1962 to 1996, the total number of technology imports stands at 9,621 cases6 (See Table 3). As the process of industrialization deepens, the number of TI contracts increases very rapidly, peaking during the period of 1987-1991. As the numbers increased, the payment amounts also continuously increased. Because many contracts contain multi-year payments, the royalty payment amounts increased further, even after the peak in the number of contracts. In addition to the number of contracts and the amounts of royalty payments, official TI records contain information on countries of origin, industrial classifications, and brief descriptions of the technologies. In terms of payments until 1996, 51% were paid to US companies, and 32% to Japanese companies. The U.S. and Japan were the major sources of technology to Korea. An interesting classification is ‘types of technologies’, which classifies the contents of contracts into the five technologies of technical information,7 technical assistance,8 patents, brands, and other types of industrial properties. According to a report published by the Korea Industrial Technology Association (1988), out of 2,407 TI contracts made between 1983 and 1987, 94% of them were made to secure the provision of technical information, whereas 85% contain clauses pertaining to the provision of technical assistance. In addition, the allowance of use of patents and brands accounted for 47% and 23%, respectively. The fact that the majority of TI contracts contain provisions for technical information and technical assistance implies that international technology transfers involve a process of learning and building technological capabilities.

The increasing trends in the numbers or amounts of TI hint at an increasingly important role played by foreign technologies in Korea. However, the official records in the Annual Report on Technology Imports are limited in providing further information on how these imported technologies were utilized. In order to address this issue, it is necessary to find other sources of information. The most direct means of doing this is to search for evidence of how imported technologies were utilized by the companies that entered into TI contracts. A report produced in 1980 stemming from collaborations among three institutions is a good example of this – a very detailed exploration of how imported technologies were used by firms.9 Another technique is to rely on secondary literature on the themes on TI in Korea. There are a few reliable studies on this. Reports published by three organizations are worth mentioning:10

The Korea Productivity Center (1985): One of the earliest studies of the effect of TI - the main objectives of this study were to identify difficulties faced by Korean companies that had entered into technology licensing contracts with foreign companies and to help them overcome the problems. An analysis was done based on firm-level surveys. Survey questionnaires were sent by mail to 874 companies that had signed TI contracts for the period of 1962-1984. The mail surveys, composed of responses from 287 companies, were complemented with additional visits to conduct interviews with key people at 36 companies.

The Korea Development Bank (1991): Commissioned by the Ministry of Finance, the KDB conducted the most comprehensive study of the effect of TI. The main part of the study is composed of detailed case studies of the development of technologies in the following ten industrial sectors: electronics, electricity, machinery, chemicals, textiles, materials, ceramics, shipbuilding, pharmaceuticals, and food. The case studies were complemented with mail surveys, the design of which is based on previous works by KPC and KITA. Mail questionnaires were sent to 1,669 companies that had imported foreign technology in the 1980s. In this case, 821 companies replied to the mail surveys. Site-visit interviews at 131 companies were also conducted.

The Korea Industrial Technology Association (1995): KITA has conducted many surveys. A survey in 1988 assessed 1,080 cases out the 1,408 TI contracts written between 1984 and 1986. The 1988 survey received 432 valid replies. It was generally similar to KPC (1985) in terms of the survey questionnaires, but KITA continued the survey, at three to five year intervals, until the mid-1990s. The 1995 survey is the last in the series. The target of the 1995 survey was 1,670 TI contracts written over the period of 1992 and 1994. The mail survey received 493 valid replies. Although not as comprehensive as the KDB survey of 1991, The KITA survey of 1995 is valuable because it contains the latest information on TI in the early 1990s.

Based on surveys of these three organizations, we devise and answer three questions about the characteristics of TI and its effects on technological developments in Korean industries.

All of the surveys cited in Table 4 contain a question about the reasons why the companies opted for importing foreign technologies instead of developing in-house technologies. Out of five answers, the lack of in-house development capabilities accounts for a large share in explaining the reason of TI, at 55% in 1985, 35% in 1991 and 38% in 1995. Reduction of costs and the shortening of technology development time were other main concerns; 20% of companies in the 1985 survey noted these as the main reasons, with 34% in 1991 and 39% in 1995. Only around 10 percent of companies indicated a risk and uncertainty in technology development and improved external credibility as reasons behind technology imports. It is important to note that opposite trends arose between the first and second most important reasons. Over time, companies increasingly place much emphasis on cost reductions and on saving time as the main reasons to pursue TI, because as companies accumulate technological capabilities, they tend to be concerned more with the cost and time elements of technology development.

Note: Number of responses in three surveys, KPC (1985) = 287; KDB (1991) = 1,567; KITA (1995) = 440.

The speed of international technology transfers or diffusion is important because it affects how rapidly follower countries can catch up with frontier countries. A higher speed of technology transfer means a greater chance of catching up. The time lag in the trans-border movement of technology generally becomes longer between advanced and developing countries than it is for countries with similar levels of economic development. Product life cycle theories postulate a typical pattern of international technology transfer with significant time lags according to the level of economic development. Technologies invented in an advanced country initially move to other countries in similar economic conditions and then later to developing countries that are insufficient with regard to capital and skills.11 From a sample of 31 US-based firms, Mansfield et al. (1982) provide evidence of the number of years between technology transferred overseas and its introduction in the United States. According to them, the age of technology transferred overseas ranges from 5.8 years for an overseas subsidiary in a developed country, 9.8 years for an overseas subsidiary in a developing country, and 13.1 years for licensing or joint ventures. The evidence, consistent with the theory of product life cycle, clearly shows that technologies flow last through licensing or joint venture channels.

