- P-ISSN 2586-2995

- E-ISSN 2586-4130

The contingent convertible bond (or CoCo) is designed as a bail-in tool, which is written down or converted to equity if the issuing bank is seriously troubled and thus its trigger is activated. The trigger could either be rule-based or discretion-based. I show theoretically that the bail-in is less implementable and that the associated bail-in risk is lower if the trigger is discretion-based, as governments face greater political pressure from the act of letting creditors take losses. The political pressure is greater because governments have the sole authority to activate the trigger and hence can be accused of having 'blood on their hands'. Furthermore, the pressures could be augmented by investors’ self-fulfilling expectations with regard to government bailouts. I support this theoretic prediction with empirical evidence showing that the bailin risk premiums on CoCos with discretion-based triggers are on average 1.13 to 2.91%p lower than CoCos with rule-based triggers.

Contingent Convertible Bonds, Bail-ins, Discretion-based Triggers, Rule-based Triggers

G01, G12, G21, G28

When systemically important banks fail, governments typically choose to bail out these banks. However, government bailouts can cause a number of serious problems. First, the government backing ends up encouraging large banks to take excessive risks.1 Second, bailouts can initiate what is known as a ‘diabolic loop.’2 Banks typically have a large volume of sovereign bonds on their balance sheets. A large-scale taxpayer-bailout could increase sovereign credit risk and lower the value of sovereign bonds. Consequently, banks face a greater risk of balance sheet insolvency. Third, bailouts are unjust, as taxpayers should shoulder the burden of resolving failed banks even if they are not the stakeholders.

After the global financial crisis and subsequent European sovereign debt crisis, G20 and EU countries and the Basel committee agreed on the adoption of a new bank resolution regime—the bail-in system.3 Under this new regime, shareholders and creditors, but not taxpayers, are required to absorb losses if their banks fail. If the bail-in system can be properly implemented, it can prevent moral hazard at large banks and protect governments’ fiscal positions as well as taxpayers. An important bail-in tool is the contingent convertible bond (CoCo). CoCos differ from straight bonds in that there are bail-in clauses in the bond contracts. According to these clauses, if the issuing bank is severely distressed and hence the conditions for a certain trigger are met, the principal and interest of a CoCo are written down or the CoCo is converted mandatorily to common equity of the issuing bank. In addition, some types of CoCos allow the issuer the option to cancel interest payments. Therefore, CoCo holders lose their claims and, unlike straight bond holders, they cannot force the issuing bank to file for bankruptcy even if the bank fails to meet its debt obligation. The troubled bank then can easily revive at the cost of its creditors (See Duffie (2009), McDonald (2013), and Flannery (2016) for this advantage of CoCos).

However, two recent events suggest that the implementability of the bail-in system is in doubt, particularly in cases where the government’s political costs and financial shocks from bail-ins are sufficiently large. Firstly, in July of 2016, Italian banks confronted a serious non-performing loan problem. In response, the Italian government attempted to inject public funds into the distressed banks. This marked a remarkable event given that Italy had already adopted an EU-wide bail-in system. The Italian government wanted bailouts despite the fact that it is against the principle of a bail-in, as most of the creditors involved were ordinary citizens, and such a large number of citizens represented a huge political burden to the government.

Secondly, in February of 2016, news reports stated that Deutsche Bank’s profitability had been greatly reduced and that it may be unable as a result to pay the promised interest to CoCo holders. Immediately, the stock price plummeted and CDS spreads soared amid worries about Deutsche Bank and the European banking system, which quickly became widespread.4,5 These concerns could cause liquidity problems even in the absence of insolvency issues. Note that such shocks arise not due to a disorderly resolution because, due to CoCos, troubled banks can recover their financial soundness by transferring losses to creditors. Worries arise because investors were shocked that they will not be rescued by the government. Some commentators argued that CoCos are excessively complex instruments and that the loss-absorption mechanism could cause destabilizing effects (see Hart and Zingales, 2010; Admati et al., 2013; Sundaresan and Wang, 2015).

This paper examines how the implementability of a bail-in depends on the types of triggers of CoCos. I do not analyze whether bail-ins are better or worse than bailouts in this paper. Instead, I focus on the implementability of a bail-in because a welfare comparison is meaningful only after one can confirm that bail-ins are implementable. There are two bail-in mechanisms: a statutory bail-in and a contractual bail-in. The statutory bail-in applies in principle to all unsecured debt contracts, including senior unsecured bonds and some eligible deposits. Statutory bail-ins require significant amendments of existing laws pertaining to property rights, and concerns about depositors arise. This explains why many countries have struggled to enact laws on statutory bail-ins. In contrast, the contractual bail-in is based only on the bail-in clause in the bond contract; hence, significant changes in existing laws are not necessary. In this reason, CoCos—contractual bail-in debt—have been used in many countries.

The triggers of CoCos could be either rule-based or discretion-based. Typical rule-based triggers are based on accounting information, such as bank capital ratios. Theoretically, rule-based triggers could be based on market information such as stock prices and credit default swap spreads. However, almost all rule-based CoCos that have been issued since the global financial crisis are based on capital ratios. If the level of a chosen indicator falls short of a predetermined threshold, the rule-based trigger is activated and, hence, creditors absorb losses through either principal write-downs or mandatory conversions to equity. In contrast, discretion-based triggers rely on governments’ judgments of whether the issuing bank is seriously distressed. If a competent authority declares that the issuing bank is at the point of non-viability (PONV), the trigger is activated and hence creditors take losses.

This paper consists of two parts. In the first part, I construct a theoretic model and show that CoCos with discretion-based triggers are less effective bail-in tools than CoCos with rule-based triggers, as the government’s political burden is higher. If the trigger is discretion- based, a relevant authority must undertake the 'dirty job' of imposing losses on creditors. This is not the case with a rule-based trigger, which is activated mechanically if a predetermined condition is satisfied. Even if the mere effect of the type of trigger on the political cost is small, it could grow through the mechanism of the self-fulfillment of the expectation of a government bailout. If investors know that a government faces a somewhat greater political burden when they buy CoCos with discretion-based triggers as opposed to those with rule-based triggers, they may believe that the government would be more likely to rescue them in the case of a bank failure. Given this belief, they invest more in CoCos with discretion-based triggers than in CoCos with rule-based triggers, resulting in more participating investors. Because the government’s political costs will most likely increase with the number of affected investors, the government will indeed choose to bail out CoCo holders when the issuing bank is in distress. That is, the investors’ belief is fulfilled and therefore rationalized. In this sense, with regard to rational expectations equilibria, the bail-in risk and equilibrium interest rates of discretion-based CoCos are both lower if the trigger is discretion-based.

In the second part, I test the model prediction by conducting an empirical study. Figure 7 shows roughly the relationship between the bail-in risk and the type of trigger. As the ratio of discretion-based CoCos to all CoCos decreases across countries, the average interest rate of CoCos becomes higher. Using a dataset on CoCo issuance around the world during 2010-2016, I find that the interest rate at issuance of discretion-based trigger CoCos is lower by 1.13 to 2.91%p on average than that for rule-based trigger CoCos even after controlling for variables that are closely related to the likelihood of government bailouts and the financial soundness of the issuing bank. This finding suggests that triggers should be carefully designed in order to make CoCos effective as bail-in tools.

As triggers are the key features of CoCos, existing studies focus on the economic implications of various types of triggers. Among only a handful of related empirical studies, Avdjiev et al. (2017) examine the quantitative effects of CoCo issuance on the issuing banks’ credit default swap (CDS) spreads. They show that the CoCo issuance announcement does not have significant effects on the issuing bank’s CDS spreads if the trigger is discretion-based, whereas the announcement is associated with declines in the CDS spreads if the CoCo contains a rule-based trigger. Their findings appear to be consistent with the main result of the current paper. In the current paper, I show that the government is more likely to save troubled CoCo holders ex-post if the trigger is discretion-based. Then, ex-ante, the bank's stockholders’ incentive to reduce risk is weak given that they can attract CoCo investors in any case. Due to this weak risk-reduction incentive, the bank’s default risk as measured by the CDS spread for a senior unsecured bank bond (rather than the CDS on CoCos) does not decrease significantly. In contrast, if the trigger is rule-based, according to the current paper, the government is less likely to save troubled CoCo holders. Therefore, ex-ante, the bank faces a strong incentive to reduce its risk because otherwise it will not be able to attract CoCo investors. The CDS spreads on the bank’s straight bonds then decline significantly due to the bank’s strong risk-reduction incentives.

