China’s Consumer Market: Growth, Changes, and Korea’s Opportunities

Abstract

This paper examines the aspects of changes in China’s consumer market since the mid-1980s. By comparing urban and rural residents’ expenditures, I find that the rural consumer market has exhibited extraordinary growth. Over the past decade, the consumption growth rate and average propensity to consume by rural residents have surpassed those of their urban counterparts, with the former’s consumption patterns becoming increasingly similar to the latter’s. Such a phenomenon prevails in rural areas which neighbor second- and third-tier cities where urbanization is progressing rapidly. These findings imply that Korean companies need to diversify their export goods in line with China’s expanding rural markets while further differentiating their product composition to satisfy the heterogeneous demands in urban areas. With regard to the government, efforts must be made to strengthen the export cooperative system so that it targets not only urban but also rural markets in China.

Keywords

China’s consumer market, Urbanization, Consumption expansion in China, Chinese economy

JEL Code

O12, O47, R11, R58

I. Introduction

The urgency for Korea to make further inroads into China’s consumer market is mounting as a countermeasure to the continued drop in Korea’s exports to China in recent years. Additionally, the Korea-China FTA and China’s tariff cuts in consumer goods have opened up numerous new opportunities in recent years. At the same time, the 13th Five-Year Plan, announced at the Chinese NPC and CPPCC1 emphasized the necessity to boost domestic demand. Accordingly, we can expect an additional consumption expansion in China.

Therefore, an important issue for Korean companies with regard to entering the Chinese consumer market is to deliberate on how, where and in what manner to go about devising a strategy. China’s consumer market encompasses numerous submarkets consisting of provinces, prefecture-level regions2 and urban/rural areas that are all highly heterogeneous in terms of population, income and consumption patterns. Moreover, this diversity urgently calls for intensive market research on and a clear understanding of the target area before jumping into the market. Prime examples include successful front runners, such as Orion, AmorePacific and the E-Land Group, who invested large amounts of time and effort to study market conditions and consumer characteristics before taking action to expand their businesses into China. Consequently, the market information and data accrued during this process have laid the foundations for their success today.

This paper analyzes the growth of and changes in China’s consumer market in an effort to gain a better understanding and to discuss the future directions of governmental and corporate strategies. To be specific, changes in urban and rural consumer markets are initially investigated through an analysis of the growth rate of consumption per capita, the average propensity to consume (APC) and consumption patterns by product categories. The consumption trends in the first, second, and third tiers of cities and rural areas were then examined to discover the source of the recent growth in the consumer market. Finally, I estimated the impact of urbanization on the expansion of consumption to evaluate the feasibility and sustainability of China’s urbanization policy with regard to expanding consumption.

From a comparison analysis between urban and rural residents’ expenditures, I find that the rural consumer market has exhibited extraordinary growth. Since the mid-2000s, the growth rate of consumption and the APC of rural residents have surpassed those of their urban counterparts, with the former’s consumption patterns becoming increasingly similar to the latter’s. Such a phenomenon prevails in rural areas that neighbor second and third tier cities, where urbanization is progressing rapidly.

Regarding the consumption-boosting effect of urbanization, the estimation results reveal that a 1%p rise in the urbanization rate increases consumption per household by 75 yuan and the total consumption by 26.2 billion yuan on an annual average basis. Depending on which empirical model is used, the magnitude of the effect varies to some extent, but the rate of urbanization is estimated to have a positive effect on consumption in all models.

These empirical results provide crucial implications for both governmental and corporate responses. First, Korean companies must diversify their products in line with China’s expanding rural markets while further differentiating their product composition to satisfy the heterogeneous demands in urban areas. With regard to the government, efforts must be made to strengthen the export cooperative system between domestic manufacturers, Korean distributors (operating in China) and logistics companies, targeting not only urban but also rural markets in China.

The remainder of the paper is organized as follows. Section II reviews the related literature and specifies the paper’s contributions. Section III presents the ‘big picture’ of the growth of the Chinese consumer market. In Section IV, I exhaustively analyze the important aspects of the consumption structure by comparing urban and rural residents’ consumption characteristics. Section V discusses the progress in urbanization in China as a crucial factor in the growth of consumption. Section VI provides explanations of the data construction, empirical model, and estimation process used here. Section VII presents the regression results. Finally in Section VIII, I conclude and provide various policy directions for the Korean government and for exporting firms.

II. Related Literature

This paper relies on several groups of existing literature on the Chinese economy. First, the paper contributes to the ongoing literature on consumption- or income-inequality in China. Regarding income disparity, Sicular, Ximing, Gustafsson, and Shi (2007) examined the size of the income gap between urban and rural areas and identified factors which contribute to this gap. Using survey data conducted by the Chinese Academy of Social Sciences (CASS), they found that the locations of residences and education levels were the most crucial factors influencing the income gap. In addition, Candelaria, Daly, and Hale (2013) analyzed the causes of regional wage disparity. Using the National Statistical Yearbook and CEIC data, they found that half of the regional wage gap can be explained by the quality of labor, the elasticity of the labor supply, the industry composition, and by variables related to the geographical location. They also suggest that it is highly likely for the regional wage gap to remain as long as the labor movement is restricted under the Hukou system.

