Analysis on Korean Economy with an Estimated DSGE Model after 2000

Abstract

This paper attempts to search the driving forces of the Korean economy after 2000 by analyzing an estimated DSGE model and observing the degree of implementation regarding non-systematic parts of both the monetary and fiscal policy during the global financial crisis.

Two types of trends, various cyclical factors and frictions are introduced in the model for an empirical analysis in which historical decompositions of key macro variables are quantitatively assessed after 2000. While the monetary policy during the global financial crisis have reacted systematically in accordance with the estimated Taylor rule relatively, the fiscal policy which was aggressively expansionary is not fully explained by the estimated fiscal rule but more by the large magnitude of non-systematic reaction.

Keywords

DSGE, Bayesian Estimation, Korean Economy, Small Open Economy, 동태확률모형, 베이지안 추정, 한국경제, 소규모 개방경제

JEL Code

E3, E5, C5

I. Introduction

The Korean economy has exhibited large changes in the evolution of macroeconomic variables. After documenting GDP trends, cycles and inflation, using various statistical methods, Lee (2009) concluded that finding consistent results on disentangling trends and cycles is difficult due to intermittent events such as the oil crisis and the financial crisis of 1997.

However, the volatilities of GDP growth and inflation rate have been substantially stabilized since 2000. This moderation may have been due to a policy shift such as the inflation targeting scheme adopted by the Bank of Korea in the late 1990s or a mere fortuitous event of reduction of the magnitude of exogenous shocks. At any rate, this finding serves as a good case study of what part of the Korean macroeconomic variables, has been generated from trend factors and cyclical factors in the context of Dynamic General Equilibrium frameworks at least after 2000, that have been better known to fit more stabilized economies.

This paper attempts to search the driving forces of the Korean economy after 2000 by analyzing an estimated DSGE model and observing the degree of implementation regarding non-systematic parts of both the monetary and fiscal policy during the global financial crisis. In order to address those questions, a highly stylized DSGE model1 is proposed and estimated. Hwang (2009) has estimated the Korean economy to investigate the natural output but the model is limited to a closed economy model. Hence, a small open economy model2 is adopted in this paper which demonstrates the substantial dependence of the Korean economy on external conditions as evidenced by the large fluctuations on economic indicators. Conversely, its own economy had minimal effect on the rest of the world. In the line of DSGE applications on the Korean economy, Lee and Yeo (2008) have also applied a small open economy model to study the business cycle properties of the Korean economy from 1991:Q1 to 2005:Q4. However, the increased volatility of the Korean economy since the 1990s and the structural change which Korean economy has undergone since the Asian financial crisis demonstrates the difficulty of estimating the Korean economy with a highly restricted model such as the DSGE model.

Our paper focuses on the Korean economy after 2000 and simultaneously attempts to find the specific structural shocks that have contributed towards key macro variables such as GDP and inflation by researching historical records. In this context, there have been number of modifications from the standard small open economy models to better reflect the Korean economy and to make policy simulations more applicable in this paper.

The model contains sufficient frictions and shocks to potentially explain the macro variables of our interest in the Korean economy. For example, preference shocks are introduced to explain the private consumption which is not only driven by supply shocks such as productivities but also by demand shocks. Besides the standard Calvo-Yun sticky price features on goods market, sticky wage is modeled to incorporate the inefficiency of labor market. Import adjustment cost is added so that the final goods fluctuations are not directly exposed to highly volatile imported goods. The model not only accommodates cyclical fluctuations from stationary shocks but also the balanced growth path from trend shocks so that there is no need of stationarizing the times series prior to bringing the data to the model. Moreover, the model incorporates two types of trends that form a balanced growth path separately for GDP and investment time series. This is necessary in analyzing the Korean economy because the growth rate of investment was lower than other GDP component after 2000 as will be confirmed in section II. In international financial market, Korea’s foreign debt generally bears a country risk premium that is nontrivial. As a result an additional parameter of a positive risk premium is inserted. Two policy rules have been extended for the purpose of policy simulations during the global financial crisis. Taylor rule for the monetary policy can not only respond to inflation gap and output growth gap but also possibly to the nominal exchange rate changes. This extension has been justified in the sense of optimal monetary policy for a small open economy in which the home bias exists as noted by Faia and Monacelli (2008). And the fiscal rule has an automatic stabilizer component to isolate the countercyclical and discretionary movements of government expenditures. Meanwhile, the government revenues are not simply based on government lump sum taxes but on consumption tax, capital income tax and wage income tax which are calibrated to match effective marginal tax rates of Korea.

This paper uses Bayesian estimation3 for the following reason. First, Bayesian estimation is a full information approach while the simulated method of moments or the generalized method of moments is a partial information approach. It allows us to fully exploit the relevant information from data by constructing a likelihood function. Second, Bayesian estimation technique allows estimation of structural parameters that are generally hard to be characterized analytically. Although, the approximation method of equilibrium conditions can be represented by a linear state space form, the distribution of parameters cannot directly be recovered by analytical forms. Bayesian numerical approach enables to characterize the distributions of parameters. Third, priors are useful to give a discipline on parameters set, if not a large scale DSGE model like proposed in this paper is practically impossible to derive any meaningful assessments as noted by Sims (2007). And there are desirable properties of Bayesian estimations that coherently deal with misspecifications and model uncertainty problems as pointed by Canova and Sala (2006) and Fernández-Villaverde and Rubio-Ramirez (2004).

For empirical analysis in this paper, a number of parameters that are calibrated to match some properties of the Korean economy and a few prior distributions related to the first moments of macro variables are tightened to match the Korean macro time series. Some assessments on posterior estimates on structural parameters have been discussed whether they show reasonable degree of estimates with the Korean economy. Given the posterior estimates, historical decompositions of the inflation rate and GDP components are shown to understand how post-2000 have contributed towards changes in those variables. And the policy simulations after 2008:Q3 are presented to show how would have the inflation and GDP evolved when the policy discretions were not implemented, in other words, if the policies followed systematic rules strictly.

The paper proceeds as follows. Section II shows a brief assessment on the evolution of the Korean economy after 2000. Section III describes a small open economy model. Section IV explains the choice of the Korean data, the econometric methodology, model’s properties with benchmark estimation and estimation results on parameters. Section V shows the historical shock decompositions to investigate how the shocks have contributed to the fluctuations of macro variables in the Korean economy after 2000 and counterfactual simulations of the economy when the non-systematic policy discretions were not implemented. Section 6 concludes.

II. A First Look at Data

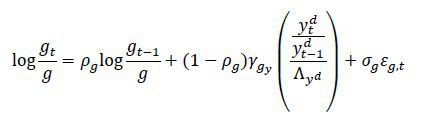

[Figure 1] shows the real growth rates of GDP components such as private consumption, private investment,4 government expenditures5 and exports of the Korean economy. As is common with the majority of the developed countries, we can observe that private consumption is much smoother than any other series while investment and exports are more volatile. And roughly looking at the graph, export seems to demonstrate higher growth rates on average than domestic demands. There have been two main events in terms of crisis for the Korean economy after 2000; the credit card crisis in 2002-2003 and the global financial crisis that began in 2008. During the credit card crisis period, private consumption was exacerbated due to credit constraints on households. However, the effects of this crisis were mainly sector-specific as opposed to wide-ranging economic depression, which resulted in a rapid recovery mainly driven by firms’ investment and exports. This reversal phenomenon is indeed consistent with the conventional assessments on the Korean economy which is generally driven by exports in the period of recovery. The global financial crisis, on the other hand, was different in scope in a sense that it has affected all of the GDP components as this was a severe macroeconomic shock and yet the recovery was still driven by exports at least in 2009 thanks to the world- wide expansionary policies such as quantitative easing from the U.S. With respect to government expenditures, it certainly seemed to have played an important role during the global financial crisis to negate the negative hit. However, it is hard to find an overall countercyclicality of government expenditure on average during the sample period. These rough assessments can be confirmed in the following <Table 1> with first and second moments.

First moments of GDP components clearly show that exports growth have surpassed other components while consumption and government expenditures are roughly close. But the private investment growth on average seems to underperform in comparison with other components which motivate to introduce a relative downward trend6 for the investment. Consistent with the graph assessments, volatilities indicate that consumption is the most smooth while exports are most volatile. In terms of cyclicality of those series against GDP, all of the components show procyclicality except government expenditures.

The Korean economy is a small open economy in which its export is largely affected by the world demand. Thus, a proxy time series that best explains the prospects of the Korean exports can be of key interest not only for the Korean policy circle but also for estimating the Korean exports. There are 11 major trading partners7 including the U.S., China and EU whose countries’ GDP can be said to constitute the world demand of the Korean exports. The other alternative measure would be the world trade volume. As can be seen from [Figure 2], the Korean nominal exports in dollars follows more closely with the world trade volume than GDP of 11 major countries. This can be confirmed in the following <Table 2>.

During the sample period, the Korean export sector has outperformed GDPs of major trading countries and has grown closer to the world trading volume although the correlations with the Korean exports remain mostly similar. Also, the volatilities’ magnitudes were quite similar to the world trade volume than GDPs of any combination8 for major trading partners. Such statistical result suggest that the world trading volume is a reasonable proxy time series for the world demand to be used later in the estimation.

The Korean monetary authority, the Bank of Korea, undertook inflation targeting scheme in 1998 right after the 1997 financial crisis hit the economy. With the exception of 1998 and 2000, the target inflation rate, CPI or core CPI, was 3% until recently.

As <Table 4> shows, the realized inflation rate has been lower than pre-inflation9 targeting periods on average and also shows lower volatilities due to either the policy shift in monetary policy or simply to overall moderation of the Korean economy.