Note: KPC (1985) does not contain this question.

Reports from the KDB and KITA discuss how much time passes after imported technology is developed in a foreign country. Because the years are grouped, precise averages are not possible. For the KDB survey, more than half of technologies are aged less than ten years. The imported technologies are younger in the KITA report of 1995, with 45% of imported technologies being less than five years old. With only these two survey results, it is too early to conclude that the time lag of technology between Korea and foreign countries is shortened. However, it is clear that the average number of years of Korea’s imported technologies is much shorter than in the findings by Mansfield et al. (1982).

In addition to the question of the age of technology, the Korean surveys included an interesting item which showed the differences in the stages of technology development in Korea and in advanced countries. The KDB survey divides the life cycle of technology into the four stages of introduction, growth, maturity, and decay.12 Each company was asked to check, at the time of importation, at which stage of the life cycle the technology is in Korea and in advanced countries. The survey results found that in Korea, 82 percent of imported technologies were at the stage of introduction, 15 percent were at the stage of growth, and 3 percent were at the stage of maturity. For the life cycle stages of those imported technologies in advanced countries, 11 percent were at the stage of introduction, 31 percent were at the stage of growth, 55 percent were at the stage of maturity, and the remaining 3 percent were at the stage of decay. The difference in the stages of the technology life cycle indicates the existence of a technology gap between Korea and advanced countries, as measured in terms of imported technologies. The KDB survey results are reproduced in Figure 2. The figure shows the existence of a striking technology gap between Korea and advanced countries. It also suggests that imported technologies could be a means to narrow the gap.

The KDB survey contains a very interesting and important section on the use of imported technologies. In order to understand how those imported technologies are used, the survey divided the stages of TI use into the following three areas:

Primitive stage of application: Under the guidance of the supplier company, imported technologies are applied on site. The solution to technical problems mostly relies on the supplier company.

Intermediate stage of digestion/absorption: As the technical guidance of the supplier company is becoming complete, engineers make use of the imported technologies. The accumulation of technological capabilities proceeds at this stage.

Mature stage of improvement/development: Technological capabilities are accumulated such that they are sufficient to develop new products or create technological innovations. When the needs of technology imports arise, core technologies are selectively imported. This allows a company to move up the technology ladder.

The survey shows that as more time elapses from the year of TI, more imported technologies are modified, improved, or become a source of innovation. For those 140 technologies that imported in 1990 (hence, only a year had elapsed from the time of the TI), 52% are at the primitive stage of application, 31% at the intermediate stage of absorption, and 17% at the mature stage of improvement. For those 566 technologies that imported from 1980 to 1985 (hence, roughly 5 to 10 years had passed since the time of TI), only 8 % remained at the primitive stage of application, whereas roughly half of technologies are improved or led to a new innovation. The survey results demonstrate that most imported technologies are well absorbed and assimilated, leading to substantial improvements as compared to the original forms. Narrowing the technological gap between Korea and advanced countries cannot be accomplished only by importing advanced technologies. Narrowing the gap requires a substantial amount of effort by the importing country. Imported technologies are adapted and assimilated. As noted in the replies of nearly two thirds of Korean firms in the KDB survey, imported technologies are adapted and assimilated during the application process.

Note: Numbers in parentheses are cases of TI made during the year.

Source: KDB (1991).

Using the survey data introduced above, this section will explore the microeconomic foundation of technology adoption. The equilibrium model of technology adoption is used as the research framework, as it is a convenient tool for organizing diverse aspects of technology adoption and diffusion. However, the model must be modified when applied to the survey data in this paper. This section will discuss this in detail. Considerations of factors affecting technology adoption are the standard examples taken from previous studies, except for discussions about the production structures. These are all appended after the main text. Empirical findings will be offered with discussions about the implications of the estimation results.

Starting with the stylized facts expressed by the sigmoid diffusion curve, theories on technology adoption and diffusion aim to identify the underlying mechanisms and factors which explain the diffusion process. This paper posits a firm’s technology adoption behavior as a choice problem with the assumption of profit maximizing at an instantaneous moment of time. Accordingly, econometric specification is framed as a probit model of technology choice in a static setting, a variation often known as the equilibrium threshold model of technology adoption.13

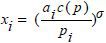

Firms in equilibrium are assumed to differ in certain characteristics, xi, affecting the probability of adopting a new technology. As Geroski (2000) states, the trick with equilibrium models of technology adoption is to identify the relevant characteristics xi. The firm adopts the technology when xi exceeds a certain threshold level x*. The probability of firm i adopting a new technology when xi exceeds x* can be expressed as follows (notation from Besley and Case 1993),

Probability {adoption by firm i} = φ(γxi / σu),

where Φ is a distribution function of the gain of firm I; the gain of the new technology for firm i is parameterized as γxi + ui , in which ui denotes the ex-ante disturbance shock. In the empirical analysis below, the distribution of the disturbance terms is assumed to follow either a normal or logistic distribution, which produces a probit or a logit model respectively. The coefficients from the logit and probit model estimations are not directly comparable, as they are scaled differently. However, because the curvatures of the normal distribution of the probit and logistic distribution are similar apart from the fact that the logit model has fatter tails, the estimation results are not statistically significantly different.14

Because the adoption behavior and diffusion process does involve consideration of the current profit due to the use of the new technologies or the future stream of the expected benefits, the adoption and diffusion process is dynamic in nature. Therefore, applying the probit model in a static setting requires some explanation. One reason is related to the data problem. An ideal approach to modeling adoption behavior is to specify explicitly the dynamic process with the data set suited as such. The data of this paper is far from ideal; it is compiled from a one-time survey of a cross-section of firms that entered into licensing contracts with foreign suppliers. Moreover, the survey questionnaires are lacking many important issues that were required if they had been designed to study adoption behavior. Consequently, the data set is plagued with shortcomings which cannot meet the requirements outlined by Besley and Case (1993). Facing this limitation, the paper opted for the creation of a parsimonious model of adoption behavior based on a short-run, or instantaneous, profit maximization assumption.

