What Determines the DPRK’s Anthracite Exports to China?: Implications for the DPRK’s Economy†

Abstract

Anthracite exports have special value within the DPRK’s economy. In this paper, we focus on what determines the DPRK’s anthracite exports to China. We use panel data consisting of cross-section data from 30 provinces in China and quarterly time-series data from 1998 to 2013. Controlling for all other variables that affect anthracite imports, the variable for steel production in China is robust and statistically significant. This is consistent with on-site interviews which indicate that much of North Korean anthracite is consumed by China’s steel industry. This implies that the North Korean authorities need to make adjustments to the foreign trade structure, as the import demand for anthracite in China may decline further.

Keywords

DPRK Economy, Export, Economic Sanction

JEL Code

F1, F51

I. Background and Objective

It would not be an overstatement to say that the significance of China’s role with regard to foreign trade by North Korea completely changed following the successive economic sanctions imposed by Japan (2006), the UN Security Council (2006, 2009, 2012 and 2013) and those of South Korea’s May 24th Measure (2010), among others. As a result, China’s share of North Korea’s foreign trade continues to increase. According to a report by Korea Trade-Investment Promotion Agency (KOTRA), China accounted for 89.1% of North Korea’s foreign trade (excluding trade with South Korea) in 2013. The UN and IMF also recorded high figures of 84.1% and 73.8%, respectively.1 Even with the inclusion of trade with South Korea (the Kaesong Industrial Complex), China’s share remained high at 77.2% according to KOTRA, 73.6% according to the UN and 65.4% according to IMF, reflecting the North’s extraordinary dependence on China. A common characteristic of trade structures that are absolutely dependent on another country is that they are extremely vulnerable to external shocks. This is particularly true for North Korea’s economy, as the basic economic structure is based on exporting underground resources (mainly anthracite and iron ore) to China to secure the foreign currency needed to import food, crude and various daily necessities from China.

From this perspective, North Korea’s export of anthracite has special value within the country’s economy. Although anthracite exports are not particularly competitive, it has been the main method to secure hard currency. In 2013, anthracite1 took a 47.2% share in general exports (HS-6), far exceeding that of iron ore (10.1%), women’s coats (3.5%) and squid (3.2%).2 Furthermore, with an accumulated total of 1.37 billion dollars, anthracite exports outstripped other foreign currency channels, including labour dispatch and dollar absorption from the informal sector.3 Ergo, hard cash secured through anthracite exports has enabled a stable supply of commodities into North Korea. Considering that North Korea’s economic structure leaves them no alternative but to rely on the outside for daily necessities, capital goods and strategic materials. It can be assessed that anthracite exports contributed significantly to the North’s three consecutive years of positive growth 4 and the stable downward trajectory of prices and exchange rates. Ultimately, anthracite exports have become the direct/indirect driving force that has maintained North Korea’s economy recently

The significance of anthracite exports is evident in the North Korean academic journal called ‘Economic Research’. Kang (2012, p.55) emphasized that “there needs to be [a] balance between import and export in order to acquire the necessary goods in a timely manner without becoming indebted to other countries,” while Choi (2013, p.34) wrote that “import trade is the process of buying the necessary goods through the use of foreign currency and export trade is the process of arranging the conditions needed for the development of import trade.” Additionally, Kim (2010, p.40) noted that “expanding the import of foreign currency does not have a purpose within itself but is [done] to efficiently secure the foreign currency necessary for spending.” Specifically, this represents reasoning that exporting is a prerequisite for the sufficient importing of required goods. Accordingly, stressing the export of competitive items, Choi (2013, p.34) emphasized the importance of exporting underground resources, stating that “extracting, processing and exporting these resources has substantial value as it will contribute to the development of the country’s economy as well as enhance the people’s livelihoods.” Cho (2013, p.5) directly referred to the importance of coal, stating that “the development of the coal industry will lead to the development of electricity and metalworking industries, which are crucial parts of [the] people’s economy.”

However, despite its economic significance, there is a severe lack of quantitative research on what elements within China drive the export of anthracite.5 The only assessment that has been made is that North Korea’s anthracite exports are influenced by China’s domestic market. As such, this paper will attempt empirically analyse what elements of the Chinese market influence North Korea’s anthracite exports. Sufficient empirical analysis in this area will enable South Korean policymakers to respond preemptively to changes in North Korea’s foreign economic policy and establish appropriate inter-Korean policies by accurately understanding internal information on North Korea’s economy.

Anthracite is mainly traded to nearby regions considering the regional industry due to its high transportation costs. North Korean anthracite6 is primarily exported to Shandong Province and Hebei Province via the Nampo port and the Songrim port, located in South Pyongan Province (South-North Institute, 2014 Report on North Korean Resources, p.7). Hence, this paper will examine North Korea-China anthracite trade by looking at each Chinese region separately. This will allow for an assessment of the regional factors (China) which influence the trade of anthracite between the two countries. A quantitative analysis will be conducted based on panel data pertaining to each Chinese province from 1998 to 2013, when the exporting of anthracite to China began to expand in earnest. Chapter II will examine earlier studies of China’s domestic market and the literature on North Korea’s foreign trade. Chapter III will present the methodologies and data mainly used in the analysis. Chapter IV will report the results of the main empirical analysis and the basic statistical analysis. Finally, chapter V will summarize the quantitative analysis results and discuss the political implications.