On the topic of consumption disparity in China, Qu and Zhao (2008) investigated consumption disparity between urban and rural households. Based on data from the Chinese Household Income Project (CHIP), they utilized quantile regression and found that the consumption gap was more severe within the low-income bracket than within its high-income counterpart. Investigating the causes of consumption disparity, Emran and Hou (2013) focused on the role of access to the market. They used data from CHIP 1995 and revealed that better access to domestic and international markets has positive effects on per capita consumption. Further, Cai, Chen, and Zhou (2010) examined both consumption and income disparity. They used data from the Urban Household Income and Expenditures (UHIES) study and showed that consumption inequality among urban households tended to increase during the period of 1992-2003 and that the wage gap accounts for 66% of income inequality in total.

The present research belongs to a group of studies of the effect of urbanization on consumption growth in China. Lee and Wu (2013) described the concept, features, and current progress of urbanization in China while also examining the economic impact of urbanization on each industry in China. Regarding its effect on consumption, they separately calculated the effect of urban living and the effect of migration of rural residents. Choi, Lee, Moon, and Na (2012) studied the relationship between urbanization and economic growth using Chinese regional data. They found that the progress of urbanization had a significantly positive effect on the economy, whereas for mega-cities, it had a negative impact on growth. On the basis of their results, they suggested that fostering many large cities rather than a few mega-cities would be a desirable national strategy for long-term economic growth.

Finally, from a more macroscopic perspective, the present study is related to studies on structural changes in the Chinese consumer market. This group of studies includes various policy papers which investigated the characteristics of the Chinese consumer market. For example, Jee et al. (2008) characterized the consumer market while taking various aspects into account, including the major forces behind consumption growth, consumption patterns according to specific products, sales and distribution channels, and geographic distributions of consumers by city. Similarly, Lee (2009) also describes aspects of changes in the Chinese consumer market, concentrating on scales, regions, consumer groups, products, service consumption, and goods distribution channels. As a more comprehensive study, Yang et al. (2013) analyzed regional statistics for 288 Chinese cities in an effort to identify the ten leading consumption footholds and to form strategies to make inroads into the Chinese domestic market. Jin and Oh (2013) closely investigated Chinese rural markets. Through a questionnaire survey concentrating on rural households in the suburbs of Beijing, they described the characteristics of rural consumers and their consumption patterns.

The primary goal of the present study is to analyze household consumption patterns and to examine how consumption is affected by demographic characteristics and urbanization in China. With regard to studies of consumption inequality, I utilize micro-data not only at the household level but also at the level of individual characteristics to identify more specific factors contributing to consumption. Regarding the impact of urbanization on consumption, I measured the rate of urbanization at a lower administrative division level (prefecture-level cities) using data from the China City Statistical Yearbook and CEIC and then estimated how much the progress of urbanization affected household consumption in urban and rural areas. Further, on the issue of structural changes in China’s consumer market, this paper extends the analysis period for a better understanding of the latest changes using the most recently available data from the China Statistical Yearbook.

III. Growth Trends in China’s Consumer Market

The trajectory of China’s consumer market shows two growth tipping points as presented in Figure 1. While modest growth has continued since the adoption of reforms and open policies, the first point occurred in the mid-1990s. This was when China opened its domestic market to the outside world to induce a massive influx of foreign capital. Clearly, this led to a boost in the country’s consumer market.

FIGURE 1.

GROWTH TRAJECTORY OF CHINA’S CONSUMER MARKET

Source: Created by author, using the World Bank’s Household Final Consumption Expenditure (Current US$, 1985-2013).

The second point appeared in the mid-2000s with the explosive growth in the consumer market on the back of the 11th Five-Year Plan (2006-10), which declared a growth paradigm shift away from exports and investment and towards domestic demand. Around this time, income rose sharply, as evidenced by the increase in workers’ minimum wages of more than 10%. Moreover, in conjunction with the rapid diffusion of internet access, China’s post-80s and 90s generations3 have emerged as a powerful consumer group. Their consumption has contributed to an annual 20% expansion in e-commerce (Korea International Trade Association, 2014). Moreover, due to the government’s policy efforts to support rural areas, including consumption subsidies and the modernization of distribution systems, the consumption of rural residents has also risen continuously.

Even during the 2008 global financial crisis, China’s consumption climbed on annual by over 10% on an average basis,4 unlike other countries which were hit by sagging consumption. Consequently, after ranking fifth in the world in 2008, China’s consumer market surpassed that of the UK in 2009, that of Germany in 2010 and that of Japan in 2013 to stand at second with a market scale of $3.425 trillion. While the US maintained the leading position as of 2013 at $11.5 trillion, the size of China’s consumer market relative to that of the US jumped from 5% in 1990 to 30% in 2013.

IV. Consumption Structure: City and Rural Areas

A. Analysis of per Capita Consumption Expenditures

This section examines the consumption structure of Chinese consumers, who have sustained the growth of China’s consumer market. Consumption per urban resident rose from 673 yuan in 1985 to 18,023 yuan in 2013, while that of rural residents climbed from 317 yuan to 6,626 yuan (See Figure 2).

FIGURE 2.

CONSUMPTION EXPENDITURE PER CAPITA AND CONSUMPTION RATIO

Source: Created by the author, using data from the China Statistical Yearbook (Consumption Expenditure Per Capita 1985-2013).