The question therefore becomes how well the static model can explain the dynamic process of technology adoption. The model assumes that in response to price changes, firms can reshuffle their production structure so as to maximize profit, with the resulting outcomes reaching Pareto optimality. As the production function itself can move out when the factor price ratio changes, the modeling of profit maximization requires dynamic considerations of changes in technologies. Therefore, a static model can provide a snapshot of technology adoption out of a long-term dynamic process. Moreover, it is difficult to distinguish an instantaneous response from a long-run adjustment. One way to cope with this limitation of a static model is to check the sensitivity of the estimation results with separate regressions, with the criterion of the separation of the entire sample into entries that contain temporal changes. This may be an empirical counterpart to the comparative static approach in economic theory.

Data

Variables are selected from the KDB survey. The selection is indeed a result of a compromise between data availability and theoretical requirement, as the KDB survey does not contain many important variables, such as the prices of technologies. The survey questionnaires are mostly composed of multiple-choice questions; hence, the result is what is called categorical data. These categorical data are used as dummy variables. Table 4 provides a summary of the data with brief statistics.

The dependent variable is “year(s) elapsed since the initial time of invention.” The survey offers six answers with one choice: 1) within a year, 2) 1~3 year(s), 3) 3~5 years, 4) 4~10 years, 5) 10~20 years, 6) more than 20 years. It is assumed here that firms choose technologies out of time streams. In other words, firms can choose either newer or older technologies, depending on their attributes, with the assumption that newer technologies are better than older ones.15

Explanatory variables are composed of six groups. The first group contains variables related to the production structure. Capital intensity, defined as total assets divided by the number of employees, wage per employee, and sales per employee, are used in the regression. These three variables are not compiled directly from the survey but are added by the surveyor based on the KDB’s own information about Korean manufacturing firms. The addition after the survey resulted in many missing values in these variables. The values of these three variables are positive and continuous, and they are transformed into logarithms in the estimation.

The remaining five groups of variables are all taken from the survey results. Because the questionnaire items are composed of multiple-choice questions, the variables are all transformed into dummy variables.

Firm attributes are composed of three variables. A large firm variable takes a value of 1 if the firm is registered as a large enterprise and 0 if it is a small or medium-sized enterprise. A domestic firm variable has a value of 1 if the firm is a domestic firm, 0 if it is not, such as a multinational firm or a joint venture. The R&D Lab variable asks whether the firm has a R&D laboratory, with a value of 1, or if not, with a value of 0. The R&D Lab variable is a proxy for a firm’s level of competence, as discussed as a demand determinant in the appendix. The higher the competence is, the quicker the expected adoption will be. The large firm dummy can be interpreted as an institutional factor. The role played by foreign firms in technology transfers has been one of key research and policy issues. As explained in section II, the empirical evidence shows mixed results.

Three variables compose a group called ‘market conditions’. A survey questionnaire asked whether the firm had contacted any other firms before the actual contract, with the answer of either yes or no. This information is used as the Prior contact dummy variable. The Prior contact variable has many connotations. It can imply the existence of a technology market where arm’s-length technology transactions occur, it can imply an extensive search effort by firms to find the right partner for a technology transaction, or it suggest the existence of a stable relationship between a licensor and a licensee. With the survey data, it was not possible to distinguish among these; most likely it would be safe to that assume of all these exist. In contrast, the other two variables are easier to interpret. A survey item asked whether the imported technology or a similar form already existed domestically at the time of adoption, with one choice out of five possible answers. The case of domestic non-existence is denoted as the No Existence variable with a value of 1. The Existence variables took a value of 1 when both the adopted technologies and similar forms, implying the potential for replacement, already existed. In addition to a literal interpretation of these two variables, they also show the degree of competition.

All records on technology licensing contracts until the late 1990s contain an entry to fill in regarding which types of technologies are imported. The record template denotes five types: the provision of technological information, the provision of technical assistance such as technical training and the dispatching of experts from the licensor, the allowance of using a patent, the allowance of using a product brand, and the allowance of using other types of industrial property rights. The contract includes at least one of these five types. Excluding the last one, I constructed four dummy variables.

Two countries of origin are included, with the expectation that different origins would result in different adoption behavior. As shown in the estimation results, no differences were found. Industries in the KDB survey are classified into ten types. Three major industries which comprise 65 % of the sample are included as dummy variables. These include chemical, electronics and machinery firms. Industry dummy variables are expected to show the effect of industrial specificity on echnology adoption.16

Empirical Strategy

The threshold model of technology adoption specifies that firms decide to adopt a new technology when their attributes exceed a certain threshold level. The threshold model can be translated into a regression model, where the result of the decision is regressed on the influence of covariates or explanatory variables. The dependent variable is the result of the decision, but the observed counterparts to the result serve as categories.