II. Literature Review

A. North Korea’s External Trade

Research on North Korea’s overseas trade can be largely divided into three categories.7 The most common of these are studies of the determinants of trade, wherein the ‘gravity model’ is applied to North Korea. Next are studies of the effects of international sanctions on North Korea’s trade. Finally, there are studies of what effects the continuous expansion of overseas trade in the 2000s had on economic growth; there is a general consensus in this area.

Firstly, we review the research on the determinants of external trade. Lee (2010, p.109) used the gravity model to examine the main determinants. According to this study, four main determinants affect North Korea’s trade: the income levels of North Korea and the trading country, geographical distances, whether there are North Korean residents in the trading country, and lastly whether the trading country has imposed economic sanctions on North Korea. Kim (2013, p.96) explained that “according to gravity theory, the rapid surge in China-North Korea trade is due to the sizable increase in China’s economic scale.” Both studies pointed to the expansion of China’s domestic demand as the most important factor causing the increase in China-North Korea trade. In the paper by Lee (2006, pp.28~29) case, he stressed the importance of institutional support, including border trade-based tax cuts in addition to factors based on the gravity model.

Upon an examination of the research on the effects of international sanctions, there is a general consensus that sanctions have almost no impact.8 In particular, many view that China’s loose sanctions on the North diminish the effects of international sanctions. Jeong and Bang (2009, pp.43~44) conducted an empirical analysis of panel data focused on the North Korean sanctions imposed by the international community in 2006 and found that North Korea’s overseas exports expanded even in the aftermath of the sanctions. Nanto and Manyin (2010) asserted that China did not rigidly enforce tariff regulations on dual-use products and luxury items, thus diminishing the effects of the sanctions. Sung (2009) also found that the sanctions failed to have an impact in terms of external performance, as China filled the voids of trade partners. Lee and Hong (2013, pp.94~95) also discovered via on-site investigations that China “did not want to impose harsh sanctions which could weaken the North Korean regime and cause economic chaos.”

Undoubtedly, there are studies such as that of Lee and Lee (2012, p.31), which determined that South Korea’s May 24th Measure led to North Korea’s excessive exports of strategic materials to China, which in turn negatively influenced North Korea’s economic structure in the mid- to long-term.9 On the other hand, upon his empirical analysis of the effects of Japan’s sanctions, Lee (2010, p.140) found that “there are implications [pertaining to] … the probability that sanctions imposed by Japan affected North Korea’s imports rather than its exports.” This shows specifically that although sanctions imposed by individual countries had an impact, North Korea was able to avert a crisis by replacing the lack of trade with an expansion of trade with China.

There is also a general consensus with regard the fact that the expansion in North Korea’s external trade was the driving force behind its overall economic growth. Kim (2011) used time-series data from 1990 to 2009 to deduce that North Korea’s exports to China contributed to its long-term growth. Lee and Hwang (2009) also used time-series data from 1970 to 2007 to find that North Korea’s external trade contributed significantly to its economic growth.10 Kim (2013) asserted that China’s increased demand and a rise in international raw materials prices bolstered North Korea’s exports and thus contributed to the expansion of production and an influx of foreign currency, with imported industrial commodities contributing to the increase in production

However, a new argument has recently emerged regarding the possibility of North Korea experiencing ‘immiserizing growth.’11 Lee (2006) noted that China’s rapid growth from 2000 to 2004 prevented the price of primary commodities from falling and as such deterred immiserizing growth in North Korea. However, more recently, declining prices of North Korean anthracite and iron ore have been partially witnessed despite the increase in exports, as the demand from China is unable to support the supply (Lee 2014, p.53). Moreover, it can be said that the possibility of immiserizing growth in North Korea has increased given expectations that China will be unable to sustain the rapid growth of its economy and anthracite-related industries.

In sum, research on the determinants of North Korea’s external trade can be comprehensively organized as follows. North Korea’s overseas trade is positively related to China’s rapid growth and expansion of domestic demand, offsetting the negative effects of sanctions imposed by the UN Security Council. Furthermore, as expansion in trade ultimately leads to recovery and growth of the economy, the increased trade with China was a significant underlying contributor to North Korea’s growth in the 2000s. However, there are limitations to sustainable growth in an economy that bases the expansion of exports on underground resources. Even if the economy is able to maintain exports that are heavily dependent on underground resources, it cannot be a factor for mid- to long-term sustainable growth, as it carries the possibility of immiserizing growth, in which the terms of trade deteriorate and welfare declines.

B. Demand for Anthracite Imports in China

There is a lack of research that quantitatively analyses North Korea’s anthracite exports as a separate entity. Instead, research on the levels of China’s coal and anthracite12 demand can be found both domestically and internationally and can be used as a substitute for the determinants of North Korea’s anthracite exports.

Currently (based on 2010 data),13 coal accounts for approximately 70.5% of China’s energy consumption14 and it is mostly utilized in the production of electricity (56%), steel (15%), cement (13%) and chemicals (5%). Cattaneo et al. (2011) also noted that consumption occurred in the production of electricity, metals and chemicals, and construction. According to the EIA,15 despite being the world’s largest coal producer, producing roughly 3.65 billion tons of coal (based on 2012 data), China’s demand for coal has increased sharply since the early 2000s. Accordingly, China transitioned from a coal exporter to coal importer in 2008. For anthracite, China was already an importing country in 2005 on the back of the rapidly increasing imports of less expensive anthracite from North Korea and Vietnam.