Over the past three decades, the nominal consumption expenditures of urban and rural residents expanded more than twenty-fold while the consumption ratio, which refers to the consumption per urban resident relative to that per rural resident, increased from 2.1 to 2.7. This implies that the advancement of the consumption level has progressed while the polarization of consumption has become more serious.

However, a closer look reveals that there have been significant changes in the consumption growth of urban and rural areas since 2004. Since peaking at 3.4 in 2003, the consumption ratio has declined continuously. Further, as shown in Figure 3, the growth rate for rural residents of consumption per capita has generally exceeded that of urban residents since 2004. Indeed, although consumption in rural areas has occasionally surpassed that in urban areas in the past, the current trend has continued for the past ten years, raising the call for more attention.

FIGURE 3.

GROWTH RATE OF CONSUMPTION PER CAPITA

Source: Created by the author using data from the China Statistical Yearbook (Consumption Expenditure Per Capita 1996-2013).

Being well aware of the difficulty in sustaining consumption-driven economic growth without boosting the consumption of rural residents, the Chinese government has implemented active policies to heighten rural consumption since the mid-2000s. Such polices include subsidies to boost car and home appliance sales, the ‘10,000 villages and 1,000 townships market project’ to encourage the establishment of wholesale and retail stores in county- and township-level areas, and the ‘double-hundred’ project to foster 100 large-scale distribution companies and establish 100 wholesale markets. Helped by these efforts, rural consumption has soared owing to numerous changes, such as increases in rural income, increases in income transferred by migrant peasant workers in cities, and the spread of an urban consumption culture to rural areas.

B. Analysis of the Average Propensity to Consume (APC)

The more active consumption by rural residents can be confirmed by the trends of the average propensity to consume (APC), which refers to the percentage of consumption in disposable income, as shown in Figure 4.

FIGURE 4.

TRENDS IN THE APC OF URBAN AND RURAL RESIDENTS

Note: Rural residents’ net revenue is equivalent to urban residents’ disposable income and is the sum of agricultural entrepreneurial income and off-farm income (wage income, property income and transfer income).

Source: Created by the author using data from the China Statistical Yearbook (Consumption Expenditure Per Capita, Cash Consumption Expenditure Per Capita and Per Capita Income 1985-2013).

For urban residents, the APC has been on a clear downward trajectory, declining from 0.91 in 1985 to 0.67 in 2013, suggesting that the absolute amount of consumption has risen but that actual spending relative to income has decreased.

In contrast, the APC for rural residents surpassed that of urban residents in 2005, with the APC fluctuating at the 0.80 mark in 1985 and then posting a mark of 0.74 in 2013 (red line in Figure 4). Hence, the extent of the overall decline is more modest than that of urban residents, and even the fluctuation patterns leave room for future rebounds.

Besides consumption expenditures, this study separately identified what is termed ‘cash outlay,’5 particularly for rural areas. The results show that the percentage of cash outlay of rural residents’ net revenue increased consistently from 0.49 in 1985 to 0.69 in 2013 (green line in Figure 3). In other words, with reference to cash-only consumption, excluding self-consumption, the APC of rural residents has improved continuously.

C. Analysis of Consumption Composition by Item

The consumption growth rate by item offers a better understanding of the upward trends in urban and rural areas. Table 1 shows the annual average growth rate of the consumption of eight subordinate items that constitute consumption expenditures during the period of 2003-13.

TABLE 1

GROWTH RATE OF CONSUMPTION PER CAPITA BY ITEM: 2003-13ANNUAL AVERAGE

Source: Created by the author using data on expenditures by item from the China Statistical Yearbook (Consumption Expenditure Per Capita 2003-13).

Based on the calculations, the consumption growth rate for rural residents is higher than that of urban residents across all items, except for education, culture and entertainment. Such growth is particularly attributable to the increased cost of medical care resulting from population aging in rural areas, more spending on transportation and communication (such as vehicles and mobile phones), and the greater use of durable household equipment, mainly household appliances.

Accordingly, the consumption patterns of rural residents appear to be gradually mirroring those of urban residents, at an increasing speed. In Figure 5, which shows the percentages of expenditures by item among total consumption, the percentage of food products has receded rapidly, with Engel’s coefficient dropping below 40 in 2013 (35.0 in urban areas and 37.7 in rural areas), while those associated with medical care and transportation and communication climbed for both urban and rural areas.

FIGURE 5.

CONSUMPTION EXPENDITURE PERCENTAGES BY ITEM

Source: Created by the author using data on expenditures by item from the China Statistical Yearbook (Consumption Expenditure Per Capita 1985-13).

Overall, the percentages of essential living expenses, including food and clothing, decreased while those linked to spending on health and leisure activities, including transportation and communication, education, culture and entertainment and medical care, increased. This implies that, in line with the increases in income and consumption, China’s rural areas today are also experiencing a service economy.

D. Consumption by Urban and Rural Residents by Tier

This raises the question of the identity of the main driving force spurring the growth of consumption among China’s rural areas. Another pertinent issue is to determine, among urban areas, which if any are experiencing particularly rapid drops in consumption.

