Trade Liberalization, Growth, and Bi-polarization in Korean Manufacturing: Evidence from Microdata

Abstract

This paper examines the effect of trade liberalization or globalization, more broadly, on plants’ growth as well as on “bi-polarization”. To do so, we reviewed the possible theoretical mechanisms put forward by recent heterogeneous firm trade theories, and provided available micro-evidence from existing empirical studies on Korean manufacturing sector. Above all, the empirical evidence provided in this paper strongly suggests that globalization promoted growth of Korean manufacturing plants. Specifically, evidence suggests that exporting not only increases within-plant productivity but also promotes introduction of new products and dropping of old products. However, the empirical evidence also suggest that globalization has some downsides: widening productivity differences across plants and rising wage inequality between skilled and unskilled workers. Specifically, trade liberalization widens the initial productivity differences among plants through learning from export market participation as well as through interactions between exporting and R&D, both of which increase plants’ productivity. We also show that there is only a small group of large and productive “superstar” plants engaged in both R&D and exporting activity, which can fully utilize the potential benefits from globalization. Finally, we also show evidence that trade liberalization interacts with innovation to increase the skilled-unskilled wage inequality.

Keywords

Trade Liberalization, Productivity, Bi-Polarization, Firm Heterogeneity, Wage Inequality, 무역자유화, 생산성, 양극화, 기업 이질성, 임금불평등

JEL Code

F14, F61

Ⅰ. Introduction

This paper examines the effects of globalization on productivity and growth of plants as well as on “bi-polarization”, based on evidence from plant-level micro data from Korean manufacturing sector since early 1990s. Although we do not attempt to give a rigorous definition of bi-polarization, we consider a widening of performance differences among economics agents, such as productivity differences across plants or wage inequality between skilled and unskilled workers, as evidence consistent with bi-polarization. This paper provides various pieces of evidence supportive of the hypothesis that although trade liberalization promoted the productivity growth of Korean manufacturing sector, it also contributed to widening productivity differences across plants and wage inequality between skilled and unskilled workers.

There is a huge literature, both theoretical and empirical and both macroeconomic and microeconomic, which examine the nexus between trade on one hand and growth and productivity on the other.1 Broadly speaking, it would be fair to say that while the macroeconomic literature on the effect of openness on growth is somewhat inconclusive, the microeconomic studies tend to provide more clear-cut answers. Even among microeconomic studies, however, there seems to be no clear consensus on whether trade promotes firm-level productivity growth and what the mechanisms are. This issue is important, as will be discussed further below, not only for clarifying whether and how trade promotes growth, but also for understanding whether trade also has the effect of widening productivity differences across plants. Similarly, although the distributional effects of trade is a long-standing issue with huge literature, it would be fair to say that whether and how trade increases the wage inequality between skilled and unskilled workers remains largely as an open question.

As well known, Korea’s past rapid growth relied heavily on the manufacturing sector which probably utilized the benefits from a larger and more integrated world market during the second wave of globalization. Since the early 1990s, however, there has been a growing concern among commentators and policy makers that Korean economy is increasingly bi-polarized, between exporting and domestically-oriented firms and between large and small firms. Do these two phenomena, rapid growth of manufacturing firms and bi-polarization, have the same underlying cause? Korea is a good place to examine this question.

This paper is organized as follows. In the following section, we examine the linkages among exporting, productivity, and plant-productivity divergence. In section III, we examine whether trade liberalization contributed to increasing the wage and employment disparity between skilled and unskilled workers. In both section II and III, we start by examining some basic facts, discuss theoretical mechanisms whereby trade affects growth and bi-polarization and, finally, provide empirical evidence on those mechanisms. The final section concludes by summarizing the results and discussing policy implications.

II. Exporting, Productivity, and Bi-polarization

1. Basic Facts

In this subsection, we examine the plant productivity distribution and its changes over time, utilizing a plant-level dataset in Korean manufacturing sector for the period from 1991 to 2006. This is a micro dataset underlying Mining and Manufacturing Census which covers all plants with five or more employees. Specifically, we first examine whether there are cross-sectional differences in the levels of plant productivities and, in particular, whether these productivity differences tend to widen over time. The issue here is whether there are legitimate empirical basis in terms of productivity for the popular concerns for the bi-polarization. Then, we examine whether the plant productivity is systematically correlated with the plant’s exporting status. As will be discussed below, one of the robust empirical regularities in the literature on firm’s exporting behavior is that firms that export are “better” than those that do not export in various performance characteristics, such as productivity, size, average wages, and so on. We want to make sure that similar patterns are found for Korean manufacturing plants.

[Figure 1] shows the distribution of (the logarithm of) plant total factor productivity (TFP)2 for selected years during the sample period. Not surprisingly, the figure shows that there are huge productivity differences across plants.3 Do we observe a tendency for the productivity differential to widen over time? The answer to this question seems to be a nuanced “Yes”. If we ignore the top 1 percentile values of productivity distributions, we do not see any clear tendency of widening productivity differential across plants. If at all, the relative productivity gap between the top and bottom 10 percentile plants has narrowed since 2003. However, we observe a clear tendency for the relative productivity gap between the top 1 percentile plant and other plants to widen since the late 1990s.4 Thus, if there is a factual basis for the popular concerns for the bi-polarization, it is likely to be related to the exceptional productivity performance of a very small set of, e.g., top 1 percent of, plants.