The Bank of Korea uses an overnight call rate as a policy rate to stabilize the inflation. Despite the fact that Bank of Korea missed its inflation target a couple of times since the adoption of the inflation targeting scheme in 2000, the call rate and risk free rates such as treasury bond yields and the inflation rate moved in synchronous fashion demonstrating inflation-stabilizing monetary policy stance as shown in Figure 3. The inflation rate was subdued between the tranquil periods of 2005 to 2007. The drastic fall of the interest rates triggered by the crisis made the Bank of Korea employ expansionary stance. Despite a strong recovery of the economy in 2010, there have been some concerns as to whether the monetary authority's policy rate was adequate to prevent the high inflation Those concerns turned into strong criticisms in the year of 2011 when the inflation rate stayed above its target range for prolonged periods10. Thus, a question whether this high inflation rate was due to supply driven shock or to sluggish increments of the call rate can be a good motivation to implement a counterfactual simulation with an estimated model to see whether the inflation rate could have been lower than its realization under a more aggressive monetary policy to inflation stabilization.

The Korean financial market and the monetary policy has been strongly affected by the global financial condition as well. [Figure 3] also plotted the short term interest rate from the U.S. Treasury bill and the spread between the Korean risk free rate and the U.S. risk free rate. While those interest rates share common directions during most periods, most conspicuously with global crisis in 2008, the spread that stands for a country premium for Korea can be a good proxy to understand the risk to which Korea has been exposed. During the credit card crisis and the global financial crisis, the spread has widened while it remained at lower level in tranquil periods. <Table 5> shows the average and standard deviation of the spread after 2000. The average spread will be used to calibrate the country premium parameter later in the model.

III. Model

The model described in this section assumes a small open economy. New Keynesian features are prevalent among price decisions of different goods, not only to have nontrivial effects of the monetary policy onto real activities but also to introduce incomplete pass through of foreign price shocks. In order to generate price heterogeneity due to sticky price, monopolistic competitions are present in intermediate goods market, labor market, import sector and export sector. Trends are incorporated both into total productivity shock and investment specific shock as argued by Greenwood et al. (1997) to explain the lower trend of private investment of Korea during the sample period. Owing to Cobb-Douglas production function, variables of interest such as consumption, output, investment, government expenditures and exports show a balanced growth path by weighted average of those two trends. Besides those productivity shocks, the source of fluctuation in the economy are generated by two preference shocks, monetary policy shock, government expenditure shock, foreign inflation shock, foreign demand shock, foreign interest rate shock and risk premium shock.

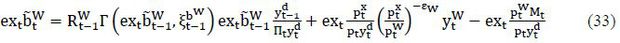

Households allocate final consumption good, final investment good, differentiated labor supply, domestic risk free bond and foreign risk free bond to maximize its own lifetime utility subject to the budget constraint. Labor packer aggregates households’ differentiated labor to sell in the factor market demanded by the intermediate good producer. Intermediate good producers, using Cobb-Douglas technology with homogenous labor and utilized capital which entails factors payments such as wage and rental rate, provide differentiated goods to a distribution chain which produces homogenous final domestic good. This final domestic good can be sold to meet both domestic and foreign demands. Final consumption (or investment) good is produced by the final consumption (or investment) good producer with a composite of final domestic good and final imported good. In the import sector, there are two layers of firms, one of which is importers who purchase homogenous foreign good in the international market and differentiate by brand naming and the others buy differentiated imported goods to produce homogenous imported good by aggregation technology. Exporters buy final domestic good to sell differentiated goods to importers from the rest of the world. The monetary authority, whose goal is to stabilize output growth and inflation, determines the domestic risk free bond’s interest rate with augmented Taylor rule. Also, the experience of 1997 currency crisis has made Korean monetary authority pay attention to the movements of nominal exchange rate and thus the growth rate of the exchange rate has been included in Taylor rule. The government’s revenues are based on taxes which are levied on consumptions, wages and capital rents, while the government expenditures are composed of exogenous shock and automatic stabilizer. Although government expenditures in data show acyclical property on average, the automatic stabilizer is modeled to investigate the counterfactual simulation during the global financial crisis when expansionary fiscal policy was clearly implemented.

1. Households Problem

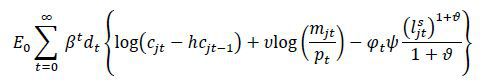

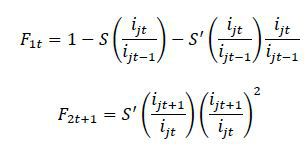

There is a continuum of households in the economy index by j which maximizes the lifetime utility function over consumption, real money balance and leisure.

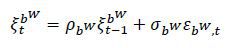

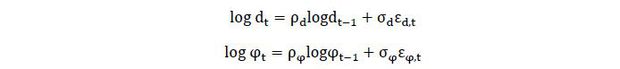

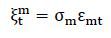

where ݄h is the habit persistence and ϑ is Frisch labor supply elasticity. Habit formation for consumption generates hump-shaped response of consumption to stochastic disturbances. And thus this creates another smoothing mechanism of consumption path on the top of smoothing due to log-utility. The separable utility for real money balance does not play a qualitative role to change other real allocations since the monetary policy is implemented via open market operation rather than money printing but only to be included in the government budget constraints. ݀dt is an intertemporal preference shock and φt is a labor supply (or intertemporal) shock :

Those preference shocks will act as aggregate demand shocks in the economy. The intertemporal shock, dt, is an important source of business cycle fluctuations according to Primiceri et al. (2006). And the labor supply shock, φt, stands for changes in employment that is another source of aggregate fluctuations.11

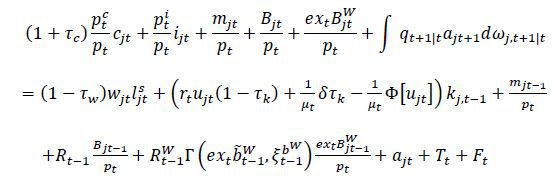

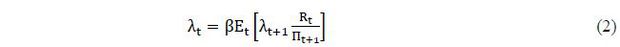

The jth household’s budget constraint is given by :

pt is price level of final domestic good which is numerarie in this model.  and

and  are prices of final consumption and investment good that differ from pt since they are composites of final domestic and final imported goods. Bjt is nominal domestic bond holding with uncontingent gross interest rate, Rt, and ajt+1 is Arrow contingent bond for every state which forms a complete asset market within

the economy.

are prices of final consumption and investment good that differ from pt since they are composites of final domestic and final imported goods. Bjt is nominal domestic bond holding with uncontingent gross interest rate, Rt, and ajt+1 is Arrow contingent bond for every state which forms a complete asset market within

the economy.

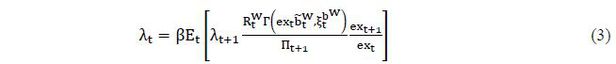

In the international asset market, however, household can only purchase uncontingent

foreign bond, ext , where

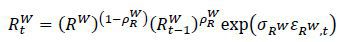

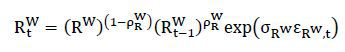

, where  is in foreign currency and ext is the exchange rate. The world interest rate associated with this foreign bond evolves

as

is in foreign currency and ext is the exchange rate. The world interest rate associated with this foreign bond evolves

as

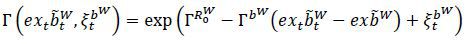

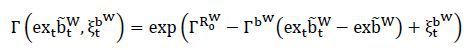

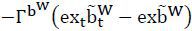

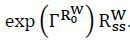

Since the risk free interest rates of Korea has shown difference from world interest rate such as U.S. Treasury Bill, the world interest rate cannot directly be the price of foreign bond which the household must bear. Thus, the country risk premium is included to the gross interest rate of foreign bond by Γ(⋅) for possible time variation and systematic gap. In order to close the small open economy, i.e. to prevent from nonstationary responses of variables to world interest rate shock, as argued by Schmitt-Grohé and Uribe (2003), the risk premium is modeled as debt elastic. The functional form for premium is

where time varying premium shock

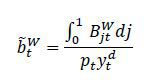

and the share of foreign bond holdings as

is the systematic gap that implies the average interest rate spread between the Korean

interest rate and the world interest rate. The term,

is the systematic gap that implies the average interest rate spread between the Korean

interest rate and the world interest rate. The term,  , ensures the foreign debt does not explode by penalizing the risk premium when foreign

debt is increased.

, ensures the foreign debt does not explode by penalizing the risk premium when foreign

debt is increased.

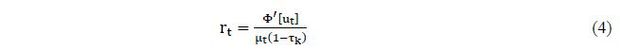

wjt is the real wage from the differentiated labor supply,  . rt is the rental price of capital, ujt > 0 is the intensity of use of capital, and

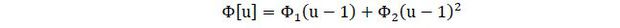

. rt is the rental price of capital, ujt > 0 is the intensity of use of capital, and  Φ[ujt] is the physical cost12 of use of capital in resource term where

Φ[ujt] is the physical cost12 of use of capital in resource term where

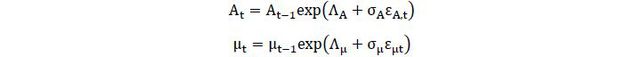

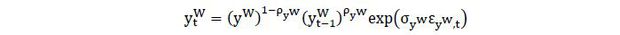

μt is an investment-specific technology shock or also its inverse is interpreted as the relative price of investment good in final good unit. As mentioned earlier, this can capture the gap between investment time series and output. Since the Korean investment growth has been lower than any other GDP components, it is likely to have negative trend in this process during the sample period. The exogenous process is

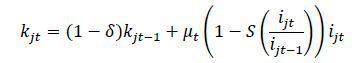

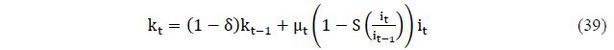

And the capital stock13 evolves with

where

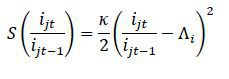

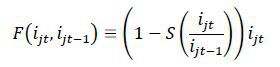

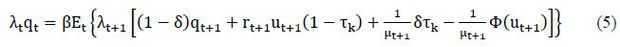

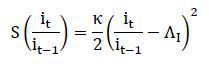

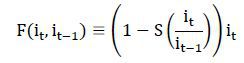

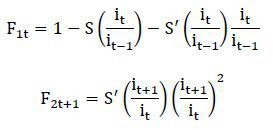

S(⋅) is the investment adjustment cost which is a smoothing mechanism for investment and thus generates hump-shaped response to shocks, if not, the implied investment becomes too volatile. Due to this cost, Tobin’s Q, qt, which is the price of installed capital becomes time varying. For ease of notation, define

and

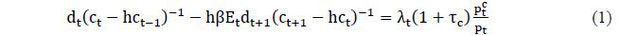

There are three types of taxes on consumption, wages and capital income. Note that

the tax on capital income is only for the net return of capital after depreciation

and thus the tax credit,  δτk, is included.