The choice decision of a firm can be posited as an ordered choice model. The ordered choice model specifies a latent regression y* = γxi + ui with the observed counterpart to y*, as follows:

In the above specification, the μ variables are free parameters, where the unit distance between the set of the observed values of y does not carry any significance. Assuming that the variance of the disturbance terms follows a logistic distribution posits the estimation equation to be an ordered logit regression equation.17

In the threshold estimation model, the firm’s choice problem is modeled as an atemporal one. The atemporal estimation model is based on the assumption that firms select technologies out of time streams and that newer technologies are better, as is explained above with regard to the dependent variable in the data section. The assumption is valid when technologies are not monopolized or alternatives to monopolized technologies exist, as in this case, firms can choose out of many options. The KDB survey contains questions which attempt to check this issue. It asked whether the licensor is a monopoly of the imported technology; 201 replies answered positively, and from those, 37 reported the existence of alternatives. From this information, we can infer that 90 percent of imported technologies in the KDB survey are either non-monopolized, or alternatives exist. Based on this observation, the ordered choice model is applied rather than the duration model in which firms make temporal decisions.

The threshold model in this paper intrinsically contains a sample selection problem, as only those firms that imported technologies are included in the sample. The dependent variable contains a censoring problem, as the observed year is right-censored. Transforming the dependent variable into a categorical data mitigates the censoring problem, but the sample selection problem is not corrected econometrically, as the shortage of data does not allow the application of instrumental variables. In practice, sample selection becomes a serious problem when drawing conclusions about the wider population, not only about the subpopulation from which the data was taken (Kennedy 1998). This indicates a reasonable interpretation of the estimation results.

Another critical methodological issue is the omitted variable problem. Ideally, the estimation should include the variable of the price of the adopted technology. Because information about lump-sum payments and royalty rates contained in the survey is varied and incomplete, it cannot be used as an explanatory variable. Consequently, a very important variable is omitted in the regression. One way to circumvent this problem is to assume the price of technology to be a numéraire. Then, the prices of other inputs translate into relative terms. I take this approach here. However, this approach causes another problem. Because Wage is the only price variable in the regression and given that information about the price of capital input is not available, the estimates can also imply in relative terms the price of capital. Acknowledging this problem requires a careful interpretation of the estimation results.

The omitted variable problem also raises doubts about the validity of the modeling strategy used here. A static adoption decision underlies the dynamic diffusion process, and the adoption decision at a given moment of time contains dynamic considerations about the future streams of increased profit or reduced costs. As discussed above about the equilibrium threshold model, the static model is limited with regard to incorporating the dynamic elements of technology adoption, such as the role played by the learning effect. In order to cope with this problem, a practical approach is taken here. As some entries in the survey contain temporal questions, the entire sample can be divided into two groups according to the answers to these questions, after which the two regressions show differences. There are two entries of this type: a question on whether employment increased after the technology adoption, and another on whether the company improved the adopted technologies. Though this approach is far from ideal, it is found to be a reasonable empirical counterpart to theoretical comparative static analysis. In line with this approach, two additional separate regressions were utilized. This strategy assumes that the two separate groups are behaviorally different.

Estimation Results

Table 7 summarizes the estimation results using the entire sample. For comparison purposes, the second and the third columns report the Probit and Logit estimation results, respectively. Owing to the different assumptions about the distributions of the disturbance terms, the magnitudes of the estimated coefficients differ but the signs and significance levels of the estimates are nearly identical. Logit estimates can be used to calculate odds ratios, which is a convenient tool for interpreting the estimated coefficients. Hence, in the subsequent estimations, only Logit results are reported.

The dependent variable is coded into six groups of years elapsed since the first invention, with group 1 being the newest and group 6 the oldest. Hence, a negative sign of the estimated coefficients refers to the adoption of newer technologies while a positive sign implies the adoption of older technologies. In order to make the interpretation easy, I calculated the inverse odds ratio, which determines the odds of adopting newer technologies. The last column contains the percentage change in the odds of a one unit change of the explanatory variable. As continuous variables are all in logarithms, a one unit change of, for example, the Wage variable implies a 96% change in wage per labor. The implication for dummy variables is rather awkward, as the doubling of the given state does not change the value of the dummy variable. Nonetheless, it can be interpreted as a strengthening of twice the given status.

Among the three variables representing the production structure, there appears a consistent pattern in Table 7 and in Tables 8-10, as follows. First, the higher the capital intensity, the older the technologies adopted are. Second, the higher the wage, the newer the technologies adopted are. Finally, the sales variable, expected to indicate the market size, does not have statistical significance. The first result is consistent with the fact that investment in machinery and equipment is in general irreversible and the replacement of existing capital stocks incur frequently significant sunk costs to firms. With greater investments in capital stocks, firms tend to delay their adoption of new technologies. An interpretation from an opposite direction is as follows: when a firm’s fixed costs of already existing capital stock are low, they will be able to adopt newer technologies. The estimation results and interpretations thereof are aided by the additional regression results in Table 8. The entire sample used in Table 7 is divided into two groups: one in which technology adoption was accompanied with the concomitant importation of machinery and equipment - all these capital goods - and another in which importation was not done. In the regression of the former group, the explanatory variable in the production structure did not produce statistically significant results, but in the latter group of no concomitant importation, the pattern is strengthened with statistical significance of 1 percent. The estimation results in Table 8 suggest that existing capital stock becomes a barrier to adopting new technologies; the higher the capital stock, the higher the fixed cost, delaying the adoption of new technology as embodied in new machines.