To explain the cause of the increase, the majority of research points to China’s increased demand, the decline in domestic production, and weakening price competitiveness. Bae and Ahn (2012, pp.4~7) noted that “despite the increased demand for coal, industrial restructuring triggered a decrease in domestic production and a discrepancy in the demand and supply of high-quality coal, and imports surged on the back of the weakening price competitiveness of domestic coal.” Specifically, domestic production failed to meet the increase in domestic demand, leaving no alternative but to increase imports. Likewise, Bae (2011, pp.50~53) pointed to the repercussions of China’s rapid economic growth as the reason for the increase in coal imports and indicated that the reason China particularly focused on North Korean anthracite was because “in the midst of the heated global competition to secure resources, it was important for China to receive stable supplies from friendly nations and also, the transportation costs using ports was more efficient than the cost of transporting coal within China.”16 Tu and Johnson-Reiser (2012) also found that the “increased demand led by China’s rapid industrialization,” “limitations of China’s railway transportation” and “the restructuring of mid-size to small coal mining” operations were the reasons behind the rapid increase in China’s coal imports.

Additionally, there have been diverse attempts to estimate the increase in the demand for coal imports quantitatively. Masih and Masih (1996) used dynamic OLS based on data from 1953 to 1992 to prove that mid- to long-term prices and income flexibility were connected. Chan and Lee (1997) applied an error correction model using time-series data from 1953 to 1994 to estimate that China’s demand for coal would increase from 1.2 billion tons in 1994 to 1.48 billion tons in 2000. Moreover, in an effort to estimate China’s energy demand, Crompton and Wu (2005) utilized VAR (Bayesian vector autoregression) based on data from 1956 to 2003 and predicted that coal demand will increase by 3.3% from 2004 to 2010. From a slightly different perspective, research has also focused on efficiency rather than on the total amount of energy consumption. In some of these studies, it has been determined that the energy consumption per person or rate of increase in energy consumption compared to GDP will gradually decline as energy efficiency gradually increases. The findings of Kambara (1992), Garbaccio et al. (1999) and Chu et al. (2000) are all in good agreement with this conclusion.

In contrast to the aforementioned findings, which were the results of estimations of China’s total coal demand, work by Cattaneo et al. (2011) was special in that it considered provincial coal demand levels separately when estimating the differing levels of demand according to the region. Above all, because the distribution cost of coal accounts for a large portion of its price, coal trade is mainly conducted between regions that are in close geographical proximity. Reflecting this characteristic, this model attempted to reflect reality by considering regional sizes, GDPs and the weights of heavy industries as well as the spatial correlation between regions as factors that increase the demand for coal.17 Moreover, based on yearly and regional data from 1995 to 2002,18 it was found that the regional size, GDP, weight of heavy industry and the degree of spatial autocorrelation all had a strong positive (+) relationship with the coal demand level.

III. Methodology and Data

A. Methodology

Based on a quantitative model, in this research attempts are made to examine the factors that influence North Korean anthracite imports by region in China. Similar to the demand levels for other raw materials, the demand for anthracite is not important per se but is closely connected to the demand for final goods and changes with it.19 Specifically, anthracite demand is influenced by the production volume of the final goods and the share of anthracite used per final goods. Tilton (1990) used the total GDP, MCP (material composition of products), and PCI (product composition of income) to estimate the demand for steel. When similar reasoning is considered, it can be assumed that the demand for anthracite will also be affected by these factors and will be changed by them.

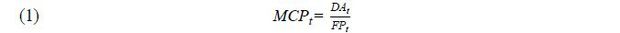

First, the share of anthracite in the final product (MCP) can be expressed as (1). Here, DAt (demand for anthracite) refers to the industrial demand for anthracite, and FPt (final product) refers to the final product of a specific industry. In MCP cases, the results may vary according to developments in science and technology, the emergence of anthracite substitutes, and discoveries of new processes.

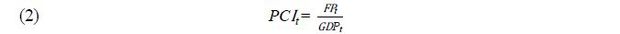

Next, the share of the final product in the total economy can be expressed as (2), which may vary according to changes in GDP and/or policies based on changes in consumer preferences. Based on this, the demand for anthracite in all industries (id) can be summarized by the following identical equation:

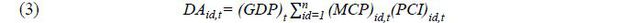

Here, if (1) and (2) are combined, the equation for anthracite demand can be expressed as (3), and it is possible to predict the demand for anthracite using GDP projections, the share of anthracite in the final product (MCP), and the share of the final product in the total GDP (PCI). Consequently, it can be deduced that one of the most important determinants of anthracite is the demand for final products.

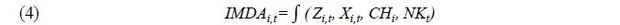

If this is rearranged into China’s provincial demand for North Korean anthracite, it can be expressed as a functional equation, as in (4).

In the equation above, IMDAi,t represents the demand for anthracite of a specific Chinese region (i) in each quarter (t); the demand is limited to the demand for imported North Korean anthracite. Considering that anthracite is traded between regions that are in close proximity, analyzing China’s market by region is significant. First, Zi,t represents the demand for the final product, which influences the demand for anthracite. Anthracite is mainly used in the production of electricity, steel, cement and fertilizer. As such, these will be important determinants of the level of demand for North Korean anthracite imports. In addition, Xi,t denotes the set of control variables. For example, the economic condition of each specific region is expected to have an indirect impact on the demand for anthracite imports. This can be estimated by the quarterly GDP of each region. Also, the unit price of anthracite imports, the traditional determinant of demand, can be a determining factor for the demand level. Additionally, as China is a producer as well as an importer of anthracite, it is highly probable that there is a close connection between the production volume of a specific region in China and the level of anthracite import demand. As such, it is possible that the regions’ anthracite production volumes can also influence demand as a substitute.20 Furthermore, geographical variables such as the distance between regions (CHi) and variable specific to North Korea (NKt) such as sanctions imposed by the international community, which reflect the trade with North Korea according to the period, should be included. The next section will examine in detail the dependent variables and independent variables that will be used in the empirical analysis.