We are not yet warranted to interpret the above evidence as suggesting that initial productivity differences have widened over time between those plants at the very top of the productivity distribution and others, unless plant productivity is highly persistent especially in the top of the productivity distribution. <Table 1> shows, however, that there is a high degree of persistency in plant productivity especially in the relatively-high-productivity plants. This table shows the five-year transition matrix of relative productivity rankings of plants (weighted by plant employment) between 1990 and 1995 following the methodology by Baily, Hulten, and Campbell (1992). When there is a persistency is productivity, it is expected that the relative productivity rankings does not change much over time and the diagonal numbers of the transition matrix tend to be higher than off-diagonal ones. This tendency is most pronounced for the plants that were in the top quintile of productivity distribution in 1990.5

<Table 1>

Five-year Transition Matrix of Relative Productivity Rankings

Note: Weighted by plant employment.

Source: Hahn (2000),Table 16.

We have shown above that there are large productivity differential across plants and that a small set of high-productivity plants have widened their relative productivity advantage over other plants. Then, could these phenomena possibly be driven by plants’ export market participation behavior? Before we discuss this issue in more detail later, we will examine here, to set the stage, whether exporter plants have higher productivity than non-exporters. <Table 2> shows that they do. Furthermore, compared with non-exporters, exporters are larger in size and more capital- and skill-intensive6 and pays higher wages.

2. Exporter Productivity Premium: The Mechanisms

Why does the exporter’s productivity premium exist? Does exporting cause the productivity heterogeneity among plants to arise? If so, what are the underlying mechanisms? Where are the market failures, if at all?7 Understanding answers to these questions is important for identifying key areas where policy intervention might be needed in order to fully utilize the potential benefits from trade liberalization and minimize its potential adverse consequences.

The heterogeneous firm trade theories and the related empirical studies for the past decade or so provide us, to a considerable degree, with the insights into the above issues. While earlier studies focused on clarifying the exporting-productivity nexus, some more recent studies additionally considered the role played by innovation and tried to clarify various interactions that exist among exporting, innovation, and productivity. Meanwhile, several theories based on multi-product firms have shown that product compositional changes induced by trade liberalization could be one mechanism by which productivity heterogeneity among firms arises endogenously in response to trade liberalization.

Exporting-Productivity Nexus

Broadly two types of explanations, which are not necessarily mutually exclusive, have been provided for the exporter’s productivity premium. First, exporter’s productivity premium reflects self-selection in export market participation. In the presence of fixed cost of export market entry, only the most productive firms can enter the export market. Second, exporter’s productivity premium reflects the so-called learning-by-exporting. That is, exporting itself increases productivity because firms learn about new markets, new products, and advanced foreign technologies. The self-selection view has nothing to say about the fundamental causes of the productivity heterogeneity among firms since firm’s productivity is assumed to be exogenously determined. Export market simply plays the role of sorting firms based on productivity. By contrast, according to the learning-by-exporting view, trade liberalization or exporting could be a cause of productivity heterogeneity among firms.8

How is the existence of learning-by-exporting effect related to the issue of the effect of trade liberalization on growth and bi-polarization? We first discuss the case where there is self-selection in export participation but not learning-by-exporting, and then discuss the case where there are both self-selection and learning-by-exporting.

The first theoretical paper which analyzed the effect of trade liberalization on aggregate productivity under the assumption of heterogeneous firms is Melitz (2003). He assumed, as in previous theories of industry dynamics such as Jovanovic (1982), that firm productivity is exogenously determined. When trade is allowed, there arises a self-selection in export participation: only a subset of high-productivity firms participate in the export market and the remaining low-productivity firms produce for domestic market only. Melitz showed that trade liberalization increases the aggregate productivity by reallocating resources among firms even if it does not affect firms’ inherent productivity. Specifically, as trade is liberalized, firms with low productivity producing for domestic market shrink or exit, firms with higher productivity previously producing for domestic market start exporting, and firms with highest productivity expand their exports and expand. Melitz did not allow for the possibility of learning-by-exporting. If, however, the learning-by-exporting effect is taken into account, the effect of trade liberalization on aggregate productivity and growth would be larger than suggested by the Melitz’s theory.

What does the Melitz’s theory imply about the effect of trade liberalization on bi-polarization? Since his model assumes exogenously determined firm productivity, it implies that trade liberalization does not widen initial productivity differences across firms. However, his model predicts that trade liberalization does widen initial size differences across firms with the size being measured as employment or production; initially productive firms grow and expand and initially unproductive firms shrink or exit.

It is not hard to see that, when there is learning-by-exporting effect in addition to the self-selection effect, trade liberalization not only widens initial size differences but also initial productivity differences, across firms. Self-selection implies that only a subset of firms is able to participate in the export market whose productivity level is higher than some threshold or cut-off productivity level. Those high-productivity firms that are able to start exporting will see their productivity improve further if the learning-by-exporting effect exists. By contrast, firms whose initial productivity is below the threshold level cannot be engaged in global activities (e.g., exporting) and, hence, cannot hope to learn at the global market. Hence, initial productivity differences across firms widen as trade costs are reduced.