The second result has multiple interpretations. Literally, it means that high-wage firms tend to adopt newer technologies, with 1.4 times higher odds. On the other hand, as new technologies enable the achievement of high performance and better productivity, causation may flow from new technology to high wages.18 Moreover, because it is not possible to ascertain whether the Wage variable is in relative terms with regard to the prices of capital or technology, the estimates cannot offer clear demarcation. With these limitations in mind, however, we can conjecture about the relationship between factor prices and new technology demand. This interpretation is aided with the estimation results in Table 9. The sample in this table is divided into two groups: one in which employment increased after technology adoption and another with no employment change. The case with increased employment shows a greater effect of wage increases upon new technology adoption: 1.8 times higher against almost no effect and with no increase in employment. It appears that a wage increase stimulates the adoption of new technologies and that this in turn increases the demand for labor. A wage increase induces the adoption of new technologies, but the directions are uncertain. The estimation results cannot shed clear light, but they imply that there is a positive interrelationship between capital-labor complementarity and wage increase — a variation of the skill-biased technical change thesis.

Among the four variables in the firm attribute group, only the R&D Lab dummy variable produces statistically significant estimation results at the 10% level. The estimation results show that the odds of those firms with a R&D lab adopting newer technologies are 1.6 times higher than those without a R&D lab. Other variables, including Large Firm dummy, Domestic Firm dummy and Export dummy, are all statistically insignificant. The effect of the R&D Lab dummy in Table 8 is 4.5 times higher with regard to the odds in the case of the accompanied importation of facilities and equipment.

Three variables in the market condition group all show significant estimation results. These firms that contacted other providers before choosing a contractor tended to import older technologies, only at the 10% level. This estimation results appear to contradict the expectation that firms would make extensive searches for newer technologies. An alternative explanation is as follows: firms would choose older technologies, which may cost less than new ones, in order to minimize the cost of technology adoption. However, without information about the price of the adopted technologies, it is impossible to test which hypothesis is correct. In contrast, the estimates of the other two variables have a clearer interpretation. When adopted technologies did not exist, the odds of adopting newer technologies are twice as high as the other case. This tendency is also confirmed by the estimates of the Both Existence dummy variable. When both domestic technology and imported technology are available, firms tend to import older forms. The estimation results imply that competition to be first in the domestic market prompts the adoption of newer technologies.

Of the five types of technologies, two dummy variables show statistically significant estimation results. The Technical Information dummy variable shows a 2.3 times higher odds, whereas the Technical Service dummy variable shows a 0.6 times lower odds. The effects of the Patent and Brand dummy variables are insignificant. The estimation result hints that intellectual property rights such as patents and brands are protected under law and have much longer life spans than the know-how contained in technical information.

Origin of country does not matter in technology adoption. Technologies originating in the US and Japan appear to be adopted later than in other countries, but the estimates are not statistically significant. However, industries greatly matter with regard to technology adoption. In terms of years elapsed since the first invention, technologies in the electronics industry are adopted much more rapidly and technologies in the chemical or machinery industry are adopted much later than the industry average. These estimation results correspond to the common understanding that the technological life cycle is much shorter in electronics than in the chemical or machinery industry.

The last table contains the estimation results from the separate regressions. The criterion of sample division is three stages of usage of adopted technology, detailed explanation about which was given in the previous section. The later stages imply more advanced states than the earlier stages. I divided the entire sample into two groups, one which remains at the stage of application and the other which is either at the stage of absorption or the stage of improvement. Between these two, the most striking differences appear in the production structure variables of capital intensity and wage. These two variables at the application stage have almost no effect on influencing the speed of technology adoption, but they tend to have very strong effects at the stages of assimilation and improvement. As explained in section II, imported technologies need to be adapted and improved in order to fit the local conditions and thereby achieve higher efficiency. Thus, in order to be closer to the technology frontier or to achieve technical efficiency, substantial post-adoption efforts are necessitated. Facing this necessity, high wages prompt much intensive efforts, whereas less capital-intensive firms tend to accelerate their adoption times.

Summary of Empirical Findings

To recapitulate, I could confirm following facts from regression results:

i) Capital intensity serves as an obstacle to the adoption of new technology. High capital intensity levels mean high fixed costs, which leads to higher replacement costs. All of these factors delay the choice of new technologies.

ii) In adopting new technologies, firms are significantly responsive to wages. Due to the limitation of data availability, it was not possible to identify which factor prices are working in which directions.

iii) R&D fastens the adoption of new technologies. Other variables in the firm attribute group - the domestic firms and large firm dummy variables - are not statistically valid. With regard to technology adoption, a firm’s capability to adopt, assimilate and improve a foreign technology dominates other firm attributes.

iv) Market conditions work effectively; competition to be first in the domestic market strongly prompts the adoption of new technologies.

v) The time difference in technology adoption among the five aforementioned types of technologies is not strong. Only technology transfer contracts including technical information show a statistically significant tendency to choose newer technologies.

vi) There are substantial differences across industries. Electronics firms tend to adopt newer technologies, a characteristic of the electronics industry in which the life cycle of technology is much shorter than in other industries.

The above list lacks a number of factors that is believed to play important roles in a firm’s adoption decision. The expectation on future profits, uncertainty about new technologies and the price information about the technologies are among the omitted variables. Despite these shortcomings, the findings ascertain the notion that technology adoption is mostly induced by economic factors, such as capital intensity, wage levels, and market conditions.19 Extending this view allows a further conjecture about the relationship between factor prices and technology adoption.

The empirical finding is that when wages rise, firms tend to adopt newer technologies, and this in turn causes an increase in employment. When interpreting new technology adoption as a technical advance, there are two paths for this to occur: 1) the labor-augmenting technical change is labor-biased when capital and labor are gross substitutes, or 2) the capital-augmenting technical change is labor-biased when capital and labor are gross complements.20 As prior studies of the elasticity of substitution in the Korean economy converge to the consensus of low substitutability,21 the second path will be the more plausible one. This implies that technical change in Korea was mostly capital-augmenting but with low substitutability between capital and labor, this further creating the demand for labor.