In an effort to address these issues, panel data on the consumption of each urban and rural prefecture-level area, from CEIC,6 were compiled. Additionally, by applying the city classification standards established by the Ministry of Housing and Urban-Rural Development (MOHURD), prefecture-level urban and rural areas were categorized into several tiers.7 Using this data, I calculated the trajectory of the growth of consumption per capita in rural and urban areas in each tier as well as the changes in consumption expenditures (Figure 6).

FIGURE 6.

GROWTH RATE OF CONSUMPTION PER CAPITA

Source: Created by the author using the CEIC’s China Premium Database (Household Survey, 2002-14).

The analysis finds that the second and third tiers have spurred the consumption growth in rural areas since the mid-2000s. The growth rate of their consumption per capita recorded an annual average of 13% in 2002-14, even maintaining growth momentum during the 2008 global financial crisis, with the yearly average growth rate rising to 15% since that event.

Meanwhile, consumption in urban areas has decelerated due to the reduced growth in consumption by first-tier residents in areas such as Beijing, Shanghai and Tianjin. These cities responded highly sensitively to global economic fluctuations, and their consumption growth plunged to 1.1% in 2008. Additionally, with the penetration rates of washing machines, refrigerators, TVs, air conditioners and mobile phones at nearly 100% in these cities, their consumer markets have become saturated, and it is mainly replacement demand (mostly for new products) that is driving consumption.

In contrast, consumption growth in second- and third -tier cities has remained steady at a relatively high 11% (growth rate of per capita income also posted an annual average of 12%). These cities are the beneficiaries of the government’s SOC investment expansion project, aimed at developing inland mid-western regions, the main destination for migrants from rural areas, and the entry market for distribution companies and consumption goods manufacturers.

Among urban prefecture-level cities with consumption per capita exceeding 20,000 yuan, Baoji (14.0%) in Shaanxi province, Botou (13.7%) and Hohhot (13.4%) in Inner Mongolia, and Harbin (12.1%) in Heilongjiang province demonstrated particularly high growth rates. In addition, among rural prefecture-level areas with consumption per capita exceeding 10,000 yuan, Wuhan (15.3%) in Hubei province ranked first, followed by Zhengzhou (14.6%) in Henan province, Xiangtan (14.5%) in Hunan province, and Nanjing (14.3%) in Jiangsu province.

As evidenced above, consumer markets in the rural second and third tiers have taken the lead in boosting China’s consumption together with their urban counterparts, which are now on a solid growth track.

V. The Progress of Urbanization in China

Given the above, the question arises as to which economic factors have influenced the growth of the Chinese consumer market. Among various possible causes, this paper focuses on the progress of urbanization as spurred by the Chinese government.8

China’s urbanization has clearly progressed on each nationally important occasion, including the founding of new China in 1949, the reform and opening up of the country in 1978, the land reform of 1988, and the entry of China into the WTO in 2001. As a result, the rate of urbanization has tended to increase by 0.7%p on average annually since 1978.

One of the main reasons why the urbanization of China has been receiving governmental attention is its contribution to raising domestic consumption. Urbanization usually occurs in line with swift economic growth and industrialization, increases in the numbers of urban workers, improved market access, and active exchanges of purchase information, all of which ultimately contribute to the growth of consumer markets. While a rise in income directly affects consumption growth, the progress of urbanization can establish a favorable environment for this type of growth.

In Section IV, we observed the relatively high growth of consumption of secondand third-tier cities. This growth and sustainment may be influenced by the recent rapid urbanization of these regions.9 Indeed, these cities recorded rapid growth in their urbanization rates, as shown in Table 2.

Table 2 lists the urbanization rates of prefecture-level regions for each tier. The rates of cities in the second and third tiers recorded rapid growth of 1.1%p on average annually for the period of 2005-12 and showed urbanization rates of 64% and 41% in 2012, respectively, with sufficient room for additional increases. In contrast, the rates of those in the first tier surpassed 90% on average in 2012 with a rapidly slowing pace; recent regulations that strictly control the sizes of city populations in Beijing and Shanghai are mainly responsible for the slowdown.

TABLE 2

CHANGES IN THE URBANIZATION RATES OF PREFECTURE-LEVEL REGIONS IN EACH TIER

Note: The urbanization rate of prefecture-level regions refers to the proportion of the prefecture-level city population among the total population of prefecture-level regions (prefecture-level city + prefecture-level rural area).

Source: Urbanization rates of prefecture-level regions in the three tiers are calculated using CEIC’s China Premium Database (Socio Demographic, 2002-14), and the urbanization rate nationwide is calculated using data from the China Statistical Yearbook (Total Population by Urban and Rural Residence 2005-12).

An examination of the urbanization rate at the province level (see Figure 7) finds several regional differences and changes over time. As of 2013, the urbanization rate of the eastern coastal region in China is much higher than the rates in other regions. The rates in Shanghai (89.6%), Beijing (86.3%), and Tianjin (82.0%) exceed 80%, reaching the level of developed countries. The rates for Guangdong (67.8%), Liaoning (66.5%), Jiangsu (64.1%), Zhejiang (64.0%), and Fujian (60.8%) all exceed 60%. On the other hand, southwest regions including Sichuan, Hainan, Yunnan, and Guizhou exhibit urbanization rates in the range of 35-45%, lower than the level of the east coast by around 20%p.

FIGURE 7.

THE RATE OF URBANIZATION BY PROVINCE IN CHINA

Source: Created by the author using data from the China Statistical Yearbook (Total Population by Urban and Rural Residence 2005-12).