So far, it was discussed that whether learning-by-exporting effect exists or not is an important issue for understanding whether trade liberalization or reduction of trade costs could be a source or a cause of productivity heterogeneity across firms. More broadly, this issue is also important for understanding the effects of trade liberalization and the mechanism by which the effects operate. Strictly speaking, however, the issue that is more relevant here is whether, at the firm level, there are productivity-enhancing effects of exporting or trade liberalization. Several recent theoretical studies examined this issue.

Bernard, Redding, and Schott (2006), for example, is an extension of Melitz’s model to multi-product firms. They show that trade liberalization increases not only aggregate productivity but also firm productivity. Here, the mechanism of firm-level productivity increase is the resource9 reallocation across products within firm from low-expertise products to high-expertise products.10 Specifically, they show that trade liberalization increases firm-level productivity by inducing firms to drop low-expertise products and concentrate on “core competences”. Concentration on core-competence products, or product rationalization, is an additional mechanism through which trade liberalization increases aggregate productivity and promotes economic growth.

What are the implications of the Bernard, Redding, and Schott (2006) on the effect of trade liberalization on bi-polarization in terms of firm productivity? To begin with, it should be noted that, in their model, trade liberalization increases the productivity of all firms by reallocating resources across products. One implication of their model, however, is that trade liberalization increases the average productivity differential between non-exporting firms and those firms that switch from non-exporting to exporting. The reason is that new exporters have an additional source of productivity growth relative to non-exporters; New exporters not only drop lower-expertise products but also expand output of newly exported products in response to reduced trade costs. Meanwhile, their model also predicts that trade liberalization magnifies the initial firm size differences between high-ability exporters and low-ability domestic producers.11

The above discussion can be summarized as follows. When learning-by-exporting effect exists, trade liberalization can widen initial differences in productivity between low-productivity non-exporters and higher-productivity new exporters. Even when learning-by-exporting effect does not exist, similar effects are expected in the case of multi-product firms. The prediction that trade liberalization magnifies initial size difference between low-productivity non-exporters and high-productivity exporters is fairly robust to model specifics.

Exporting, Innovation, and Productivity

Costantini and Melitz (2007) analyzed the effect of trade liberalization under the framework of heterogeneous firms, explicitly considering the role played by innovation. They showed that anticipated trade liberalization induces firms to innovate prior to trade liberalization. Here, the productivity premium of exporters reflects not only self-selection in export participation but also productivity growth within firm due to enhanced innovation activity. The innovation incentive is strengthened due to market size effect associated with trade liberalization. Aw, Roberts, and Xu (2009) is similar to Costantini and Melitz, except that they allow for the learning-by-exporting effect. In their model, there is productivity-based self-selection in both export participation and R&D participation. Both exporting and R&D increases firm-level productivity. Thus, in their model, a complex set of interactions exist among exporting, R&D, and productivity. For example, high-productivity firms select themselves into participating in the export market (R&D) and improve their productivity further. This productivity gain strengthens the incentive to participate in R&D (exporting) which improves productivity even further. In short, both Costantini and Melitz (2007) and Aw, Roberts, and Xu (2009) suggests that the productivity premium of exporters can result from trade liberalization or exporting. The key mechanisms include enhanced incentive to do R&D due to trade liberalization and learning-by-exporting.

One interesting point to note is that the above theories imply that there are bi-directional causality between exporting and innovation. This reinforces the effect of trade liberalization on widening productivity differences among firms based on the initial productivity. Due to this bi-directional causality, however, it becomes difficult to identify separate roles of exporting and innovation in accounting for exporter productivity premium.

3. Empirical Evidence on the Mechanisms in Korean Manufacturing

In this subsection, we provide some empirical evidence on the mechanisms outlined above by which trade liberalization improves plant-level and aggregate productivity and, at the same time, magnifies productivity differences across plants, utilizing plant-level or plant-product level panel datasets on Korean manufacturing.12

Learning-by-exporting and Self-selection13

There are a large number of studies which support self-selection in export participation, but empirical evidence on learning-by-exporting is mixed.14 It is worth mentioning, however, that more recent studies tend to find evidence in favor of learning-by-exporting hypothesis particularly for developing countries.15

For Korea, Hahn (2012) provides empirical evidence supportive of learning-by-exporting. Hahn (2012) examines the effect of export market participation on plant-level total factor productivity, utilizing propensity score DID (difference-in-difference) matching methodology as in Heckman, Ichimura and Todd (1997). When there is a selectivity of export participation based on observed characteristics of firms, propensity-score matching is a convenient way to reduce this bias associated with an endogenous participation decision. However, when there is a selectivity of export participation based on unmeasured characteristics, or if there are time-invariant level-differences in outcome variables between new exporters and non-exporters, 16 the propensity score difference-in-difference (DID) matching estimator is a more appropriate econometric methodology.