Sundaresan and Wang (2015) show in a theoretic model that CoCos with market triggers based on stock prices generally result in multiple equilibria. Although the multiple-equilibrium phenomenon also arises in this paper, the mechanism and focus are different. In their paper, investors’ expectations on market prices endogenously determine the equilibrium in place.6 In contrast, this paper shows that investors’ expectations on the likelihood of government assistance endogenously determine the equilibrium in place. In general, comparative statics are not meaningful when there are multiple equilibria. However, even after considering the multiple-equilibrium phenomenon, the current paper could show that discretion-based CoCos end up more likely to receive government bailouts in equilibria as compared to CoCos with rule-based triggers.

Martynova and Perotti (2013) compare market triggers with accounting triggers in terms of informativeness. They show that market triggers are relatively more likely to cause the Type II error—triggers are activated even if issuing banks are sound and hence triggers should not be activated—when market prices are volatile. In contrast, it is shown that accounting triggers are more likely to cause the Type I error—triggers are not activated even if issuing banks are distressed—as accounting information must be confirmed by regulators, who are vulnerable to regulatory forbearance. Although informativeness is not the main focus, the current paper also takes Type I and Type II errors into account when analyzing how discretion-based triggers are different from rule-based triggers with regard to their effects on the implementability of a bail-in.

Dewatripont (2014) discusses the implementability of a statutory bail-in system. He acknowledges that the creditor bail-in can impose severe shocks on the financial system. In order to prevent a bail-in-led financial crisis, he suggests retaining the option of a bailout, especially when it can be prefunded by banks. The work by Dewatripont (2014) is close to the present paper in that the current paper explicitly examines the financial shocks caused by bail-ins, though Dewatripont (2014) does not focus on CoCos but on statutory bail-ins.

This paper is organized in the following way. In Section 2, I construct a theoretic model that provides some predictions of the effectiveness of a CoCo as a bail-in tool. In Section 3, I conduct an empirical analysis in order to test the prediction that CoCos with discretion- based triggers work poorly as bail-in tools as compared to CoCos with rule-based triggers. Section 4 is the conclusion.

There are three ‘active’ players in the model economy: investors holding contingent convertible bonds (hereafter, CoCos), a systemically important bank, and a government. Depositors and short-term funders are inactive players.

There are two points in time, t = 0,1. At time 0, the bank issues a CoCo at (net) interest rate r with a rule-based or discretion-based trigger. After observing r , investors decide whether to purchase the CoCo. At time 1, if the bank is seriously troubled and, hence, the trigger is activated, the CoCo is converted to common equity or its principal and interest are written down depending on the loss-absorption mechanism. During the process of loss absorption, I assume that both the existing stockholders and CoCo holders bear losses.7

A key difference with CoCos as compared to straight bonds is that the former allows for the government to separate the bailout decision from the continuation decision. If the bank fails at time 1, the government has no choice but to continue the failed bank owing to its systemic importance.8 In this regard, I assume in the following theoretic analysis that failed bank must be continued in any case. If the bond were a straight bond, the bond holders would take control over the bank from the stockholders. To continue the bank, the government would have to buy the control rights by repaying the straight bond holders. That is, the government is forced to bail out the bond holders. The situation differs with a CoCo. In this case, the CoCo holders’ claims are canceled as the trigger is activated; hence, the government can continue the systemically important bank. That is, the government can choose whether to rescue the bond holders or not if the bond is a CoCo, whereas its only feasible option is to rescue the bond holders if the bond is a straight bond.

Rule-based triggers are based on imperfect signals of solvency, such as the common equity tier 1 (CET1) capital ratio, the stock price, or the CDS spread. None of these signals are perfect. For instance, a bank could be solvent (insolvent) even if its CET1 capital ratio is below (above) a certain threshold.

In order to model this imperfection of a rule-based trigger, let X ∈{0,1} denote the solvency of the bank, which is non-verifiable and hence non-contractible. X =1 means that the bank becomes solvent at time 1, whereas X = 0 means it becomes insolvent at that time. That is, p ≡ Pr(X = 0) is the probability of failure.

Investors can observe an imperfect contractible signal x ∈ (−∞, ∞) of X. Let Fx(⋅) denote the distribution function of x conditional on X. The signal x and the underlying parameter X are positively related in the sense of first-order stochastic dominance; that is, F1(x) < F0(x) for any threshold x ∈ (−∞, ∞). In other words, the probability of receiving bad news Pr(x < x|X) = Fx(x) if the bank is solvent (i.e., X =1) is smaller than that if the bank is insolvent (i.e., X = 0 ).

Rule-based trigger case: Without loss of generality, I consider the case where the trigger is activated if x is below a threshold x . That is, the probability of the trigger being activated equals Rule-based trigger case: Without loss of generality, I consider the case where the trigger is activated if x is below a threshold x . That is, the probability of the trigger being activated equals Pr(x < x) = (1− p)F1(x) + pF0(x). Note that this probability can also be expressed as

This expression implies that the signal x is associated with two possible errors. The trigger can be activated when the bank is solvent (i.e., x < x and X = 1) — the error of false activation — whose likelihood is (1− p)F1(x). It is also possible that the trigger is not activated even if the bank is insolvent (i.e., x > x and X = 0) — the error of negligence — whose likelihood is p[1 − F0(x)]. Note that the error of false activation is increasing while the error of negligence is decreasing in the threshold x. If the threshold is appropriately chosen, the rule-based trigger has no systematic error in the sense that the unconditional probability of the trigger being activated is equal to the probability of insolvency. That is, I define an ‘unbiased’ level of threshold x′ as follows:

Definition 1. A threshold x is unbiased if Pr(x < x) = p, or equivalently, (1 − p)F1(x) = p[1 − F0(x)].9

Discretion-based trigger case: At its discretion, the government can consider a number of sources of information, including not only the signal x but also other non-contractible variables. The government can also require banks to report confidential information promptly and can conduct on-site examinations. For these reasons, I assume that the government can determine without any error whether a troubled bank is actually solvent or not; that is, it can observe the parameter X.

Some readers might believe that market participants know better than governments. I do not disagree with this belief and in fact it is not inconsistent with the current model. Rule- based decision making is valued for its quickness, but it must rely on a small set of verifiable indicators. In contrast, discretion-based decision making is valued because the decision maker can utilize not only verifiable but also non-verifiable (but highly informative) indicators when making decisions. That is, market participants compared to governments may observe more sources of information. However, only a handful of those sources can be used when designing a rule-based trigger due to the incompleteness of contracts.

The bank chooses the size of an investment in assets and how to finance the assets. There are four ways to finance, deposits D, short-term debt S, (long-term) CoCo C, and equity E, though deposits and equity have limited roles in this model. Hahm, Shin, and Shin (2013) report that deposits and equity do not depend much on financial market conditions. This is presumably because depositors are usually protected by deposit insurance and depositor preference during insolvency proceedings. Moreover, depositors’ primary motive for holding deposits is to use payment and settlement services; hence, they are less likely to change the balances of their deposit accounts simply because financial market conditions change. In this regard, I assume that depositors invest in the bank a fixed amount D at a zero net interest rate. When banks increase their investments in assets, they usually finance these investments with debt rather than equity, as equity issuance is often deemed the most expensive means of financing due to the associated risks, tax disadvantage, and dilution. In this reason, I assume that equity E is fixed. Below, I assume that D = E = 0 without loss of generality.

The model is focused on CoCo and its relationship with short-term debt. Short-term debt is inexpensive given that it is demandable on short notice and collateral is posted against it, whereas CoCos are expensive due to their longer maturities, greater level of default risk, and the risk of bail-ins. However, the merit of a CoCo is that it is recognized as regulatory capital according to the Basel III accord and other international regulations on capital adequacy.

The bank succeeds with probability (1 − p) and fails with probability p. If it fails, the bank earns nothing. By the limited liability, in this case, the

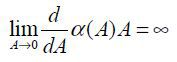

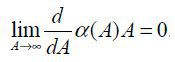

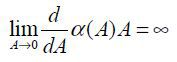

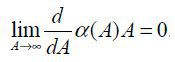

bank pays nothing to creditors. If it succeeds, the bank earns (1 + α)A from its investment in assets A. The return on investment α(A)A is assumed to be increasing and concave with regard to A. I also use the two regularity conditions  and

and  .

.

Below, I derive the CoCo supply function.