In comparison with the urbanization rate in 2005,10 we note that rapidly progressing urbanization is not a unique phenomenon confined to the eastern coastal region but is instead a fairly general trend in the northeast, northwest, central, and southwest regions as well.

As a result, a standard deviation of urbanization decreased continuously from 15.4%p in 2005 to 13.9%p in 2013 (see Table 3). Urbanization has proceeded across all regions in China such that its regional disparity has shrunk. This implies that market potential and attractiveness are growing in most parts of China other than in the eastern coastal region, where the fruits of economic growth were concentrated until recently.

TABLE 3

STANDARD DEVIATION OF THE URBANIZATION RATE BETWEEN PROVINCES

Note: The urbanization rate in 2010 is omitted due to a lack of information on provincial populations for that year.

Source: Created by the author using data from the China Statistical Yearbook (Total Population by Urban and Rural Residence by provinces 2005-13).

VI. The Consumption-boosting Effect of Urbanization

A. Data

In the previous chapter, we examined the growth of and structural changes in the Chinese consumer market mainly using province-level consumption data. Henceforth, I utilize micro-data at the individual/household/city level to proceed with an in-depth analysis. The ultimate goal is to identify how and how much the household consumption would be affected by urbanization and various household or individual characteristics. The data used in this section is described below.

Household and Individual-level Data

First, I utilize the Chinese Household Income Project (henceforth “CHIP”), which is generated based on household surveys carried out in China.11 CHIP provides information on household consumption and household members’ characteristics. In addition, the survey separates urban and rural areas. Thus, for each year, CHIP is composed of the four sub-datasets of urban households, urban individuals, rural households, and rural individuals.

Given that household-level datasets primarily contain annual consumption expenditures for each category, I compiled the total consumption of a household by summing food, clothing, residence, and durable good expenditures, as listed in Table 4.

TABLE 4

DESCRIPTIVE STATISTICS: CONSUMPTION BY ITEM IN THE CHIPHOUSEHOLD DATA

Note: All spending variables are transformed into real variables using the Consumer Price Index (CPI) with the reference year 2008.

Source: Chinese Household Income Project (CHIP, 1988-2008).

Individual-level data have various characteristics for each household member, such as the relationship to the householder, gender, age, occupation, education level, marital status, and whether one is retired, disabled, or a minority member see Table 5). Since the survey began in 1988, CHIP has been made available for years 1988, 1995, 1999, 2002, 2007, and 2008. I utilize all years in the analysis here.12

TABLE 5

DESCRIPTIVE STATISTICS: PERSONAL CHARACTERISTICS IN CHIP INDIVIDUAL DATA

Note: All characteristics except age and educational period are binary variables.

Source: Chinese Household Income Project (CHIP, 1988-2008).

Prefecture-level Data

Another necessary variable in this research is the rate of urbanization, which is calculated as the proportion of urban population. We can simply create this using the provincial population data in the China Statistical Yearbook, following many previous studies. However, doing this would cause a considerable gap in terms of the observation level, i.e., the urbanization rate at the province level and consumption expenditures at household level.

Because each province in China is composed of urban areas, rural areas, prefecture-level, and county-levels districts, it is highly possible that quite heterogeneous consumption patterns exist within the same province. For a more accurate analysis, therefore, we need to make the gap in the observation level as narrow as possible. In this regard, I calculate the urbanization rate in prefecture-level regions by utilizing the China City Statistical Yearbook.

A prefecture-level region refers to the second grade of administrative districts in China, with several third-grade districts as well, such as city-controlled districts, county-level cities, counties, and autonomous counties. Among these subdivisions, this research recognizes the former two subdivisions as urban areas. Thus, the rate of urbanization of a prefecture-level region is defined as the percentage of the population living in a city-controlled district or a county-level city out of the total population in the prefecture-level region.13

B. Empirical Specifications

To estimate the impact of urbanization on consumption, I matched the urbanization variable derived from the China City Statistical Yearbook with the CHIP data. As a link variable to merge the two datasets, I used the Chinese administrative code number of each prefecture-level region.14

It is also important to note that during the sample period of 1988-2008, inflation accompanied by economic growth occurred consistently. Taking this into account, I converted nominal consumption expenditures into actual variables using the CPI of each year with the reference year 2008.

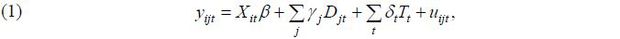

The econometric analysis is composed of two parts. The first part is based only on CHIP household data and examines how spatial/temporal factors and household characteristics affect household consumption. The estimation model has the following form,

where yijt denotes the annual household consumption of household i living in region j in year t . Xit is a vector of household characteristics, including the number of household members. Djt is a vector of dummy variables representing various categories of regions. Specifically, Djt includes information about a household’s location (either a first-, second-, or third-tier city or a rural area. Tt is a vector of dummy variables for each year. uijt is an i.i.d. error term.