To implement the methodology, Hahn (2012) estimates the following probit model.

where P(Xi) is the probability of becoming an exporter for plant i conditional on the vector of pre-exporting characteristics Xi, and di is the dummy indicating export-market participation. The probit model is estimated for three model specifications. Model (1) includes as explanatory variables the log of plant TFP (lnTFP), the log of the number of employment (plant size), plant age (age), the log of plant’s capital-labor ratio (K/L ratio), a dummy variable indicating whether the plant reported a positive amount of R&D expenditure (R&D_yes), and a dummy variable indicating whether the plant is a multi-product plant (multi-product). In models (2), we include the four dummy variables which take on the value of one if the plant added (adding), dropped (dropping), created (creation), or destroyed (destruction) at least one product between year t-1 and t, respectively in addition to the above variables. Here product adding or dropping is defined from a plant’s viewpoint, while product creation or destruction is defined from a economy-wide viewpoint. Thus, for example, a product created by a plant is also a product added by the plant, but not necessarily vice versa. Model (3) includes plants’ total factor productivity growth (tfpg) between years t-1 and t, in addition to the variables in model (2).17

<Table 3> shows the probit model estimation results. Above all, the positive and significant coefficient on plant’s TFP is consistent with the productivity-based selection in export participation. Thus, the productivity premium of exporters, shown in <Table 1>, partly reflects the self-selection of more productive plants into export market.

<Table 3>

Probit Model of Export Participation

Note: Numbers in parenthesis are standard errors. *, **, and *** indicates that the estimated coefficients are significant at 10, 5, and 1 percent level, respectively.

Source: Hahn (2012), Table 5.

The table also shows that larger plants are more likely to participate in the export market, controlling for plant TFP. One interpretation might be that the positive effect of plant size reflects the effect of plant’s productivity that is not fully captured by the measured plant TFP. Another interpretation might be that it reflects the effect of other factors that are not included in our mode. For example, if larger plants are better able to access financial markets and if export market entry requires financing for the fixed entry cost, larger firms are more likely to participate in the export market with other things being equal. The coefficient on R&D dummy variable is estimated to be significantly positive, suggesting that plants that are engaged in R&D activity are more likely to participate in exporting. This evidence is consistent with the existence of causality running from R&D to export participation.18

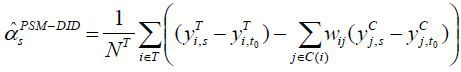

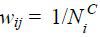

Based on the estimated probability of export participation (propensity score), a set of non-exporters are matched to each export beginners. Let T and C denote the set of treated (export beginners) and control (non-exporters) units, and yr and yc be the corresponding observed outcome variables: plant TFP in this case. Let t0 denote the year two years prior to export market entry. Denote the set of control units matched to the treated unit i by C (i), the number of control units matched with i ∈T by NC, and the number of plants in the treated group by NT. Then the propensity-score DID estimator at s years after export market entry is given by

where  if j ∈ C(i) and wij = 0 otherwise. We reports results based on the radius matching.19

if j ∈ C(i) and wij = 0 otherwise. We reports results based on the radius matching.19

The results in <Table 4> are strongly supportive of the learning-by-exporting hypothesis. Export beginners start to improve their TFP from one year before export market entry up to three years after export market entry. This result is fairly robust to model specifications. The estimated average effect of export participation on plant TFP after three years of exporting is between 6 and 10 percent, which seems fairly large.20

<Table 4>

The Estimated Learning-by-exporting Effect: 1990~1998

Note: The asterisks *, **, and *** indicate that the estimated effects are within the 90%, 95%, and 99% confidence interval, respectively. The confidence intervals were calculated from a bootstrapping procedure with 1,000 repetitions.

Source: Hahn (2012), Table 6.

The above results suggest that theoretical models, such as Melitz (2003), which do not take learning-by-exporting effect might under-evaluate the true effect of trade liberalization on aggregate productivity and growth, at least for Korea’s case. That is, trade liberalization enhances aggregate productivity not only by promoting resource reallocation across firms but also by enhancing firm-level productivity. Another implication of the above results, which has not been pointed out very often previously, is that trade liberalization or globalization has played the role of magnifying productivity differences across plants in the case of Korean manufacturing. Depending on the initial productivity level, plants with higher productivity are able to participate in the export market and, consequently, further improve their productivity while plants with lower productivity cannot. These lower-productivity plants contract or exit. In short, trade liberalization creates both winners and losers even within a narrowly defined industry. The existence of learning-by-exporting effect reinforces these forces.

Exporting, Introduction of New Products, and Product Rationalization

As shown by Bernard, Redding and Schott (2006) and Eckel and Neary (2010), trade liberalization can enhance not only aggregate-level but also firm-level productivity by reallocating resources across products. As a specific mechanism of the cross-product reallocation within firm, these authors focused on “product exits”: concentration on core competence products or product rationalization.