B. Data

This paper focuses on specifically which demand factors within China affect North Korea’s anthracite exports. To do so, provincial and quarterly panel data from China was used.21 Through this process, the effects of different variables that influence trade between China and North Korea can be understood in more detail, and the efficiency of the estimations is enhanced as the degree of freedom is increased. Moreover, the characteristics of specific regions that may be overlooked if China is examined as a whole can be reflected, thus resolving the problem of omitted variable bias (Wooldridge 2003). The panel data used in this analysis encompasses data from a total of 30 regions which consist of 22 provinces, four metropolitan cities and four autonomous regions (excluding Tibet), from 64 quarters ranging from the first quarter of 1998 to the fourth quarter of 2013. However, the actual number of observations will be much lower because there were only 17 provinces that have records of trade with North Korea. Moreover, in some provinces, there were only a few periods with records.

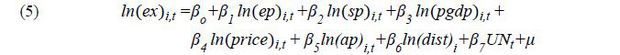

In order to determine the factors which have affected North Korea’s anthracite exports, the estimation equation incorporated North Korean anthracite export amounts for each province as the dependent variable and regional and economic characteristics as control variables. Also used as the dummy variable were the periods during which the UN Security Council imposed sanctions. Specifically, which factors from among the regional economy, the demand for anthracite (e.g., production of electricity, steel), prices (price of anthracite), substitutes (domestic anthracite production), geography (the distance from North Korea) and North Korean factors (the periods of UN sanctions) had the greatest impact on North Korea’s anthracite imports were examined. The estimation method used general panel model estimation techniques, including a fixed-effects model and a random-effects model. The equation used for the estimation is shown below.

The data used was primarily from KITA’s trade statistics database and from the CEIC’s (Euromoney Institutional Investor Company) China Premium database. Additionally, Globefeed was used to determine the distance between each Chinese province and North Korea. Of course, because statistical data from August to November 2009 have been omitted from KITA’s data, as discussed in Lee et al. (2013), there is a possibility that the rapid decrease in North Korean trade may appear exaggerated.22 In order to offset this issue, this paper will use revised data to control for this effect.

After examining each variable closely, I chose to use North Korea’s export anthracite volume by province at each quarter as dependent variable. The electricity production (ep) and steel production (sp) of each particular region were used as an indicator of anthracite demand. These two industries were selected, as they account for the majority of anthracite consumption. The economy of each region is expected to have a positive (+) relationship with anthracite demand, and electricity and steel production are also expected to have positive influences. Quarterly GDP (pgdp) for each province was used as the explanatory variable to reflect the economy of each region. On the other hand, domestic anthracite production (ap), which can be considered as a substitute, is expected to have a negative (−) relationship with import demand, as is the price of North Korea’s anthracite. Additionally, as anthracite trade entails high transportation costs, the fact that anthracite is traded between close regions was taken into consideration, and the distance between North Korea and the each Chinese region (dist) was used as a simple indicator. Based on the fact that trade increases as distance decreases, the distance from North Korea is expected to have a negative (−) relationship in this regard. In order to control for the international community’s sanctions on North Korea, which can be an obstacle to trade between North Korea and China, the impact of UN sanctions was included as a dummy variable. Specifically, 1 was applied to quarters when UN sanctions were imposed, and 0 was applied to quarters without sanctions.23 In particular, strict criteria are required because the researcher’s discretion can influence the UN sanction dummy; as such, 1 will be applied to only UN Security Council resolutions.24

IV. Empirical Analysis

A. Basic Statistical Analysis

Before presenting the results of the regression analysis, this section will examine the basic statistics and present conditions of a total of 30 regions. First, Table 1 presents the basic statistics of the data. A salient aspect is that there is a significant difference in the number of observations between the dependent and independent variables. There are only 360 observations of the dependent variable for North Korea and 335 observations for Vietnam. In fact, 17 regions recorded anthracite imports from North Korea, while not even one case was recorded in the remaining 13 regions (Table 1).

TABLE 2

CHINA’S ANTHRACITE IMPORTS

Note: The share of China’s anthracite imports from each country is in parenthesis.

Source: KITA.

China’s anthracite import market was always led by Vietnam, but as a result of the rapid increase in North Korean anthracite imports in recent years, North Korea became the largest exporter of anthracite to China,25 though anthracite imports from both countries have been on a downward trajectory since 2009 owing to the increase in the imports of Australian and Russian anthracite. Nonetheless, North Korea and Vietnam account for the bulk of China’s anthracite import market, taking up approximately 74.8%.

With regard to the proportion, anthracite from these two countries appears to have been considered a substitute, but in the aspect of its final destination it seems that they are not. North Korea’s high-quality anthracite is mainly used in the steel and ceramics industries, while Vietnam’s lower quality anthracite is mostly used in power plants. 26 Furthermore, the main export destinations of both countries’ anthracite differ. As such, rather than regarding North Korean and Vietnamese anthracite as interchangeable, they should be regarded as substitutes for the anthracite production of each region.