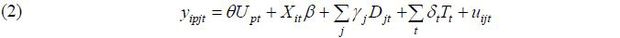

For a more comprehensive analysis, the second part utilizes all datasets, i.e., CHIP household data, CHIP individual data, and the urbanization rate. The estimation model has the following form:

This model emphasizes the key variable of the urbanization rate, UPT . UPT denotes the urbanization rate of a prefecture-level region P in year t. Further, the vector Xit represents a greater variety of household and individual characteristics, including the existence of post-80s or 90s generations, the average educational period, the number of males, the presence of disabled persons, the number of retirees, and workers by firm type in a household. These variables are originally available at the individual level; thus, I convert them into household- level variables by counting the number of people in a family corresponding to the cases.

As an estimation method, we may undertake a panel data analysis when considering that the data period of CHIP is 1988-2008. However, each of the individual, household, and prefecture-level regions does not continuously exist during the sample period, generating a crucial limitation for a panel analysis. Consequently, I adopt a pooled regression while controlling for time and region (province, each tier of city and rural) fixed effects. The estimation results are provided in the following section.

VII. Empirical Results

A. Estimation Results Based on CHIP Household-level Data

Table 6 reports the regression estimates from the various models used here. In model (1) as a basic specification, I undertook a regression of total consumption of households in terms of spatial and temporal variables. The estimates indicate that urban households spend more than rural families by 13,510 yuan on an annual basis.

TABLE 6

ESTIMATION RESULTS: HOUSEHOLD LEVEL DATA

Note: This table reports the regression results based on CHIP household level data. ***, **, and * denote statistical significance at the 1%, 5%, and 10% level, respectively. Standard errors are in parentheses.

To verify the credibility of the estimates, Table 7 calculates the per capita consumption gap from the China Statistical Yearbook and then multiplies it by the average number of household members to derive the household consumption gap. The average gap for 1988-2008 is 14,667 yuan. It was found that the parameter from the CHIP household-level data is somewhat lower than the figure from the national statistics, but we can assess it as a fairly realistic figure.

TABLE 7

CONSUMPTION GAP: PER CAPITA AND PER HOUSEHOLD

Note: Consumption gaps in 1988 are estimates as indicated by *. I estimate them by applying the average growth rates of the consumption gaps between 1985 and 1990.

Source: China Statistical Yearbook and CHIP (1988-2008).

While summing the expenditures on each item to create the total consumption from CHIP, I found that some values for certain items were missing. Considering the higher spending by urban residents on each item, the missing values may lead to a relatively low consumption gap from CHIP compared to that from the China Statistical Yearbook.

The estimation results of model (1) in Table 6 also indicate that the consumption level has been generally increasing as time passed. For example, a household total consumption in 2007 is higher than in the base year 1988 by 21,790 yuan. This result is fairly consistent with the ongoing trend of Chinese consumption increment. However, the spending level in 2008, which is lower than in 2007, raises doubts. This is likely due to difference between the survey questions. Unlike other years, 2008 survey asked a minimum cost to live out of above poverty level rather than asking the actual amount of expenditure. Therefore, this can underestimate the actual total consumption of 2008.15

In addition, as the number of household members increase by one, the total consumption tends to rise by 1,292 yuan per year. Considering the recent relaxation of Chinese birth control (from one child to two children per household), the result has an important economic implication in that it will clearly increase the demand for infants’ goods.

The model (2) controls for each tier of city to identify the consumption gap between those cities.16 The results show that households living in 1st, 2nd, and 3rd tier cities, respectively, spend more than those living in base area (other small urban and rural households) by 20,390 yuan, 10,250 yuan, and 3,325 yuan. This implies that China faces significant consumption disparity not only between urban and rural area, but also between each tier of cities.

Similarly, model (3) controls for each tier of rural to see if the rural areas neighboring cities exhibit higher level of expenditures compared to other small rural areas. Since 1st tier rural does not exist in the sample, 2nd and 3rd tier rural areas are specified. The parameters indicate that households in 2nd and 3rd tier rural areas, respectively, consume more than those in other rural by 2,623 yuan and 313 yuan. This can occur because increased demand for high value-added crops by urban households contributes to rises in rural income and because the increasing number of migrant workers transfer their cash to family in rural.

Finally, model (4) presents the consumption disparity between regional parts of China (Northeast, Bo Hai Bay, East, Southeast, Northwest, Southwest, and Center as a base part). From the estimates, we can confirm that the eastern coastal region exhibits significantly higher consumption expenditure. To be specific, households in Southeast, East, and Bo Hai Bay area, respectively, exhibit higher level of consumption than those in Center region by 9,001 yuan, 5520 yuan, and 4503 yuan. Along with various types of consumption disparity (urban and rural, each tier of city, each tier of rural), the results provide clear evidence on consumption gap between regional parts in China.

C. Estimation Results Based on the Comprehensive Data

Henceforth, we utilize all datasets to perform a more comprehensive analysis. The primary aim is to examine the effect of urbanization and various household/individual characteristics on the boost in consumption. Table 8 presents the regression results.

According to model (1), urban households are likely to spend more than rural families by 8,664 yuan on average. The consumption gap between urban and rural households appears to be 36% lower than the estimate in part A, as the model controls not only for urban dummies but also for the urbanization rate such that the explanatory power of the urban dummies is reduced to a corresponding amount.

TABLE 8

ESTIMATION RESULTS: COMPREHENSIVE DATA

Note: 1) This table reports the regression results based on a comprehensive dataset, including CHIP householdlevel data, CHIP individual-level data, and the China City Statistical Yearbook. ***, **, and * denote statistical significance at the 1%, 5%, and 10% level, respectively. Standard errors are in parentheses. 2) Regional dummies include indicator variables for the northeast, Bo Hai Bay, east, southeast, northwest, and the southwest regions.