δτk, is included.

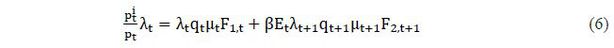

Symmetric Equilibrium Since we consider a symmetric equilibrium due to complete asset market (the complete

set of state contingent Arrow securities and perfect risk sharing) so that cjt = ct, Bjt = Bt,  =

=  , λjt = λt, ujt = ut, qjt = qt, ijt = it, kjt = kt except for the wage and differentiated labor supply. After rearranging FOCs from

household optimization problem,

, λjt = λt, ujt = ut, qjt = qt, ijt = it, kjt = kt except for the wage and differentiated labor supply. After rearranging FOCs from

household optimization problem,

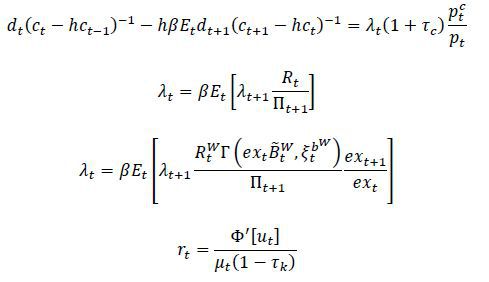

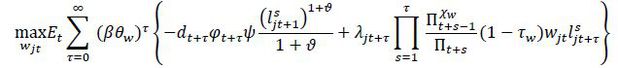

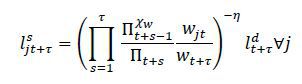

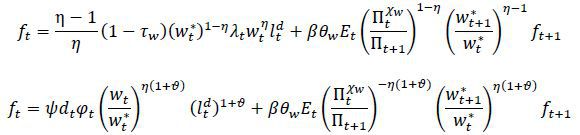

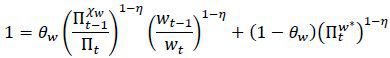

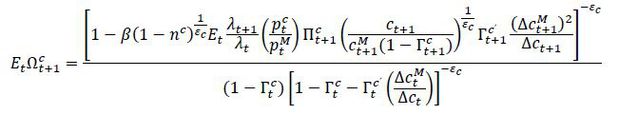

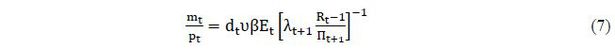

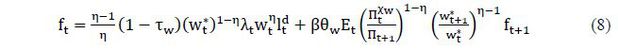

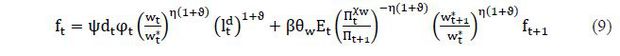

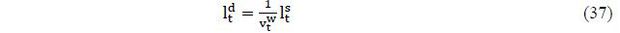

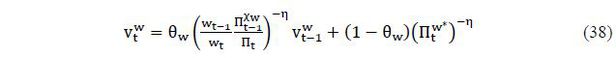

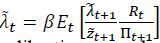

Household Labor Problem The labor problem for the household can be solved separately due to the separable utility. The household who is allowed to optimize with a probability, θw, its wage maximizes the possible future stream of wage revenues when the wage is not allowed to be optimized minus its future stream of disutilities from labor supply. The household posts its monopolistic competitive wage and its labor supply is determined via labor demand function which is derived from the labor packer’s problem.14 η is the elasticity of substitution between differentiated labors, and the following demand function is a standard outcome from Dixit-Stiglitz type of aggregation of differentiated labors in a monopolistic competitive market. Also, to generate a possible persistence for the inflation of wage a partial indexation, parameterized by χw, is adopted. In summary, the household maximizes net revenue in utility terms with respect to its wage subject to labor demand function.

subject to

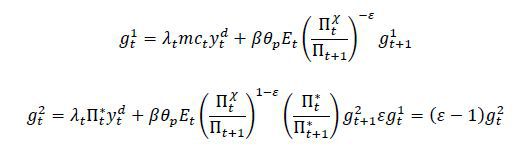

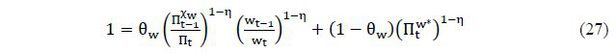

The FOCs of this problem will yield an optimal wage level by equilibrating the intertemporal marginal revenues to intertemporal marginal disutilities. Those households who allowed to optimize at t will set the same wage level due to the perfect risk hedging for the timing of wage change. Thus, the optimal conditions in this problem becomes symmetric. Now, these conditions can be better implemented in computation if it is transformed into recursive representation by introducing an auxiliary variable, ft. After a tedious algebra, the law of motion for the recursive representation becomes

where  is the symmetric optimized real wage for households who are allowed to optimize while

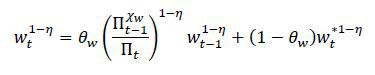

wt is the aggregate real wage for all households. Since in Calvo-Yun setting, there

is a fixed population of households who are allowed to set wage with 1 − θw and who are not with θw, the real wage index evolution can be derived by aggregation.

is the symmetric optimized real wage for households who are allowed to optimize while

wt is the aggregate real wage for all households. Since in Calvo-Yun setting, there

is a fixed population of households who are allowed to set wage with 1 − θw and who are not with θw, the real wage index evolution can be derived by aggregation.

which can be rewritten

where

2. The Distribution Sector

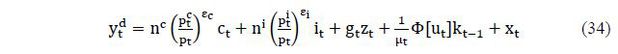

A. Final Consumption and Investment Good Producers

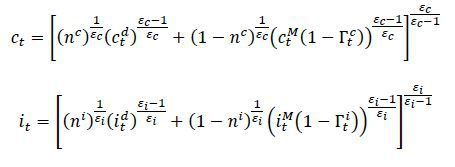

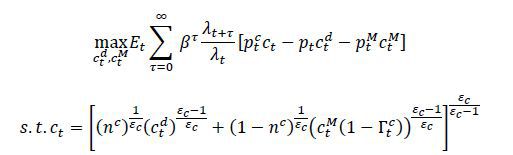

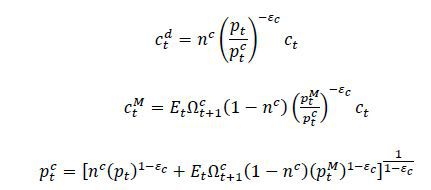

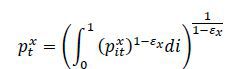

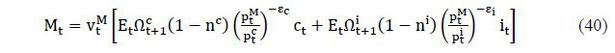

Perfectly competitive final consumption good producer and investment good producer

pack domestic consumption and investment good ( ,

,  ) with imported consumption and investment good (

) with imported consumption and investment good ( ,

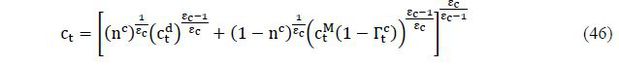

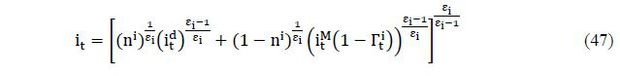

,  ) to produce final consumption and investment good (ct, it) using following CES technology :

) to produce final consumption and investment good (ct, it) using following CES technology :

where home biases, nc and ni, are present. εc and εi represent elasticity of substitution between domestic and imported good. In order

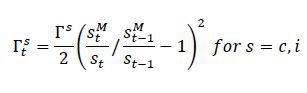

to dampen the excessive volatility of imported goods that affects the final consumption

and investment, a costly transformation of imported goods in the aggregation technology

is adopted.15 The cost function is a quadratic form of a growth rate of a share of imported good.