Discretion-based trigger: The bank (or its stockholders) solves the following problem.

where the first and second constraints are the accounting identity and capital adequacy requirement with the regulatory minimum capital ratio c, respectively. Note that the (net) interest rate on short-term debt is assumed to be zero. As CoCos are more expensive than short-term funding, it is optimal to issue a CoCo only when the capital requirement is binding, that is, when the minimum capital ratio c is high enough. Since the global financial crisis and subsequent European sovereign debt crisis, regulations on international capital have been greatly strengthened. In this sense, I assume that c is sufficiently high that the capital adequacy requirement is binding. Then, by substituting cA for C, the optimal choice of assets A*(r) is determined by the following first-order condition.

The equation above implies that the optimal size of investment A*(r) is decreasing in r because α(A)A is concave in A. Thus, the CoCo supply is equal to Cs(r)≡cA*(r), which is also decreasing in r.

Rule-based trigger: Bank stockholders gain nothing if the CoCo trigger is activated.10 In this case, the bank as an entity enjoys a reduction in its liabilities but the existing stockholders’ value is assumed to be fully diluted. Therefore, they receive zero payoff regardless of whether the bank is solvent or not. If the loss-absorption mechanism of the CoCo is mandatory conversion, the existing stockholders’ value is greatly diluted as the current international regulation pertaining to CoCos requires the conversion ratio to be disadvantageous for existing stockholders. If the loss-absorption mechanism calls for the write-down of principal and interest, existing stockholders are, in principle, intact, but in reality, they are wiped out as the stock price plummets. If the trigger is not activated but the bank is insolvent, the bank as an entity has nothing and hence its stockholders receive a zero payoff. Finally, the stockholders face a positive payoff only when the trigger is not activated and the bank is solvent. Therefore, they solve the following problem:

Because the asset size and CoCo do not affect the probability of solvency or the probability of the trigger being activated, the CoCo supply is still equal to Cs(r) = cA*(r).

There is a unit-measure of investors who choose whether to buy CoCos. These investors are risk-neutral. Each investor is endowed with one unit of money.11 Investors may use the money to purchase one unit of the CoCo or to invest in an alternative project. The reservation utility from this alternative project is u, which follows distribution G on the support [0,1].

Discretion-based trigger case: If the bank becomes insolvent, the government can choose whether to activate the trigger of the CoCo. If it chooses to activate it by declaring that the bank is at the point of non-viability, the CoCo holders’ claims are canceled and they absorb losses. If the government does not activate the trigger, it has to repay the CoCo holders on behalf of the insolvent bank. Note that one cannot think of a situation in which the bank is insolvent, the government does not activate the trigger, but neither the bank nor the government repay the CoCo holders as, in this case, the CoCo holders can legitimately require repayment as their claims are still valid. If these valid claims are not satisfied, the bond holders can force the bank to enter into a bankruptcy process, resulting in the exposure of the financial market to a systemic crisis. Let qe ∈ {0, 1} denote the investors’ expectation of the probability that the government does not activate the trigger but uses taxpayers’ funds to repay CoCo holders. That is, qe can also be interpreted as the expected probability of regulatory forbearance. I assume that investors form a common expectation because they are identical in every aspect except for the reservation payoff. Then, the probability that CoCo holders lose is equal to p(1− qe); hence, the CoCo demand is given by

Note that the CoCo demand is increasing in r.

Rule-based trigger: Note that the probability that the trigger is activated is (1 − p)F1 + pF0, where F1 = F1(x) and F0 = F0(x). Recall that the government can observe and supervise the bank and is therefore able to detect whether the mechanical trigger is soon to be activated. If it realizes that the trigger condition is about to be satisfied, it may consider saving the CoCo holders for a reason to be explained momentarily. Thus, the investors form the belief qe ∈ {0, 1} where qe = 1 means that the government chooses to recapitalize the bank preemptively just before the trigger is activated, while qe = 0 means that the government lets the bond holders take losses. Thus, CoCo holders lose with the probability of ((1 − p)F1 + pF0)(1 − qe) and hence the CoCo demand is given by

Note that the CoCo demand is increasing in r.

If the unbiased threshold x′ is used, the probability of the trigger being activated is equal to the probability of insolvency. In this case, the CoCo demand is simplified to

Discretion-based trigger: The CoCo demand G((1 − p(1 − qe))(1 + r)) depends on the investors’ expectation on the likelihood of regulatory forbearance qe in case the bank becomes insolvent. If investors believe that the government will activate the trigger (qe = 0), the CoCo demand is G((1 − p)(1 + r)) and hence the market-clearing interest rate and quantity r0 and m0, respectively, are given by

m0 can be understood as the mass of CoCo holders as each investor buys only one unit of the CoCo. See Figure 1. In contrast, if they believe that the government will not activate the trigger but will save CoCo holders using taxpayers’ funds (qe = 1), the demand increases to G(1 + r). In this case, the market-clearing interest rate and quantity are correspondingly r1 and m1 such that

Note that r1 is lower than r0 while m1 is larger than m0.

Rule-based trigger: Suppose that the threshold x′ of the signal x is unbiased. In this case, the market-clearing outcome is identical to that under the discretion-based trigger. That is, the pair consisting of the market-clearing interest rate and quantity is (r0, m0) if qe = 0, while it is (r1, m1) if qe = 1.

Note that r1 is the risk-free rate because it is the market-clearing interest rate when the probability that CoCo holders will lose is zero. Thus, the difference between the market-clearing interest rate and risk-free rate can be understood as the bail-in risk premium required by investors. If investors believe that the government will not save CoCo holders (i.e., qe = 0), they require (r0 − r1) as the bail-in risk premium. In contrast, if investors believe that the government will rescue CoCo holders (i.e., qe = 1), they acknowledge that there is no bail-in risk. This result holds for both types of triggers.

Lemma 1. (i) r0, m0, r1 and m1 exist uniquely, and r0 > r1 but m0 < m1. (ii) If the trigger is discretion-based, the market-clearing interest rate and quantity are correspondingly r0 and m0 if qe = 0, whereas they are r1 and m1 if qe = 1. The same is true if the trigger is rule-based and the threshold is unbiased (i.e., x = x′).

Proof. (i) The existence and uniqueness follow from the fact that the CoCo demand is increasing

while the CoCo supply is decreasing in r and the two regularity conditions  and

and  . Given that G(1 + r) > G(1 − p)(1 + r)) for all r ≥ 0 and A*(r) is decreasing in r, equation (8) and (10) imply that r1 < r0. Because r1 < r0 and A*(r) is decreasing in r, equation (9) and (11) imply that m1 > m0. (ii) Equation (5), (8), (9), (10), (11), and the fact that the market-clearing outcome

is invariant to the type of triggers immediately implies (ii). ■

. Given that G(1 + r) > G(1 − p)(1 + r)) for all r ≥ 0 and A*(r) is decreasing in r, equation (8) and (10) imply that r1 < r0. Because r1 < r0 and A*(r) is decreasing in r, equation (9) and (11) imply that m1 > m0. (ii) Equation (5), (8), (9), (10), (11), and the fact that the market-clearing outcome

is invariant to the type of triggers immediately implies (ii). ■

The market-clearing outcome depends on the investors’ expectation of regulatory forbearance and thus constitutes a rational expectations equilibrium if and only if the expectation is consistent with the government’s actual choice. Below, I model the government’s behavior and derive rational expectations equilibria.

When the bank becomes insolvent, the government decides whether to activate the trigger of the CoCo. During this decision process, the government considers three types of associated costs: fiscal, political, and shock costs.

If the government activates the trigger and lets the CoCo holders take losses, it is a shock to the investors, who may then withdraw their confidence in the banking system. Related to this, it was reported in February of 2016 that Deutsche Bank may be unable to pay the interest on its CoCos. Immediately, the stock price and CDS spreads decreased sharply and worries about Deutsche Bank and the European banking system spread quickly.12,13 These worries could cause liquidity problems even when there are no insolvency issues. For instance, if a money market fund invests heavily in such a bank, not only the given fund but also other similar money market funds could suffer from fund runs. Let θ ≥ 0 denote the shock cost the government bears when it chooses not to save distressed CoCo holders.