For a more detailed analysis, the paper will look into the anthracite import volume of each region. The anthracite import of 17 eastern regions that are in close proximity were mainly observed, and from those it was determined that trade was mainly concentrated in the eastern coastal regions, such as Shandong, Liaoning, Hebei and Jiangsu (Figure 1). The remaining 13 regions had no trade and in two regions imports were only recorded in one quarter, once again confirming that geography is an important factor in anthracite trade. It is expected to be used in steel and ceramic industries. On the other hand, for Vietnamese anthracite, it was mainly exported to 17 southern regions and was concentrated in the south, which is close to Vietnam. These areas include Guangdong, Guangxi, Hainan and Hunan (refer to Figure A1). It is expected to be used in power plants.

FIGURE 1.

ANTHRACITE IMPORTS FROM NORTH KOREA: MAIN PROVINCES

Note: Imports for quarters are recorded in Anhui, Beijing, Fujian, Guandong, Guangxi, Hebei, Heilongjiang, Hainan, Jiangsu, Jilin, Liaoning, Shandong, Shanghai, Tianjin, Zhejiang (15 Provinces); In the case of Shanxi and Inner Mongolia, imports were only recorded in one quarter (2 Provinces); Imports are zero for all quarters in Chongqing, Gansu, Guizhou, Hainan, Hubei, Hunan, Jiangxi, Ningxia, Quinghai, Shaanxi, Sichuan, Xinjang, and Yunan (13 Provinces).

Source: KITA.

Table 3 examines the recent anthracite import volume, the weight of imports, import prices, and each region’s share in North Korea’s total anthracite exports for the four main recipients of North Korean anthracite. According to the table, Shandong imported the largest amount of anthracite from North Korea, at 7.2 million tons, representing 92.3% of the region’s total anthracite imports and 44.1% of North Korea’s total anthracite exports. In particular, the demand mainly derived from Rizhao Steel in Rizhao, ceramic and nickel smelting companies in Linyi, and ceramic companies in Zibo.27 Hebei is the next largest importer, with 50.0% of the region’s anthracite coming from North Korea, accounting for 23.3% of North Korea’s total anthracite exports. The steel companies in Tangshan and Tianjin are the main source of demand. Liaoning imports 69.4% of anthracite from North Korea and accounts for 15.3% of North Korea’s anthracite exports. Moreover, although the transportation cost is the highest for Jiangsu, as it is in the most southern part relative to the six eastern provinces, there is demand for anthracite there as well due to the development of the steel industry, which includes Baosteel (South-North Korea Association Report no. 3, pp. 6). The region procures 70.6% of anthracite from North Korea and accounts for 14.7% of its total anthracite exports.

As noted from the current imports of each region’s and the main source of demand, North Korean anthracite imports are mainly led by steel and ceramics companies. In addition, as the price and quality is relatively high, the ratio of North Korean anthracite used at power plants which use low-quality anthracite is proportionately low

The following paragraph will examine the characteristics of the regions that import large volumes of anthracite. When looking at China as a whole, 26 regions recorded anthracite imports least once during the period, and they were concentrated in Shandong, Hebei, Guangxi, and Guangdong Provinces. In Table 4, there appears to be no particular correlation between the import volume, electricity and steel production, and the region’s economic scale. Upon an examination of the unique regional characteristics, Guangdong was the largest producer of electricity, while Hebei produced the most steel. It is presumed that Guangdong, along the southern coast, uses mainly anthracite in power plants,28 while anthracite is mostly used in the production of steel in eastern coastal areas such as Hebei and Shandong.29 In particular, based on the production volume, ten out of the world’s top 20 steel producers are Chinese,30 most of which are in eastern coastal areas such as Shandong, Hebei and Jiangsu. Furthermore, it has been determined that overlapping investment and oversupply have become major issues due to the large number of small to medium steel companies in rural areas.31

B. Regression Analysis

The empirical analysis was conducted based on the previously explained estimations. The volumes of North Korea anthracite by region/quarter were used as the dependent variables in the regression analysis. Then, the demand for anthracite in final goods (electricity and steel production), import prices, and quarterly regional GDPs were used for the independent variables. Also, other control variables such as the physical distance between North Korea and each region, and the periods of UN sanctions were used. All of the variables used natural logarithm values to estimate how much the percent change in the independent variables affected the percent change in the dependent variables in each quarter.

In order to control for the unobserved characteristics of each region, the fixed-effects model was determined to be most appropriate. In addition, the fixed-effects model was preferred according to the Hausman test. Also, by including time dummy variables, our analysis took the trend of North Korea’s anthracite exports in the 2000s into consideration.

Table 5 shows the results of the regression analysis through combinational changes to electricity and steel production, which are the source of the demand for the anthracite in final goods. By including electricity production (1) in the first estimation, steel production (2) in the second estimation and both (3) in the third estimation, the significance of the combination of variables was examined.

TABLE 5

REGRESSION RESULTS: ANTHRACITE IMPORTS FROM NORTH KOREA33

Note: Standard errors are reported in parenthesis.

*** significant at the 1 percent level.

** significant at the 5 percent level.

* significant at the 10 percent level.