In some respect, however, it might be a rather mechanical approach to focus on product exits only when examining the effect of trade on firms’ product portfolio. As Schumpeter emphasized the creative destruction as a fundamental process for a development of a capitalist economy, the introduction of new products, together with the exits of existing products, is a crucial feature of economic growth.21 In this regard, we discuss whether exporting promotes introduction of new products as well as exits of existing products based on evidence from Korean manufacturing.22

<Table 5> shows that exporters are more active than non-exporters not only at product dropping but also at product adding. To the extent that the product adding and dropping measures capture the Schumpeterian creative destruction process, this result indicates that the creative destruction process is related to exporting or trade liberalization.

<Table 5>

Product Adding and Dropping: Estimated Exporter Premium

Note: Product adding and dropping measures are cumulative counts of added and dropped products during the period from 1990 to 1998. The figures estimate exporter premium over non-exporters. The asterisks *, **, and *** indicate statistical significance at 10, 5, and 1 percent level.

Source: Hahn (2012), Table 4.

Do these results reflect the effects of exporting on product adding or dropping? To answer this question, Hahn (2012) again uses the propensity score DID matching methodology to estimate the effects.23 <Table 6> shows the results. Here, the outcome variables are cumulative counts of added or dropped products of a plant. Above all, export market participation is estimated to have positive effects on product adding (or new product introduction) both prior to, and after export participation. Although the enhanced innovation activity associated with larger market size has been emphasized as a main mechanism by which the benefits from trade liberalization is realized, it is also true that empirical evidence supporting this mechanism have not been easily available.24 The evidence in table 6 shows that this mechanism was operating in Korean manufacturing sector during the 1990s. Meanwhile, the finding that exporting promotes new product introduction prior to export market participation is broadly consistent with Costantini and Melitz (2007).

<Table 6> also shows that exporting has an effect of promoting product exits, broadly consistent with the theoretical predictions of Eckel and Neary (2010) and Bernard, Redding, and Schott (2006) that trade liberalization induces firms to concentrate on core competences.

<Table 6>

The Effect of Exporting on Product Adding and Dropping

Note: Product adding and dropping measures are cumulative counts of added and dropped products during the period from 1990 to 1998. *, **, and *** indicate that the estimated effects are significant at 10, 5, and 1 percent significance level, respectively. The confidence intervals were calculated from a bootstrapping procedure with 1,000 repetitions.

Source: Hahn (2012), Table 6.

Bi-directional Causality between Exporting and Innovation

Does exporting promote R&D? Does R&D cause exporting? Or both? We discussed above that, theoretically, there exists bi-directional causality between exporting and R&D. This issue is important for understanding the linkage between trade and growth as well as for understanding better whether and how trade liberalization could widen differences in productivity across firms. Below, we first provide some basic features of plants’ exporting and R&D activity.

<Table 7> shows that exporters account for between 12 and 16 percent of plants during the 1990s. Thus, Korea’s case is in line with previous studies for other countries in that only a small fraction of plants are engaged in exporting activity.25 Plants that do R&D account for a smaller fraction, between 6 and 9 percent. Plants that do both exporting and R&D is less than four percent of all plants with five or more employees.

<Table 7>

Distribution of Plants by Exporting and R&D Status

Note: Plants are grouped depending on whether they reported positive amount of exports or R&D expenditure.

Source: Hahn and Park (2011), Table 1a.

<Table 8> shows the average characteristics of plants, where plants are classified into four groups depending on whether they do exporting and on whether they do R&D. It is clear that there are systematic differences across plant groups in terms of productivity, plant size, capital intensity, and skill intensity (proxied by non-production worker ratio). Controlling for exporting status, R&D performing plants are more productive and larger than plants reporting no R&D expenditure and, controlling for R&D status, exporting plants are more productive and larger than non-exporters. Plants that do both exporting and R&D are the most productive and the largest.

<Table 8>

Characteristics of Plants by Group Classified by Exporting and R&D

Note: Plants are grouped depending on whether they reported positive amount of exports or R&D expenditure.

Source: Hahn and Park (2011), Table 2a.

Then, is there a bi-directional causality between exporting and R&D? Hahn and Park (2011) show empirical evidence supportive of the bi-directional causality, based on propensity score matching technique (Table 9). Specifically, export market participation positively and significantly affects the probability of R&D participation from one year after exporting. The effect on R&D intensity (=R&D/Shipment*100), however, is positive and significant only at one year after exporting. Similarly, the effect of R&D participation on exporting shows up mainly at the extensive margin rather than at the intensive margin (exports/shipments* 100).26

<Table 9>

The Effect of Exporting (R&D) on R&D (Exporting)

Note: Results are based on the propensity score matching technique as in Becker and Ichino (2002).

Source: Hahn and Park (2011), Table 7.

The bi-directional causality between exporting and innovation strengthens the mechanism by which trade liberalization widens the productivity differential among plants depending on their initial productivity level. The fact that only a small portion of plant can export and innovate, as shown in <Table 7> , implies that globalization might produce only a few superstars.