The catch-up thesis of economic development states that backward countries can growth more rapidly than advanced countries by borrowing foreign technologies. Catch-up growth, however, is not a universal phenomenon; only a small numbers of countries have been successful. The mere existence of foreign technologies does not guarantee success in industrialization and faster economic growth. Many developing countries become more dependent on foreign technologies rather than successfully constructing their own technology system. The lack of experience in operating modern plants and facilities is the source of operational inefficiency in many developing countries. Rapid changes in certain technologies can prevent developing countries from securing the time to learn from new technologies.

Successful industrialization requires a substantial revision of imported technologies to fit local conditions, through which developing countries increase their technical efficiency and reach out to the world technology frontier. The intensive and extensive assimilation and the improvement of imported foreign technologies are preconditions for a successful path of development. This is the key to shorten the technology gap against advanced countries.

The period covered in this paper is Korea’s high growth era, from the 1960s to the 1990s. Structural transformations in various sectors of the economy occurred during this period. Korea’s technology system was also fundamentally changed; a notable feature is the rapid increase in private R&D beginning in the early 1980s. The interplay between foreign technologies and indigenous R&D reinforced them both. Even without formal R&D efforts, Korean firms learned to industrialize by adapting and assimilating foreign technologies.

The Korean experience provides the context of success in the catch-up growth. The co-movement of technology imports, expressed in terms of royalty payments, with capital goods imports manifests Korea’s effort to improve the technical efficiency toward the world frontier. Underlying this trend are firms’ decisions to adopt new technologies. The regression results show that firms respond proactively to wage increases by adopting newer technologies and thus, in turn, increasing employment. In order for this transpire, productivity must increase faster than the rate of wage-hike. Despite some limitations, the microeconomic findings here correspond squarely to macroeconomic trends. With this backdrop, I conjecture that at the microeconomic level, wage increased, the adoption of new technologies, and employment growth are reinforced mutually – a conjecture on the existence of a virtuous interactive mechanism among these factors.

It is the adoption and diffusion process rather than inventions or innovations that ultimately determine the pace of economic growth and the rate of productivity change. According to Rosenberg (1972), the diffusion process has two characteristics: its slowness and the wide variations in the rates of acceptance of different inventions. In this sense, factors affecting technology adoption are of concern to economists and those who interested in the spread of new technologies. Corresponding factors are placed into four categories: the production structure, demand determinants, the supply behavior, and environment factors. Hall and Khan (2003) offer succinct explanations of the last three categories, from which the statements below are taken. Factor in the production structure are added in order to investigate the relationship between production factors and adoption behavior.

1) Production Structure

The assumption of instantaneous profit maximization associated with static equilibrium enables the introduction of an adopted technology as an additional factor of production function. The logic is similar to energy as a production factor (Lann 2010), or clean vs. dirty technologies in environmental economics (Kulmer 2013). The main focus is on how the factor mix and the adoption of technologies respond to changes in factor ratios and other attributes of the production structure.22

A firm’s adoption of new technologies in general introduces two possible ways to represent it in terms of a production function framework. When firms are undertaking their production activities on the frontier of technical possibilities, raising revenue by increasing production incurs an increase in the cost of production. In contrast, if firms are operating within the production possibility frontier, revenue may increase without increasing the cost. The former case implies that the firm achieves technical efficiency, whereas the latter implies that the firm is technically inefficient.

The distinction between these two cases is important when we consider the effect of factor price changes on the adoption of new, or newer, technologies. When operating on the frontier, factor price changes will affect the level of factor demand, through which the firm will try not to deviate from the frontier. When operating within the frontier, factor price changes will either not affect the factor mix at all or affect it less than when the firm is on the technological frontier. The distinction becomes especially important when modeling technology adoption by a firm. If firms are operating far below the technology frontier, the equilibrium approach may not adequately predict the outcome of the output and factor mix because when firms strive to minimize costs or maximize profit and movement toward the production frontier will not be accompanied with changes in inputs or increases in costs - only appearing as increases in efficiency - it becomes difficult to distinguish technical advances from increased efficiency due to, for instance, better management of resources.

2) Demand Determinants

It is apparent that decisions about new technology adoption are made in consideration of the benefits received by user and the costs of adoption. As Rosenberg (1972) argues, the skill level of workers and the state of the capital goods sector are important determinants of technology diffusion to individual firms. If it requires complex new skills or is time-consuming or costly to acquire the required level of competence, or if the initial idea is too advanced relative to the engineering capacity of the industry, then adoption may be sluggish. For example, Caselli and Coleman (2001) investigated computer adoption by OECD countries during 1970 to 1990, and found out that worker aptitude, the openness to manufacturing trade, and the overall investment rate in the country are crucial to the level of investment in computers.

It is also important for firms to be assured of future profits when they make costly investments in new production technologies. In the presence of customer commitment, firms may be able to predict demand and profits more precisely. This helps them to decide whether to adopt new technologies. Helper (1995) uses as a proxy for customer commitment the length of the contract between automotive suppliers and their customers, arguing that this directly affects adoption by providing suppliers guaranteed demand as well as indirectly by extending market share, as there are fewer alternatives for customers in a highly concentrated market.