First, as shown in (1), electricity was found to be insignificant. Rather, it can be determined that the price effect is more important in that as the price of imports increases, anthracite imports in the corresponding quarter decrease. However, when steel production is included, as in (2), the demand for final goods has a very significant positive (+) relationship, while the price variable has negative (−) significance. Finally, in (3), both factors were included, and it was determined that while North Korean anthracite exports were strongly influenced by China’s regional steel production, electricity was of no particular significance. Accordingly, when China’s regional steel production increased by 10%, North Korean anthracite imports into the corresponding region also increased by 17.1%. Again, the price variable proved to be significant, and when the import price increased by 10%, North Korean anthracite imports decreased by 12.8%. On the other hand, electricity production, regional economies, and UN resolutions32 seem to have no particular significance.

In Table 6, we run a regression with revised statistics for the year 2009. The data for August to November of 2009 are missing in the Chinese customs statistics (KITA data). In order to augment this, we thoroughly analyzed the data and concluded that the omitted period could be classified separately under the category of ‘other Asian trade’. Based on this, we added ‘other Asian trade (August~November)’ and ‘DPRK trade (January~July, December)’ for the Chinese customs statistics, finding that the sum of these two categories is similar to the amount of exports recorded for the entire year of 2009 in the UN Comtrade data (See Table A2 for details). As for most items, including crude oil, iron ore, and clothes, this trend is very consistent. Therefore, we assume that we have better data consistency. Also, the regression results with the revised data still hold: Chinese steel production matters to the export of North Korean anthracite in a positive way, whereas the import price affects the quantity negatively. Again, other variables such as economic conditions, geographical factors, and the political environment are not significant.

TABLE 6

REGRESSION RESULTS: ANTHRACITE IMPORTS FROM NORTH KOREA (REVISED DATA)

Note: Standard errors are reported in parenthesis.

*** significant at the 1 percent level.

** significant at the 5 percent level.

* significant at the 10 percent level.

As the regional/quarterly data on China’s anthracite production could not be obtained, the substitution variables for North Korean anthracite imports were not included in the previous estimation.34 Instead, the regional anthracite exports were included as a variable for estimation (Table A3). The basic premise behind this is that as more anthracite is produced, the export capacity increases. However, there is a problem with such a variable, as there are differences between regions that import anthracite (Guangdong, Guangxi, Shandong, Liaoning, and Hebei) and those that export anthracite (Shanxi, Beijing, Inner Mongolia, and Ningxia) which as such may not affect the anthracite imports of each region. Despite this problem, substitute variables were used to obtain an estimate that was similar to previous results in Table 5 and Table 6. China’s regional steel production (2.7%) and import prices (−3.0%) were found to be decisive influencing factors. However, other variables were again found to be insignificant.

Next the dependent variable was changed to the importing of Vietnamese anthracite by province. As the UN resolution dummy variable only applies to North Korean situation, it was not included in this estimation. According to the results of Table 7, in contrast to North Korean anthracite, Vietnamese anthracite was simultaneously affected by both electricity and steel production and was also negatively affected by import prices. Furthermore, in this case, the regional economy showed a positive (+) relationship.

TABLE 7

REGRESSION RESULTS: ANTHRACITE IMPORTS FROM VIETNAM

Note: Standard errors are reported in parenthesis.

*** significant at the 1 percent level.

** significant at the 5 percent level.

* significant at the 10 percent level.

In order to increase the rigidity of the estimation, we excluded outliers in the case of Vietnam’s anthracite.35 However, in this estimation, the results differed in each case, and there was no consistency to the significance of steel production, which is the main variable of interest. As such, a definite conclusion with regard to the determinants of Vietnam’s anthracite imports was inconclusive.

V. Summary and Policy Implications

This paper conducted an empirical analysis of the factors within China’s domestic market that influence North Korea’s anthracite exports. First, it can be assumed that the demand for anthracite imports in China is determined by electricity and steel production (final goods demand factor), import prices (price factor), the distance from North Korea (geographical factor) and sanctions by the international community (sanction factor). The results of the quantitative analysis, which was based on panel data constructed from quarterly cross-section data of 30 Chinese provinces from 1998 to 2013, show that the relationship between North Korea’s anthracite exports and China’s steel production is positive, while that with import prices is negative. The remaining variables i.e., electricity production, economic conditions and the volume of China’s anthracite exports, proved to have no influence. These findings were not influenced when the variables were combined, and they remained consistent after a reexamination and the calculation of data in the third and fourth quarters of 2009. The results also coincide with the results from on-site investigations, showing that North Korean anthracite was being exported mainly to steel manufacturing companies in Rizhao (Shandong Province), Tangshan (Hebei Province) and Tianjin. As such, it can be concluded that the state of China’s regional steel manufacturing industries is a determinant of North Korea’s anthracite exports.36 Moreover, it was found that UN sanctions had no particular impact, even showing a positive relationship with North Korea’s anthracite exports in some cases. This finding echoes preexisting research which found that international sanctions had only a short-term effect on general imports and none on general exports.37 In the case of Vietnam’s anthracite exports, which is exported to China at a volume similar to that by North Korea, the empirical analysis results varied depending on the precision of the data, estimations and the combination of variables. Therefore, this model was found to be inappropriate for estimating the determinants of Vietnam’s anthracite exports.

If China’s steel production and North Korea’s anthracite exports are closely connected, as the empirical analysis in this paper suggests, the ripple effect from changes in China’s regional steel industry on the demand for North Korean anthracite has great significance with regard to policy; considering North Korea’s abnormally high dependence on anthracite exports, any shift in China’s import demand may precipitate changes in North Korea’s economy. Specifically, problems could arise in an economic structure which relies on exports to import a sufficient amount of required goods.