III. Trade Liberalization and Wage Skill Premium

1. Basic Facts

[Figure 2] shows the trends in average wage and employment of production and non-production workers in Korean manufacturing sector from 1991 to 2006, calculated from Mining and Manufacturing Census. First of all, the relative wage of non-production workers has risen slightly, if at all, over the period. Next, although the employments of both production and non-production workers have declined secularly, the pace of the decline was more pronounced for the employment of production workers. In this paper, we use non-production and production workers as proxies for skilled and unskilled workers, respectively.27 Then, trends shown in figure 2 suggest that the relative demand for skilled workers have been rising in Korean manufacturing for the past two decades. Then, what explains the rise in the relative demand for the skilled workers? Is trade liberalization or globalization an underlying cause?

[Figure 2]

Employment and Wage of Production and Non-production Workers

Source: Hahn and Choi (2013), Figure 1.

2. A Brief Review of Theoretical Mechanisms

Whether the rise in the wage inequality between skilled and unskilled workers is caused by international trade has been a long-standing issue in international economics. According to the traditional Heckscher-Ohlin (H-O) theory, it is possible that a skill-abundant country is expected to experience a rise in the wage of the skilled as a result of trade liberalization. The view that trade is a cause for the observed rise in skilled-unskilled wage inequality, however, was not widely accepted due, for example, to the following reasons. First, while the H-O theory predicts that the trade liberalization increases the wage inequality in skill-abundant developed countries and decreases it in skill-scarce developing countries, the wage inequality rose not only in developed countries but also in many middle-income developing countries. Second, the H-O theory predicts that the aggregate increase in the relative employment of the skilled workers occurs through the resource reallocation across industries, from low- to high-skill-intensity industries, most empirical studies have found instead that the within-industry increase in the relative employment of the skilled accounts for most of the aggregate increase in the skilled workers’ relative employment. Finally, although the H-O theory is based on the assumption of free labor mobility across industries, many empirical studies have found that the inter-industry labor mobility following trade liberalization is very limited. Against this background, it has been a prevailing view that skill-biased technological change, rather than trade, is a main cause for the rise in relative wage of the skilled workers.

More recent theoretical studies, however, shows that trade liberalization can widen the wage gap between skilled and unskilled workers through other mechanisms. These include, among others, outsourcing and trade in intermediate goods,28 and interactions between trade and skill-biased technological change.29 Verhoogen (2008) and Bustos (2009) are examples of studies that examine the interaction between trade and skill-biased technological change under the heterogeneous firm framework. Verhoogen shows that trade liberalization induces product quality upgrading by high-productivity exporting firms which increases the relative demand for the skilled. Meanwhile, Bustos shows that trade liberalization induces medium-productivity new exporters or existing exporters to adopt a more skill-intensive technology, based on the assumption that a skill-intensive technology requires fixed investments but reduces the variable cost.

3. Evidence from Korean Manufacturing

Did trade liberalization or globalization contribute to the rise in the relative demand for the skilled in Korean manufacturing? Is there evidence that the interaction between trade and skill-biased technological change is indeed an important mechanism? Below, we discuss these issues based on empirical evidence from microdata.

<Table 10> shows a decomposition of the growth rate (annualized) of the aggregate relative employment of the skilled workers into “between” and “within” effect in Korean manufacturing.30 First, the annualized growth rate of the relative employment of the skilled from 1991 to 1997 is very high at 1.76 percent. The within effect accounts for a large share of this growth: 1.01 percentage point per annum. The within effect basically reflects the increase in skill intensity within plants, while the between effect basically reflects the reallocation of employment across plants. A large within effect has traditionally been interpreted as evidence suggestive of an important role of skill-biased technological change.

When there are interactions between trade and skill-biased technological change, however, this interpretation is not necessarily warranted. <Table 10> also shows additional decomposition results with plants further classified into exporting and non-exporting plants or into plants with and without R&D expenditure. We find that the within effect is mostly accounted for by exporting plants or by R&D-performing plants. Although not reported, most of the within effect is accounted for by large plants. So, in Korean manufacturing, the within-plant rise in skill intensity, or skill upgrading, is driven by exporting, R&D-performing, or large plants.

<Table 10>

Decomposition of the Changes in Share of Non-Production Workers

Note: The unit is percent. Methodology based on Bernard and Jensen (1997).

Source: Hahn and Park (2012), Table 4.

<Table 11> shows the cross-plant regressions of within-plant skill upgrading. It is found that exporting or, in particular, export market participation has a significant and positive effect on within-plant skill upgrading during the period from 1991-1997, even after controlling for other plant characteristics, such as R&D dummy, plant TFP, size, age, and so on.31

<Table 11>

Regressions of Within-Plant Skill Upgrading

Note: Based on OLS. The dependent variable is within-plant change in skill intensity during the period from 1991 to 1997. Standard errors in parenthesis. *, **, *** indicates that the coefficients are significant at 10, 5, and 1 percent level.

Source: Hahn and Park (2012), Table 5.