The cost function for this is denoted by  and

and  where

where

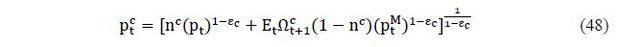

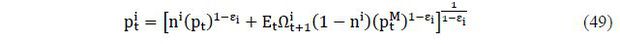

Due to this adjustment costs that depends on the past share of imported goods, the problem for final good producer becomes dynamic instead of a standard static problem.16 :

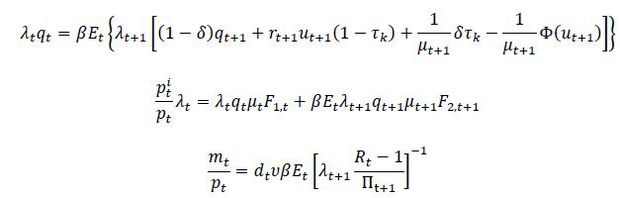

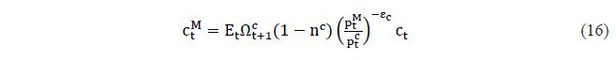

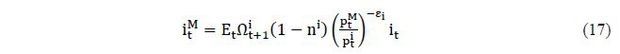

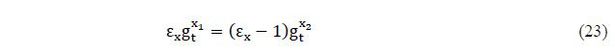

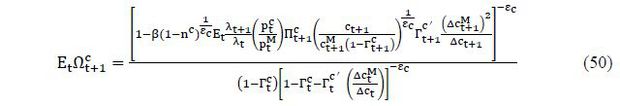

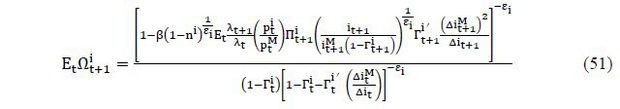

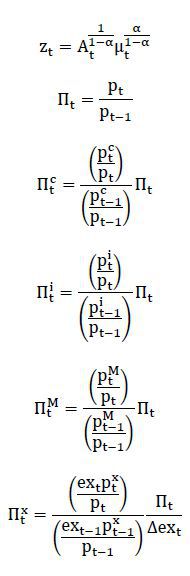

Solving this problem, the equilibrium conditions are :

where

B. Final Domestic Good Producer

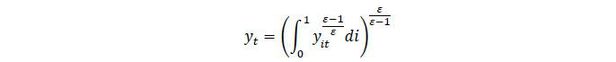

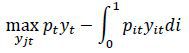

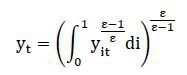

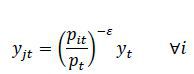

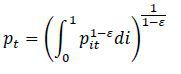

Final domestic good producer produces a homogenous final good to sell at a perfectly competitive market using intermediate good with the Dixit-Stiglitz technology.

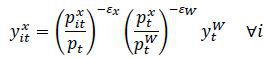

where ε is the elasticity of substitution between intermediated goods. The static problem of the final good producer is

subject to

gives input demand function

where the aggregate price level is

The problems for the labor packer, imported goods distributor and foreign importers who purchase domestic exported goods are all similar to this final good producer’s problem in which demand functions for differentiated goods are derived. Henceforth, demand functions directly appear as constraints to differentiated goods producers without solving each problem.

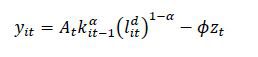

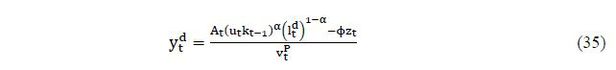

C. Intermediate Good Producers

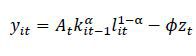

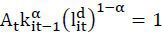

There exists a continuum of intermediate good producers whose ith firm’s technology is

where kit and lit are capital services and homogenous labor. ϕ is fixed cost parameter to guarantee zero profits in the economy at steady state (No entry or exit).

And

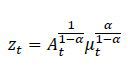

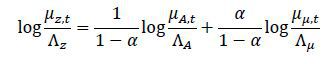

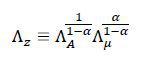

Now, At follows

This exogenous process is a total factor productivity with a trend. The trend in this

process together with the investment specific trend constitutes a balanced growth

path of the economy. This outcome of these two trends is only possible due to a particular

functional form of the production technology which is Cobb-Douglas. First, define

μA,t ≡  then, we can rewrite

then, we can rewrite

and define  , then

, then

where

This weighted average of trends will be used to stationarize the system.17

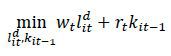

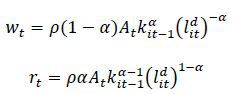

The problem for intermediate good producer can be dissected into two stage. First problem is a static cost minimization where the firm decides how much to employ labor and capital from perfectly competitive factor markets. The other problem is a price setting under Calvo-Yun friction which becomes dynamic.

Factor Demands Firm pays wage and rents, wt and rt, for  and kit-1. The firm solves a static cost minimization problem,

and kit-1. The firm solves a static cost minimization problem,

subject to the production

Assuming interior solution, FOCs are

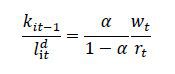

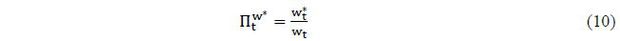

where ρ is the Lagrangian multiplier. The capital labor ratio is derived from above two equations,

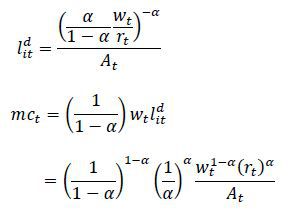

This implies capital labor ratio is same across the intermediate good producing industry

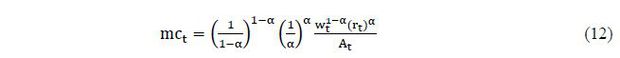

and thus real marginal cost is also same. We can find real marginal cost mct by setting  . This implies

. This implies

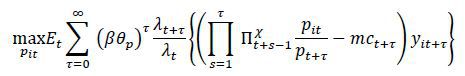

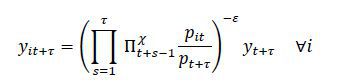

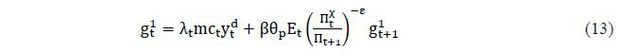

Price Setting Calvo-Yun pricing decision is similar to wage setting problem from the previous section only to replace marginal revenues and marginal costs. Since the firm is owned by households, the firm discounts the future stream of profits from households’ point of view and thus by the stochastic discount factor. A partial indexation is again introduced and so the firm sets the price to maximize :

subject to

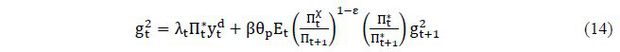

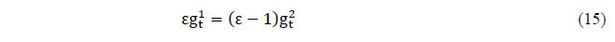

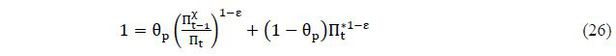

Similarly, the law of motion can be summarized by

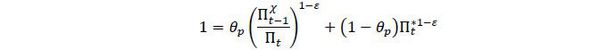

where  . Due to fixed population of firms who optimize price and who cannot, the aggregate

price level evolves as

. Due to fixed population of firms who optimize price and who cannot, the aggregate

price level evolves as

3. Foreign Sector

The demand functions in the foreign sector are shown first and price setting problems in the foreign sector appear later in this subsection.

A. Importing Firms

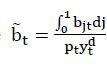

The distributor produces the final imported good  from differentiated imported goods

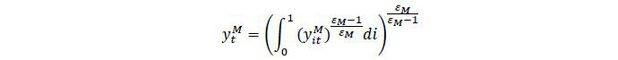

from differentiated imported goods  by aggregation with following technology :

by aggregation with following technology :

where εM is the elasticity of substitution across foreign imported goods. The import demand function and the price of the imported final good are,

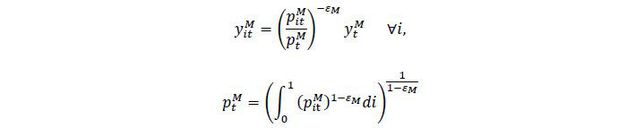

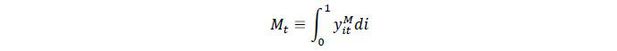

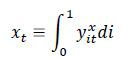

The total amount of imported goods is given by:

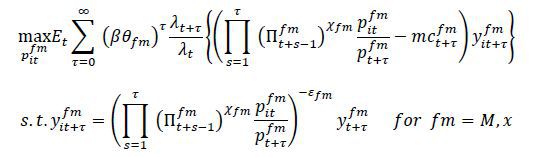

B. Exporting Firms

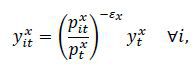

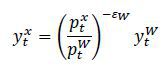

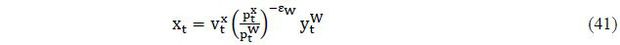

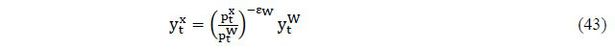

There exists a continuum of monopolistically competitive exporting firms who buy the final domestic good and differentiate it by brand naming. They sell those goods to importers from the rest of the world. Each exporting firm faces following demand function :

where both prices are expressed in the foreign currency of the export market. The export price is

And the total amount of exported good is given by :

And since the economy is a small open economy with measure zero, we can safely assume that the world demand for our export is,

Thus combining above demand functions gives,

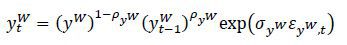

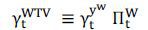

The world demand is exogenously given by :

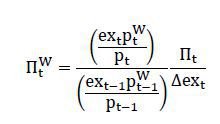

and world inflation,  , by :

, by :

C. Price-setting in the Foreign Sector

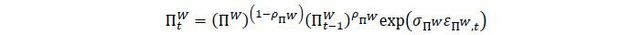

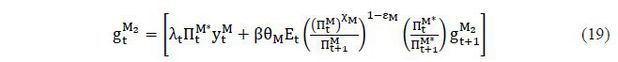

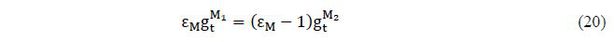

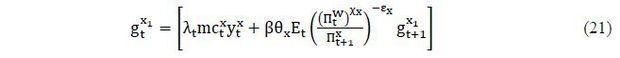

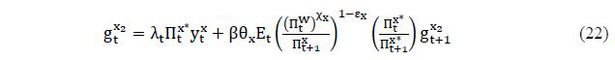

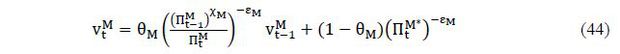

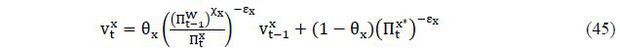

Calvo-Yun price setting for importing and exporting firms is assumed to allow for incomplete exchange rate pass through. The problem of importing and exporting firms is identical and thus,