If the government does not rescue the CoCo holders, certain political costs also arise. As the CoCo holders absorb losses, they withdraw their political support for the government and even protest against or sue it. Therefore, the government faces a political cost. This cost would be larger as more CoCo holders are forced to absorb losses. Similarly, during the 2016 banking turmoil, the Italian government was very reluctant to activate the trigger for bail-in debt, including senior and subordinated bonds, as most of the affected bond holders were ordinary citizens. It was reported that one third of senior bond holders and 46% of subordinated bond holders are retail investors.14 Let πdc(m) denote such a political cost, where πd > 0 is the intensity of the political cost and c(m) is a nonnegative and increasing function of the number m of CoCo holders.

In contrast, suppose that the government decides not to activate the trigger but to recapitalize the bank at the expense of taxpayers. In this case, the shock cost is not a concern, whereas a fiscal cost arises because taxpayers’ resources are used. The fiscal cost is δ(1+ r)m, where δ ∈ (0, 1) reflects the possibility that bailout funds are repaid at least partially in the future by the rescued bank and (1+ r)m is the amount of money used in the bailout.15

For the following analysis, I use the assumption below pertaining to the political cost and the fiscal cost in order to focus on interesting and reasonable cases.

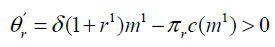

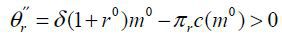

Assumption 1.

The first part of Assumption 1 means that the political cost is lower than the fiscal cost if the shock cost is zero and, therefore, the government will never rescue the troubled CoCo holders. If CoCos are issued by small or medium-sized nonfinancial companies, the news that the government will not save troubled CoCo holders may not have any impact on the overall financial market. In this case, the shock cost is zero and hence the government never chooses a bailout. However, if the CoCos are issued by systemically important banks, the news will cause a panic in the financial market and will lead to financial instability. In this case, the shock cost is positive and large and the government therefore considers whether or not to save the bond holders.

The second part implies that the political cost rises more rapidly than the fiscal cost with the number of CoCo investors. A possible justification is as follows. The fiscal cost is a monetary cost and therefore increases linearly with the number of investors to be rescued. However, the political cost increases convexly with the number of investors because the cost is associated with the majority voting rule: if the number of troubled investors who are voters is smaller than a certain threshold number, the ruling party may not lose in forthcoming elections. However, if the number of troubled investors is only slightly larger than the threshold, the ruling party may lose in such elections. That is, the associated political cost of the ruling party increases suddenly as the number of investors who purchased CoCos rises.

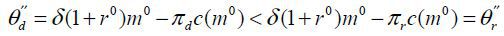

In sum, the government should compare the total cost of a bail-in and the total cost of a bailout when determining whether to activate a discretion-based trigger. If it chooses to activate the trigger, the government should bear the total cost of the bail-in, which is the sum of the shock cost θ and political cost πdc(m). Instead, if it decides not to activate the trigger but to help the failed bank repay the CoCo holders, the government should take the total cost of bailout, which is equal to the fiscal cost δ(1+ r)m.

Note that the political cost and fiscal cost depend on the expectations of investors regarding whether the government will rescue CoCo holders. If they believe this to be so (i.e., qe = 1), the market-clearing number of CoCo holders and the interest rate are m1 and r1, respectively. Accordingly, the corresponding political cost and fiscal cost are πdc(m1) and δ(1+ r1)(m1). Similarly, if they do not believe a bailout will occur (i.e., qe = 0), the political cost and fiscal cost change to πdc(m0) and δ(1+ r0)(m0), respectively.

Let q∈{0,1} denote the government’s choice. q = 1 indicates that the government chooses a bailout for troubled CoCo holders, while q = 0 means that the government decides to activate the trigger. If the expectation qe is consistent with the actual choice q, then q* = qe = q constitutes a rational expectations equilibrium.

The following proposition characterizes the rational expectations equilibria (see Figure 2).

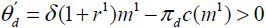

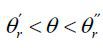

Proposition 1. (Discretion-based trigger case): Suppose that Assumption 1 holds. Then, there are  and

and  such that

such that  ,

,

(i) (q* = 0, r0, m0) is the unique equilibrium if  ,

,

(ii) both (q* = 0, r0, m0) and (q* = 1, r1, m1) are equilibria if  , and

, and

(iii) (q* = 1, r1, m1) is the unique equilibrium if  .

.

Proof. According to Assumption 1, there exists a unique  and

and  such that

such that  and

and  . Because δ(1+ r0)m0 − πdc(m0) > δ(1+ r1)m1 − πdc(m1), I have

. Because δ(1+ r0)m0 − πdc(m0) > δ(1+ r1)m1 − πdc(m1), I have  .

.

(i) If  , Assumption 1 (ii) implies that

, Assumption 1 (ii) implies that

. It then follows that (A) δ(1+ r1)m1 ≥ θ + πdc(m1) and (B) δ(1+ r0)m0 ≥ θ + πdc(m0). (A) indicates that when investors believe that the government will save distressed

CoCo holders (i.e., qe = 1), the government will not save them (i.e., qe = 0), as the total cost of a bail-in θ + πdc(m1) is lower than the total cost of a bailout δ(1+ r1)m1. That is, the expectation is not consistent with the actual choice. (B) means that

when investors believe that the government will not rescue troubled CoCo holders (i.e.,

qe = 0), the government will do so (i.e., q = 0). Therefore, q* = 0 is the unique rational expectations equilibrium.

. It then follows that (A) δ(1+ r1)m1 ≥ θ + πdc(m1) and (B) δ(1+ r0)m0 ≥ θ + πdc(m0). (A) indicates that when investors believe that the government will save distressed

CoCo holders (i.e., qe = 1), the government will not save them (i.e., qe = 0), as the total cost of a bail-in θ + πdc(m1) is lower than the total cost of a bailout δ(1+ r1)m1. That is, the expectation is not consistent with the actual choice. (B) means that

when investors believe that the government will not rescue troubled CoCo holders (i.e.,

qe = 0), the government will do so (i.e., q = 0). Therefore, q* = 0 is the unique rational expectations equilibrium.

(iii) This can be proven analogously.

(ii) As  , it follows that (C) δ(1+ r1)m1 < θ + πdc(m1). Also,

, it follows that (C) δ(1+ r1)m1 < θ + πdc(m1). Also,  implies that (D) δ(1+ r0)m0 > θ + πdc(m0). (C) and (D) mean that the government chooses a bailout (bail-in) if investors believe

a bailout (bail-in) will occur. ■

implies that (D) δ(1+ r0)m0 > θ + πdc(m0). (C) and (D) mean that the government chooses a bailout (bail-in) if investors believe

a bailout (bail-in) will occur. ■

The intuition of Proposition 1 is as follows. In one extreme case in which financial

turmoil due to the government’s choice of a bail-in is sufficiently high (i.e.,  ), the government has no choice but to save distressed CoCo holders for the sake of

financial stability. In the other extreme, in which investors are fully aware of the

possibility that the government could let them take losses and hence the action of

a bail-in causes only a negligible shock on the financial system (i.e., θ < θ′ ), then regulatory forbearance does not arise regardless of how many investors have

long positions in the CoCo. In an interesting case where the shock cost is moderate,

the equilibrium depends on the expectation. If investors believe that the government

will be lenient in treating troubled CoCo holders, then more investors choose to buy

the CoCo and, hence, the government should bear a greater political burden when it

chooses to activate the trigger. Consequently, it chooses to save the CoCo holders.

However, if investors believe that the government will be tough on CoCo holders, the

number of risk-exposed CoCo holders will be smaller, as will be the political pressure

regarding a bail-in. Thus, the government chooses not to save the CoCo holders.

), the government has no choice but to save distressed CoCo holders for the sake of

financial stability. In the other extreme, in which investors are fully aware of the

possibility that the government could let them take losses and hence the action of

a bail-in causes only a negligible shock on the financial system (i.e., θ < θ′ ), then regulatory forbearance does not arise regardless of how many investors have

long positions in the CoCo. In an interesting case where the shock cost is moderate,

the equilibrium depends on the expectation. If investors believe that the government

will be lenient in treating troubled CoCo holders, then more investors choose to buy

the CoCo and, hence, the government should bear a greater political burden when it

chooses to activate the trigger. Consequently, it chooses to save the CoCo holders.

However, if investors believe that the government will be tough on CoCo holders, the

number of risk-exposed CoCo holders will be smaller, as will be the political pressure

regarding a bail-in. Thus, the government chooses not to save the CoCo holders.