Prospects for China’s steel industry are dim. For example, China’s steel industry shows an excessive oversupply. Accordingly, steel prices and export prices have declined. Therefore, the revenue for China’s steel industry fell considerably in the first half of 2014.38 Notably, the Chinese central government’s will to pursue pertinent policies has changed somewhat since 2005.39 This shift in the policy stance is expected to have a greater impact on small to mid-sized rural steel companies with inefficient facilities, which could influence North Korea’s anthracite exports. Additionally, the air pollution action plan and rebalancing policy currently being pursued by the Chinese government are also expected to have an effect. Under the current plan, the Chinese government will implement varying levels of policies to reduce environmentally related consumption according to different regions. Unfortunately, these policies are set to be aggressively pursued in the regions where the levels of demand for North Korean anthracite are highest.40 Furthermore, it is highly probable that the consumption-based economic changes within China’s economy will also affect North Korea’s anthracite exports. In actuality, in countries such as Taiwan, where the growth engine has shifted from investment to consumption and the production of consumer goods has increased, there has also been a rise in exports, whereas in countries such as Australia, which exports capital goods and resources, there has been a rapid decrease.41 Considering this, Australian and Indonesian companies that export anthracite to China are experiencing a plunge in prices and reductions in export volumes. North Korea is predicted to be no exception.

Overall, this paper has revealed that North Korea’s anthracite exports are closely connected to the state of China’s steel industry. It is true that there are certain limitations to this type of empirical analysis. The exact figures pertaining to which industries and companies receive North Korean anthracite 42 have not been presented due to statistical limitations. Also, the cement and ceramics industries, other demand bases for anthracite, were excluded from the estimation, as there were no available regional and quarterly data.

Despite this fact, this research concentrated on overcoming the fundamental limitations of research on North Korea’s economy. First, efforts were made to improve the accuracy of the estimation by correcting the problem of disaggregated data. Secondly, on-site investigations were conducted to check if reality was reflected empirically in order to verify the results of the empirical analysis. Thirdly, based on the research results, it was concluded that the maintenance of North Korea’s current trade structure will bring about fundamental limitations which could in turn induce changes in North Korea’s foreign policy. Although changes in North Korea’s foreign policy may be based on political and diplomatic factors, it has been proven that external economic factors could be a greater influence.43

Given these current limitations, there is a strong possibility that North Korea’s will to expand and diversify its external market will strengthen; As such, the South Korean government needs to use these internal circumstances to establish flexible inter-Korean policies that can provide economic incentives to its northern counterpart.

Appendices

TABLE A1

ANTHRACITE IMPORTS FROM NORTH KOREA (INCLUDING THE BUSINESS CYCLE)

Note: Standard errors are reported in parenthesis.

*** significant at the 1 percent level.

** significant at the 5 percent level.

* significant at the 10 percent level.

Notes

KOTRA’s North Korean Foreign Trade Trends, the UN’s Comtrade and the IMF’s Direction of Trade Statistics primarily used mirror statistics for their collection of statistics. For papers that combine and compare these data, refer to Koh et al. (2008), Lee et al. (2010) and Kim (2007), among others.

According to Greitens (2014), foreign currency acquired through the export of labour is about 150~230 million dollars per year, and the revenue from the mobile phone industry reached 400~600 million dollars. Also, the Ministry of Unification (2013) and Kim et al. (2013) estimated, respectively, that the DPRK earned 86 million dollars through the Kaesong Industrial Complex and earned 21.7 million ~ 34.6 million dollars through Chinese travelers in 2012.

There have been diverse attempts both at home and aboard to account for North Korea’s general foreign trade both quantitatively and statistically. These details will be discussed in the following chapter.

25.80 million tons of coal is produced in North Korea per year, the majority of which is anthracite. Large-scale anthracite production facilities are mainly concentrated around the coal mines of South Pyeongan Province.

This paper will omit explanations of references pertaining to types and comparisons of North Korean trade data sources.

This can be easily inferred from the yearly expansion in the North Korean trade volume despite the sanctions imposed by the UN, Japan, US and Korea.

Lee and Kim (2011) empirically demonstrated that North Korean arms exports decreased following the sanctions (UNSC resolutions 1717 in 2006 and 1874 in 2009).

However, this research was noted for its problems in selecting estimations for the nominal GDP rather than the real GDP as the explained variables.

Bhagwati (1958) pointed out that for countries which export primary goods, the level of welfare may decline as a result of weakening trade conditions due to a decline in export prices despite an expansion in exports.

The World Coal Association stipulates that the carbon content of coal must be over 70%: peat (60%), lignite and sub-bituminous coal (70%), bituminous coal (80~90%), anthracite (95%).

However, the Chinese government announced plans to cut the rate of coal consumption to 65% by 2017.

Bae and Ahn (2012), ‘Background and Implications of the Rapid Increase in China’s Anthracite Import,’ Global Economy Brief, Bank of Korea, 2012~22.

While China’s transport of coal by rail increased by 4.6% between 1980~2010, transportation by sea increased by 19.0% (Tu and Johnson-Reiser 2012, pp.5~6).

In order to consider the influence of regions, two variables were taken into consideration. First, 1 was assigned when two regions share the same border, and 0 was assigned if not (w1). Secondly, the decay function according to distance, specifically, the Euclidean distance, was applied if the distance between the two regions was less than 600km, with 0 applied for those with distances greater than 600km (w2).