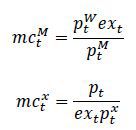

where the real marginal costs in domestic and foreign currency terms for importing and exporting firms are,

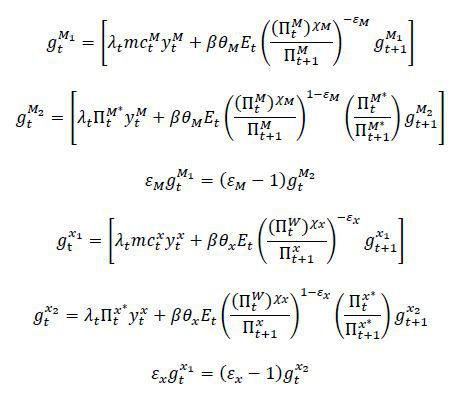

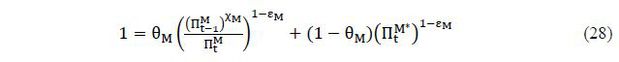

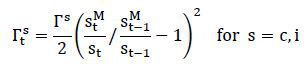

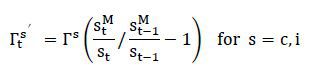

Similar to imtermediate domestic good producers, price setting equilibrium conditions in recursive forms for importing and exporting fimrs can be derived as :

where  and

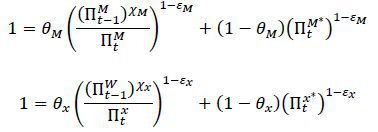

and  Price evolution for import and export goods is,

Price evolution for import and export goods is,

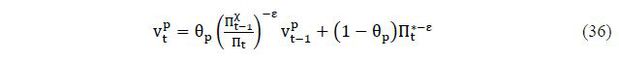

4. Monetary Authority

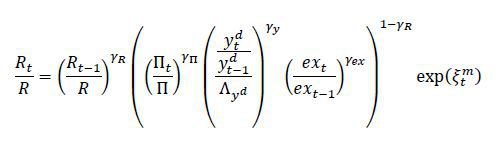

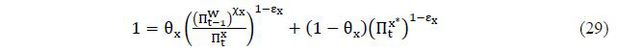

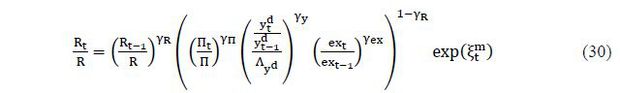

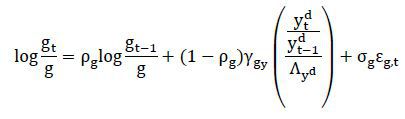

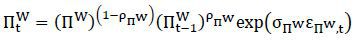

While the monetary authority’s primary goal is to stabilize the inflation, output stability can be another important objective. Thus, an augmented Taylor rule in which the interest rate not only responds to inflation gap but also to output gap is generally assumed. In addition, the growth rate of the exchange rate is added to reflect more realistic setting for a small open economy like Korea who in practice wants to stabilize the exchange rate as well. The monetary authority sets the nominal interest rates according to :

Π represents the target level of inflation (equal to inflation trend in the steady

state in this model), R steady state gross return of asset, and Λyd the steady state gross growth rate of  . The term

. The term  is a random shock to monetary policy that follows

is a random shock to monetary policy that follows  .

.

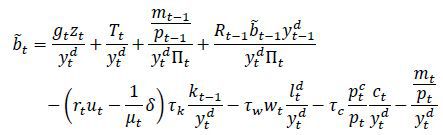

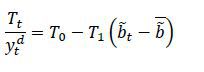

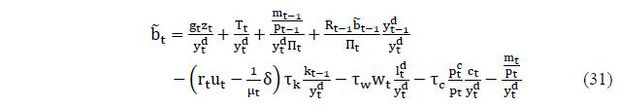

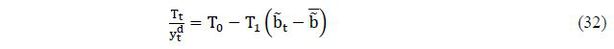

5. Government

The government’s revenues are generated by marginal taxes and lumpsum tax (or negative lumpsum subsidy) while the expenditures are determined with an exogenous shock and an automatic stabilizer. The government budget constraint is :

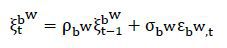

where  . The real government expenditure is exogenously given by,

. The real government expenditure is exogenously given by,

But level of debt should be prevented from exploding and thus the lumpsum transfer should be designed to be controlled by the deviation of debt from its own steady state level

where the steady state of debt level

IV. Empirical Analysis

1. Data

Domestic data are imported from ECOS (Economic Statistics System of the Bank of Korea) and KOSIS (Korean Statistical Information Service) while foreign data are from FRED and Global Insight. The model described in this paper is a practically representative agent model so that the variables of interest such as output and expenditures are in terms of capita. As KOSIS only provides annual data for population, the quarterly time series was constructed by a linear interpolation to divide GDP components. Another indirect mapping from the raw data to the model is applied with private consumption, private investment and government expenditures. Durable consumption is excluded from private consumption variable in the model but is instead included in the private investment. This treatment can be done in practice when the model does not specify durable goods sector explicitly since the utility flow from consuming durable goods is not concentrated in one decision time period but dissembled for prolonged periods. Also, durable goods are generally depreciated over periods which show more of an investment characteristic in the model. Hence, the private consumption is constructed by nondurables, semidurables and services while the private investment is constructed by durables and private fixed capital formation. Government expenditures are constructed based on addition of government consumption and government fixed capital formation as they are not reported in KOSIS. As noted earlier in section II, KOSIS GDP components in real terms are based on Lespeyres chain weighted index. Having this taken into account, the constructed series are recovered.18 The consumption deflator associated with this constructed consumption is computed as byproduct to be used for estimation.

Although Call rate is the policy rate for the Bank of Korea, the risk free interest rate in this paper not only represents the policy rate but also the interest rate which households directly face at the same time without risk premium or financial friction. Hence, 1 year Treasury Bond rate was chosen to serve as proxy for the risk free domestic interest rate. And the world interest rate is 3 months U.S. Treasury Bill. For labor supply, total working hours from raw data is normalized so that it is between zero and one. DSGE models in general are hard to replicate the excessive volatilities of the nominal exchange rates. Nevertheless, Won/Dollar exchange rate has been included in the dataset because of the inclusion of the global financial crisis in 2008. The export for Korea in Won during 2008 has exceeded the growth of world demand. This cannot be explained either by the world demand or the world inflation both of which have been decreasing during the crisis. It is only possible with a strong depreciation of Korean Won. The proxy for the world inflation is the deflator for the sum of GDPs of 11 major trading partners with Korea. As it was motivated in section II, the World Trade Volume is chosen for world demand in the model. It is worth noting that the World Trade Volume is a nominal value in terms of the U.S. dollars. So the variable from the model should be constructed accordingly.

GDP components and World Trade Volume are transformed into growth rates for stationarity.

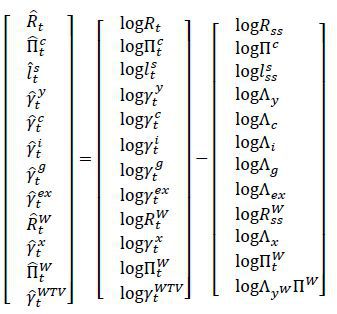

In summary, there are twelve time series data available for the estimation; domestic interest rate, inflation rate of consumption deflator, labor hours, GDP, private consumption, private investment, government expenditures, exports, world demand, world interest rate, world inflation and exchange rate. So the observable vector in log-deviation from steady state is,

where Λz = Λy = Λc = Λg = Λx = Λyw , Λex = 1 , ΠC = ΠW and RSS =

But using all of those time series have not necessarily resulted in good fit of key macro variables as shown below. Thus, we present the various results with different combinations of selected time series after econometric methodology subsection. The key variables that were included with any set of observables were domestic interest rate, domestic inflation rate, labor hours, GDP, consumption, investment, government expenditures, exchange rate and world interest rate. Three variables from world demand, world inflation rate and exports were brought to test different sets of combinations. In order to avoid the stochastic singularity problem and also to minimize any excessive movements of observables, measurement errors have been specified when the model is brought to the estimation with 10% of each own variabilities in observations except for the exchange rate volatilities. The standard deviation of measurement error for the exchange rate growth is set as 35% of its own standard deviation in data. Although, this magnitude of standard deviation in measurement error is larger than other variables, this was necessary in order to derive reasonable magnitude of implied volatilities of other key macro variables. This limitation of empirical results is not alone since the volatility of exchange rate in general is difficult to be replicated in the context of sticky price DSGE models as argued by Chari et al. (2002). Nevertheless, the exchange rate growth has been included to explain the high growth of exports in Korean won during the global financial crisis. Otherwise, the model which estimated without the exchange rate growth19 was attributed the high growth of export in 2008 to the high world inflation which is inconsistent to our general understanding of the crisis periods.

2. Econometric Methodology

Bayesian method20 is adopted to map the data to the model. To make it implementable for estimation and various simulation exercises, the system of stationarized equilibrium conditions is approximated up to first order around the deterministic steady state. Since the posterior distribution of structural parameters is hard to be characterized analytically, Random Walk Metropolis-Hasting algorithm is used for the numerical approach. The proposal density is Hessian of the likelihood function evaluated at the posterior mode which is estimated via CMAES method.21 The posterior distributions reported in the following subsection are based on the second half of 5 million draws from MCMC algorithm, i.e. discarding the first 2.5 million draws for the initial burn-in. The acceptance ratio was approximately 61.34 % which indicates appropriate property for estimation.