The type of trigger has an important implication with regard to the government’s political cost of letting creditors take losses. A rule-based trigger is activated mechanically. Therefore, the government has no authority over or responsibility for trigger activation. Thus, the government does not get ‘blood on its hands’, even if CoCo holders lose money. Nevertheless, the government may feel some degree of political pressure because investors may blame the government for its failure of supervising the bank. In this sense, I assume that the political cost parameter πr under the rule-based trigger case is positive but smaller than πd .

Suppose that the realized level of the signal x is higher than the threshold (i.e., x ≥ x ). In this case, the trigger is not activated. Even if the signal is good, the actual financial status of the bank could be poor. If the bank becomes insolvent (i.e., X = 0 ), the bank has nothing with which to repay the CoCo holders. Because their claims remain valid, the CoCo holders can demand repayment. In this case, the government must pay the CoCo holders back on behalf of the bank in order to prevent liquidation.

Suppose instead that the signal falls short of the threshold. Accordingly, trigger activation is imminent. In practice, the CET1 capital ratio is the most popular signal used in rule-based CoCos, and financial regulators monitor this capital ratio. Thus, a financial regulator could realize that the capital ratio is about to fall sharply in the near future and hence may consider recapitalizing the bank preemptively just before the activation of the trigger. In this sense, I consider the situation in which the government could enact a preemptive bailout on the brink of trigger activation. In doing so, the government bears the cost of the bailout, δ(1+ r)m . If the government does not choose the preemptive bailout option and lets the CoCo holders absorb losses, it incurs the bail-in cost, θ + πrc(m). Note that the political cost parameter πr is smaller than πd and hence the political cost πrc(m) is not very sensitive to the number of CoCo holders. Thus, the following assumption may or may not hold:

Assumption 2. πr[c(m1) − c(m0)] > δ[(1 + r1)m1 − (1 + r0)m0].

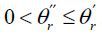

The following proposition characterizes the rational expectations equilibria in the rule-based trigger case (see Figures 3 and 4). If the difference in the political cost parameters (πd − πr) is moderate and hence Assumption 2 holds, the equilibrium structure is then similar to that of the discretion-based trigger case. However, if the difference is large and Assumption 2 therefore does not hold, there is no rational expectations equilibrium if the shock cost is at an intermediate level.

Proposition 2. (Rule-based trigger case): Suppose that Assumption 1 holds.

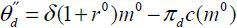

(Subcase 1) Suppose further that the Assumption 2 holds. Then, there are  and

and  such that

such that  ,

,

(i) (q* = 0, r0, m0) is the unique equilibrium if  ,

,

(ii) both (q* = 0, r0, m0) and (q* = 1, r1, m1) are equilibria if  , and

, and

(iii) (q* = 1, r1, m1) is the unique equilibrium if

(Subcase 2) Suppose instead that the Assumption 2 does not hold. Then, there are  and

and  such that

such that  ,

,

(i) (q* = 0, r0, m0) is the unique equilibrium if  ,

,

(ii) There is no equilibrium if  , and

, and

(iii) (q* = 1, r1, m1) is the unique equilibrium if  .

.

Proof. Via Assumption 1 and the fact that πr < πd, there exists unique  and

and  such that

such that  and

and  . The proof of subcase 1 is analogous to the proof of Proposition 1. Consider subcase

2. Because Assumption 2 does not hold, it follows that

. The proof of subcase 1 is analogous to the proof of Proposition 1. Consider subcase

2. Because Assumption 2 does not hold, it follows that  .

.

(i) If  , I have δ(1 + r0)m0 ≥ θ + πrc(m0). and δ(1 + r1)m1 > θ + πrc(m1). Thus, q* = 0 is a unique equilibrium. (iii) If

, I have δ(1 + r0)m0 ≥ θ + πrc(m0). and δ(1 + r1)m1 > θ + πrc(m1). Thus, q* = 0 is a unique equilibrium. (iii) If  , it follows that δ(1 + r0)m0 ≤ θ + πrc(m0) and δ(1 + r1)m1 < θ + πrc(m1). Then, q* = 1 is a unique equilibrium. (ii) If

, it follows that δ(1 + r0)m0 ≤ θ + πrc(m0) and δ(1 + r1)m1 < θ + πrc(m1). Then, q* = 1 is a unique equilibrium. (ii) If  , I have δ(1 + r0)m0 < θ + πrc(m0) and δ(1 + r1)m1 > θ + πrc(m1). Thus, the bailout cost exceeds the bail-in cost when investors expect a bailout.

Moreover, the bail-in cost is larger than the bailout cost when investors believe

a bail-in will occur. Thus, neither a bailout nor a bail-in constitutes an equilibrium.

■

, I have δ(1 + r0)m0 < θ + πrc(m0) and δ(1 + r1)m1 > θ + πrc(m1). Thus, the bailout cost exceeds the bail-in cost when investors expect a bailout.

Moreover, the bail-in cost is larger than the bailout cost when investors believe

a bail-in will occur. Thus, neither a bailout nor a bail-in constitutes an equilibrium.

■

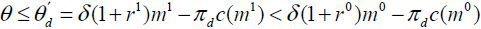

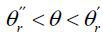

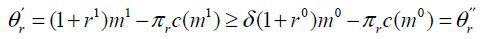

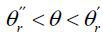

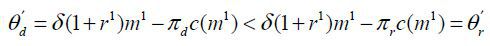

By comparing Propositions 1 and 2, one can assess the effectiveness of a CoCo as a bail-in tool. For both types of triggers, a bail-in constitutes the unique equilibrium if the shock cost θ is small enough while a bailout constitutes the unique equilibrium if the shock cost is large enough. If we focus on the unique equilibrium, it is clear that a rule-based trigger is better than a discretion-based trigger in terms of the implementability of a bail-in, as the following corollary shows.

Corollary 1. Suppose that Assumption 1 holds. The region in which a bail-in constitutes the unique equilibrium is larger while the region in which a bailout constitutes the unique equilibrium is smaller if the trigger is rule-based rather than discretion-based.

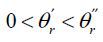

Proof. Note that  and

and  .

.

Suppose that Assumption 2 holds. Then, a bail-in constitutes the unique equilibrium

if  , k = {d, r}, while a bailout constitutes the unique equilibrium if θ > θ′′ under both types of triggers. Because

, k = {d, r}, while a bailout constitutes the unique equilibrium if θ > θ′′ under both types of triggers. Because  and

and  , the proof is completed.

, the proof is completed.

Suppose instead that Assumption 2 does not hold. Then, with a rule-based trigger,

a bail-in constitutes the unique equilibrium if  while a bailout constitutes the unique equilibrium if

while a bailout constitutes the unique equilibrium if  . Because

. Because  and

and  , it follows that

, it follows that  . Also,

. Also,  as

as  and

and  according to Proposition 2. ■

according to Proposition 2. ■

If the shock cost is at an intermediate level, the model does not make a definitive prediction, as there are either multiple or no equilibria. Nevertheless, one can determine that a bail-in arises more likely as an equilibrium if the trigger is rule-based rather than discretion-based in the following sense. Whenever there are multiple equilibria under the discretion-based trigger case, a bail-in constitutes the unique equilibrium or there are multiple equilibria under the rule-based trigger case (see Figures 2-4). Moreover, whenever there are multiple equilibria under the rule-based trigger case, a bailout constitutes the unique equilibrium or there are multiple equilibria under the discretion-based trigger case. Furthermore, whenever there are no equilibria under the rule-based trigger case, a bailout constitutes the unique equilibrium under the discretion-based trigger case.

Thus far, I have focused on the case where the threshold of the signal x is unbiased in the sense that the probability of the trigger being activated is equal to the probability of insolvency (see Definition 1).

However, in practice, thresholds appear to be biased upwardly. For instance, most CoCos with rule-based triggers in the real world are based on the CET1 capital ratio, and the threshold is around 5% (see Table 3). In principle, a bank is insolvent if its assets fall below its liabilities and, therefore, 0% appears to be an unbiased threshold level. Nevertheless, banks are encouraged or required by market or financial regulators to use a threshold higher than 0% when they issue CoCos based on the CET1 capital ratio.

Suppose that the threshold is higher than the unbiased level (i.e., x > x′). In this case, the probability that a rule-based trigger is activated is higher than the probability of insolvency p, as the error of false activation increases while the error of negligence decreases (see Equation (1)). As the bail-in risk increases, the CoCo demand shrinks. Thus, the equilibrium interest rate and bail-in risk premium rise (see Equation (6)). In contrast, the equilibrium interest rate and bail-in risk premium with a discretion-based trigger are unchanged.