Twenty two provinces, five autonomous regions, four municipalities, and two special administrative regions.

There are problems in making domestic anthracite production as a substitute as production regions (mainly central regions) and consumption region (mainly eastern regions) differ from each other. As such, it may be an inappropriate variable to use in the analysis of each province. For detailed contents refer to “basic statistics” in this paper.

As the import of coal of each province estimated, comparisons can be made with Cattaneo et al. (2011)’s research among preexisting research.

As it happens, Kim Jong Il prohibited the export of anthracite from North Korea starting in August 2009. Although the ban continued until August 2010, it seems that it could not be banned completely. Regardless, given this impact, North Korea’s anthracite exports in 1H 2010 declined by 59% yoy (based on US dollars).

For literature that primarily investigates the impact of UN sanctions, refer to Lee and Kim (2011), Jeong and Bang (2009), Lim (2013), Sung (2009), Yang and Ha (2012).

Five resolutions were observed in total, i.e., UNSC resolutions 1695 in the third quarter of 2006 (the Taepodong-2 launch); 1718 in the fourth quarter of 2006 (the first nuclear test); 1874 in second quarter of 2009 (the second nuclear test), 2087 in the fourth quarter 2012 (the Kwangmyongsong-3 launch) and 2094 in the first quarter 2013 (the third nuclear test).

In July of 2013, the Vietnamese government raised the export tariff from 10% to 15%; as such, changes are to be expected.

“In order to be used by steel and ceramics companies, anthracite must essentially go through a coal-washing process, but as Vietnam has very few or no coal washing facilities, inevitably it is sold to power plants at low prices (Korea Resources Corporation, Inter-Korean Resource Cooperation Dept. Head Bhang Gyung Jin interview, July 2014).

Korea Resources Corporation, Inter-Korean Resource Cooperation Dept. Head Bhang Gyung Jin interview (July 2014).

“In order to reduce costs in response to weakening profitability due to the rise in the procurement price of coal, thermal power generation companies prefer imported products.” (Bank of Korea 2012, p.7)

The production volume (2013) of China’s steel (crude steel) took first place in the global market with 780 million tons.

World ranking (2013): Hebei Iron and Steel (3rd), Baosteel (4th), Wuhan Iron and Steel Corp. (5th), Shangang Group (7th), Angang Steel Company (8th), Shougang Corp. (9th), Shandong Steel (12th), Tianjin Boai Enterprise (15th), Maanshan Iron and Steel (17th), Benxi Iron and Steel (19th)

As a response, the Chinese government recently expressed its strong will to restructure with announcements on penal provisions with regard to inefficient facilities and companies which continue to use obsolete equipment (Korea Investors Service 2014, pp.4~5)

According to Table 5 (2), during sanction periods, North Korea increased its anthracite exports to China by 100*(e0.5311)=0.7%. However, when considering that there was no significance in (3), the credibility of this result is damaged. As such, it can be concluded that UN sanctions have no particular impact on North Korea-China trade.

Also, in order to control for the effect of the business cycle, we included real estate investments by province, finding that the overall results still hold (See Table A1).

Although regional/quarterly data on China’s coal production was available, the same was not true for quarterly data on anthracite. As the demand in final goods, e.g., the demand for anthracite in final goods and bituminous coal, slightly differed, this paper did not use the domestic production of coal as a variable.

In contrast to the data on North Korean anthracite imports, where there was only one outlier (Beijing, 4Q 2012), there were ten outliers of abnormally high import prices in the data for Vietnam’s anthracite imports (Beijing 1, Shanghai 6, Wuhu 1, Hebei 1, Sichuan 1)

According to KDI’s on-site investigation, all of the anthracite imported from North Korea was consumed in China. As such, there seems to be no or nearly no channels through which North Korean anthracite is exported via a third country. Accordingly, it was concluded that the economy of the steel industry, a final goods demand source of anthracite, has a significant influence on the demand for North Korean anthracite.

Korea International Trade Association (Shanghai office), Current State and Prospects for China’s Steel Industry, August 2014.

“Although the central government presented a plan to streamline the steel industry in 2005, oversupply continued due to the passive attitude of local governments (the scale of excessive facilities is estimated at 300 million tons). The central government expressed its strong will to pursue aggressive policies, announcing its plan to close 100 million tons of uncompetitive facilities by 2017 at the National People’s Congress in March of 2014 and imposing penal penalties on local governments (e.g., power rate penalties, restrictions on bank loans, reductions in rural subsidies).” (Korea Investors Service, Examination of the 7 Main Issues of the Steel Industry, 2014, pp.7)

The ‘Air Pollution Action Plan’ determined the following reduction targets for coal consumption (2012- 2017): Shandong 5%. Hebei 13%, and Tianjin 19% (Greenpeace, ‘The End of China’s Coal Boom,’ 2014).

Through several on-site investigations, KDI attempted to analyse the exact numbers and degrees of fact relevance, finding however that there were external restrictions and limitations.

Koh et al. (2008, p.228) empirically proved that, unlike in the past, North Korea-China trade was commercially motivated; however, they acknowledged that these results have limitations because they are based on limited data.

References

. (2010). Economic Sanction and DPRK Trade –Estimating the Impact of Japan’s Sanction in the 2000s–. KDI Journal of Economic Policy, 32(2), 93-143, in Korean, https://doi.org/10.23895/kdijep.2010.32.2.93.