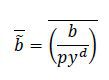

There are a small set of parameters that are calibrated rather than estimated because

they are either hard to be identified with macro time series or irrelevant, shown

in <Table 7>. β is calibrated to match the steady state of Euler equation,  . 22 The steady state condition requires β =

. 22 The steady state condition requires β =  . For calibration, sample mean of inflation, growth rate of output and interest rates

are used for ΠSS , ΛZ and RSS . These values imply β of 1.0044 which seems unconventional. However, because the model has a balanced growth

term,

. For calibration, sample mean of inflation, growth rate of output and interest rates

are used for ΠSS , ΛZ and RSS . These values imply β of 1.0044 which seems unconventional. However, because the model has a balanced growth

term,  , β needs not to be less than one as long as

, β needs not to be less than one as long as  23 is less than one. With this calibrated β , the model is still stationary to any kind of shocks.

23 is less than one. With this calibrated β , the model is still stationary to any kind of shocks.  is calibrated to match average total government debt to GDP ratio during the sample

period as well as for

is calibrated to match average total government debt to GDP ratio during the sample

period as well as for  to average nominal government to nominal GDP ratio. Besides

to average nominal government to nominal GDP ratio. Besides  being stationary in data, the other reason for calibrating the ratio instead of the

level of government expenditures, ݃g, is that it allows us to solve the steady states of all the endogenous variables

in closed forms. Otherwise, having ݃g calibrated would render a nonlinear equation for the labor supply to be solved.24 Marginal tax rates are calibrated to effective value-added tax revenues over private

consumption, effective income tax over total wage income and corporate tax revenues

over private capital formation. The rest of parameters are generally known to be standard

in the class of DSGE models.

being stationary in data, the other reason for calibrating the ratio instead of the

level of government expenditures, ݃g, is that it allows us to solve the steady states of all the endogenous variables

in closed forms. Otherwise, having ݃g calibrated would render a nonlinear equation for the labor supply to be solved.24 Marginal tax rates are calibrated to effective value-added tax revenues over private

consumption, effective income tax over total wage income and corporate tax revenues

over private capital formation. The rest of parameters are generally known to be standard

in the class of DSGE models.

3. Empirical Moments of Estimated Models

Before the detailed results of the benchmark estimation are presented, first and second moments of the estimated models with different combinations of time series are reported in this subsection. There are seven possible estimations to choose from any combination of the last three observables. As <Table 8> shows, Model 1 estimates the model with first ten observables excluding the world trade volume and export growth, Model 2 excluding export growth and so on. The numbers in parenthesis are implied first moments of variables that were not included as observables in estimations. First moments implied by the estimated models do not show much differences across estimations since the long run trends’ estimates are mostly influenced by tight prior distributions. Note that the growth rates of GDP, consumption, government expenditures and exports are consistent within a model because they share the same balanced growth path by construction. However, this reason made the trends in world trade volume and export become difficult to match with data.

<Table 9> shows the volatilities of fitted observables. The fitted observables were estimated via smoothing Kalman Filter which retrieves the historical structural shocks. This procedure is generally done when it is necessary to demonstrate how the estimated DSGE model fits the data well. Thus, gaps between the actual observed data and the fitted values of observables have been filled by measurement errors. As can be seen from <Table 9>, the estimated models generally fit well with the data except the exchange rate growth. As mentioned earlier, this comes from the large magnitude of measurement errors which have been set intentionally for exchange rates.

Another way of evaluating the empirical properties of estimated models is to observe the volatilities of simulated series. Table 1 shows the volatilities of observables simulated for the sample period. Given the estimated values for predetermined states25 in 2000:Q2 where the sample begins, the models are simulated onward until 2012:Q4 where the sample ends with randomly generating structural shocks. This has been done 10,000 times for each estimated model and averages over 10,000 standard deviations of simulated series which are collected in <Table 10>. In general, comparing the size of volatilities of each model to data shows that Model 1 and Model 3 match well at least with the observables. However, the implied volatilities of world trade volume and exports in Model 1 show significant discrepancy with data. On the other hand, Model 3 performs quite better even with matching the implied volatilities of unobservables to those of data. Therefore, we chose Model 3’s result as a benchmark estimation to be used for presenting detailed results below.

4. Estimation Results

The prior and posterior distributions are reported in <Table 11>. There are several things worth noting with these estimates. First, the prior distributions

are set as loosely as possible to meet reasonably good statistical properties of the

whole estimation and follow much of the convention in the literature except parameters

related to the trends. As Del Negro and Schorfheide (2008) has argued, the priors for trends such as, Λμ, ΛA, Π and  , need to be tight around the sample mean of time series directly related to these

parameters. As mentioned earlier, the lower trend in private investment resulted in

negative trends in Λμ along with the posterior estimates. Total factor productivity trend, on the other

hand, reports 0.653. The inflation trend, Π, is estimated to be 0.716 which in per

annum is approximately 2.863% close to the target inflation rate of the Bank of Korea.

The average risk free interest rate spread between Korea and U.S. is estimated to

be 0.636% which if translated to per annum results approximately in 2.544%.

, need to be tight around the sample mean of time series directly related to these

parameters. As mentioned earlier, the lower trend in private investment resulted in

negative trends in Λμ along with the posterior estimates. Total factor productivity trend, on the other

hand, reports 0.653. The inflation trend, Π, is estimated to be 0.716 which in per

annum is approximately 2.863% close to the target inflation rate of the Bank of Korea.

The average risk free interest rate spread between Korea and U.S. is estimated to

be 0.636% which if translated to per annum results approximately in 2.544%.

Second, the preference parameters are mostly within standard boundary of estimates found in literature. The habit persistence parameter, ݄h, shows a strong persistence which seems obvious since the private consumption is defined as consumption of nondurables, semidurables and services. The inverse of Frisch elasticity, ϑ,was estimated to be 0.049 which is considerably lower than that of the U.S. and most of the developed countries.

Third, elasticities of substitutions vary across different sectors. The markups,  − 1, implied by the estimates for domestic, imported and exported goods are 12.8%,

12.2% and 11.6%, respectively. This is not a surprising outcome since the Korean export

sector faces more competitions in the world market compared to that of the import

sector which faces far less competition. On the other hand, the wage markup,

− 1, implied by the estimates for domestic, imported and exported goods are 12.8%,

12.2% and 11.6%, respectively. This is not a surprising outcome since the Korean export

sector faces more competitions in the world market compared to that of the import

sector which faces far less competition. On the other hand, the wage markup,  − 1, shows an estimate of 16.5% which implies the rigidity of the Korean labor market.

Calvo parameters related to those sectors indicate stickiness in price changes, especially

in the domestic good, θp, and exported good sector, θx. On the other hand, the estimate for the wage stickiness, θw, is 0.101 which is significantly lower than the usual findings in developed countries.

This result combined with the high wage markup implies that there are more changes

in the wage settings while the labor suppliers have market power in terms of negotiation.

The adjustment cost parameter for imported consumption good, Γc, shows a higher degree of adjustment cost than that for imported investment good,

Γi, which implies that imported investment goods will add relatively more volatility

towards the final investment good than imported consumption goods to final consumption

good. This can be understood with the characteristics of the Korean manufacturing

industries which mostly import raw materials and intermediate goods to produce final

manufactured goods. The home biases, nc and ni, also demonstrate reasonable estimates, 0.857 and 0.234. Although this result relies

somewhat on the prior distributions, it is consistent with the fact that consumption,

in general, has more weights on nontradables such as services while the investment

good consists less of nontradables but more of imported goods like machineries and

installations.

− 1, shows an estimate of 16.5% which implies the rigidity of the Korean labor market.

Calvo parameters related to those sectors indicate stickiness in price changes, especially

in the domestic good, θp, and exported good sector, θx. On the other hand, the estimate for the wage stickiness, θw, is 0.101 which is significantly lower than the usual findings in developed countries.

This result combined with the high wage markup implies that there are more changes

in the wage settings while the labor suppliers have market power in terms of negotiation.

The adjustment cost parameter for imported consumption good, Γc, shows a higher degree of adjustment cost than that for imported investment good,

Γi, which implies that imported investment goods will add relatively more volatility

towards the final investment good than imported consumption goods to final consumption

good. This can be understood with the characteristics of the Korean manufacturing

industries which mostly import raw materials and intermediate goods to produce final

manufactured goods. The home biases, nc and ni, also demonstrate reasonable estimates, 0.857 and 0.234. Although this result relies

somewhat on the prior distributions, it is consistent with the fact that consumption,

in general, has more weights on nontradables such as services while the investment

good consists less of nontradables but more of imported goods like machineries and

installations.

Fourth, Taylor rule parameters in this estimation are γR, γΠ, γy and γex. The interest rate smoothing, γR, shows strong persistence. The inflation stabilization stance, γΠ, is estimated to be 1.583 which is close to the prior. However, the posterior standard deviation is tighter than the prior distributions which indicates the likelihood of supporting the inflation stabilizing monetary policy during the sample period on average. On the other hand, the output gap stabilization stance parameter, γy, shows close to the prior mean to a less degree than γΠ. And γex shows the somewhat positive response of the monetary policy to the nominal exchange rates.26 And lastly, the positive estimate of γgy, the automatic stabilizer in the government expenditure process, shows countercyclicality.

Lastly, the autoregressive parameters to the structural shocks mostly show quite a strong persistence. The intra-temporal preference shocks, world interest rate shock and world demand shock particularly shows strong persistence while the inter-temporal preference shock, the government shock, risk premium shock and world inflation shock somewhat less. The standard deviation parameters of structural shocks indicate that the inter-temporal shock is the most volatile, followed by the world demand shock, intra-temporal shock and government expenditure shock.