Regarding the effect of the urbanization rate, the estimate is 7.532. Considering the unit of the rate (0 to 1) and the total consumption (1,000 yuan), the estimate indicates that a 1%p increase in the urbanization rate tends to raise household consumption by 75.3 yuan and China’s total consumption by 25.8 billion yuan. In terms of the national economy, the magnitude of the effect corresponds to an increase in China’s total consumption of 0.58% and a rise in the GDP of 0.14%. Notably, this magnitude is a direct (or causal) effect of urbanization; i.e. with all other conditions being equal, rural residents migrating to cities enjoy easier access to consumer markets and have more product choices, which raises consumption. When considering indirect effects such as income growth, employment expansion, and infrastructure investments to accommodate migrants, the impact of urbanization on spending would be much greater.

Regarding various household and individual characteristics, the results confirm that households having post-80s or post-90s generations are likely to consume more by 434 yuan and 1,711 yuan, respectively.17 Those generations are highly skilled with computers and information systems and thus shop online frequently with strong preferences for product diversification. Although data limitations prohibit us from identifying their consumption patterns after 2008, they may have higher purchasing power than the magnitude implied by the estimated coefficient considering their massive spending since the mid and late 2000s.

About the educational effects on consumption, we can consider two paths. First, as a person becomes more educated, that person tends to spend more on educational expenditures such as textbooks, tuition fees, and educational activities. Further, indirectly, more educated people tend to have high-paying jobs, and higher income leads to more consumption. To verify the educational effect, I control for a household’s average educational period. The estimate indicates that an increase of one year in the training period raises the expenditures of a household by 342 yuan. In addition, when the educational period of workers participating in the labor market increases by one year, it is likely to boost household consumption by as much as 459 yuan. The fact that the education level of Chinese people has steadily improved in recent years leads to a more positive outlook on the growth of China’s consumer market.

VIII. Summary and Policy Implications

China’s rural areas have been paid little attention as Korea makes inroads into Chinese consumer markets. However, this paper confirms that the rural consumer market has exhibited extraordinary growth and that rural second- and third-tier areas have played a leading role in supporting the growth of the Chinese market, along with their urban counterparts. Moreover, given that urbanization boosts consumption not only in cities but also in rural areas neighboring their cities, the rural consumer market is highly likely to expand.

Based on the discussions above, we consider proper response measures for Korean firms and government. With regard to Korean manufactures of consumer goods, they need to expand their product lines to China’s rural markets. One of the easiest means of reaching rural consumers is via online shopping platforms such as Alibaba’s Rural Taobao. As of now, the majority of Korean products sold online in China appear to include cosmetics, clothing and accessories. However, when considering that rural markets have exhibited growing consumption rates for durable household equipment, more effort to engage rural markets is required, especially by Korean manufacturers of large household appliances, kitchen appliances, household goods and processed food products.

In order to increase the possibility of purchasing in rural areas, Korean companies should be fully aware of the unique purchase environment there. In rural regions, online shopping takes place under O2O (online-to-offline) commerce, where operators of offline service-center serve as shopping agents and recommend commodities for visitors. Therefore, Korean companies must visualize service centers in local areas as well as online platforms as targets for active marketing and advertising.

In the markets of urban second- and third-tier areas, consumer preferences are quite heterogeneous (with factors such as urban residents, migrant workers, replacement demand, new demands, and online and offline demand levels). Therefore, it is important to present a wide variety of product categories with differentiated characteristics. To cope effectively with the characteristics of such a market, Korean distributors in China need to release diverse products ranging from high-quality goods to private brand products in cooperation with large and small manufacturers in Korea. Furthermore, taking into account the growing demand for cultural and entertainment products as well as the influential power of the Korean Wave, there should be more collaboration between large distributors and Korean entertainment companies.

The Korean government should focus on strengthening the cooperative export system between Korean distributors in China, domestic manufacturers, and logistics companies. At the same time, it must tighten the connection between various fiscal programs related to exports, distribution, logistics and SMEs, which have been handled separately by their respective governmental departments. Strong connections between supporting policies can provide greater incentives for relevant industries to participate in the export cooperative system. Through this environment, purchasing data pertaining to local demand complied by Korean distributors in China is immediately transferred to domestic manufacturers. They can then manufacture and promptly send goods to Chinese consumers through efficient logistics and clearance procedures.

Furthermore, surveys and analyses of local markets in China must be conducted at a much more micro level. Although TradeNAVI currently serves as an information portal for China, it is not specific enough to provide relevant information for Korean firms entering the Chinese market. The surveys need to be performed on a micro level regarding product prices, quality, sales and purchase routes in urban and rural prefecture-level areas. Moreover, information about market conditions, such as the urbanization rate, distribution system, the degree of market competition, consumption constraints and consumption-boosting policies must be monitored consistently. For more detailed market research, surveys need to utilize sales data about respective distribution channels and product items, which are usually established by private data-collecting companies in China.

Notes

In its NPC and CPPCC meetings in March of 2013, the Chinese government announced the 13th Five-Year Plan (2016-20), which aimed at doubling the national per capita income from the 2010 level and raising the current urbanization rate (54%) to 60% by 2020.