In addition, network effects are important given today’s high degree of interrelation among technologies. This operates both directly and indirectly. Direct network effects arise when a benefit from using a technology increases with the size of the network. Meanwhile, indirect network effects apply when the increase in utility comes from the wider availability of a complementary good, such as “hardware-software,” where the availability of software increases as more hardware is sold due to the complementarities between them. In this regard, Saloner and Shepard (1995) investigated commercial banks in United States and found that banks tend to adopt ATMs sooner when they have more branches and a larger value of deposits from customers. However, according to Majumdar and Vankataraman (1998), economies of scale and network effects do not always affect adoption decisions simultaneously. In other words, production economies of scale are more important during the earlier years and weaken over time, while network effects are important during all phases of technology adoption.

3) Supply Behavior

Following Rosenberg (1972), the behavior of suppliers of new technologies both in improving them and in lowering costs over time is essential for adoption. Three important factors on the supply side are identified. First, improvements in the new technology are crucial because the efficiency gain from the new technology is much greater during the enhancement stage than in the initial stage. In some cases, manufacturing capabilities fail realize inventions. Secondly, improvements of old technology are also important, especially when a new innovation is a close substitute for an existing technology because it requires providers of the old technology to make progress or engage in other types of competitive behavior to retain their market position. Thirdly, complementary inputs are critical for the diffusion of new technology. It is often the case that hardware manufacturers, for instance, mobile telephone producers, cooperate with software suppliers such as Microsoft, reaching a deal to produce the software and encourage customers to purchase the hardware products.

4) Environmental and Institutional Factors

The economic literature on incentives for innovative activities has been somewhat contentious since the influential work of Schumpeter and Arrow in 1962. Dorfman (1987) suggests four major arguments with regard to the positive role of the firm size and market share in determining the level of innovative activity. The first two arguments come from Schumpeter. First, firms that are large or with sufficient market share have more incentive to undertake innovations due to the greater expected benefits from new technology and the availability of funds to cover the costs of adoption. Second, larger and more profitable firms are more likely to have the financial resources, human capital, and other resources required to purchase and install a new technology. Third, firms with a large market share are more able to spread the potential risks associated with new projects because they are more able to diversify their technology choice and try out a new technology. Lastly, larger firms adopt new technologies sooner due to the scale-enhancing characteristics of the technologies; it is more feasible for them to spread fixed costs across a larger number of units.

However, large firms with a large market share may also slow down the rate of diffusion. Larger firms tend to have multiple levels of bureaucracy which may impede the decision-making processes for innovation and the hiring of new workers. In addition, as Henderson and Clark (1990) stressed, it is more expensive for older and larger firms to adopt a new technology because they already have numerous resources, including the human capital costs sunk in their old technology and existing architecture.

In a study conducted by Hannan and McDowell (1984) investigating ATM adoption by banks in US, adoption decisions were found to be highly correlated with the prevailing wage rates in the market because ATM machines are substitutes of labor. Therefore, the adoption of a labor-saving technology is more profitable in a market with higher wages. Evidence in the mobile telephone market was also found by Gruber and Verboven (2001) and by Parker and Roller (1997), who claimed that the presence of market competition encourages the adoption of new technologies by lowering prices.

Microeconomic, empirical studies of adoption and diffusion have flourished in the areas of agricultural technology and innovation, where data has been abundant (Foster and Rosenzweig 2010). Other fields such as social networks (Banerjee et al. 2013), information systems (Venkatesh et al. 2007), and medical innovation have shown reasonably good data availability.

OECD (1990) defines technology balance of payments with two terms: technology adoption (TA) payments and technology export (TE) receipts. Technology adoption in this paper is equivalent to the OECD’s definition of TA at the firm level.

The adoption of technology focuses on the end recipient of the diffusion process, while diffusion refers to all related processes when technology is adopted or rejected by individuals or firms in a society over time (Sriwannawit and Sandstrom 2015). “Adoption” and “diffusion” are used interchangeably in this paper, unless a misunderstanding may arise.

The publication of the first edition of Everett Rogers’ book, Diffusion of Innovations, in 1962 marks an important junction in diffusion research. Continuously updated until its fifth edition in 2003, the book has been considered as the basic framework of diffusion research. In a conclusive bibliometric review of diffusion research, Sriwannawit and Sandstrom (2015) state that Rogers is the most influential scholar in all subfields of diffusion research combined.

As the rationale of governmental control was to protect infant industries, the policy became more liberal when industries grew.

Due to government intervention into TI activities, nearly all transactions that incurred payment in foreign currencies were officially recorded until the late 1990s. The coverage of TI records until the year 1988 is nearly complete due to the approval system under which companies had to operate. The approval system changed became a report system in 1988: companies reported their transaction records directly to the government or via the bank that made the payment transactions. The farther the year from 1988, the more incomplete the TI records become. This partially explains the decrease in the total number of licensing contracts from 1992 and to 1996. As one referee commented, there must be other reasons for the decrease. The OECD (1996) explains that as the Korean economy became more technology-intensive, foreign firms became more reluctant to provide core technologies. This tendency seems to have intensified over time.

Technical information includes non-patented technical know-how: layouts and construction of plants, the installation of machines and tools, assembly and manufacturing procedures and methods, and methods of quality control.

Technical assistance includes such activities as invitations of experts and technical training of engineers, and the dispatching of engineers to licensor companies.

Three organizations collaborated in preparing the report − the Korea Institute of Science and Technology, the Korea Association of Machinery Industry, and the Korea Chamber of Commerce. The report is, to the best of my knowledge, the most comprehensive and detailed technical report on TI in Korea.