Then, did trade liberalization increase the relative wage of the skilled in Korean manufacturing sector? To answer this question, we estimate fixed-effect regressions of relative wage of skilled workers utilizing the same plant-level dataset as before. Here, we include as explanatory variables a dummy variable indicating whether a plant performed R&D or not, industry-level output and input tariffs, and the interactions of output and input tariffs with R&D dummy, controlling for other plant characteristics. <Table 12> shows the results. We find that the coefficient on the output tariff interacted with R&D are estimated to be significantly negative, suggesting that trade liberalization, as measured by tariff reduction, had an effect of increasing wage skill premium within R&D-performing plants. This result is supportive of the view that trade liberalization, in interactions with skill-biased technological change, contributed to the increase in the skilled wage premium at the aggregate level.32

<Table 12>

The Effect of Tariff Reductions on Wage Skill Premium

Note: Fixed-effect regressions based on plant-level panel data for the period from 1992-2003. Dependent variable is the logarithm of the ratio non-production to production wage rate. Numbers in parenthesis are standard errors corrected for clustering at plants. *, **, *** indicates that the coefficients are significant at 10, 5, and 1 percent level.

IV. Concluding Remarks

This paper examined the effect of trade liberalization or globalization, more broadly, on plants’ growth as well as on “bi-polarization”. To do so, we reviewed the possible theoretical mechanisms put forward by recent heterogeneous firm trade theories, and provided available micro-evidence from existing empirical studies on Korean manufacturing sector. Above all, the empirical evidence provided in this paper strongly suggests that globalization promoted growth of Korean manufacturing plants. Specifically, evidence suggests that exporting not only increases within-plant productivity but also promotes introduction of new products and dropping of old products. However, the empirical evidence also suggest that globalization has some downsides: widening productivity differences across plants and rising wage inequality between skilled and unskilled workers. Specifically, trade liberalization widens the initial productivity differences among plants through learning from export market participation as well as through interactions between exporting and R&D, both of which increase plants’ productivity. We also show that there is only a small group of large and productive “superstar” plants engaged in both R&D and exporting activity, which can fully utilize the potential benefits from globalization. Finally, we also show evidence that trade liberalization interacts with innovation to increase the skilled-unskilled wage inequality.

This paper has the following policy implications, for example. First and foremost, further liberalization of trade and reduction in various trade costs are essential for Korea’s sustained growth. Productivity growth, R&D, and introduction of new products, which are all critical processes of economic growth, are shown to be promoted by global market participation. Second, however, trade liberalization should be pursued not in isolation but as part of a more broad growth strategy which at least includes innovation policy, competition policy, labor market policy, welfare and income redistribution policies, for example, as its key components. Establishing an effective policy governance scheme for such a strategy is likely to be an important issue. Third, supporting globalization of SMEs, although it should be subject to a strict discipline, is likely to be a policy which is likely to yield a large social return. Various market imperfections are likely to exist associated with SMEs’ global market participation, such as lack of information on foreign market, credit constraints, learning from global engagement that are not fully appropriable, and so on. However, specific policy measures should be based on a more careful examination of the exact nature of the market failures. Further studies seem necessary.

Notes

본 논문의 초기 버전은 ‘Confronting the Challenges of Slow Growth and Sustainable Development’라는 주제로 2012년 12월 서울에서 열린 The Shadow G-20 Workshop of the International Policy Advisory Group 및 ‘Fiscal Sustainability and Innovative Welfare System’이라는 주제로 2013년 8월 KDI에서 열린 KDI Journal of Economic Policy Conference에서 발표되었다. 필자는 유익한 논평을 해주신 임원혁 박사, 안상훈 박사, 함준호 교수 및 다른 conference 참가자들과 익명의 검토자에게 사의를 표한다.

Plant total factor productivity was measured by the multilateral index number approach as in Good, Nadiri, and Sickles (1996). For further details of the measurement, see Hahn (2005).

There exist pervasive and large differences in plant productivity even within a narrowly defined industry. For evidence on Korea, see Hahn (2000).

The total number of plants in the sample in 1997, for example, is 92,138, so that the total number of plants with productivity higher than the top 1 percentile value is about 921 .

Whether there is also a high persistency of productivity in the top of the productivity distribution in Korea especially in the 2000s is an empirical matter. Because of the fairly restrictive dada access in this period, we could not examine this issue for the 2000s.

In this paper, we use non-production and production worker as proxies for skilled and unskilled workers, respectively.

Even if exporting causes productivity improvement, it does not necessarily mean that export participation should precede in time productivity improvement.

In their model, concentration on core competences occurs because of the wage increase following trade liberalization, which decreases the profitability of products with lowest expertise. While their model is based on monopolistic competitive firms, Eckel and Neary (2010) shows that trade liberalization also induces concentration on core competences under oligopolistic market structure.

In their model, a firm’s productivity in a product depends on two components: “ability” of firm that is common to all products and product “expertise” that is specific to each product.

This effect is larger than when firm’s product scope is exogenous. With endogenous product scope, their model predicts that firm’s extensive margin (product scope) and intensive margin (average output per product) are positively correlated. Thus, high-productivity exporters are larger than lowproductivity non-exporters not only because their average output per product is higher but also because they sell more products.

The empirical evidence provided in this subsection mostly comes from author’s previous or ongoing studies, such as Hahn (2012), Hahn and Park (2012). Due to limited space, we only provide a limited discussion on empirical evidence from other countries, which can be found in the above studies and elsewhere.