In China, prefecture-level regions represent a second-level administrative division between provinces (first level) and counties (third level). Prefecture-level regions consist of prefecture-level cities and neighboring prefecture-level rural areas.

Chinese generations born in the 1980s and 1990s were raised under the one-child policy and therefore have grown up in relatively affluent circumstances. They are very familiar with online shopping and have a strong inclination towards high-end, diverse and luxurious consumption.

According to 2009 household consumption expenditures relative to those of 2008 from the World Bank’s Household Final Consumption Expenditure study, consumption in the US dropped by $166.7 billion, that in Germany dropped by $114.3 billion, and consumption in the UK fell by $296.5 billion, whereas in China it increased by $202.0 billion.

The gap between consumption expenditure and cash outlay occurs mostly in spending on food. Farmers consume a part of their crops, and the self-consumption is included in consumption expenditure, but not in cash outlay.

CEIC data contain macroeconomic indicators for 128 countries, along with separate data by country and by industry. This study mainly uses the China Premium Database, which is included in the CEIC data.

The classification of first-, second-, and third-tier cities is based on their overall competitiveness (economic power, political status). First-tier cities include Beijing, Shanghai, Guangzhou, Shenzhen and Tianjin, whose economies are more advanced than others; second-tier cities include Nanjing, Xi’an, and Chongqing, where substantial levels of industrialization have been achieved. Third-tier cities include Yinchuan, Xining and Harbin, all of which recently underwent economic development. The list of cities of each tier was sourced from the Korea Chamber of Commerce & Industry (2012).

Urbanization refers to a social phenomenon in which the proportion of the urban population is increasing or the number of cities larger than small towns is increasing.

Urbanization takes place as manpower in rural areas moves to urban areas or when rural areas are integrated into neighboring cities.

CHIP was firstly constructed in 1988 by the Chinese Academy of Social Sciences (Beijing) by domestic and foreign scholars who studied Chinese consumption and income and their distributions. Currently, Beijing Normal University is in charge of the survey (Gustafsson et al. 2014). CHIP data can be obtained from the ICPSR website (http://www.icpsr.umich.edu/icpsrweb/ICPSR/series/243).

Although CHIP provided a wealth of micro information, one major constraint was that the latest data (since 2008) was not available while conducting this research. Fortunately, CHIP for the year 2013 was recently released. The growth paradigm of the Chinese economy has been changing quickly towards domestic demand, especially after the global economic crisis in 2008. This may have significantly affected consumption trends thereafter. Using the CHIP 2013 data may allow for an analysis of possible changes.

A city-controlled district is associated with vigorous economic, social, cultural activities based on a high population density. Therefore, it serves an actual urban function within a prefecture-level region. County-level cities are generally experiencing rapid industrialization and urbanization.

CHIP data contains administrative codes per se, but China’s City Statistical Year Book does not. To overcome this problem, I closely compared the Chinese name of each prefecture-level region in China’s City Statistical Year Book with the name in the administrative codebook of the National Bureau of Statistics of China. The codebook is available at the website of the National Bureau of Statistics of China (http://www.stats.gov.cn/tjsj/tjbz/xzqhdm/201504/t20150415_712722.html).

Until 2007, for example, the CHIP survey asked “How much did your family spend on food?”, but in 2008 survey asked “How much food per year do you think your whole family needs to rise above the poverty level?”

I defined first-, second- and third-tier cities by applying the city criteria in the Korea Chamber of Commerce and Industry (2012). The first tier includes the most economically powerful cities, such as Beijing, Shanghai, Tianjin, Guangzhou, and Shenzhen. The second tier refers to those cities where there has been much progress in urbanization and industrialization (e.g., Nanjing, Xi'an, and Chongqing). The third tier includes various cities which have experienced meaningful economic development in recent years.

In the sample data, I define a person as a member of the post-80s generation when he or she is aged from 18 to 27 years old as of 2007 and from 19 to 28 years old as of 2008. Similarly, a person is considered as a member of the post-90s generation if he or she is aged from 8 to 17 years old as of 2007 and from 9 to 18 years old as of 2008.

References

, , & . (2010). Income and Consumption Inequality in Urban China. Economic Development and Cultural Change, 58(3), 385-413, https://doi.org/10.1086/650423.

CEIC. CEIC, China Premium Database, 2014, (, https://www.ceicdata.com, ).

, , & . (2015). Persistence of Regional Inequality in China. Pacific Economic Review, 20(3), 365-387, https://doi.org/10.1111/1468-0106.12113.

, & . (2013). Access to Markets and Rural Poverty: Evidence from Household Consumption in China. The Review of Economics and Statistics, 95(2), 682-697, https://doi.org/10.1162/REST_a_00354.

, , & . (2014). Data for Studying Earnings, the Distribution of Household Income and Poverty in China. China Economic Review, 30, 419-431, https://doi.org/10.1016/j.chieco.2014.05.012.

, , , & . (2007). The Urban–rural Income Gap and Inequality in China. Review of Income and Wealth, 53(1), 93-126, https://doi.org/10.1111/j.1475-4991.2007.00219.x.

TradeNAVI(http://www.tradenavi.or.kr). TradeNAVI, (, http://www.tradenavi.or.kr, ).