The properties of prior and posterior distributions can be confirmed with the following figures. The thin lines indicate priors while the thick lines indicate posteriors. When the thick line is formed far from the thin line or shows tighter boundary, it means the structural parameter estimate is more strongly supported by data. This can be found easily with parameters related to structural shocks because posterior distributions of those parameters demonstrate stationary distributions. Most of the structural parameters show good identifications that are well supported by data with the exception of few parameters such as Γc, Γbw, θM and ξM which shows unsatisfactory data support. Trend parameters whose priors were set intentionally tighter would obviously result in posterior distributions that are close to prior distributions. Policy parameters except for the interest rate smoothing, γR, show that priors matter as well. The elasticities, ε' s and η,show reasonably well boundedness although the mixing properties are somewhat less than ideal. In general, there is room for an improvement by letting the data tell much as it can but we believe this outcome of estimates show quite reasonable properties considering the relative shortage of samples of Korean data compared to other developed countries.

5. Model’s Properties

Next five following figures show impulse response functions of key variables to five different structural shocks. The variables are all in one hundred times of log deviations from steady states. A shock simulation is based on one standard deviation of posterior estimates. The variables are nominal interest rate, inflation rate of consumption deflator, output growth, consumption growth, investment growth, wage growth, labor hours, export growth, imported consumption, imported investment, import growth and nominal exchange growth, respectively from top left to bottom.

[Figure 5] shows IRFs to inter-temporal preference shock. This shock brings today’s marginal utility relatively larger than tomorrow’s resulting in increased consumption at the expense of dissaving which in turn leads to less investment. But since the domestic output does not increase enough to meet the consumption demand, imported consumption good demand increases which entails increase in inflation and depreciation of Korean won.

[Figure 6] is IRFs to total productivity shock. The results in this figure are consistent with the convention in RBC models. Thanks to an increase in total factor productivity, the output grows and household increases consumption but with smoothing over time by saving in the initial period. Marginal productivity of labor, which is practically close to the wage in this estimated model due to weak wage stickiness, increases. Since the interest rate does not move significantly at the initial period while prices drop, uncovered interest parity condition requires that the exchange rate decreases and which leads to an appreciation of Korean won.

[Figure 7] is IRFs to expansionary monetary policy shock. When the interest rate decreases by approximately 25bp , i.e. expansionary, the real variables such as output, consumption, investment, wage and labor hours increase due to price stickiness. Those firms that produce intermediate goods that are unable to optimize the price can only adjust real allocations which means that change in nominal interest rate has propagation mechanism on real variables. Since inflation rate increases as much as in Neoclassical models, increase of output results largely from favorable investment opportunities with more imported investment goods. Fall in interest rate combined with rise in inflation rate also depreciates Korean won which is implied by uncovered interest parity.

[Figure 8] is IRFs to government expenditure shock. Although increase in government expenditure boosts up the output of the economy, this should be seen as a mere alteration in accounting record rather than having an expansionary effect on other domestic demands such as consumption and investment in a concrete manner. Decrease in consumption and investment is a clear sign of crowding out effect of expansionary government expenditure. Thus this model does not imply the effectiveness of government expenditure policy on private sectors of the economy as it focuses rather on sticky price features

Lastly, [Figure 9] shows IRFs to the world demand shock. World demand first influences the export growth which leads to more demand in domestic productions from abroad. This raises the prospects of domestic firms and thus increases investment. Consumption increases as well with slow convergence to steady state due to increase in saving initially, wage grows and labor hours increase. Since export grows initially more than import, exchange rate drops initially.

Next figure shows the forecast error variance decompositions of selected variables. For simplicity, two preference shocks’ contributions are combined as "preference" and two productivity shocks as "productivities". The figure also shows the variance decompositions with 2Q, 4Q, 12Q, 40Q and 100Q forecast horizons to see the short-run and long-run effects.

[Figure 10] shows the variance decompositions of nominal interest rate and inflation rate of consumption deflator. It is evident that both series are largely affected by preference shocks, monetary shocks and productivities. Having preference shocks variation constitute 60% of interest rate and 70% of inflation variance is similar to the findings reported by Smets and Wouters (2005), but they had instead price and wage markup shocks in replacement of those preference shocks. With regard to inflation’s decomposition, preference shocks slightly mitigates as the time horizon increases while mone ary policy and productivities increases. Interest rate, on the other hand, shows different result as the variation of monetary policy shrinks while that of productivities increases in the long-run.

[Figure 11] shows variance decompositions of output growth and labor hours. Variance of both series are affected with more diverse shocks than the previous two. Productivity shocks are still the first factor explaining the variation of both output growth and labor hours. Government expenditures shock has considerable influence on output growth while world inflation, demand and risk premium somewhat evenly contributes to output growth. Interestingly, the time horizon does not seem to differentiate those ratios for output growth. In contrast, labor hours, demonstrates more fluctuations due to the preference shocks in the long-run although they are not dominating productivity shocks.

V. Historical Decompositions and Policy Analysis

Given the posterior means of parameters, the historical structural shocks have been retrieved using the smoothing Kalman Filter. As [Figure 12] shows, the most obvious outcome of those historical shock processes is the conspicuous movements of shocks which can be observed in the late 2008 a period which marked the advent of the global financial crisis. Total productivity shock, the world demand shock and the world inflation shock27 have experienced significant drops and as a result of the expansionary policy discretions such as massive government expenditures and the implementation of reduced interest rates. Due to the monetary easing initiated by the Federal Reserve of the U.S., the world interest rate shock has remained below zero ever since 2008. One can doubt that such unreasonable outcome is due to the significant persistence of the world interest rate shock rather than the more evenly dispersed fluctuations around zero. But since the Korean economy is a small open economy which directly confronts the world interest rate as an exogenous factor, the world interest rate movements are not modeled endogenously and is not necessary to show more evenly dispersed fluctuations around zero.

The next following three figures demonstrate how those historical shocks have contributed towards our variables of interest. The lines are the actual observed time series in a data while the dotted lines are fitted values by the estimated model. In [Figure 13], the inflation rate of the consumption deflator and growth rate of GDP are historically decomposed. The inflation rate fluctuates around the grey box in which the inflation trend is specified by the model. Supply shocks such as productivity shocks mostly contributed towards lowering the inflation. In contrast, the demand shocks by preference shocks show somewhat cyclical features. The shocks contributed to lowering the inflation rate in periods of crisis, namely credit crisis in 2003 to 2004 and global financial crisis after 2008, while in the absence of shocks shows contrasting results periods such as 2005 to 2007. The growth rate of GDP is mostly driven by productivity shocks28 as typically observed in the class of DSGE models. There were sizable shrinks of productivity shocks in credit crisis and also after the global financial crisis. The monetary policy shock, shows contrasting result compared to the credit crisis and the global financial crisis. In 2003 and 2004, the monetary policy seemed to indicate contractionary discretions as opposed to expansionary despite the presence of an economic slowdown. On the other hand, the monetary policy turned into more expansionary stance during the global financial crisis and have boosted.

GDP growth at least for the next two years. But the expansionary monetary policy was accompanied by an increase in inflation rates. Meanwhile, the fiscal policy seemed to act more countercyclically for both periods. The expansionary government expenditures in 2003 and 2008 both seem to have dampened the adverse effects of the crisis. Another notable result on GDP growth is that the strong recovery in 2009 and 2010 was not only driven by the productivity shocks but also by the world demand shock, followed by the world inflation shock. This result confirms the characteristics of Korean economy which is largely exposed to external conditions of both goods and financial market and which also exhibits characteristics of export-driven recovery.

In [Figure 14], the private consumption growth is mainly driven by two types of shocks; the productivity shocks and the preference shocks. The growth trend of productivity shocks constitute a substantial part of consumption growth while the preference shocks create more fluctuations. However, it seemed that the fitted value constantly tends to be slightly higher than the actual series since the observed consumption growth was lower than the model’s implied trends of consumption growth during the sample period. Credit crisis which was linked to the household debt problem and the resulting low consumption growth has attributed to the nega tive contribution of the preference shocks. The global crisis also indicates that the consumption growth has declined due to the preference shocks. The private investment growth shows fluctuations that are driven by more diverse shocks than consumption growth. During the credit crisis, the investment was subdued mainly due to the productivity shock and the monetary policy shock. After the steep drop in the global crisis due to the productivity shock, the investment growth has benefited from the expansionary monetary policy in contrast to the credit crisis. In more recent years, the investment growth has shown signs of slowdown from the deterioration of the productivity shocks.

In [Figure 15], two variables that represent main policy tools, the growth rate of government expenditure and the nominal interest rate, are shown. The government expenditure is mostly driven by productivity shocks and government expenditure shocks. Although, the government expenditure shock does not seem to show a clear countercylicality overall, it turns into a expansionary phase as the crisis hit. The expansions of the government expenditure shocks in 2003 and 2008 clearly show dampening of the productivity shocks’ decrease. For the nominal interest rate, the fitted values are slightly below the actual time series. While the substantial part of the interest rate comes from the constant term defined by its own steady state, the interest rate varied mostly due to productivity shocks, preference shocks and monetary policy shock which is consistent with the forecast error variance decomposition shown above. During the credit crisis in 2003 and 2004, the interest rate did not decline at a level sufficient enough to stabilize the negative preference shock. The figure shows that a non-systematic part of the monetary policy, i.e. the monetary policy shock, was not expansionary but contractionary. On the other hand, the decline during the global financial crisis in 2009 is in fact estimated to have been expansionary since the monetary policy shock is negative.