In this paper, we mainly focus on empirical evidence on plant’s exporting or export participation behavior to discuss the effects of trade liberalization, primarily because understanding the causes and effects of export participation is critical to, not because it is sufficient for, understanding the effects of trade liberalization. One empirical issue which is relevant for this paper but not fully examined is whether trade liberalization, or trade cost reduction, induces high-productivity firms to participate in export market, as shown by Melitz (2003). Bernard, Jensen, and Schott (2006) find empirical evidence supportive of this mechanism for U.S. manufacturing plants. However, the author is not aware of the existence of such studies for Korea.

See, for example, Girma, Greenaway, and Kneller (2002) for UK, De Loecker (2007) for Slovenia, Albornoz and Ercolani (2007) for Argentina, Aw, Roberts, and Xu (2009) for Taiwan, and Ma, Tang, and Zhang (2011) for China.

In our case, starter plants might have unmeasured higher product quality, for example, which is likely to be correlated with export participation.

We discuss below in more detail the evidence on the bi-directional causality between exporting and innovation in Korean manufacturing.

The radius is set to be equal to 0.001. The main results do not change qualitatively when the nearest-neighbor matching method is used alternatively.

The effects for s greater than 3 cannot be estimated because the there is no observation for the outcome variables of the control units. For the control units, there is no natural export market “entry” year. So, as in De Loecker (2007), the export entry year for the control units was set at around the mid-point of the sample period, 1995. The results are qualitatively similar when it is set at 1994. By the way, the effect at s=-2 is zero because this is the based year for difference-indifference.

The role of new product introduction in economic growth is modeled by several endogenous growth theories, such as Stokey (1988), Grossman and Helpman (1991), and Romer (1990).

For previous empirical studies on this issue, see Damijan, Kostevc, and Polanec (2010) and the literature cited.

When the propensity score DID matching technique is employed, we find more clear results that exporting has a significant and positive effect on, mainly, the extensive margin of R&D and vice versa.

It may be arguable whether and to what extent the distinction between production and nonproduction workers captures the differences between skilled and unskilled workers. However, the workers in the dataset used in this paper and other papers cited here cannot be disaggregated by, for example, worker’s education level or occupation type which would have allowed us to classify skilled and unskilled workers in alternative ways. Meanwhile, existing studies also use production and non-production workers as proxies for unskilled and skilled workers apparently when constrained by the data. For example, Bernard and Jensen (1997) follow this strategy to estimate the effect of exporting on relative demand for the skilled workers for the U.S.

For a review of literature on the interactions between trade and skill-biased technological change, see Goldberg and Pavcnik (2007).

The decomposition of the relative wage of the skilled workers is qualitatively similar to table 10. See Hahn and Park (2012). For a detailed explanation of the decomposition methodology, see Bernard and Jensen (1997).

Choi and Hahn (2012) finds that export participation has a significant and positive effect on withinplant skill upgrading using propensity score DID matching technique.

References

, & (1997). Exporters, Skill Upgrading, and the Wage Gap. Journal of International Economics, 42, 3-31, https://doi.org/10.1016/S0022-1996(96)01431-6.

, , & (2006). Trade Costs, Firms and Productivity. Journal of Monetary Economics, 53, 917-937, https://doi.org/10.1016/j.jmoneco.2006.05.001.

, , & . (2010). From Innovation to Exporting or Vice Versa? World Economy, 33(3), 374-398, https://doi.org/10.1111/j.1467-9701.2010.01260.x.

(2007). Do Exports Generate Higher Productivity? Evidence from Slovenia. Journal of International Economics, 73(1), 69-98, https://doi.org/10.1016/j.jinteco.2007.03.003.

, & (1999). The Impact of Outsourcing and High-Technology Capital on Wages: Estimates for the United States, 1979-1990. Quarterly Journal of Economics, 114(3), 907-940, https://doi.org/10.1162/003355399556179.

, & (2007). Distributional Effects of Trade Liberalization in Developing Countries. Journal of Economic Literature, 45(1), 39-82, https://doi.org/10.1257/jel.45.1.39.

, & . (2007). Firm Heterogeneity, Exporting and Foreign Direct Investment. Economic Journal, 117, 134-161, https://doi.org/10.1111/j.1468-0297.2007.02018.x.

, , & (1997). Matching As an Econometric Evaluation Estimator: Evidence from Evaluating a Job Training Programme. The Review of Economic Studies, 64, 605-654, https://doi.org/10.2307/2971733.

. (1982). Selection and the Evolution of Industry. Econometrica, 50(3), 649-670, https://doi.org/10.2307/1912606.

(2003). The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica, 71(6), 1695-1725, https://doi.org/10.1111/1468-0262.00467.

(1990). Endogenous Technological Change. Journal of Political Economy, 98(5), S71-S102, https://doi.org/10.1086/261725.

. (1988). Learning-by-Doing and the Introduction of New Goods. Journal of Political Economy, 96, 701-717, https://doi.org/10.1086/261559.

(2008). Trade, Quality Upgrading and Wage Inequality in the Mexican Manufacturing Sector. Quarterly Journal of Economics, 123(2), 489-530, https://doi.org/10.1162/qjec.2008.123.2.489.