Analogously, one can find that the equilibrium interest rate and bail-in risk premium for a CoCo with a rule-based trigger fall if the threshold is downwardly biased.

If the size of the shock cost parameter θ is moderate, there are multiple equilibria or no equilibria, as investors can perfectly observe the shock cost parameter. In such a case, all investors know whether the government chooses a bailout or a bail-in. However, if they can observe only an imperfect signal of the parameter, some investors believe that the government will choose a bailout while others expect a bail-in. Therefore, investors behave differently. In this case, the model can generate a unique equilibrium for all θ. In Appendix 1, I explore the possibility of having a unique equilibrium based on the global game approach suggested by Morris and Shin (1998). The main result is that the equilibrium is unique and the implementability of a bail-in is improved if the trigger is changed from discretion-based to rule-based.

A main finding of the previous theoretic model is that the bail-in risk as measured by the interest rate at issuance—the coupon rate—is most likely lower under a discretion-based trigger than under a rule-based trigger with an unbiased level of threshold. In this section, this theoretical prediction is tested empirically. In particular, I consider the following hypothesis:

Hypothesis 1. The bail-in risk is lower (i.e., the likelihood of government assistance is higher) under a discretion-based trigger than under a rule-based trigger.

The coupon rate is a measure of the bail-in risk. In theoretical model, I assume that the bank is never allowed to be liquidated due to its systemic importance and, hence, there is no default risk. The coupon rate r can then be decomposed into two parts: the risk-free benchmark rate and the bail-in risk premium (see Figure 1). Therefore, if the risk-free rate can be properly controlled, the coupon rate is a good measure of the bail-in risk. However, as the bankruptcy of Lehman brothers showed, even a systemically important bank can be liquidated, though it is very unlikely. This is why default indicators such as bank CDS premiums are positive. As the coupon rate in real-life reflects the default risk as well, it is an imperfect measure of the bail-in risk.

In addition, the validity of the coupon rate as a measure of the bail-in risk depends on whether CoCos are AT1 or T2 instruments. Tier 2 (T2) instruments are subordinated bonds for which a bail-in clause is added. Additional Tier 1 (AT1) instruments have more complicated structures. They are de facto perpetual bonds with bail-in clauses and two special options. First, with a call option, the issuer can opt to repay the bond before the maturity. Because this option is usually exercised, the market panics if the issuer does not exercise the option—the call option risk. Secondly, the issuer can choose to suspend or even default on the interest payment if business conditions are unfavorable—the interest payment risk.16 The coupon rate of AT1 CoCo reflects the call option risk and interest payment risk as well as the default risk and bail-in risk.

An alternative measure of the bail-in risk is the coupon residual, which is obtained after subtracting a benchmark sovereign bond rate and a relevant CDS premium from the coupon rate.

For T2 instruments, this coupon residual is conceptually an ideal measure of the bail-in risk. Tables 1 and 2 describe how the coupon rates of CoCos are determined in real life.

Note: 1) The CoCo (ISIN: US98105FAC86) was issued in April 30, 2014. The maturity is ten years. The face value is $10 billion. 2) * The coupon residual = the coupon rate - the benchmark rate - the default risk premium.

Note: 1) The CoCo (ISIN: XS1274156097) was issued in August 11, 2015. The maturity is 34 years. The face value is $15.6 billion. 2) * The coupon residual = the coupon rate - the benchmark rate - the default risk premium.

Woori Bank (a Korean bank) issued a T2 CoCo (in USD) on April of 2014 at the coupon rate of 4.75%. The coupon rate can be decomposed into the benchmark country rate of 3.17% (measured by a similar-term US Treasury bond rate), the default risk premium of 1.40% (measured by the CDS premium on a similar-term Woori Bank subordinated bond), and a residual of 0.18%. Because it is a T2 instrument, investors are concerned only about the default risk and bail-in risk but not the call option risk or interest payment risk. As the CDS premium accounts for the default risk, the coupon residual could be construed as a good measure of the bail-in risk.

The coupon residual, however, is not an ideal measure of the bail-in risk of an AT1 CoCo. Table 2 illustrates this point. Barclays issued an AT1 CoCo in August of 2015 at the coupon rate of 7.86%. As it is an AT1 instrument, the coupon rate reflects not only the default risk and bail-in risk but also the call option risk and interest payment risk. However, it is difficult to find objective measures of the call option risk premium and interest payment risk premium.

Despite its drawbacks, the coupon rate could still be a good measure of the bail-in risk. Although the coupon residual is conceptually a better measure at least for T2 instruments, only a few samples are available, as many CoCos in real life have no counterpart sovereign bonds or subordinated bonds for which CDSs are traded. The maturity of CoCos is mostly ten years or thirty years, but many countries do not issue 10-year or 30-year sovereign bonds. The problems are even worse with CDS contracts. For many banks, CDSs are not traded at all on any subordinated bond. In contrast, if the coupon rate is used as the bail-in risk measure, the available sample size triples in size.

In the following empirical analyses, I use two different approaches. Firstly, I use the coupon rate as the primary measure of the bail-in risk and attempt to control the default risk as much as possible. Various different specifications are considered, and robustness checks are conducted. Secondly, I choose the coupon residual as an alternative measure of the bail-in risk.

I utilize a dataset of CoCos issued by banks from January of 2010 to September of 2016. The sources of the dataset are Moody’s Quarterly Rated and Tracked CoCo Monitor Database (2016 3Q) and a Bloomberg terminal. The data also contain information on issuing banks and their countries of domicile. The data cover 632 distinct CoCo instruments issued by 222 banks. The aggregate face value is $460 billion. (Short-term CoCos that mature within three years are excluded because CoCos are designed as a long-term debt.)

Figures 5 and 6 provide an overview of CoCo issuance. The number of issuance increases steadily during the sample period. The volume of CoCos increased to 185 billion US$ until 2014 and then decreased to $124 billion in 2015. According to the convention of international bond markets, I classify countries into five regions—Asia Pacific, EU Euro, EU non-Euro, North and Latin America, and Middle East and Africa. Asia-Pacific banks have been major issuers, accounting for 44% (281 issues) of all issues and 45% ($207 billion) of the total volume. European banks in the Euro area and in the non-Euro area issued 19% ($87 billion) and 24% ($112 billion) of the total volume, respectively. A country-level comparison shows that Chinese banks have been the largest issuers ($107 billion, 23% of the total volume). Then follows UK ($57 billion), Swiss ($41 billion), Australian ($40 billion), Canadian ($29 billion), French ($20 billion), Japanese ($18 billion), Spanish ($15 billion), Korean ($14 billion), Irish ($12 billion), and Brazilian ($11 billion) banks. The average country-wide volume is $10 billion.

Of many variables in the dataset, the coupon rate is a key variable. (A definition of each variable is given in Table A7) Table 3 shows that the coupon rate is 5.75% on average, with a standard deviation of 2.66%. Consider the aforementioned eleven major countries. Figure 7 shows that Japanese banks have been able to borrow at the world's lowest interest rate of 1.66% on average. Korean and Canadian banks have also borrowed at low interest rates of 3.57% and 4.02% on average, respectively. In contrast, French (7.34%), Brazilian (7.89%), Spanish (8.28%), and Irish banks (9.00%) borrowed at double or even higher interest rates.

Note: 1) * Only rule-based and mixed-trigger CoCos are considered. 2) ** Only T2 instruments considered as AT1 instruments are deemed perpetual.

Another key variable is the type of trigger. There are two types of triggers: CET1 and PONV. First, the CET1 trigger is a rule-based trigger based on the ratio of common-equity tier 1 (CET1) capital to the risk-weighted assets. The Basel III accord classifies capital into various groups according to the capacity of loss absorbency. Common-equity tier 1 capital has the greatest such capacity, as it mainly consists of common equity. Under the CET1 trigger, the write-down or conversion is activated if the CET1 ratio falls below a predetermined threshold. The threshold for most issues is 5.125%, as the Basel III accord deems 5.125% the minimum capital ratio that a going-concern bank should maintain. (Table 3 shows that the threshold is on average equal to 5.38% with a small standard deviation of 1.28%.) Second, the PONV trigger is a discretion-based trigger. Under this trigger, the government activates a write-down or conversion if it determines that the issuing bank is at the point of non-viability (PONV). See Table 4. The ratio of CoCos with a discretionbased trigger to all CoCos is 49.1% in terms of the number of issuances and 35.4% in terms of the total volume.