1. Policy Analysis During Global Financial Crisis

In [Figure 16], the policy simulations have been investigated during the global financial crisis. The purpose of this exercise is to see to what degree of non-systematic discretion of those policies were made in a relative sense during the crisis. Therefore, the systematic parts of the monetary and fiscal policy which follow the estimated Taylor rule and fiscal rule specified in the model is still maintained to avoid Lucas critique, while the simulation is based on eliminating the estimated historical processes of the monetary policy shock and the fiscal policy shock which are the non-systematic part of the policies.29 The top two panels show the simulated and realized time series of the inflation and GDP growth imposing no monetary policy shocks beginning from 2008:Q3. During the crisis overall, the non-systematic part of the monetary policy does not seem to have strongly influenced both inflation rate and GDP growth. This implies that the monetary policy was reacting to the economic slowdown along with lower inflation rather systematically via Taylor rule than being inordinately expansionary or contractionary.

On the other hand, no government expenditure shock would have resulted in GDP growth being substantially more volatile although it has almost no effect on the inflation rate. This result makes it evident that the fiscal policy during the crisis was more or less an exceptional policy to dampen the large economic fluctuations. The following table confirms the findings from [Figure 16].

First row of <Table 12> shows the standard deviations of observed time series on the inflation rate and GDP growth rate. The second row shows the standard deviations of two series when the monetary policy discretions were not implemented. The result shows that the monetary policy shock on average during this period was not necessarily overly expansionary in stabilizing both the inflation and GDP. On the contrary, the government expenditure shock was quite successful at least in terms of stabilizing GDP growth while not necessarily with the inflation. However, this outcome should not be interpreted as the fiscal policy being more effective for stabilizing the economy than the monetary policy. Nevertheless, this simulation exercise seems to imply that an unconventionally large non-systematic expansion of the government expenditures have played a significant role in the period of the global financial crisis.

VI. Conclusion

This paper has studied Korean economy after 2000 with an estimated DSGE model. The model proposed in this paper follows closely to the highly stylized small open economy models that incorporate price frictions and various other frictions with ten structural shocks. The paper also attempted to bring the model to the Korean data without preprocessing of data so that the model fully explains both trends and cycles. Under Bayesian estimation technique, the posterior estimates of structural parameters seem to fall into reasonable boundaries considering the characteristics of Korean economy. Macro variables of key interests have been extensively analyzed with historical decompositions that demonstrate which types of structural shocks are responsible for fluctuations during the sample period. Lastly, some policy simulations have been investigated during the global financial crisis. The simulation seems to imply that the nonsystematic discretion of fiscal policy was unconventionally large and has played a considerable role in dampening the adverse effects of the crisis on GDP growth while the monetary policy have followed more systematically with Taylor rule. Furthermore, there have been some limitations of this work to be done in the future. First, it was difficult to explain the relatively higher growth rate of export that is far above the balanced growth path of the model. Although, the world trade volume which seems to reflect the high growth of Korean export in data was used as a proxy for the world demand, there seems to be a gap that needs to be filled in the theoretical model in which the export growth is allowed to be higher than the balanced growth path of other real variables. Second, the fiscal policy in this model did not support the view of the effectiveness of the fiscal policy on the private sector. The model in this paper implies that the crowding out effect of the fiscal policy possibly is contradictory to the findings in the empirical literature which was documented by Hur (2007). Third, the absence of financial friction in this paper may be an important source of fluctuations of Korean macro variables, especially in crisis periods such as the credit card crisis and the global financial crisis. Nevertheless, we believe this paper has provided a good starting point at least in terms of comprehensive analysis of Korean economy with an estimated DSGE model that contains fairly rich features.

Appendices

Appendix

Equilibrium Conditions

• Households

• Wage setting by households

• Intermediate domestic good producer

• Demand for imports

• Importing and exporting firms set prices

• Prices and wages evolve as

• Monetary authority

• Government

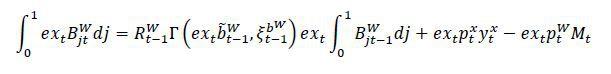

• Net foreign asset evolves as

• Aggregation

- Goods market clears

- Price dispersion

- Labor market clears

- Capital evolves as

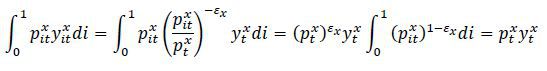

- Aggregate imports and exports

- Prices dispersions for aggregate imports and exports

- Aggregate consumption and investment evolve as

- Prices for aggregate consumption and investment

where

• Exogenous Process

- Productivity shocks

- Preference shocks

- Monetary policy shocks

- Government expenditure

- World interest rate

- Premium shock

- World demand and inflation shocks

and world inflation by :

• Definitions

• Functional forms

- Capacity utilization cost

- Investment adjustment cost

Derivatives associated with this

and

- Cost function for change of share of imports of consumption and investment

derivative

- Premium for foreign assets

Notes

A large scale small open economy DSGE model is developed by Adolfson et al. (2007) and Burriel et al. (2010). This paper has mainly borrowed standard features of small open economy from the latter.

KOSIS which is the Korean official GDP database uses terminology of capital formation instead of investment.

KOSIS reports government consumption and government capital formation separately. Thus, this series is constructed by weighted sum of government consumption and investment using Lespeyres chain weighted index calculation.

The model in this paper later introduces an investment specific trend that allows a separate trend for the investment.

7 Those 11 major trading countries are the U.S., China, EU, Japan, Taiwan, Hong Kong, Indonesia, Singapore, Malaysia, Brazil and Mexico. And exports to the U.S. and China have a share of 35% in the Korean exports.

Financial crisis that began in late 1997 was excluded since inflation was highly volatile than normal periods with an unprecedented pace.

Alternative way of capacity utilization cost can be done by having depreciation of capital being a function of capital use, but its qualitative result is indifferent.

This problem is omitted in this paper, but this is similar to the final domestic good producer’s problem who aggregates differentiated intermediate goods into the final homogenous domestic good.

Alternative way of dampening the excessive volatility of imported goods is to model a nontradable sector as Mendoza (1995).

See Whelan (2002) for more general chain weighted index such as Fisher ideal chain weighted index and other indices. This paper converted the excel file that automatically constructs Lespeyres chain weighted index provided by the Bank of Korea into a matlab function code for its use.

The model estimated without exchange rates but with export and world demand is available upon request to the author.

This finding is different from the previous draft of this paper in which the exchange rate growth was not included in the vector of observables for the estimations.

In the previous version of this paper, one shortcoming of these historical shocks was the significant increase of the world inflation rate during the crisis rather than decrease. Given that there was a big drop of oil price during the crisis and weak world demand, it is a contradictory result to our understanding. This limitation was coming from the fact that the model does not generate enough volatility of the nominal exchange rate. In 2008, Korean Won has been depreciated by a large degree which is perceived as a high world inflation from the perspective of the Korean export sector. Thus, the world inflation in the estimated model of the previous version should not be interpreted as simply the world price in dollar terms but rather world price that the Korean economy faces with the nominal exchange rate taken into account. This was the main reason the exchange rate growth was included in the observables vector for the current benchmark estimation.

References

, et al. (2007). Bayesian Estimation of an Open Economy DSGE Model with Incomplete Pass-through. Journal of International Economics, 72(2), 481-511, https://doi.org/10.1016/j.jinteco.2007.01.003.

, & (2007). Bayesian Analysis of DSGE Models. Econometric Reviews, 26(2-4), 113-172, https://doi.org/10.1080/07474930701220071.

(2010). How to Maximize the Likelihood Function for A Dsge Model. Computational Economics, 35(2), 127-154, https://doi.org/10.1007/s10614-009-9182-6.

, , & (2002). Can Sticky Price Models Generate Volatile and Persistent Real Exchange Rates? The Review of Economic Studies, 69(3), 533-563, https://doi.org/10.1111/1467-937X.00216.

, , & (2007). Business Cycle Accounting. Econometrica, 75(3), 781-836, https://doi.org/10.1111/j.1468-0262.2007.00768.x.

, , & (2005). Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy. Journal of Political Economy, 113(1), 1-45, https://doi.org/10.1086/426038.

, & (2008). Forming Priors for DSGE Models (and How It Affects the Assessment of Nominal Rigidities). Journal of Monetary Economics, 55(7), 1191-1208, https://doi.org/10.1016/j.jmoneco.2008.09.006.

, & (2008). Optimal Monetary Policy in a Small Open Economy with Home Bias. Journal of Money, Credit and Banking, 40(4), 721-750, https://doi.org/10.1111/j.1538-4616.2008.00133.x.

(2010). The Econometrics of Dsge Models. SERIEs, 1(1-2), 3-49, https://doi.org/10.1007/s13209-009-0014-7.

, & (2004). Comparing Dynamic Equilibrium Models to Data: A Bayesian Approach. Journal of Econometrics, 123(1), 153-187, https://doi.org/10.1016/j.jeconom.2003.10.031.

(1997). Macroeconomic Fluctuations and the Allocation of Time. Journal of Labor Economics, 15(1), 223-250, https://doi.org/10.1086/209862.

(2009). Changes in the Business Cycle of the Korean Economy: Evidence and Explanations. KDI Journal of Economic Policy, 31(2), 47-85, https://doi.org/10.23895/kdijep.2009.31.2.47.

(1995). The Terms of Trade, the Exchange Rate and the Economic Fluctuations. International Economic Review, 36(1), 101-137, https://doi.org/10.2307/2527429.

, & (2003). Closing Small Open Economy Models. Journal of International Economics, 61(1), 163-185, https://doi.org/10.1016/S0022-1996(02)00056-9.

, & (2005). Comparing Shocks and Frictions in US and Euro Area Business Cycles: A Bayesian DSGE Approach. Journal of Applied Econometrics, 20(2), 161-183, https://doi.org/10.1002/jae.834.

(2002). A Guide to US Chain Aggregated NIPA Data. Review of Income and Wealth, 48(2), 217-233, https://doi.org/10.1111/1475-4991.00049.