Due to the importance of TI not only for business enterprises but also for its contribution to industrial development, many public organizations were engaged in work related to the TI of business enterprises. For instance, the Korea Institute of Science and Technology (KIST) established Technology Transfer Support Center in 1976. In addition to the promotion of the transfer of technologies developed by KIST to domestic companies, the Center also helped business enterprises search for appropriate foreign technologies, make favorable contracts, and they assisted in solving problems related to the assimilation of imported technologies (KIST, 2006). Several public organizations published guidebooks on international technology transfers which contained detailed explanations of the process of international technology transfer, including contract templates in English (KIMM. 1987; KITA 1991). In addition, many organizations conducted studies of the effect of TI on, for example, the productivity of firms and the technological progress of industries.

There are many factors influencing the process of international technology transfer. Rogers (1995) is a very comprehensive and in-depth reference on this issue. The study of Freeman and Soete (1997) contains a chapter on international technology transfers from a catch-up perspective.

KITA (1995) also contains a similar question about the life cycle of technology between Korea and advanced countries, but it divided the issue into six stages, and the terminology is somewhat different from that of KDB (1991). Nonetheless, the pattern of the technology gap found in the KDB survey is nearly identical to that in the KITA survey.

For a comprehensive review of microeconomic models of technology adoption, see Geroski (2000), David (2011) and Foster and Rosenzweig (2010). Comin and Mestieri (2014) offer the latest contribution to the literature on macroeconomic studies of technology diffusion.

An advantage of using the logit model is the accompanying use of odds ratios, which give clearer interpretations of estimates.

The dependent variable contains a censoring problem, as the observed year is right-censored. Transforming the dependent variable into a categorical data mitigates the censoring problem. This issue will be discussed more in the section on the empirical strategy below.

A referee suggested making separate estimations by industry instead of the use of industry dummies. This suggestion is valid, as there are wide differences in the adoption times across industries. (This is shown in appendix 2.) I attempted separate regressions by industry and found that some industries, such as the chemical industry, show small differences in the estimated coefficients. However, this did not make a major difference with regard to those reported. For other industries, the estimation was not possible due to the small sample size by industry. Hence, I opted to use industry dummies in the estimation.

Despite the differences in the estimated coefficient, there are no statistical differences when using the Probit and Logit models. I used the OLOGIT and OPROBIT commands from STATA software.

Liu et al. (2001) confirm that the adoption of advanced technology by Taiwan manufacturing firms caused an increase in wages. Certainly, causality must run in two directions.

Stefano et al. (2012) argue that the technology push and demand pull theses are reinforcing each other.

The usage of terminology is based on Acemoglu (2002). A technical change is either neutral or factor-specific, or both. It is customary to assume no time variation in a neutral technical change. Acemoglu’s distinction was made with this assumption due to the impossibility of fully identifying both neutral and factor-specific technical changes. See Carraro and De Cian (2013) for detailed explanations.

Previous studies do not accord squarely, but mostly show that factors are complements rather than substitutes in Korea. Kim (1984) confirms the low substitutability and differences between large firms and SMEs. Kwack (2012) shows the complementarity between human capital and physical capital. Yuhn (1991) argues that the elasticity of substitution between labor and capital in Korean industries is close to unity.

The induced factor demand function from a CES production function can be denoted as

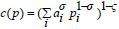

, where

, where  represents the constant elasticity of substitution and

represents the constant elasticity of substitution and  . The cross-price elasticity of substitution in more than three input cases is not

pre-determined but depends on the curvature of the production function (Varian 1993).

. The cross-price elasticity of substitution in more than three input cases is not

pre-determined but depends on the curvature of the production function (Varian 1993).

. (2002). Directed Technical Change. Review of Economic Studies, 69(4), 781-809, https://doi.org/10.1111/1467-937X.00226.

, & . (2013). Factor-augmenting Technical Change: An Empirical Assessment. Environmental Modeling & Assessment, 18(1), 13-26, https://doi.org/10.1007/s10666-012-9319-1.

, , & (2010). Technology Adoption and the Investment Climate: Firm-level Evidence for Eastern Europe and Central Asia. World Bank Economic Review, 24(1), 121-147, https://doi.org/10.1093/wber/lhp021.

(2000). Models of Technology Diffusion. Research Policy, 29(4/5), 603-625, https://doi.org/10.1016/S0048-7333(99)00092-X.

. (September 2004). International Technology Diffusion. Journal of Economic Literature, 42(3), 752-782, https://doi.org/10.1257/0022051042177685.

. (1984). CES Production Functions in Manufacturing and Problems of Industrialization in LDCs: Evidence from Korea. Economic Development and Cultural Change, 33(1), 143-165, https://doi.org/10.1086/451447.

. (2008). Energy Prices and the Adoption of Energy-saving Technology. Economic Journal, 118, 1986-2012, https://doi.org/10.1111/j.1468-0297.2008.02199.x.

, , & (2001). The Impact of Advanced Technology Adoption on Wage Structure: Evidence from Taiwan Manufacturing Firms. Economica, 68, 359-378, https://doi.org/10.1111/1468-0335.00251.

, & . (2015). Large-scale Bibliometric Review of Diffusion Research. Scientometrics, 102, 1615-1645, https://doi.org/10.1007/s11192-014-1448-7.

(1989). Technological Adaptation in Canadian Manufacturing, 1900-1929. Journal of Economic History, 49(3), 569-591, https://doi.org/10.1017/S0022050700008767.

. (1991). Economic Growth, Technical Change Biases, and the Elasticity of Substitution: A Test of the De La Granville Hypothesis. Review of Economics and Statistics, 73(2), 340-346, https://doi.org/10.2307/2109526.