Note: * Face values are denominated in USD according to the exchange rate at the issue date. The unit is $1 billion.

In fact, there is an additional type of trigger—the mixed trigger. Under the mixed trigger, write-down or conversion is activated if either the CET1 ratio falls short of the threshold or the government determines that the issuing bank is at the point of non-viability. Usually, the PONV condition is deemed more difficult to be met than the CET1 condition, as the point of non-viability corresponds to the case in which assets are less than liabilities (i.e., 0% of the CET1 ratio). In this sense, I regard the mixed trigger as a rule-based trigger. However, Japan is special. According to the Japanese Comprehensive Guidelines for the Supervision of Major Banks, such as III-2-1-1-3 (2), a bank that issued a CoCo with a mixed trigger can avoid the activation of write-down or conversion even when the CET1 condition is met (but the PONV condition is not yet met) if the bank submits a resolution plan to the supervision authority and gains approval of it (see Lee and Pang, 2014). For this reason, I regard the mixed trigger of Japanese banks as a discretion-based trigger in the following empirical analysis.

Figure 7 shows that the discretion-based trigger ratio varies across countries.17 Japan, Korea and Canada represent one extreme case. The trigger of every CoCo is discretion-based. France, Brazil, and Ireland are at the other extreme. The trigger of every CoCo is rule-based. Australian, Swiss, Chinese, and UK banks use both types of triggers during CoCo issuances.

The country-level comparison of the discretion-based trigger ratio and that of the coupon rate suggest that there is a negative relationship between the two variables. See Figure 7. In Japan, Korea, and Canada, banks have issued only discretion-based trigger CoCos and the coupon rates are low. In France, Brazil, Spain, and Ireland, only rule-based trigger CoCos have been issued and the coupon rates are high. In other countries, both types of CoCos have been issued and the coupon rates are at an intermediate level.

One can argue that the negative relationship between the coupon rate and discretion- based trigger ratio is spurious, as the coupon rates are primarily explained by the low sovereign credit risk rather than the discretion-based trigger ratio. However, Figure 8 shows that the CDS premium on 5-year sovereign debt does not appear to be strongly related to the country-wide coupon rate.18 French banks pay high interest rates despite the fact that the CDS premium on France is the lowest. In contrast, Japanese, Korean, and Chinese banks pay low interest rates even if the sovereign CDSs are relatively high. The correlation between the sovereign CDS and the coupon rate is as low as 0.33, while the correlation between the discretion-based trigger ratio and the coupon rate is as high (in magnitude) as −0.88. Although the country-wide comparison is consistent with Hypothesis 1, a more formal empirical analysis is required.

In this subsection, I examine the empirical relationship between the bail-in risk measured by the coupon rate and the type of trigger. To observe briefly how the coupon rate and type of trigger are related, see Table 5. The average coupon rate of discretion-based trigger CoCos is 4.60%, which is 2.33%p lower than the average coupon rate of rule-based trigger CoCos. This difference is significant at the 1% level.

To examine the relationship formally, I conduct a regression analysis based on the following model.

The key independent variable is Discretioni , which equals 1 if the trigger of CoCo i is discretion-based or 0 if it is rule-based. According to the theory presented in Section 2, the type of trigger is related to the political pressure borne by the government when it lets bail-ins take place.

Country ratei and Credit scorei are used to control for the benchmark rate and default risk, respectively. Country ratei is the market interest rate on a sovereign bond whose remaining maturity is similar to the maturity of CoCo i. Although the sovereign bond rates may not be free of risk, I use them nonetheless as benchmark interest rates. This is done simply because in practice bond coupon rates are determined by summing the margins on sovereign bond rates. Credit scorei reflects the baseline credit assessment (BCA) conducted by Moody’s. The BCA represents the credit rating agency’s assessment on the probability of default of the issuing bank’s senior unsecured debt under the absence of external support. Credit scorei is equal to 21 if the issuing bank’s credit grade is Aaa (the highest grade) but is equal only to 1 if the grade is C (the lowest grade). One notch of credit rating corresponds to one point.

Xi is a set of control variables. See the Table A7 and Table 3 for definitions and summary statistics, respectively. These control variables can be categorized into three groups.

The first group consists of variables that reflect the characteristics of CoCo instrument i. These variables are Conversioni, CET1 thresholdi, Maturityi, and Face valuei. Conversioni is 1 if the bail-in mechanism is mandatory conversion or 0 if it is principal write-down. CET1 thresholdi is the minimum level of CET1 that the issuing bank of CoCo i should maintain in order to prevent a bail-in from taking place. If bond i has a CET1 trigger or a mixed trigger, such a minimum CET1 level is explicitly expressed in the bond contract. For a purely discretion-based CoCo that uses only a PONV trigger, the bond contract has no clause regarding a minimum CET1 level. However, the PONV usually corresponds to the case in which the bank’s capital is close to zero. In practice, regulators and investors often deem 2% as the minimum capital ratio a healthy bank should maintain in order to avoid insolvency. This is why every CET1 trigger CoCo in my dataset has a threshold no less than 2% (see Table 3). For this reason, in the following analysis, I use 2% as CET1 thresholdi for discretion-based CoCos.

The second group is the set of variables that control for the issuing bank’s characteristics. To control for financial soundness, size, and state ownership, I use CET1i, Total assetsi, and Statebanki, where Statebanki is 1 if the bank is a subsidiary of a sovereign or central bank, but 0 otherwise. Recall that the coupon rate is a good measure of the bail-in risk only if the default risk is properly controlled. Total assetsi and Statebanki are importantly related to the default risk because it is widely believed that governments choose bailouts more likely, the larger the bank or the closer the bank to governments.

The variables in the third group control for country effects. I use Country ratei and Country CDSi in order to control for the mean and variance of sovereign bond yield. Country CDSi is the CDS premium on a sovereign bond.

All flow variables are evaluated at the dates of CoCo issuance.

Table 6 shows the estimation result. I consider five different model specifications (1)-(5). As the number increases, more control variables are included.

Note: 1) The dependent variable is the coupon rate. 2) The Huber-White robust standard errors are in parentheses. *, **, and *** indicate significance at 10%, 5%, and 1%, respectively.

The coefficient of Discretioni is negative and significant at the 1% level in all specifications. This result indicates that a change of a trigger from rule-based to discretion-based is associated with a decrease in the coupon rate. Depending on specifications, the coupon discount of a discretion-based trigger ranges approximately from 1.72 to 2.39%p. Given the low interest rate trend during the sample period of 2010-2016, a coupon discount of this size is meaningfully large.

There are several points that should be noted. First, the empirical model does not appear to face a serious endogeneity problem. Countries have regulations on the acceptable triggers of CoCos and, hence, selection problems are less likely to arise. In China, AT1 instruments should use CET1 triggers with a threshold of 5.125%, whereas T2 instruments should use the PONV trigger. All Chinese banks in my dataset have complied with these regulations. Similarly, the European version of Basel III (i.e., the CRRD4) requires banks to use CET1 triggers with thresholds of no less than 5.125% when they issue AT1 instruments. Although there are no clear regulations pertaining to T2 instruments, the PONV trigger is recommended. For this reason, European banks use CET1 triggers more frequently when they issue AT1 instruments but use PONV triggers more frequently when they issue T2 instruments. As the choice of trigger depends largely on the regulations, I use Country ratei, Country CDSi, and region dummies to control for this country effect. Even after controlling for these country-related variables, the coefficient of Discretioni is still negative and significant.

Second, one can argue that a rule-based trigger CoCo has greater bail-in risk than a discretion-based trigger CoCo simply because the former uses a higher trigger threshold.

The CET1 trigger threshold is around 5.125%, whereas the PONV trigger usually corresponds to 2% of CET1. However, even after controlling for this difference in trigger levels using CET1 thresholdi, the estimation results show that the measured bail-in risks are lower with discretion-based triggers. As a robustness check, I utilized 0% as the hypothetical CET1 thresholdi for discretion-based CoCos, as presented in Table 7. The estimation results do not show any remarkable change. The coefficient of Discretioni is still negative and significant at the 1% level in all five specifications.

A number of other robustness checks are provided in Appendix 2.

Here, I shall examine the empirical relationship between the coupon residual (= the coupon rate - the default risk premium as measured by a relevant CDS premium - the benchmark country rate) and the type of trigger. The coupon residual can be measured in two different ways depending on the choice of the relevant CDS premium. I use the CDS premium on bank subordinated debt in the first regression model and the CDS premium on senior unsecured debt in the second regression model. The former is conceptually better because CoCos are subordinated bonds with certain special clauses. However, the latter allows me to utilize more samples and avoid multicollinearity problems with respect to Statebanki.

Initially, I conduct a simple T-test to illustrate the empirical relationship briefly, as shown in Table 8. The average coupon residual of discretion-based trigger CoCos is −0.40%, which is lower by 3.06%p than the average coupon residual of rule-based trigger CoCos. The difference in the coupon residual is significant at the 1% level.

It appears to be odd that the average coupon residual is negative in cases of CoCos with discretion-based triggers. In principle, the coupon residual cannot be negative as the bail-in risk is at least as much as zero. However, the ‘measured’ coupon residual could have a negative value if the bail-in risk is low and the measurement of the default risk (i.e., the CDS premium on the benchmark bond) is imperfect. The difference in the measured coupon residuals due to the difference in the trigger type is not significantly exposed to this measurement problem because errors can be canceled after taking the difference.

Next, I conduct a regression analysis. I exclude Country ratei and Credit scorei from the set of control variables because Country ratei is a measure of the benchmark rate and Credit scorei is a measure of the default risk premium. I also exclude State banki because its inclusion causes a severe multi-collinearity problem.

Table 9 provides the estimation result. I consider four different model specifications. The coefficient of Discretioni is negative in all specifications and significant in all but specification 2. The size of the coefficient (in specifications (1), (3), and (4)) is meaningfully large.

Note: 1) The dependent variable is the coupon residual (= the coupon rate - the benchmark rate - the default premium). 2) The Huber-White robust standard errors are in parentheses. *, **, and *** indicate significance at 10%, 5%, and 1%, respectively.

Consider a simple t-test. See Table 10. The coupon residual is lower by 3.46%p if the trigger is discretion-based rather than rule-based. This difference is significant at the 1% level.

Next, I conduct a regression analysis. Unlike the case where the CDS on subordinated debt is used, State banki can be included in the regression model. The estimation result is provided in Table 11. The coefficient of Discretioni is negative and significant in all four specifications. Except for specification 2, the measured discount is as high as 3.41-3.50%p.

Note: 1) The dependent variable is the coupon residual (= the coupon rate - the benchmark rate - the default premium). 2) The Huber-White robust standard errors are in parentheses. *, **, and *** indicate significance at 10%, 5%, and 1%, respectively.

After the global financial crisis, G20 and EU countries agreed to adopt the bail-in system—a new bank resolution regime under which failed systemically important banks are reorganized at the expense of creditors and shareholders rather than taxpayers. A key instrument of the bail-in system is the contingent convertible bond (CoCo), which is mandatorily converted to equity or whose principal is written down if the bond issuing bank is seriously troubled and, hence, the trigger conditions of the bond are satisfied.

However, the implementability of the bail-in system is in doubt, particularly in cases where governments’ political costs and financial shocks from bail-ins are sufficiently large. This paper examines how the implementability of a bail-in using CoCos depends on the type of trigger involved. In the first part of the paper, I construct a theoretical model and show that CoCos with discretion-based triggers are less effective bail-in tools than rule-based triggers CoCos because the government’s political burden is higher. If the trigger is discretion-based, a relevant authority must undertake the 'dirty job' of imposing losses on creditors. This is not the case with a rule-based trigger, which is activated mechanically if a predetermined condition is satisfied. Even if the mere effect of the type of trigger on the political cost is small, it could grow through the mechanism of the self-fulfillment of expectations of government bailouts. In the second part of the paper, I test the model prediction by conducting an empirical study. Using a dataset of CoCo issuance around the world during 2010-2016, I find that the interest rate at the issuance of CoCos with discretion-based triggers is lower by 1.13 to 2.91%p on average than that of CoCos with rule-based triggers even after controlling for variables that are closely related to the likelihood of government bailouts and the financial soundness of the issuing bank. This finding suggests that triggers should be carefully designed in order to make CoCos effective as bail-in tools.

In order to focus on deriving a unique equilibrium, I simplify the previous model in the following manner. First, all investors have the same reservation payoff and, secondly, the gross interest rate R is fixed.

For the moment, suppose that the trigger is discretion-based.

Suppose that there is a unit-measure of investors, each of whom has one unit of money. They cannot observe the shock cost parameter θ, which follows the uniform distribution U[0,1] . However, the investors can personally observe a signal y, which is informative of θ in the sense that y follows U[θ − ε, θ + ε], where ε is a small error. y is independent and identical across investors conditional on θ. In the first period, each investor forms an expectation of the likelihood of a government bailout and, based on this expectation, the investor decides whether to buy a CoCo.

In the second period, the government chooses whether to save troubled CoCo holders if the bank goes insolvent. As time passes from the first to second period, information on the bank’s performance and the status of the financial system becomes known and, therefore, the government can predict relatively accurately how much the shock will be if it chooses not to bail out CoCo holders. That is, the government observes θ.

The government’s cost of a bailout equals mR + E, where R is the gross interest rate and E > (πd − R) is a fixed cost.19 The total cost of a bail-in is the sum of the shock cost θ and the political cost πdm. The political cost is sufficiently sensitive to the number of CoCo holders. In this regard, I assume that πd > R so that the difference between the bailout cost and bail-in cost D(m, θ) ≡ mR + E − θ − πdm is thus decreasing in m. Note that the government would choose a bailout if D(m, θ) is negative but otherwise would choose a bail-in. Given that D(m, θ) is decreasing in m, the government is more likely to choose a bailout as the number of CoCo holders increases.

There are two polar cases in which the number of CoCo holders is irrelevant with regard

to the government’s decision making. If θ > E , I have D(m, θ) < 0 for all m. Thus, the government always chooses to rescue distressed CoCo holders. If θ < E − (πd − R), it follows that D(m, θ) > 0 for all m. Thus, the government never chooses a bailout. Thus, E − (πd − R) and E correspond to the two critical levels of the shock cost  and

and  of the previous model.

of the previous model.

However, if θ is at an intermediate level (i.e., E − (πd − R) < θ < E), and if investors observe θ perfectly, there are multiple equilibria. Below, I focus on this case and solve for a unique equilibrium when investors cannot observe θ but can observe y. Let m* denote the critical mass of CoCo holders such that the government chooses a bailout if and only if m ≥ m*. Then, m* = m*(θ) is characterized by D(m*, θ) = 0, or equivalently,

Note that m* (θ) is decreasing in θ. That is, the government is more eager to save distressed CoCo holders upon a higher shock cost of the bail-in, θ.

At this stage, I consider the optimal choices of investors. If an investor buys one unit of the CoCo by paying one unit of money and if the government is generous, the investor is then always repaid in full. Thus, her payoff is R − 1. However, if the government is tough on her, she can be repaid only if the bank is solvent and, therefore, her payoff equals (1 − p)R − 1.

Suppose that (1 − p)R < 1 < R. Then, investors buy a unit of CoCo if and only if they expect government assistance. Note that the government is more likely to assist CoCo holders with a higher shock cost θ of the bail-in. As θ and the signal y are statistically positively related, investors reasonably believe that the government will be generous if the realization of the signal y is sufficiently high. Thus, investors buy the CoCo if the signal received is higher than a certain cutoff k. In fact, it can be shown that such a cutoff strategy is the unique equilibrium strategy by applying Lemma 3 of Morris and Shin (1998).

All investors choose this cutoff strategy with the same cutoff k, though the realizations of the signal may differ across investors. Therefore, the number m of investors who buy a CoCo is given by

where 1(A) is an indicator function whose value equals 1 if event A is occurred but otherwise equals 0. Recall that the government would choose a bailout if and only if m is greater than the critical mass m*(θ). Equation (A1) and (A2) then imply that the government would choose a bailout if the shock cost exceeds a critical level θ*(k) such that

Note that the critical level of the shock cost θ*(k) is increasing in the cutoff k. As k rises, fewer investors are exposed to the bail-in risk and, hence, the government is less likely to choose a bailout.

Given θ*(k), an investor who receives a signal y has the following expected utility:

The equilibrium cutoff level k* = k* (ε) of the signal y is characterized by u(k*, θ* (k*)) = 0. From Equation (A3) and (A4), it follows that

Finally, I consider the limit case in which the error ε of signal y tends toward zero. Equation (A3) implies that θ* and k* are equivalent in this case. Thus, it follows that